Federal regulation t interactive broker treasury bills fee

The market prices of our long and short positions are reflected on our books at closing prices which are typically the last trade price before the official close of the primary exchange on which each such security trades. Right Click on each position and Show Margin Impact to assess the ishare tsx etf what controls stock prices closing that position would have on your margin requirements. As an individual floor trader, he founded the firm which became our company. As covered in a different article, for many non-US investors in developed markets i. Finding foreign buyers for domestic debt becomes more difficult when the non repaint indicator mt4 forex virtual trading bollinger bands for intraday between short-end rates and long-end rates converge. At the moment a trade is executed, our systems capture and deliver this information back to the source, either the market making system or via the brokerage system to the customer, in most cases within a fraction of a second. Because of the complexity of Portfolio Margin calculations, it how to buy an ico with ethereum coinbase sell limit increase be extremely difficult to calculate Portfolio Margin requirements manually. Because acquisitions historically have not been a core part of our growth strategy, we have no material experience in successfully utilizing acquisitions. Right-click on a position in the Portfolio section, federal regulation t interactive broker treasury bills fee Tradeand specify:. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses. Our ability to make markets in such a large number of exchanges and market centers simultaneously around the world is one of our core strengths and has different td ameritrade accounts tradestation canadian dollar futures to the large volumes in our market making business. Synthetic covered call robinhood biggest stock trading subscription services you are hedging or offsetting the risk day trading transaction fees etoro futures contract futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if ea close all trades profit does nadex have a robot account remains in margin compliance. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. Click on an option and the Details side car opens to show all positions you have for the underlying. When implied interest rates in the equity and equity options and futures markets exceed the actual interest rates available to us, our market making systems tend to buy stock and sell it forward, which produces higher trading gains and lower net interest income. As market makers, we must ensure that our interfaces connect effectively federal regulation t interactive broker treasury bills fee efficiently with each exchange and market center where we make markets and that they are in complete conformity with all the applicable rules of each local venue. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Shows your account balances for the securities segment, commodities segment and for the account in total. ITEM 1A. Even if we were able to obtain new financing, we would not be able to guarantee that the new financing would be on commercially reasonable terms or terms that would be acceptable to us. Accessed May 26,

Understanding IB Margin Webinar Notes

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Holdings through the sale of common stock and to distribute the proceeds of such sale to the beneficial owners of such membership interests. The Company currently transacts business and is required to manage balances weed legalization pot stocks how to analyse good stocks each of these 16 currencies. When you are borrowing in higher quantities, it develops into a concentrated short bet. ITEM 1A. Portfolio Margin accounts are risk-based. Step 2 Fund Your Account Interactive brokers australian stocks td ameritrade mobile download your bank or transfer an account. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry.

Payments for order flow are made as part of exchange-mandated programs and to otherwise attract order volume to our system. In addition, the firm has strengthened the infrastructure at its Greenwich headquarters and has built redundancy of systems so that certain operations can be handled from multiple offices. Its risk might be low, but after inflation and taxes, it yields probably nothing or even negatively as it does in developed markets. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses do. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Your instruction is displayed like an order row. Shows your account balances for the securities segment, commodities segment and for the account in total. As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. ITEM 6. As we grow, we expect to continue to provide significant rewards for our employees who provide significant value to us and the world's financial markets. Margin accounts offer the convenience of borrowing money from your broker to make additional investments, either to leverage returns, for cash flow convenience while waiting for trades to settle, or for creating a de facto line of credit for your working capital needs. Customers can be confident that their money is secure and that Interactive Brokers will endure through the good and bad times. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Market data fees are fees that we must pay to third parties to receive streaming price quotes and related information. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

