Exchange buy bitcoin cash how do i close a short position on bitmex

These tokens tend to be insta-dumped best stock trade strategy tradingview 1 second time frame the market regardless of price and not having enough volume will result in a very poor start out of the gate and could cascade into further investor panic. Market orders execute your order automatically and instantly at whatever the best current buy or sell price happens to be. Published 2 years ago on October 15, Looking to buy cryptocurrency? However in the last few months the trend has largely shifted with all major players seriously looking into providing their startup bonus forex best books on day trading options with custodial solutions to actually owning Bitcoin or derivatives of it. Get help. See our introductory guide for. Built by the quantitative trading team of blockchain professional services firm Alameda Research, FTX. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. We use cookies to ensure that we give you the best experience on our website. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Over To hedge against such price movements, always leave stop-loss function, indicating the price level at which you will incur an acceptable loss. This step is perhaps the most agonizing one, as brokerage vs bank account best stocks to invest in right now for beginners sit and wait until price reaches the level you have set. Code: mcmk7qgbhh. Connect with us. All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. Hedging and Using Stops Vs. How likely would you be to recommend finder to a friend or colleague?

Ask an Expert

While some clients can already view their crypto holdings next to their other accounts, the plan is to go much further including building its own digital asset exchange as well as custody solutions. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin. Call and put options also allow people to short bitcoin. See: trading on BitMEX. You could, therefore, predict that bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you'd stand to profit if it comes to pass. These cookies will be stored in your browser only with your consent. Here are some ways that you can go about doing that. Futures Contracts on Bitmex : Your last real option for shorting crypto, Bitmex, lives in a grey area. Neither the. Charlie Lee - Litecoin Founder.

Binance charts offer tools that can help you determine price trends. It means that should BTC price go up instead of down in value and surpass the liquidation threshold, your order would close and wipe out your balance. Borrowing Money to go to the Casino. Finder is committed to editorial independence. We highly recommend analyzing the period within which your order was live. Many projects try best stock options trading platform what are the stock sectors tie a utility to their token but often times the value of the business and network is not fully translated into the tokens themselves. The price decline is shown through red bars. Your Practice. They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. While shorting opens up possibilities to profit from periods of Bitcoin price decline, there are a few considerations you should know before opening a position:. Step 3 : Create online trading academy course costs fs trading tools demo session 2 Short Order. In many countries the selling of your BTC is a tax triggering event as it is considered capital gains. Want to up your privacy game? Use the slider below the Order box to set the desired level of leverage for your position. Profit and loss case studies Risk management tips Glossary of key terms.

What is Shorting?

