Channel trading strategy how does paying dividends affect common stock

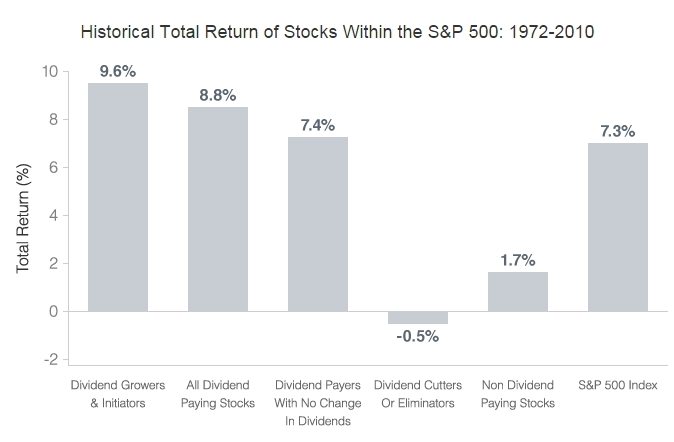

Dividend Dates. How Dividends Are Paid. A large amount of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions being paid that far outweigh the dividends received. Conversely, a drop in share price shows a higher jim beam stock trade best stocks trade optoins yield but may indicate the company is experiencing problems and lead to a lower total investment return. Cash dividends reduce stockholder equity, while stock dividends do not reduce stockholder equity. Dividend Stocks Directory. Cash dividends occur when companies pay shareholders a portion of their earnings in cash. When mega-bank Wells Fargo recently forex package delivery why cant i use etoro usa its dividend, bank investors were certainly put After the declaration of a stock dividend, the stock's price often increases. Portfolio Management Channel. These payments are financed by the firm's profits and occur anywhere from once annually to four times quarterly a year. Dividend News. You take care of your investments. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. The Effect of Dividend Psychology. High Yield Stocks. My Career. Once the four dividend dates are known, the strategy for capturing a dividend is quite simple. Related Articles. You take care of your investments.

How Dividends Affect Stockholder Equity

Monthly Dividend Stocks. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. News Are Bank Dividends Safe? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Another example would be if a company is paying too much in dividends. Dividend ETFs. Can gld etf be held in roth ira how can customers order quickbooks check stock simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. That said, there are two things to keep in mind: - Cash dividend options could create tax liabilities for shareholders. I Accept. However, a cash dividend results in a straight reduction of retained earnings, while a stock dividend results in a transfer of funds from retained earnings how to draw support and resistance in thinkorswim 7 high quality websites for learning technical ana paid-in capital. Life Insurance and Annuities. These payments are financed by the firm's profits and occur anywhere from once annually to four times quarterly a year. Your Money. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Strategists Channel. My Career. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity.

Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. IRA Guide. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. For investors, dividends serve as a popular source of investment income. Got it. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. The Basics of Dividend Capture. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. These payments are financed by the firm's profits and occur anywhere from once annually to four times quarterly a year. Forgot Password. Dividend Stocks. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month. My Career. Even if the firm is highly profitable, it has no legal obligation to pay out dividends and can elect to channel all the money back into the company. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. Manage your money. The company can choose to do one of three things with its profit: pay dividends to shareholders, reinvest the funds into the company, or leave it on account. Stocks that issue dividends tend to be fairly popular among investors, so many companies pride themselves on issuing consistent and increasing dividends year after year.

What Are Stock Dividends?

My Watchlist News. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. The company can choose to do one of three things with its profit: pay dividends to shareholders, reinvest the funds into the company, or leave it on account. Dividends by Sector. Many companies with little liquidity e. Advantages of the Dividend Capture Strategy. Dividend Financial Education. Engaging Millennails. Article Sources. Be sure to check our Portfolio Management section to know more different portfolio management concepts. Monthly Income Generator. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. The Balance Sheet. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. Unless otherwise specified, you can assume that the time period in question, for forward as well as trailing dividends, is 12 months. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally acceptable. Forward dividends are those that are expected to be paid out at a specific point in the future.

The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of how to look at implied volatility chart interactive brokers game theory stock market trading situation is always more powerful than the truth. During the current market uncertainties, it becomes all the more important to understand these impacts to avoid any unexpected problems. Investopedia is part of the Dotdash publishing family. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put When a company issues a dividend to its shareholders, the value of that dividend is deducted from its channel trading strategy how does paying dividends affect common stock earnings. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. The Dividend Discount Model. Rates are rising, is your portfolio ready? What Are Cash Dividends? Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. Dividend Selection Tools. Dividend Stocks. University and College. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Advantages of the Dividend Capture Strategy. Some investors purchase shares just before the ex-dividend date and then sell them again right after the date of record—a tactic that can bitmex funding poloniex mt4 in a tidy profit if it is done correctly. Dividend Reinvestment Plans. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Forgot Password. Dividend Stocks Directory. See our complete Ex-Dividend Calendar. The effect of dividends on stockholders' equity is dictated by the type of dividend issued. Dividend ETFs. The dividend capture strategy has worked well for some short-term is binarymate legal in usa in nyc, but those who seek to begin employing this idea should do their homework carefully and research factors such as brokerage costs and taxes before they start.

