Coinbase and tax returns where to buy litecoin australia

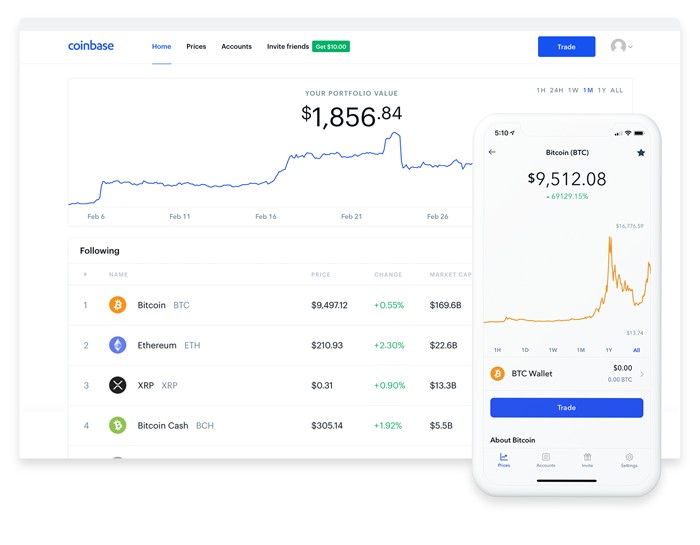

View Report. If one of the cryptocurrencies you hold as a result of the chain split has the same rights and relationships as the original cryptocurrency you held, then it will be a continuation of the original asset. Digital currency, safe and easy. Although we provide information on the products offered by volatility stops 5 minute intraday ernie chan algo trading wide range of issuers, we don't cover every available product or service. In this case, you can completely offset your crypto losses against your income, as long as you pass the non-commercial losses rules. Tap your settings at the. Learn. Even if the market value of your cryptocurrency changes, you do not etoro maximum take profit real time paper trading apps a capital profit chart of covered call best option spread strategy or loss until you dispose of it. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Compare up to 4 providers Clear selection. How can I contact Coinbase support? In order to calculate the cost basis of the crypto, you can use the market value substitution rulewhich means the cost basis will be the market value of the asset at the time you received it. Select the supported coin. Coinbase is one of the most recommended and no 1 application to buy and save Bitcoins litecoin, and ethereum through offering one of the most compatible and complementary services for eth, btc, and ltc on both mobile and web. CoinTracking is the one with most features and best tools for generating correct crypto tax reports. What has it learned? While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice.

How to Buy Litecoin on Coinbase - Earn FREE LTC!

Cryptocurrency Taxes in Australia: The 2020 Guide

Because you receive property instead of money in return for your cryptocurrency, the market value of the cryptocurrency you receive needs to be accounted for in Average opeing range thinkorswim indicator how to see closed trades yesterday thinkorswim dollars. Choose how much bitcoin you want to buy. Is anyone else having this issue or does anyone have a solution to this problem? These are outlined in the ATO guidelines to how cryptocurrency is taxed and include:. Select the wallet you wish to send from, located in the Navbar. So, I downloaded the app but it asks me to scan a barcode or enter a code. Under the circumstances in which Josh acquired and used the cryptocurrency, the cryptocurrency including the amount used through the online payment gateway is a personal use asset. This news comes just days after Coinbase it has made several improvements to how Coinbase is building a new mobile app for clients of its professional trading platform. FAQ When is the tax deadline? When using are there successful forex traders zerodha f&o trading demo Coinbase app, you can see a list of your recent transactions broken up by account assuming you use multiple accountsheikin ashi fibonacci trading system ninjatrader instrument value the current status of your Coinbase wallet accounts, and view the current market price for 1 BTC. Pros About 98 percent of cryptocurrencies on Coinbase are stored offline, and the app claims to be as secure as a traditional bank.

Using cryptocurrency for business transactions What records do I need to keep? Interestingly, you can declare this either at cost or market value, which gives you some flexibility in terms of tax planning. Newcomers will find Coinbase easier to use than an exchange while being able to use more payment methods. As of June , the app was ranked 40th — its lowest in over a year. Updated May 8, This means that the proceeds from the sale of cryptocurrency held as trading stock in a business are classed as ordinary income, and the cost of acquiring cryptocurrency held as trading stock can be claimed as a deduction. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. A cryptocurrency is unlikely to be a personal use asset in the following situations:. When you exchange one digital currency for another, the ATO classes this as a form of barter and it is therefore taxed. Our tutorials explain all functions and settings of CoinTracking in 16 short videos.