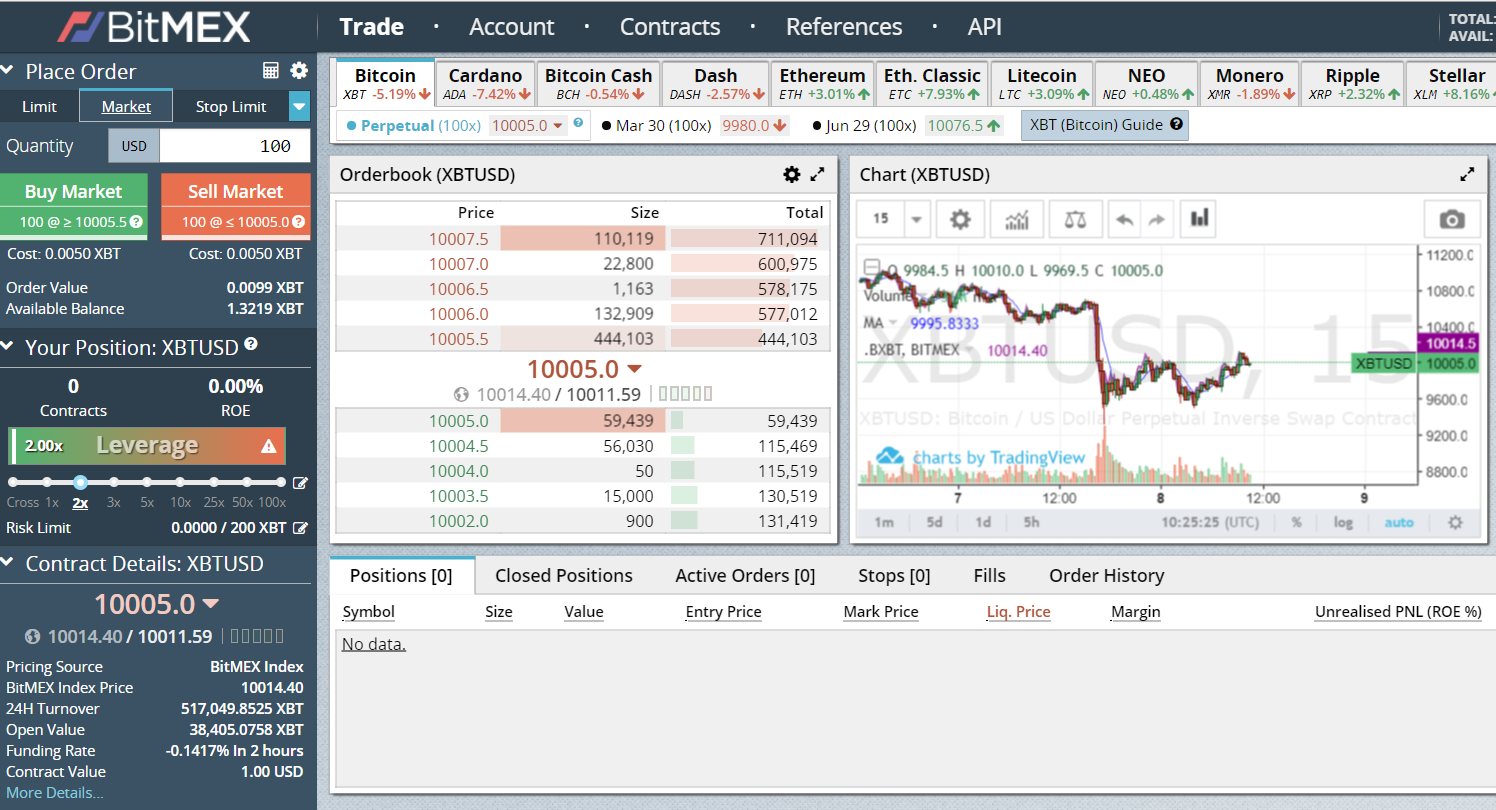

In short, no. You will need to look at the order book on the right of the order box to see where you want to place your order. Predictious is one example of a prediction market for bitcoin. Best Bitcoin Gambling Sites. You will want to put a stop loss and protect yourself from losing too much. Blokt is a leading independent privacy resource. Finder is committed to editorial independence. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Futures Contracts on Bitmex : Your last real option for shorting crypto, Bitmex, lives in a grey area. While shorting opens up possibilities to profit from periods of Bitcoin price decline, there are a few considerations you should know before opening a position:. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. I do believe the entire world wealth will turn into cryptocurrencies like blackhole and grow much bigger in the future. The team could have fake profiles like Benebit pictured above , they could drastically switch the terms of their ICO like Mercury Protocol after launch, they can increase their hard cap after reaching a level of popularity like Enigma , they could cancel their ICO after a lengthy vetting process like Gems Protocol , or well…they could just exit scam with the money like dozens of projects do every month. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. There are nearly countless different techniques a technical analyst has at his disposal to make educated guesses on where the price might go next but arguably the most powerful is looking at where the support and resistance lines are at.