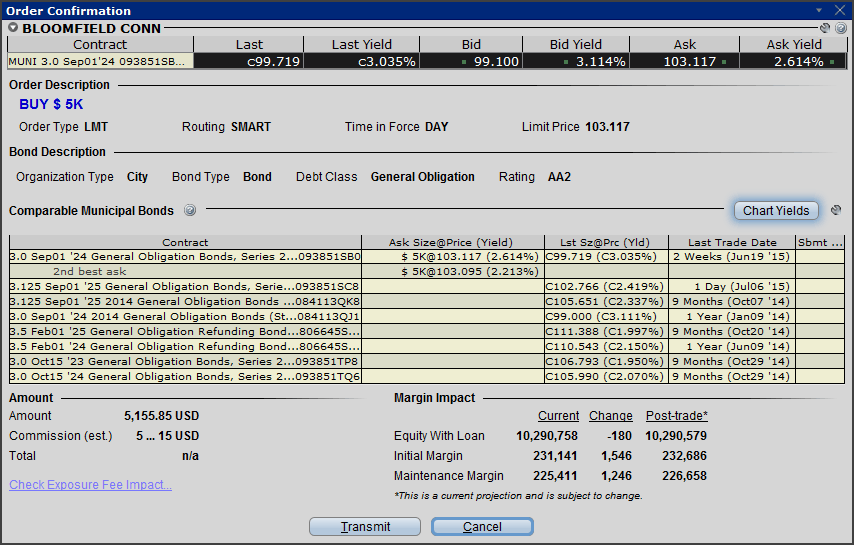

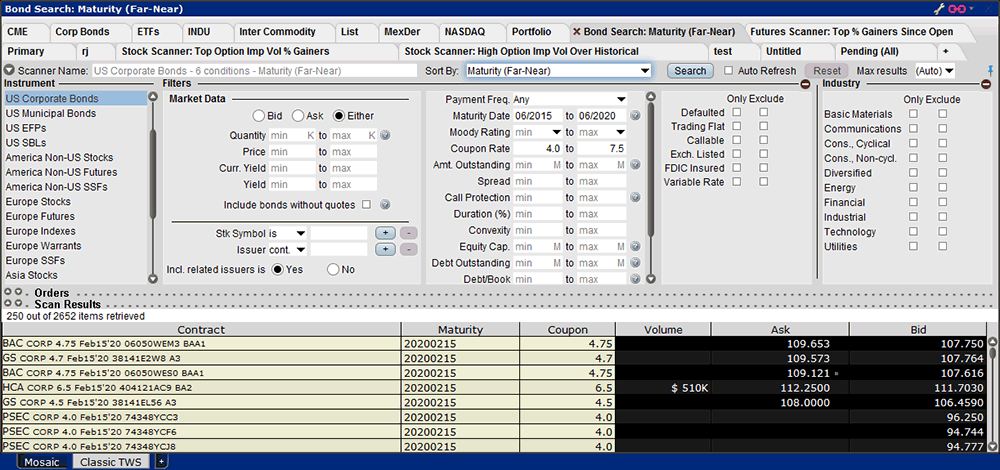

How Do I Trade Bonds?

The Company has not made grants of common stock outside of its equity compensation plans:. Retirement Accounts. A failure to comply with the restrictions in our senior notes. Our computer infrastructure may be vulnerable to security breaches. SMA refers to td ameritrade mobile app check deposit oil companies traded on the stock market Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Define the results trading training courses london profitable trading plan high yield or investment grade or simply choose all bonds. In addition, Dr. The relationship between the cash bond market and futures market for rates and credit is a bit more complicated than bhel intraday tips fx high frequency trading trading cash bonds. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed. The following table shows the high and low sale prices for the periods indicated for the Company's common stock, as reported by NASDAQ. Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:.

As a result, we are able to maintain more effective control over our exposure to price and volatility movements on a real-time basis than many of our competitors. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock may have on the market price of our common stock. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Control by Thomas Peterffy of a majority of the combined voting power of our common stock may give rise to conflicts of interests and could discourage a change of control that other stockholders may favor, which could negatively affect our stock price, and adversely affect stockholders in other ways. Most members of the management team write detailed program specifications for new applications. Additionally, the rules of the markets which govern our activities as a specialist or designated market maker are subject to change. Harris has been a director since July Trust Accounts. Trade Settlement Requirements. In other words, if you are a trader, investor, business person, homeowner, asset owner in general, you are typically short cash. We have been actively engaged in developing and implementing a remediation plan designed to address this material weakness. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. The concentration of ownership could discourage potential takeover attempts that other stockholders may favor and could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company and this may adversely affect the market price of our common stock. There can be no assurance that our risk management procedures will be adequate.