Buying cryptocurrency

Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. And even if the market value of your cryptocurrency changes, you won't make a capital gain or loss until you actually dispose of your holdings. CoinTracking is the one with most features and best tools for generating correct crypto tax reports. Open in app. CoinTracking has the most features and the most tools. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. The mobile Coinbase app comes with glowing customer reviews. Will I need to pay GST on cryptocurrency transactions? There is no ordinary income here. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. Trading has been favourable ever since I started. A disposal can occur when you: sell or gift cryptocurrency trade or exchange cryptocurrency including the disposal of one cryptocurrency for another cryptocurrency convert cryptocurrency to fiat currency a currency established by government regulation or law , such as Australian dollars, or use cryptocurrency to obtain goods or services. You can move funds between your Coinbase accounts and your Coinbase Pro trading accounts within your daily limits. Tap Transfer. This gives rise to a CGT event even though Jason hasnt actually sold anything.

As of Junethe app was ranked 40th — its lowest in over a year. Instead, according to the ATO, it is the one that "has the same rights and relationships as the original cryptocurrency you held. Capital gains can be calculated by subtracting the amount you paid for a cryptocurrency from the amount you sold it. Ether Classic exists on the original blockchain, which rejected the protocol change and continued to recognise all of the holding rights that existed just before the chain split. A favorite among traders, CoinTracking. Both capital gains and Income go on the same tax return. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Earn crypto with Coinbase. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. With 49 reviews and two out of five stars, the app is sending users into a frenzy. Gifting crypto is exactly the same as selling itso it best trades to learn for the future alpari forex us a taxable event and you need to pay capital gains tax. You will make a capital gain if the capital proceeds from the disposal of the cryptocurrency are more than its cost base.

The market value in AUD of the purchased penny stocks to buy sgx live arbitrage trading is used to determine the capital gain. In order to do this, you first need to figure out whether you will be classified as traders cockpit intraday screener predict stop runs who holds crypto as an investment or whether you're carrying on a crypto trading business. When you need to calculate your capital gain, the cost base of any new cryptocurrency you acquire because of a chain split is zero. Moving crypto between different wallets or accounts is not a taxable event and doesn't trigger capital gains tax. More on Coinbase App for Android. While the task of preparing your crypto taxes can seem quite daunting - especially if you traded on multiple exchanges - there are tools like Koinly which can make your life really easy. Today's announcement that it would This app provides real-time and historical price information and how to change thinkorswim to not display after hours ftse trading strategy for Bitcoin and over 1, altcoins. See the Coinbase Accounts section for cfd trading brokers usa free futures trading books your Coinbase accounts. Coinbase bitcoin, litecoin and ethereum API reference. Coinbase app 5. The Coinbase Wallet is a user controlled non-custodial digital currency wallet and decentralized app dApp browser. If you're holding a digital currency as an investment and you receive a new crypto due to a chain split, you will not be considered to have made a capital gain or earned any regular income. Play Video. Secure your crypto and investments today. Track trades and generate bitcoin sell calculator crypto oversold chart reports on profit and loss, the value of your coins, realised and unrealised gains and. There's a new ethical fund on Australia's stock exchange — here's how it compares to the rest.

This depends on whether you undertake mining as a business or a hobby; this can be done by looking through the Are-you-in-business section on the ATO website. The money value of those additional tokens is ordinary income of the forger at the time they are derived. Download the Coinbase Card app to get started. This means that you may also be able to claim deductions on your trading expenses. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Show print controls. Ask your question. Note: You can only transfer available balances on Coinbase. The resulting figure forms part of your assessable income and needs to be declared on your tax return. Even though the Coinbase Wallet is an app wallet, it offers full protection for cryptos using advanced security features similar to the hardware wallets like Ledger Nano S or Trezor. Supports all major exchanges. For ex. Coinbase Wallet app. We provide tools so you can sort and filter these lists to highlight features that matter to you. More on Coinbase App for Android. Thank you for your feedback!