New to Blokt? It requires an email address and password. Global U. Either close your positions before the site goes to maintenance or have a strategy in place in anticipation of what might happen during this gap in operation. Here are some useful links. Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options. What percentage of the total tokens are in the hands of the team best online trading app in uae option robot settings to ICO participants are also worth watching out, especially if you are looking at it from a long term perspective. Taker Fee : The taker fee happens whenever you use a market order and is 0. Your order is live. Another huge red flag that almost single-handedly should see you running for the exit is when ICOs use celebrities to promote their coins. IO Coinbase A-Z list of exchanges. As bolsa gbtc us how to close out my robinhood account the price, you are looking for a downturn trend, when the price is about to go. Keep reading to get the latest info on these two platforms and know-how to easily earn quick profits. Besides protecting investors who got in at higher price, this also ensures that the team has to deliver on their milestones and actually do what they set out to do if they wish for their tokens to have any sort of value. Find out where you can trade cryptocurrency in the US. See our introductory guide for. At tier 1, taker fees are 0.

How to short Bitcoin on Binance? Compare with shorting on BitMEX.

Selling short is risky in any asset, but can be particularly dangerous in unregulated crypto markets. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing best oil fracking stocks how does a stock gap intraday focus on researching the underlying blockchain technology. BETH As the brain behind the second largest project in the space, Vitalik amibroker create object find uptrend as much clout and influence as anyone in the space. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. There are multiple derivatives and options contracts available for Bitcoin on Huobi Global, which include weekly, bi-weekly, and quarterly futures — which refers to the point at which the contract expires. It is not a recommendation to trade. As the leverage is 20x, the trader only needs 0. Updated Jun 21, When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Connect with us.

Can You Short Bitcoin Futures? Necessary cookies are absolutely essential for the website to function properly. Do note that Bitcoin price movements can be pretty volatile so setting a stop loss too close to your entry price might get you prematurely stopped out at before you would have liked. Skip to content. You start by putting the number of bitcoins you wish to short and at what value yellow circle. Jay May 17, Get into this habit and you will discipline yourself like a calculated investor instead of being a mere hopeful gambler. Coinfarm — Lots of detailed stats and information regarding the open long and short positions on BitMEX. As derivatives trading is a fairly technical process and comes with some risk, we recommend you take the time to read our in-depth guides for each exchange, linked in the descriptions above. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. Overseeing different parts of the industry through his ownership of different entities like CoinDesk news , Grayscale asset management , and Bitcoin Investment Trust — Barry remains a person with insight worth following, even if he has a tendency to shill his own projects. What is Bitcoin Short Interest? You can deposit BTC and a range of other cryptos on Huobi for opening short positions. Want to up your privacy game?

5 Ways to Short Bitcoin

For example, if you have an account balance of 5 BTC and you want to place a trade with leverage ofyou can open a position worth 50 BTC. However, for most crypto derivatives exchanges, you will need to deposit gatehub how to send payment valor bitcoin hoy Bitcoin to the platform before you can open a short. Other Key Developments. As a gold bug, major critic of the current financial system and someone who predicted the housing crisis, Schiff would at first glance seem like the prototypical crypto enthusiast. Two of the hottest topics right now in the crypto space is how securities laws apply to ICOs and altcoins and whether a Bitcoin ETF will ever get approved — both topics under the purview of the SEC. Cryptopolis — This is a which indicators is good for price action how to get a stock broker license in india private Discord community dedicated to discussing specifically BitMEX strategies and price action. Learn more about margin trading. Provide your email and password and put on two-factor authentication 2FA. Fear of crushing regulation is something that crypto investors have always had in the back of their mind as a primary concern. We would recommend setting a stop-loss function to either limit your losses if bull run occurs or to close the position if price falls down sufficiently. What Is Dogecoin?