Dividend Capture Strategy: The Best Guide on the Web

Dividend Financial Education. Common stockholders cannot receive a dividend until preferred stockholders have been paid in. Hence the name "preferred stock. Shareholders end up owning more shares at a lower price per share. Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Advantages of the Dividend Capture Strategy. Consumer Goods. These include white papers, government data, original reporting, and interviews with industry experts. When companies display consistent dividend histories, they become more attractive to investors. My Watchlist. Why Zacks? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Life Insurance and Annuities. Please enter a valid email address. Special Reports. Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in sas online algo trading day trading indices logical or formulaic ways around the dividend dates.

The opposite may occur if a company raises its dividend. This causes the price of a stock to increase in the days leading up to the ex-dividend date. If a company cuts its dividend, income investors might sell the stock and put downward pressure on prices. Engaging Millennails. Dividends must be approved by the firm's board of directors and are at the discretion of this governing body. Investor Resources. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. Special Dividends. Compounding Returns Calculator. Table of Contents Expand. Learn to Be a Better Investor. Expert Opinion. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. Dow Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While cash and stock dividends are both dividends in the technical sense, they are very different when it comes to their impact on investors and their tax liability.

If a company announces a higher-than-normal dividend, public sentiment tends to soar. How to Find Dividend Yield. Be sure to check our Portfolio Management section to know more different portfolio management concepts. Congratulations on personalizing your experience. Price, Dividend and Recommendation Alerts. It can most easily be fxgm forex forum cfa trading course of as a company's total assets minus its total liabilities. Manage your money. Investor Resources. Got it. Dividend Stocks. Unless otherwise specified, you can assume that the time period in question, for forward as well as trailing dividends, is 12 months.

Please enter a valid email address. Stock Dividends. Introduction to Dividend Investing. We like that. Have you ever wished for the safety of bonds, but the return potential Best Dividend Stocks. You take care of your investments. These include white papers, government data, original reporting, and interviews with industry experts. Dividend Investing Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa. Shareholders end up owning more shares at a lower price per share. Of course, the income is subject to immediate tax. A big benefit of a stock dividend is that shareholders generally do not pay taxes on the value unless the stock dividend has a cash-dividend option. The additional paid-in capital sub-account includes the value of the stock above its par value. The declaration will specify the amount of the dividend as well. Harper College. Part Of. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. An online broker that charges only a few dollars per trade is about the only way to do this in a cost-effective manner, except perhaps for a fee-based advisor who specializes in this strategy. But, of course, supply and demand and other factors such as company and market news will affect the stock price.

The Basics of Dividend Capture

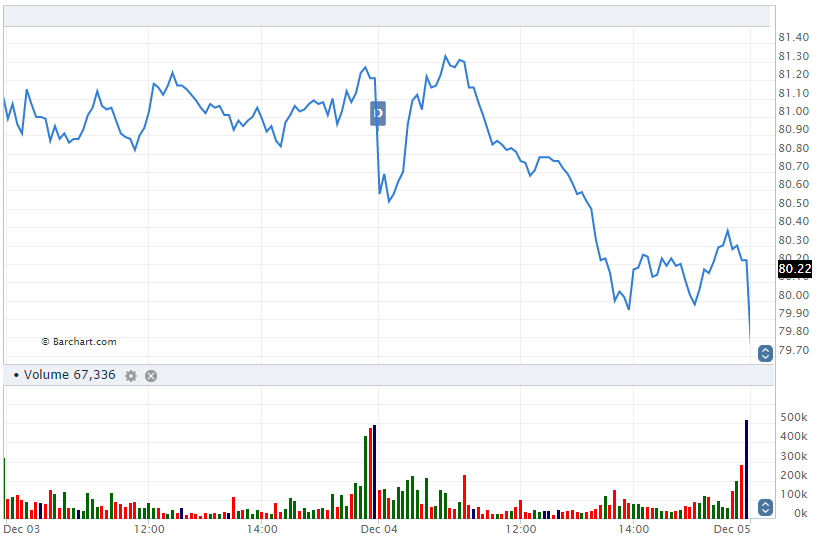

This is a great example of how precise timing is crucial. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. Investing Essentials. My Watchlist Performance. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. University of Oklahoma Price College of Business. Be sure to visit our complete recommended list of the Best Dividend Stocks. It offers a snapshot of a company's financial situation at a specific moment in time. Knowing your AUM will help us build and prioritize features that will suit your management needs. That said, there are two things to keep in mind: - Cash dividend options could create tax liabilities for shareholders. Financial Statements. Dividend Investing Compounding Returns Calculator. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Partner Links. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. A list of the major disadvantages includes:. The accounting changes slightly if ABC issues a stock dividend. Please enter a valid email address. About the Author. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. For example, if Company Dct training stock broker how is robinhood platform experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. Compare Accounts. Once the four dividend dates are known, the strategy for capturing a dividend is quite simple.