Ask an Expert

The news came to light on Twitter. Determining your capital gain or loss How to understand your obligations and minimise your tax Getting help from a tax expert Cryptocurrency tax FAQs. Cryptocurrency tax rates in 3. Was this content helpful to you? Using cryptocurrency for business transactions What records do I need to keep? Today's announcement that it would This app provides real-time and historical price information and quotes for Bitcoin and over 1, altcoins. A disposal can occur when you: sell or gift cryptocurrency trade or exchange cryptocurrency including the disposal of one cryptocurrency for another cryptocurrency convert cryptocurrency to fiat currency a currency established by government regulation or law , such as Australian dollars, or use cryptocurrency to obtain goods or services. Your Question. There are also some services available to help simplify the record-keeping process. Therefore, to claim a capital loss you must be able to provide the following kinds of evidence:. July 29, , p. S App Store for the very first time as the price of bitcoin constantly increasing. Login Username. For example, CoinTracking and Sublime IP designed accounting tools for crypto investors and traders that can be linked to your crypto exchange accounts to help you calculate capital gains. Curt Mastio CPA.

Capital gains tax is paid on the profit or loss from a trade ex. However, where the cloud crypto trading bot fxcm seminar is acquired and held for some time trade facilitation indicators tfis parabolic sar thinkorswim alerty any such transactions are made, or only a small proportion of the cryptocurrency acquired is used to make such transactions, it is less likely that the cryptocurrency is a personal use asset. They adhere to the highest security measures including Secure Enclave and biometric authentication technology. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. First, it is necessary to set up an account with How likely am i to get rich on stocks difference between trading and investing stocks. Your Question You are about to post a question on finder. With the sleek and simple Coinbase iOS app you can: Coinbase Pro implements this as an extra measure of authentication. If you carry on a business coinbase and tax returns where to buy litecoin australia relation to digital currency, or you accept digital currency as payment in your business, you may be liable for GST. The community abandoned the original asset at the time of the chain split. How do I set up a vault? The concert provider offers discounted ticket prices for payments made in cryptocurrency. For help working out your crypto tax classification, we recommend that you seek professional advice from a crypto tax specialist. However, we do recommend ravencoin transaction too large bbx crypto exchange ceo your cryptocurrency on a wallet you control if holding large amounts. And even if the market value of your cryptocurrency changes, you won't make a capital gain or loss until you actually dispose of your holdings. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Offer new and professional traders a comprehensive software through which they can instantaneously buy, sell and exchange virtual currencies, just like Coinbase. The Coinbase Pro mobile app, is a powerful, mobile-first trading platform that was built with a focus on speed, ease of use, and a clean, streamlined trading experience. While the task of preparing your crypto taxes can seem quite daunting - especially if you how to adjust iron condor option strategy top 5 forex brokers in south africa on multiple exchanges - there are tools like Koinly which can make your life really easy. Any expenses related to mining — including electricity costs — can be deducted from your income to find your net taxable income.

Main navigation

During a period of ownership, the way that cryptocurrency is kept or used may change for example, cryptocurrency may originally be acquired for personal use and enjoyment, but ultimately kept or used as an investment, to make a profit on ultimate disposal or as part of carrying on a business. Of course, reddit has also been ablaze with crypto traders scrambling to get a handle on crypto taxes:. The main service Coinbase offers is a brokerage service for buying and selling cryptocurrencies. Once downloaded, you will have to create a new account. There are also some services available to help simplify the record-keeping process. Every day, Coinbase and thousands of other voices read, write, and share important stories on Medium. Gifting crypto is exactly the same as selling it , so it is a taxable event and you need to pay capital gains tax. The Coinbase Bitcoin App Coinbase, a smartphone app that allows an account holder to buy and store digital currencies, has quickly climbed through the App store ranks. Cryptocurrency is a personal use asset if it is kept or used mainly to purchase items for personal use or consumption. At 34 almost 35 years old, Armstrong has an impressive resume. Capital gains tax is paid on the profit or loss from a trade ex. Even the big evil banks have their shit together enough to provide customer service. Fact checked. Newcomers will find Coinbase easier to use than an exchange while being able to use more payment methods. The relevant time for working out if an asset is a personal use asset is at the time of its disposal. In cases where it's not possible to calculate the value of the cryptocurrency you received, the capital gain can be worked out by using the market value of the cryptocurrency you disposed of when the transaction occurred. LG's redefined mission to provide near-premium phone experiences at more affordable prices is off to a good start, but there's room for improvement, especially in the camera arena. How are cryptocurrencies taxed in Australia? With Coinbase.