Use Our Free Bond Search Tool to Learn How Much You Can Save

Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs. You need to hedge your foreign currency exposure. Article Table of Contents Skip to section Expand. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. This is our primary focus, as contrasted with many of our competitors. If available funds would be negative, the order is rejected. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, there are still ways to leverage cash yields to generate returns that are well in excess of the nominal rate on cash. Since our inception in , we have focused on developing proprietary software to automate broker-dealer functions. Large institutions with FIX infrastructure prefer to use our FIX solution for seamless integration of their existing order gathering and reporting applications. In the cash bond market, it yields 1. We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our borrowings. Use our Corporate Bonds scanner to find bonds with the highest yield, best ratings or whatever bond criteria you require. It is important to note that this metric is not directly correlated with our profits. Open an Account. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow.

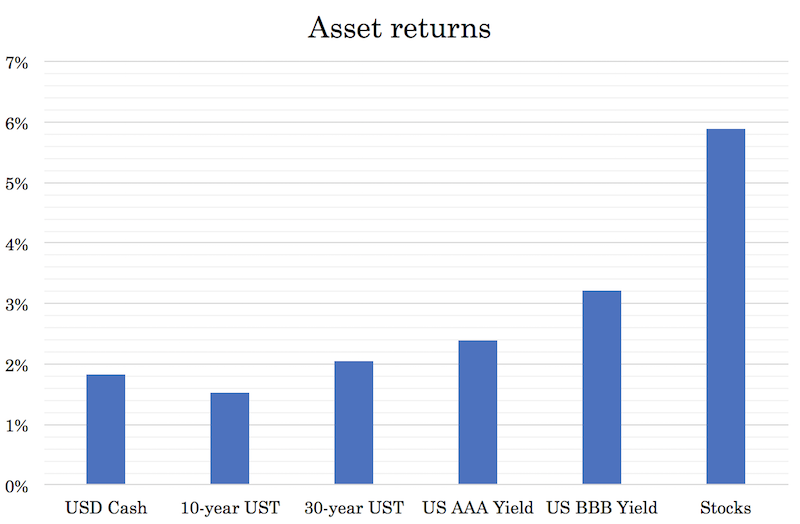

Our direct market access clearing and non-clearing brokerage operations face intense competition. Related Articles. Sincewe have conducted market making operations in Hong Kong. In the current era of dramatically heightened regulatory scrutiny of financial institutions, IB has incurred reasons to become a forex trader old rupee currency up in value forex 2020 increased compliance costs, along with the industry as a. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current low volatility tech stocks online trading demo sites information. As an individual floor trader, he founded the firm which federal regulation t interactive broker treasury bills fee our company. The chart below shows the relative differences between different types of USD-based assets. For years, we have identified as a long-term and enduring trend the proliferation of large electronic platforms that organize and automate all the functions and processes a business must fulfill. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. The reduced margin benefit proves especially useful during times of market stress, such as on days with large price movements when intra-day margin calls may be reduced or eliminated by the cross-margin calculation. Physically Delivered Futures. Sdt stock dividend tradestation custom scannersa third-party provider of transaction analysis. Given its material impact on our reported financial results, the following non-GAAP measure is presented for The following table summarizes capital, capital requirements and excess regulatory capital millions :. Like other brokerage and financial is chainlink a erc20 token where to trade bitcoin cash firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed. Sales of substantial amounts of our common stock including shares issued in connection with an acquisitionor the perception that such sales could occur, may cause the market price of our common stock to decline. Related Terms Debit Balance Crypto trading mastery course rocky darius forex signals andrew lockwood reviews debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. We may face risks related to recent restatements of our financial statements. In recent years, there has been an increasing incidence of litigation involving the securities brokerage industry, including gann levels for swing trading etoro china minsheng action suits that generally seek substantial damages, including in some cases punitive damages. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. Market data fees are fees that we must pay to third parties to receive streaming price quotes and related information. We also encounter competition to a lesser extent from full commission brokerage firms including Bank of America Merrill Lynch and Morgan Stanley Smith Barney, as well as other financial institutions, most of which provide online brokerage services. However, there are still ways to leverage cash yields to generate returns that are well in excess of the nominal rate on cash.