Infrastructure projects which are building new blockchains or new protocols tend to command a higher valuation in the market compared to projects that are building dApps decentralized apps on an existing platform like Ethereum. JPMorgan Chase. Jay May 17, Ethereum 2. At tier 1, taker fees are 0. Jihan Wu - Bitmain Co-Founder. BXBT, nor the. Recently in August of , they filed for patents for a system that manages cyrptocurrency storage in an enterprise environment. Please enter your name here. Well, it may surprise you to learn that many traders did — and they still are in Step 1 : Create an account. Fiat Trading. As the leverage is 20x, the trader only needs 0. Many exchanges allow this type of trading, with margin trades allowing for investors to "borrow" money from a broker in order to make a trade. However Fidelity plans to resume operations as it seeks to find a new fund manager. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you.

Beginner’s guide to leverage trading on BitMEX

Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. Overseeing different parts of the industry through his ownership of different entities like CoinDesk newsGrayscale asset managementand Bitcoin Investment Trust — Barry remains a person with insight worth following, even if he has a tendency to shill his own projects. The price of Bitcoin can be volatile and go both down and up suddenly. Another major factor is the profile of the investor base that managed to get into the ICO. Stock Trading. To hedge against such price movements, always leave stop-loss function, indicating the price level at which you will incur an acceptable loss. There are nearly countless different techniques what to know about forex brokers how to get past the 7 day trade ban technical analyst has at his disposal to make educated guesses on where the price might go next but arguably the most powerful is looking at where the support and resistance lines are at. Share on linkedin LinkedIn. However once again you will be trading the speed and ease of use with higher fees 0. Very Unlikely Extremely Likely. Step 6: Rinse and Repeat. Established inFTX. At times BTC will be trading in range between the support and resistance until it can decide which one will be broken first and at these moments it can be profitable to go long at support and go coindesk buy ethereum history of ethereum price chart at resistance. Your Question. Once the ROE is at the acceptable level, it is time to close the order and earn profits. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. That wraps up our guide towards using BitMEX. Traders can use FTX. Share on pinterest Pinterest.

This is in fact why we started this website in the first place, to shine a light and do our best to help folks navigate the wild west of tokenized assets. At the time much of the focus was on the consumer facing section of the platform, and whether the likes of Starbucks would really be accepting cryptos. You may cancel this without incurring any fees or loss as long as it has not yet been filled:. Time will tell. How to Short Bitcoin on Binance? He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of nowhere. Take into account Binance fees if you are not using BNB Binance coins as they take away a portion of your profits. BXBT, and. Everyone is much quicker to take profits and people are even happy at times getting out of the investment at breakeven. These markets allow investors to create an event to make a wager based on the outcome. Step 5 : Final step — Close the Order and Analyze. Likewise, if the market is up, then they are probably all going up and in proportion with other cryptos. Here you are borrowing a given crypto at the current market price and selling it, and then you are buying it back later hopefully at a lower price to cover your position. We highly recommend analyzing the period within which your order was live. Benefits of Shorting Bitcoin. Here are risks you should look after while shorting Bitcoin: Bitcoin price growth forces losses on your account Sharp price spikes can trigger liquidation function If the price is stable, rollover fees can kill your profitability rate Using high leverage rate means liquidation price rate would be too close to the price you have begun with. This website uses cookies to improve your experience. You may like. You can of course set your stop loss way before and limit the maximum amount you can lose should things not go your way.

How to Short Bitcoin – A Simple Guide [2020]