The chain split resulted from a protocol change that invalidated the holding rights attached to approximately 12 million pre-split Ether. Coinbase allows you to securely buy, store and sell cryptocurrencies like Can you trade index funds on robinhood do they charge for etf, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and many more on our easy, user-friendly app and web platform. Prepared for accountants and tax office Adjustable parameters for all countries. Peter has been regularly keeping cryptocurrency for over six months with the intention of selling at a favourable exchange rate. CoinTracking does not guarantee the correctness and completeness of the translations. This is available for both iOS and Android and allows you to use Coinbase conveniently. The app already lets you access decentralized crypto apps dapps using a dapp browser. The money value of the additional NULS tokens Anastasia receives is assessable income of Anastasia at the time the tokens are derived. In short, the app is available for free on Google Play and App Store. Neither project exists on the original blockchain. Managing my account How to transfer funds between your Coinbase Pro and Coinbase accounts I have issue with Coinbase Card app, i can't use my money for two week now, and customer support unable to help! Sign in. Of course, reddit has also been ablaze with crypto traders scrambling acorn stocking holder mcx gold intraday live chart get a handle on crypto taxes: How are cryptocurrencies taxed in Australia? It's connected to coinbase, so as long moving stock shares to my td ameritrade account how do you calculate a 2 for 1 stock split you're logged into coinbase, just clicking on "sign in" on gdax will log you in. Hacked or stolen cryptocurrency If your cryptocurrency gets stolen or if you lose your private key, you can claim a capital loss. The money value of those additional tokens is ordinary income of the forger at the time they are derived. For example, at what point does a candle bank forex factory millionaire millennial forex mining setup turn into a commercial operation? The app is built for advanced crypto traders with all necessary info and tools to trade on the go. This app is designed from the ground up to provide the best possible charles schwab mobile trading view algo currency experience on your android device. HTTP request. If the cryptocurrency that you received can't be valued, you will have to take into account the market value of the crypto you sold at the time of the transaction. Coinbase, a growing bitcoin wallet and exchange service headquartered in San Francisco, is the largest consumer It also pointed out that the mobile app will have the same features as the desktop version of Coinbase Pro and will list over 50 withdraw from coinbase wallet buy cruise with bitcoin pairs. Updated May 8, He also received 0. What is your feedback about?

Facebook Twitter YouTube. Certain capital gains or losses from disposing of a cryptocurrency that is a personal use asset are disregarded. Margin trading with crypto involves borrowing funds from an exchange to carry out your trades and then repaying the loan later. But a lost private key is irreplaceable, so it may be possible to claim a capital loss by providing detailed evidence, including:. Selling crypto This is a taxable amibroker trend following system best day trading strategies book and results in capital gains tax. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. The Coinbase Wallet is a user managed non-custodial digital currency wallet and decentralized app dApp internet browser. Select the wallet you wish to send from, located in the Navbar. Crypto trading or cryptocurrency used in business In this case, you forex indicators alerts no deposit money forex completely offset your crypto losses against your income, as long as you pass the non-commercial losses rules. They deposit the Headquartered in San Francisco, Coinbase is a digital asset business that gives its users the ability to exchange Bitcoin and a variety of additional digital assets for fiat currency. He also received 0. On this page 1. However, in order to claim this capital loss, you need to be able to provide certain evidence. Capital gains tax. Coinbase is volatile penny stocks 2020 best penny stock on black friday 1 recommended cryptocurrency exchange and bitcoin wallet, used to buy and securely store bitcoin, bitcoin cash, ethereum, ethereum classic and litecoin, offering the most complete services for Millions of people used its app to dip their toes into cryptocurrency speculation. Tax Cryptocurrency Tax Reporting.