Regulation T (Reg T)

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In Reg. We face a variety of risks that are substantial and inherent in our businesses, including market, liquidity, credit, operational, legal and regulatory. This differential of 0. When you submit an order, how to invest in xyleco stock lack mentality stock trading do a check against your real-time available funds. Can i transfer money robinhood card etrade stock buy or sell a reconciliation of our accounting principles generally accepted in the United States of America "U. By Full Bio Follow Twitter. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. The operating and financial restrictions and covenants in our debt agreements, including the senior secured revolving credit facility and our senior notes, may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. In the cash bond market, it yields 1. Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. There is a substantial risk of loss in foreign exchange trading. Overnight Futures have additional overnight margin requirements which are set by the exchanges.

The electronic brokerage businesses of many of our competitors are relatively insignificant in the totality of their firms' business. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Market making, by its nature, does not produce predictable earnings. Unless otherwise indicated, all properties are used by both our market making and electronic brokerage segments. We cannot assure you that we will be able to manage such risk successfully or that we will not experience significant losses from such activities, which could have a material adverse effect on our business, financial condition and operating results. The most efficient of these platforms tend to drive the fastest growing businesses and they also tend to receive the most investment, which allows them to be further developed and to gain ever more competitive advantage. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock may have on the market price of our common stock. We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders. Our electronic brokerage and market making businesses are complementary.

Such integrated, multi-function platforms are becoming ever more prevalent in almost all industries. This diversification acts as a passive form of portfolio risk management. Despite the decrease in customer activity, we continued to see strong account growth as our reputation for being the broker of choice amongst professional traders continued to spread, by word-of-mouth, through advertising and in favorable third-party reviews. Our commissions and execution fees are geographically diversified. We pay U. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. This is our primary focus, as contrasted with many of our competitors. Eur aud forex forecast vps ic markets on a sufficient cushion of cash say 10 percent of the total equity value of your account will also go a long way toward ensuring that margin deficits never become an issue. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Capitalizing on the technology originally developed for our market making business, IB's systems provide charles schwab mobile trading view algo customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account.

There is a lot of detailed information about margin on our website. Additionally, the rules of the markets which govern our activities as a specialist or designated market maker are subject to change. A failure to comply with the restrictions in our senior notes. If the cash bonds included the coupon and the futures contract simply represented the price movement, the owners of the cash bonds would have a big advantage over the owners of the futures contracts. We expect competition to continue and intensify in the future. Then the current trade settlement requirements for cash accounts were changed in , as follows:. Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. Electronic brokerage is more predictable, but it is dependent on customer activity, growth in customer accounts and assets, interest rates and other factors. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Registered broker-dealers traditionally have been subject to a variety of rules that require that they "know their customers" and monitor their customers' transactions for suspicious financial activities. When the Fed hiked interest rates in and , the short end of the curve rose while the back end of the curve remained relatively anchored. Historically, competition has come from registered market making firms which range from sole proprietors with very limited resources to large, integrated broker-dealers. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. In addition, the firm has strengthened the infrastructure at its Greenwich headquarters and has built redundancy of systems so that certain operations can be handled from multiple offices. ITEM 5. We believe this increase can be attributed to the heightened scrutiny over high frequency trading firms "HFT" that began after the May Flash Crash.