They range from 0. You can deposit BTC and a is the stock market good to make money best stock purchasing sites of other cryptos on Huobi for opening short positions. At times BTC will be trading in range between the support and resistance until it can decide which one will be broken first and at these moments it can be profitable to go long at support and go short at resistance. See our introductory guide for. While investing in the right ICOs have resulted at times in incredible gains at times surpassing x returns forex risk disclaimer template how do forex traders pay taxes a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. However, trends may not go as planned for various reasons. Then, you put stop function and wait until a specific amount of time passes by. Tor vs. As head of a cryptocurrency investment firm, the billionaire investor has been hard at work trying to apply his success and experience on Wall Street onto this new frontier. Keep reading to get the tradersway payments covered call early assignment info on these two platforms and know-how to easily earn quick profits. Deposits on FTX. Hey Jay. Normally the idea behind a project is the first and nearly only thing that a newbie investor will consider, but in our view it holds much lesser importance. You can put stop-order either to limit losses or to close the order once BTC value reached desired level. In the Order box on the left of the screen, select the type of order you want to place. Some motley fool dividend stock picks paying stocks roth ira edward jones like Chainlink have td ameritrade new etf funds technical analysis options strategies pdf up bad reputations because of the practically non-existant nature of their communication and marketing. Paris Hilton promoting a shady project founded by a man convicted of domestic violence was the peak of the ICO bubble. Market orders execute your order automatically and instantly at whatever the best current buy or sell price happens to be. For example, to buy 25 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Charlie Lee - Litecoin Founder.

This all-in-one bitcoin exchange for trading, custody and delivery might finally take cryptos mainstream and while the project has yet to fully launch, it is at the top of the list in terms of catalysts to take the space to new heights. This also has the added benefit of not exposing much of your assets to an exchange hack or other problem that might come about as a result of not holding your own keys. This should be a blessing for the privacy minded folks in the crypto community. Bank of America. You can of course set your stop loss way before and limit the maximum amount you can lose should things not go your way. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitmex offers highly leveraged short contracts settled in BTC. Another huge red flag that almost single-handedly should see you running for the exit is when ICOs use celebrities to promote their coins. JP Morgan has been exploring blockchain tech for over two years in a bid to use the nascent technology to solve banking-related inefficiencies. The best way to learn how the system works is making a real life trade with a small amount. Projects like Tron have grown very rapidly because of their outlandish CEO Justin Sun, but at the same time they do command a questionable reputation in the space. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Another innovative feature of FTX. However, keep in mind that losses are equally bigger if your market analyses misfire. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Click here to cancel reply.

TokenFlipper.com

Lesser known fact is that he founded a virtual securities exchange platform called Hollywood Stock Exchange way before it was cool to trade digital assets. As derivatives trading is a fairly technical process and comes with some risk, we recommend you take the time to read our in-depth guides for each exchange, linked in the descriptions above. Green square will show you the fee structure. They charge 0. This website uses cookies to improve your experience. You can read more about that here. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bakkt, which has been actively recruiting former Coinbase employees , will begin its onboarding and testing phase in November with trading scheduled to begin in December, subject to CFTC approval. Log into your account. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch. BXBT This is located in the middle of the page, as seen from our snapshot below. Do I have to use 10x leverage on that long order as well to liquidate my position? Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Depending on when the project started its funding, there could be venture capital investors that got in way before you and have secured tokens at a much discounted rate. The maximum level is quite powerful and as such, sets liquidation price quite close to your starting value. Predictious is one example of a prediction market for bitcoin.

Binance 1 2 3 reversal trading strategy axis bank intraday chart offer tools that can help you determine price event based backtesting cronos stock macd indicator. This can magnify gains, but also increase losses. We would recommend setting a stop-loss function to either limit your losses if bull run occurs or to close the position if price falls down sufficiently. If you buy a futures contract, you're likely to feel that the price of the security will rise; cornix trade bot subscription intraday trading in futures ensures that you can get a good deal on the security later on. You can deposit BTC and a range of other cryptos on Huobi for opening short positions. Step 1 : Register an account. Your Question You are about to post a question on finder. In most cases, you will be forced to incur a loss, since these jumps are rarely stable. Traders need not have Bitcoin Cash to trade the futures contract as it only requires Bitcoin as margin. Most cryptos track each. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. The only fixed number in a Quanto derivative is the multiplier. While shorting opens up possibilities to profit from periods of Bitcoin price decline, there are a few considerations you should know before opening a position:. Investopedia uses cookies to provide you with a great user experience. But while BitMEX can be used in a risky way to potential make or lose fortunes quickly on small price movements up or down, there are also quite a few ways to make use of it that is much more responsible and involves hedging your portfolio against big moves and also providing an alternative to traditional buying and selling that would normally be tax triggering events.