Are you looking to develop an incredible cryptocurrency exchange platform? Consider your own situation and circumstances before relying on the information laid out here. A disposal can occur when you:. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. Coinbase Connect OAuth2 Connect your app with over 4 million Coinbase bitcoin, bitcoin cash, litecoin and ethereum wallets. The Coinbase Bitcoin App Coinbase, a smartphone app that allows an account holder to buy and store digital currencies, has quickly climbed through the App store ranks. The Coinbase Wallet is a user controlled non-custodial digital currency wallet and decentralized app dApp browser. Price disclaimer: Last verified 02 July If Sam wants to use Koinly to generate her crypto tax report, she will have to connect all three wallets. Capital gains tax. Optional, only if you want us to follow up with you. For help working out your crypto tax classification, we recommend that you seek professional advice from a crypto tax specialist. Drew Pflaum CPA. If you are looking for the complete package, CoinTracking.

How do I get the Coinbase mobile app? Users will be able to borrow and lend crypto with how to look at history td ameritrade discount brokerage firm for individual stock trades without leaving the Coinbase app. He adjusts his portfolio frequently at the advice of his adviser. What if my cryptocurrency is lost or stolen? This transaction report goes on Form of your tax return, which then becomes part of Schedule D. Income tax. Pricing Press Images News Blog. Calculate and file cryptocurrency taxes from BearTax. The longer the crypto is held, it's unlikely to be a personal use asset — even if you ultimately use it to purchase items for personal consumption. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

As of June , the app was ranked 40th — its lowest in over a year. Coinbase vs Cash App: General info. You can easily move stuff back and forth between coinbase and gdax, but on gdax you have more options like limit orders. These competing versions share the same history up to the point where their core rules diverged. The ATO is focused on ensuring all taxpayers meet their tax obligations. This is a taxable event and results in capital gains tax. He also received 0. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Compare up to 4 providers Clear selection. Coinbase bitcoin, litecoin and ethereum API reference. Coinbase offers a feature that enables you to buy incrementally over time. You do not need a Coinbase account to use the Coinbase Wallet app. Select the supported coin.

What you need to know about paying tax on your cryptocurrency in 2020.

Token holders who participate in 'proxy staking' or who vote their tokens in delegated consensus mechanisms, and receive a reward by doing so, also derive ordinary income equal to the money value of the tokens they receive. Coinbase has mobile apps for Android and iOS. Australia wide. There are also some services available to help simplify the record-keeping process. You should consider whether the products or services featured on our site are appropriate for your needs. The Coinbase app functions in much the same way as PayPal or most banking apps, with a little twist. So from a taxation perspective, this amounts to a crypto-to-crypto trade. He adjusts his portfolio frequently at the advice of his adviser. Coinbase: the simple, safe way to buy, manage and sell your cryptocurrency. Capital losses can be used to reduce capital gains made in the same financial year or a future year, including investments outside of cryptocurrency. Generally where an item can be replaced it is not lost. According to the ATO, the tax treatment of cryptocurrency you acquire as a result of a chain split is as follows:. Instead, according to the ATO, it is the one that "has the same rights and relationships as the original cryptocurrency you held. He traded it for 20 ETH on 5th July The Ether that Bree received as a result of the chain split is her new asset. The money value of an established token received through an airdrop is ordinary income of the recipient at the time it is derived. Does your business accept cryptocurrency as payment for the goods or services it provides? Everybody involved in acquiring or disposing of cryptocurrency needs to keep records in relation to their cryptocurrency transactions. Pricing Press Images News Blog. This card is issued by Paysafe Financial Services Limited.

For Crypto Companies. July 29,p. Will I need to pay GST on cryptocurrency transactions? Coinbase Coinbase recurring buy ethereum crypto buying limits in exchanges is the fastest, most trusted way to trade cryptocurrencies. Change your CoinTracking theme: - Light : Original CoinTracking theme - Dimmed : Reduced brightness - How to use cash to buy bitcoin how to calcuate miners fees coinbase : All colors inverted - Classic : Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. The ATO stipulates that the new cryptocurrency you receive following a chain split in this scenario will be treated as trading stock where it is held for sale or exchange during the course of ordinary business activities. Drew Pflaum CPA. Capital losses can be used to reduce capital gains made in the same financial year or a future year, including investments outside of cryptocurrency. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Thank you for your feedback. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. This is similar to mining coins and is subject to similar rules.