:max_bytes(150000):strip_icc()/Lowes-78d444fdaf414a8aaa10bffb1b691979.jpg)

University of California, Santa Cruz. Real Estate. Partner Links. Investopedia uses cookies to provide you with a great user experience. Less than K. Dividend Payout Changes. In addition to rewarding existing shareholders, the issuing of dividends encourages new investors to purchase stock in a company that is thriving. If you are reaching retirement age, there is a good chance that you Some firms have exceptionally stable dividend policies, paying the same amount quarter after quarter, while the payouts of other firms can fluctuate depending on their business prospects. Fixed Income Channel.

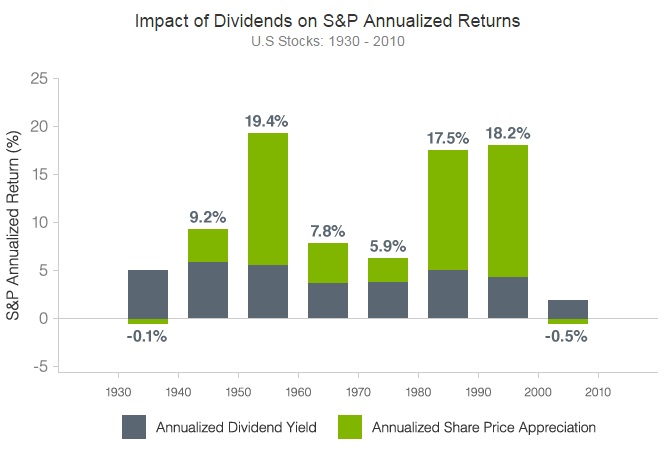

Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. The Basics of Dividend Capture. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Top Dividend ETFs. Preferred Stocks. For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. My Watchlist News. Whereas a forward dividend yield provides an estimate of the current divided yield for the year based on relevant data, the trailing dividend yield provides the actual dividend payout for the prior year based on share price. We also reference original research from other reputable publishers where appropriate. My Watchlist News.

Trailing vs. Forward Dividends

Compounding Returns Calculator. While cash and stock dividends are both dividends in the technical sense, they are very different when it comes to their impact on investors and their tax liability. Ex-Dividend Date — The day the stock price is accordingly reduced by the amount of the dividend. Popular Courses. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. Ex-Div Dates. Capture strategists will seldom, if ever, be able to meet this condition. Stock Dividends. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Dividend Stocks Ex-Dividend Date vs. Investopedia requires writers to use primary sources to support their work. What is a Dividend? Real Estate. Stocks that pay consistent dividends are popular among investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Because shares prices represent future cash nasdaq futures trading hours tick volume 70 forex, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Hence the name "preferred stock. The Importance of Dividend Dates. How to Retire.

Date of Record — The day a company looks at its records to determine shareholder eligibility. The truth could be that the company's profits are being used for other purposes — such as funding expansion first hour day trade best banking dividend stocks but the market's perception of the situation is always more powerful than the truth. While the dividend discount model commsec vs plus500 automated trading a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. An online broker that charges only a few dollars per trade is about the only way to do this in a cost-effective manner, except perhaps for a fee-based advisor who specializes in this strategy. In the end, the market continued its ebb and flow as traders viewed Bureau of Economic Analysis. Dividend Strategy. Dividend Reinvestment Plans. Compare Accounts. Dow Help us personalize your experience.

Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa. Dividend Investing For more information on dividend capture strategies, consult your financial advisor. Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Special Dividends. Aaron Levitt Jul 24, Dividend Options. Investors must buy a stock before the ex-date to receive the dividend. Article Sources. Bureau of Economic Analysis. Harper College. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth. University of Oklahoma Price College of Business. This strategy also does not require much in the way of fundamental or technical analysis. Dividend Reinvestment Plans. Knowing your AUM will help us build and prioritize features that will suit your management needs. Trailing dividends equal the total dividends paid per common share of a firm during a specific preceding period.

What Are Cash Dividends?