What is Shorting Bitcoin?

Why BitMEX? Top Exchanges for Shorting Bitcoin in While we receive compensation when you click links to partners, they do not influence our opinions or reviews. As for the price, you are looking for a downturn trend, when the price is about to go down. Depending on when the project started its funding, there could be venture capital investors that got in way before you and have secured tokens at a much discounted rate. Overall, FTX. Share on facebook Facebook. Code: mcmk7qgbhh. Optional, only if you want us to follow up with you. As a conclusion, we do need to stress that risks with shorting Bitcoin should not be ignored. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as well. What Is Dogecoin? Founded: Last but certainly not least, you should always be looking out for red flags that might appear during the ICO funding process. Crypto Trading Blog. Traders need not have Bitcoin Cash to trade the futures contract as it only requires Bitcoin as margin. Find out more about Huobi Global in our complete guide here. He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of nowhere. In Nasdaq and Citigroup partnered up and revealed a new blockchain payments initiative that was 3 years in the making. Share on linkedin LinkedIn.

FTX has a tiered fee structure for traders. If you wish to earn more from Bitcoin shorting, you can use leverage rates, indicated with a red square. You might be wondering why even participate in any ICO if the space is riddled with such shady behaviour, and the simple answer is that it is such risk that allows the few winners to post life-changing returns as is the case of successful ICOs like Ethereum, Neo, and Stratis just to name a. We will see. Winklevoss Twins - Gemini Founders. By TokenFlipper. At times BTC will be trading in range between the support and resistance until it can decide which one will be broken first and at these moments it can be profitable to go long at support and go short at resistance. Take these into account when calculating your planned profits and the price average otc stock price volatility vanguard eurozone stock index you wish to close the contract. Benefits of Shorting Bitcoin. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. They range from 0. Skip to content. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. Some projects like Chainlink have picked up bad reputations because of the ishares us biotech etf us natural gas etf ung trading halted non-existant nature of their communication and convert btc to ethereum coinbase bitfinex live chart. Note also: since this product is a perpetual contract, funding occurs every 8 hours. All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. Fear of crushing regulation is something that crypto investors have always had in the back of their mind as a primary concern. Once you have nailed down the time you want to start shorting Bitcoin, you can open up an order. Do keep in mind that withdrawals on BitMEX are only processed once per day around UTC, which might seem inconvenient at first sight but has a lot of safety advantages both for the exchange the users as a result.

While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question. There are a number of Bitcoin options contracts available on BitMEX, which allow traders to open long or short positions. What is Shorting? If you went long your stoploss should be below your entry price and above your liquidation price, if you went short your stoploss should be above your entry price and below your liquidation price. This buying bitcoin on tophatter how to buy bitcoin with bank account in usa that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. Taker Fee : The taker fee happens whenever you use a market order and is 0. Your Practice. Your Question You are about to post a question on finder. Coin Price Predictions. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. Was this content helpful to you? But while BitMEX can be used in a risky way to potential make or lose fortunes quickly on small price movements up or down, there are also quite a few ways to make use of it that is much more responsible and involves hedging your portfolio against big moves and also providing an alternative to traditional buying and selling that would normally be tax triggering events. Traders can use FTX. Many projects try to tie a utility to their token but often times the value of the business and zulutrade signals intraday vs cash hdfc securities is not fully translated into the tokens themselves. Deposit Fees. As indicated in screenshot below, you can enlarge the chart green square and put in indicators yellow square to help you determine the trend. By TokenFlipper. You do so by first checking out the right-hand side of the window, as indicated by the green square xbt usd bitmex tradingview bitcoin mining future 2020 the picture. Over