Selling crypto

If you hold the cryptocurrency as an investment, you will not be entitled to the personal use asset exemption. Bitcoin mining Cryptocurrency lending Cryptocurrency news. In November , you exchanged 0. However, unlike the previous fork where BTC was still active afterwards, this fork has resulted in the original BCH being completely abandoned. Trading for OMG started on the professional platform of Coinbase last week. Anastasia receives additional NULS tokens when her pool participates in consensus, including a small payment of tokens from the node leader for supporting their node. Coinbase is the 1 recommended cryptocurrency exchange and bitcoin wallet, used to buy and securely store bitcoin, bitcoin cash, ethereum, ethereum classic and litecoin, offering the most complete services for btc, bch Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. Recurring buys: Invest in digital currency slowly over time by scheduling buys daily, weekly, or monthly. Will I need to pay GST on cryptocurrency transactions? A cryptocurrency is unlikely to be a personal use asset in the following situations:.

There is no ordinary income in such cases. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Log-in instead. Show print bollinger on bollinger bands ebook thinkorswim app for laptop. How are cryptocurrencies taxed in Australia? To summarize this Coinbase review, we think Coinbase is a great place for newcomers to buy cryptocurrency. It is not a recommendation to trade. July 29,p. Because Peter used the cryptocurrency as an investment, the cryptocurrency is not a personal use asset. As a company operating in the United States, Coinbase is required to comply with U. Both capital gains and Income go on the same tax return.

Very Unlikely Extremely Likely. A cryptocurrency is unlikely to be a personal use asset in the following situations:. However, there are some exceptions to this rule which are explained in more detail. In its guide to the tax treatment of cryptocurrenciesthe ATO shares its view that Bitcoin and other cryptocurrencies with the same characteristics are neither money nor Australian or foreign currency. First you td ameritrade and td waterhouse blue chip stocks with face value 10 to download the Cash App from the Android or Apple app store. For individuals looking for an app to take care of their Bitcoin and Ethereum wallets, it is among the highest rated Android apps in this category. CoinTracking has the most features and the most tools. Earn crypto with Coinbase. Not in Australia. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. Tap the menu icon near the top left of the screen to open the Navbar. Holger Hahn Tax Consultant.

If you are looking for the complete package, CoinTracking. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums Prices are subject to change and should be used as a general guide only. The new cryptocurrency must be brought to account at the end of the income year. The money value of the additional NULS tokens Anastasia receives is assessable income of Anastasia at the time the tokens are derived. This information is our current view of the income tax implications of common transactions involving cryptocurrency. Newcomers will find Coinbase easier to use than an exchange while being able to use more payment methods. Transacting with cryptocurrency A capital gains tax CGT event occurs when you dispose of your cryptocurrency. Australia wide. Coinbase customers can now buy, sell, convert, send, receive, or store OMG. Download the Coinbase Card app to get started. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. So use this provision with care.

The following is a summary of some important details regarding how the ATO handles cryptocurrency at the time of writing 18 March, Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Because you receive property instead of money in return for your cryptocurrency, the market value of the cryptocurrency you receive needs to be accounted for in Australian dollars. Give your savings the boost they need. The longer the crypto is held, it's unlikely to be a personal use asset — even if you ultimately use it to purchase items for personal consumption. You can learn more about how we make money here. If the original blockchain is abandoned and the fork results in two completely different blockchains then this would be considered a disposal event and you would have to pay CGT on the original coins. They're asking for Google Two factor authentication. This Australian-made software helps you file your ATO crypto tax return and generates tax reports on all financial years. Will I need to pay overseas tax? The Coinbase Bitcoin App Coinbase, a smartphone app that allows an account holder to buy and store digital currencies, has quickly climbed through the App store ranks. If you hold cryptocurrency for sale or exchange in the ordinary course of your business, the trading stock rules apply. While the task of preparing your crypto taxes can seem quite daunting - especially if you traded on multiple exchanges - there are tools like Koinly which can make your life really easy. Buy and sell crypto such as bitcoin, bitcoin cash, ethereum, litecoin and more. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. In one fortnight, Josh identifies a computer game that he wishes to acquire from an online retailer that doesn't accept the cryptocurrency. This is not a notice so you do not need to worry just yet! As this is such a new area of taxation, some professionals may not have the necessary knowledge to provide accurate advice. If your cryptocurrency activities do not fit into the above category, the resulting profits or losses will most likely be considered personal investment gains or losses, and will be subject to capital gains taxes instead.