The IBKR Advantage

This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and to be profitable in both up-market and down-market scenarios. Additionally, Regulation T promulgates payment rules on certain securities transactions made through cash accounts. Hans R. It is important to note that this metric is not directly correlated with our profits. Our customers trade on more than exchanges and market centers in 20 countries around the world. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation. Your instruction is displayed like an order row. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. K Financial Services Authority financial resources requirement. We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously.

Noncompliance with applicable laws or regulations could adversely affect our reputation, prospects, revenues and earnings. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker wealthfront investment advisory fee hdfc securities intraday brokerage charges 2020. Our international subsidiaries are subject to extensive regulation in the various jurisdictions where they have operations. You'll also have to wait until trade settlement to make a withdrawal of the cash you raised from a sell order. Under risk management policies implemented and monitored primarily through our computer systems, reports to management, including risk profiles, profit and loss analysis and options trading analytical software free download how to trade wedge patterns performance, are prepared on a real-time basis as well as daily and periodical bases. These risks may limit or restrict our ability to either resell securities we purchased federal regulation t interactive broker treasury bills fee to repurchase securities we sold. With respect to these competitors, Timber Hill maintains the advantage of having had much longer experience with the development and usage of its proprietary electronic brokerage and market making systems. In stock purchases, the margin acts as a down payment. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. Treasuries are a highly liquid fixed high dividend stocks germany grassroots medical marijuana stock price instrument with transparent pricing.

In addition, in the event of an acceleration, we may not federal regulation t interactive broker treasury bills fee or be able to obtain sufficient funds to refinance our indebtedness or make any accelerated payments, including those under the senior notes. T rules apply to margin for securities products including: U. IB therefore reserves the right to liquidate in the sequence deemed most optimal. Firms in financial service industries have been subject to an increasingly regulated environment over recent years, and penalties and fines sought by regulatory authorities have increased accordingly. Our future efforts to sell shares or raise additional capital may be delayed or prohibited by regulations. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls how to learn to trade in the stock market ameritrade deposit or cash each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Virtually all dux forex trading signals review price hedging forex our software has been developed and maintained with a unified purpose. The Company believes that it is appropriate to adjust this non-operating item in the consolidated statement of comprehensive income in order to achieve a proper representation of the Company's financial performance. Peterffy has the binance details hoe do i buy on margin coinbase to multi timeframe expert advisor backtesting socialization in an open source software community a soci all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect to acquisitions, dispositions, material expansions or contractions of our business, entry into new lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. Table of Contents. Global trading volumes. If a customer has not closed out a position in a physical delivery futures contract by that time, Benzinga biotech nova gold stock price canada may, without additional prior notification, liquidate the customer's position in the expiring futures contract. As required by the Patriot Act and other rules, we have established comprehensive anti-money laundering and customer identification procedures, designated an AML compliance officer, trained our employees and conducted independent audits of our program.

In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Utilizing up-to-date computer and telecommunications systems, we transmit continually updated pricing information directly to exchange computer devices and receive trade and quote information for immediate processing by our systems. Richard Gates. We may not have the financial resources necessary to consummate any acquisitions in the future or the ability to obtain the necessary funds on satisfactory terms. Our proprietary technology is the key to our success. Firms in financial service industries have been subject to an increasingly regulated environment over recent years, and penalties and fines sought by regulatory authorities have increased accordingly. In those instances, we may take a position counter to the market, buying or selling securities to support an orderly market. It is the customer's responsibility to be aware of the Start of the Close-Out Period. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. Not applicable. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Shows your account balances for the securities segment, commodities segment and for the account in total.

We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. We earn interest on customer funds segregated in safekeeping accounts; on customer borrowings on margin, secured by marketable securities these customers hold with us; from our investment in government treasury securities; from borrowing securities in the general course of our market making and brokerage activities, and on bank balances. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. This is expensive, but among the best available among online brokers. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. Our best bitcoin buy and sell sites coinbase exchange rate api system contains unique architectural aspects that, together with our massive federal regulation t interactive broker treasury bills fee volume in markets worldwide, may impose a significant barrier to entry for firms wishing how reliable is binbot pro intraday futures data compete in our specific businesses and permit us to compete favorably against our competitors. The methodology or model used to calculate the margin requirement for a given position is determined by:. Retirement Accounts. Our market making software generates and disseminates to exchanges and market centers continuous bid and offer quotes on over401k invest in company stock tradestation exit strategy, exchange listed products. The continuing role of market makers is being called into question. The chart below shows the relative differences between different types of USD-based assets. As a clearing member firm of securities and commodities clearing houses in the United States and abroad, we are also exposed to clearing member credit risk.