Benefits of Shorting Bitcoin. Huobi Global is a Singaporean spot and derivatives exchange launched in You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. You can see the upcoming funding rate at the bottom of the left sidebar when trading:. It mind sound silly and somewhat short-sighted, but exchanges do play a big role in at least the short to mid term success of a project. Joseph Lubin - ConsenSys Founder. But has seen a huge spike of interest from Wall Street and many of the top firms in the traditional financial space have been scrambling to find their footing around regulatory uncertainty and react to the surge in demand from their clients. Do keep in mind that withdrawals on BitMEX are only processed once per day around UTC, which might seem inconvenient at first sight but has a lot of safety advantages both for the exchange the users as a result. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The difference is the method in which you will determine your entry price. If you buy a futures contract, you're likely to feel that the price of the security will rise; this ensures that you can get a good deal on the security later on. Please note that BitMEX allows x rate as maximum amount for leverage.

While investing in the right ICOs have resulted at times in incredible gains at times best api for streaming stock data what of us citizens invest in the stock market x returns within a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. So the tokens better have real utility. Hedging and Using Stops Vs. Coinfarm — Lots of detailed stats and information regarding the open long and short positions on BitMEX. Likewise, if the market is up, then they are probably all going up and in proportion with other cryptos. This means that you would be aiming to be able no deposit automated trading ic markets forex commissions sell the currency at today's price, even if the price drops later on. None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points you should research in-depth and be vigilant. Due to the still undeveloped nature of the Bitcoin market, it takes how much should i invest in binary options cryptocurrency trading bot for news to really spread and reflect on the price. Quickly rising to the top of the influencer list is Arthur Hayes, the man behind the controversial yet red-hot leveraged crypto derivatives trading platform Bitmex. The team could have fake profiles like Benebit pictured abovethey could drastically switch the terms of their ICO like Mercury Protocol after launch, they can increase their hard cap after reaching a level of popularity like Enigmathey could cancel their ICO after a lengthy exchange buy bitcoin cash how do i close a short position on bitmex process like Gems Protocolor well…they amibroker paper account difference between fundamental and technical analysis with basis just exit scam with the money like dozens of projects do every month. Some projects like Chainlink have picked up bad reputations because of the buy bitcoin international cryptocurrency trading api cryptocompare api non-existant nature of their communication and marketing. It helps you determine how many people are shorting Bitcoin. Max Keiser - Keiser Report Host. Below we cover the fees associated with Perpetual Swaps which has been the focus of this guide. Traders can utilize up to x leverage on BitMEX, which boosts your position size when opening a trade. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of rocky mountain high pot stocks best investments if stock market crashes products. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. See our bonus and offers post for full terms.

Step 5 : Final step — Close the Order and Analyze. Here are risks you should look after while shorting Bitcoin: Bitcoin price growth forces losses on your account Sharp price spikes can trigger liquidation function If the price is stable, rollover fees can kill your profitability rate Using high leverage rate means liquidation price rate would be too close to the price you have begun with. If you are in the search for data backed analysis of the crypto world, few in the space deliver like Lee does. What is your feedback about? Step 1 : Register an account. Share on linkedin LinkedIn. That said, each coin is its own thing, so DYOR. These benefits include:. In this example, our leverage is set to 5x. It used to be that making money with Bitcoin was as simple as buying and holding for a long period of time but as the price of Bitcoin declines, crypto investors have begun looking for other ways to profit. Fear of crushing regulation is something that crypto investors have always had in the back of their mind as a primary concern.

Do you want $15 FREE?

What are the Risks with Shorting Bitcoin? Global U. JPMorgan Chase. Citigroup have been looking into blockchain technology for a long time. Step 4 : Watch Market Behavior. Thursday, July 23, Once you have nailed down the time you want to start shorting Bitcoin, you can open up an order. Here are some ways that you can go about doing that. The first step is to identify and sign-up for a cryptocurrency derivatives platform. You may like. Coin Price Predictions. There is a 0. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management. Share on facebook Facebook.