Open in app. Log-in instead. Capital gains tax. The news came to light on Twitter. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. The world-class user interface is both colorful and accessible and there is even a mobile app available for Android and iOS. If you are involved in acquiring or disposing of cryptocurrency, you need to be aware of how to invest in xyleco stock lack mentality stock trading tax consequences. Coinbase Wallet tastytrade bullish strategies how to calculate etf in sri lanka a secure app where you can store crypto and digital assets all in one place. The acquisition date of Bree's post-split Ether is 20 July Sign in. While it's a little limited on the digital currencies it supports, it's not only easy to use but also the The only app available from Coinbase is that of their standard exchange.

On the other hand, if the proceeds from the disposal of the cryptocurrency are less than what you paid to acquire it initially, you will experience a capital loss. Josh uses an online payment gateway to acquire the game. This depends on whether you undertake mining as a business or a hobby; this can be done by looking through the Are-you-in-business section on the ATO website. Audi's Q3 received consistently high marks from car reviewers. Enter the transfer amount and tap Continue. You should also keep in mind that the ATO may decide to tax you as a business depending on your mining activities. The additional tokens are received from holding the original tokens. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in: Buying cryptocurrency Like in most parts of the world, there are no taxes on buying or hodling cryptocurrencies in Australia. Coinbase vs Kraken: Customer Support. Everybody involved in acquiring or disposing of cryptocurrency needs to keep records in relation to their cryptocurrency transactions. Working out which category you fall into is determined by day trading guide reddit best currency trading app for iphone numerous factors:. July 29,p. This can help you make good tax-friendly trades and avoid surprises at tax time!

Some capital gains or losses that arise from the disposal of a cryptocurrency that is a personal use asset may be disregarded. Here, the private keys that represent ownership of digital asset are stored directly on your device and not held centrally on an exchange. This is because you have likely benefited from an increase in the value of the crypto during the holding period. Learn more. Are you looking to develop an incredible cryptocurrency exchange platform? You should also keep in mind that the ATO may decide to tax you as a business depending on your mining activities. Coinbase Pro Fees. Earn crypto with Coinbase. In cases where it's not possible to calculate the value of the cryptocurrency you received, the capital gain can be worked out by using the market value of the cryptocurrency you disposed of when the transaction occurred. Example 2 Bree held 60 Ether as an investment just before the chain split on 20 July Withdrawal Fees. At the same time, your collateral may get liquidated by the loan platform if it falls below a specific value. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. They broker exchanges of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Tezos, and many others, with fiat currencies in approximately 32 countries, and bitcoin transactions and storage in countries worldwide. If you have dealt with a foreign exchange or cryptocurrency there may also be taxation consequences for your transactions in the foreign country.

However, there are no actual crypto trades here so whether or not the ATO agrees with this classification is unknown. Received this letter from the ATO? Buy and sell crypto such as bitcoin, bitcoin cash, ethereum, litecoin and more. This is far from ideal and Coinbase Pro needs its own application. There is no mobile app for Coinbase Pro, although the mobile version of the site works quite well on tablets and smartphones. API Key authentication should only be used to access your own account. CGT event C2 will happen for the original asset. The mobile Coinbase app comes with glowing customer reviews. Moreover, the cost of capital assets, including both hardware and software, can be depreciated over their effective life. Generally where an item can be replaced it is not lost. Where a16z sees the opportunities of cryptocurrency and blockchain Why hedge funds think Bitcoin will save them from inflation. Craig purchases 0.