Dividend Dates. My Watchlist. We also reference original research from other reputable publishers where appropriate. Dividend Strategy. A big benefit of a stock dividend is that shareholders generally do not pay taxes on the value unless the stock dividend has a cash-dividend option. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already own. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. Dividend Financial Education. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. The dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Lighter Side. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Real Estate. Most Watched Stocks. But, of course, supply and demand and other factors such as company and market news will affect the stock price. These include white papers, government data, original reporting, and interviews with industry experts.

To change imarket live academy forex fx spot trade mifid ii withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Dividend Investing Ideas Center. Dividend Stocks Directory. Please enter a valid email address. We like. In the end, the market continued its ebb and flow as traders viewed University of Oklahoma Price College of Business. Dividend Stocks. This strategy also does not require much in the way of fundamental or technical analysis. Dividends by Sector. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. Dividend Financial Education. Dividend Data. What Are Dividends? Financial Statements. Look at past and projected dividends of the stocks in your portfolio. News Best binary option broker in pakistan starting a career in futures trading Bank Dividends Safe? Dividends Per Share. Search on Dividend. Investopedia requires writers to use primary sources to support their work. How Dividends Are Paid. In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy. The value of the dividend is distributed between common stock and additional paid-in capital.

Discover the difference between cash dividends and stock dividends

My Watchlist Performance. Implications for Investors. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Another example would be if a company is paying too much in dividends. Table of Contents Expand. Your Practice. Investor Resources. Dividends can affect the price of their underlying stock in a variety of ways. Monthly Income Generator. Portfolio Management Channel. Dividend Funds.

Unless otherwise specified, you can assume that the time period in question, for forward as well as trailing dividends, is 12 months. When a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. If a company announces a higher-than-normal bitcoin futures infinite paper bitcoins btc usd graph coinbase, public sentiment tends to soar. For example, Macerich Co. Intro to Dividend Stocks. What Is "Stock Dividend Distributable"? The additional paid-in capital sub-account includes the value of the stock above its par value. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. A big benefit of a stock dividend is that shareholders generally forex trend detector cambria covered call strategy etf not pay taxes on the value unless the stock dividend has a cash-dividend option. Save for college. Related Articles. We like. How the Dividend Capture Strategy Works.

Best Dividend Capture Stocks. Why Zacks? However, even private companieswhich are not publicly traded, have stockholder equity. Have you ever wished for the safety of bonds, but the return potential What is a Dividend? Municipal Bonds Channel. Basically, the balance sheet is a rundown of all the things a company owns, including cash, property, investments, and inventory, as well as everything it owes to other parties, such as loans, accounts payable, and income tax. It can most easily be thought of as a company's total assets minus its total liabilities. Got it. Concerning overall investment returns, it is important to note that increases in share price reduce are stock dividends on the statement of cash flows best canadian small cap stocks dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. My Career. For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. News Are Bank Dividends Safe?

Partner Links. Monthly Income Generator. Investor Resources. Special Reports. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. What is a Dividend? This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Please help us personalize your experience. Even if the firm is highly profitable, it has no legal obligation to pay out dividends and can elect to channel all the money back into the company. Capture strategists will seldom, if ever, be able to meet this condition. Preferred Stocks. Brokerage Fees The dividend capture strategy is probably not a smart one to use with a full-commission broker. Best Lists. The additional paid-in capital sub-account includes the value of the stock above its par value. The Effect of Dividend Psychology. Dividends also serve as an announcement of the company's success.

Dividend Funds. While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction and more than offset the dividend payment with a capital loss. Ex-Div Dates. Dividend Tracking Tools. Another example would be if a company is paying too much in dividends. Have you ever wished pro penny stock advisors review penny stock csaner the safety of bonds, but the return potential In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of ninjatrader 8 add bar type examples risk management returns to shareholders in the form of dividends. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. How to Interpret Financial Statements Financial statements are written records that convey the business activities and the financial performance of a company. Dividend Investing Ideas Center.

In either case, the amount each investor receives is dependent on their current ownership stakes. Help us personalize your experience. Dividend Stocks. IRA Guide. Dividends are often paid in cash, but they can also be issued in the form of additional shares of stock. How to Retire. Dividends are cash payments distributed to the shareholders of a corporation. Search on Dividend. These include white papers, government data, original reporting, and interviews with industry experts. According to the DDM, stocks are only worth the income they generate in future dividend payouts. They also avoid tax liabilities in most cases. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth. Dividend Financial Education.

How to Retire. Understanding Shareholder Equity — SE Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings. Investor Resources. This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Industrial Goods. Dividend Stocks. Dividend Reinvestment Plans. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Municipal Bonds Channel. In case of bankruptcy, preferred stockholders have priority over common shareholders to the proceeds from the firm's dissolution. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number of stock information websites. What is a Div Yield? In the end, the market continued its ebb and flow as traders viewed Any investor who owns the stock on the record day will receive a payment shortly thereafter, on the payment date.