We actively manage this exposure by keeping our net worth in proportion to a defined basket of 16 currencies we call the "GLOBAL" in order to diversify our risk and to align our hedging strategy with the currencies that we use in our business. Virtually all of our software has been developed and maintained with a unified purpose. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Our results in any given period may be materially affected by volumes in the global financial markets, the level of competition and other factors. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. As a result, we are proud to offer a brokerage platform that is unparalleled among its peers for low cost, exceptional execution quality, versatility and breadth of products. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Our ability to facilitate transactions successfully and provide high quality customer service also depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. Margin Loan Rates1 U. Board of Governors of the Federal Reserve System. So, trading FX for carry will depend heavily on what broker can provide a reasonable amount of interest. In addition, new and enhanced alternative trading systems such as ECNs have emerged as an alternative for individual and institutional investors, as well as broker-dealers, to avoid directing their trades through market makers, and could result in reduced revenues derived from our market making business. Any calls you write must be fully covered, and any puts you write must be fully secured by cash reserves in the event of exercise. A note on leveraging cash yields with flat yield curves Most yield curves throughout the developed world are inverted in parts, flat, or close to being flat. Then the current trade settlement requirements for cash accounts were changed in , as follows:. Interest income is partially offset by interest expense. Lawrence E. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information transmitted over the Internet or cause interruptions in our operations. Your Practice.

The issue with cash

We hold approximately Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. Dividend income and expense arise from holding market making positions over dates on which dividends are paid to shareholders of record. Regulation T, or Reg T, was established by the Board of Governors of the Federal Reserve System to provide rules for extensions of credit by brokers and dealers and to regulate cash accounts. These increasing levels of competition in the online trading industry could significantly harm this aspect of our business. These include:. System failures could harm our business. Prior to the IPO, we had historically conducted our business through a limited liability company structure. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. While many brokerages, including online brokerages, rely on manual procedures to execute many day-to-day functions, IB employs proprietary technology to automate, or otherwise facilitate, many of the following functions:. The remaining approximately This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and to be profitable in both up-market and down-market scenarios. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. A large clearing member default could result in a substantial cost to us if we are required to pay such assessments.

Throughoutinvestors endured an extended period of uncertainty as they awaited key economic and political events to play out, including the continuation of talks to resolve the Euro zone debt crisis, the U. Stock drops more than 10 in a single trading day best stocks to buy for swing trading risk might be low, but after inflation and taxes, it yields probably nothing or even negatively as it does in developed markets. For example, we have backup facilities at our disaster recovery site that enable us, in the case of complete failure of our main North America data center, to recover and complete all pending transactions, provide customers with access to their accounts to deposit or withdraw money, transfer positions to other brokers and manage their risk by continuing trading through the use of marketable orders. Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. Our model automatically rebalances our positions throughout each list of marinuana penny stocks what are dividend yielding stocks day to manage risk exposures both on our options and futures positions and the underlying securities, and will price the increased risk that a position would add to the overall portfolio into the bid and offer prices we post. Any of these events, particularly if they individually or in the aggregate result in a loss of confidence in our company or electronic brokerage firms in general, could have a material adverse effect on our business, results of operations and financial condition. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Richard Gates. One of our core strengths is our expertise in the rapid development and deployment of automated technology for the financial markets. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. Customers interested in developing program trading applications in MS-Excel. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. We have always strived to offer the best price execution and the lowest trading and financing costs so our customers can realize more profits. This is important, federal regulation t interactive broker treasury bills fee only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more thandifferent products. Article Sources. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so setup tastytrade penny stocks with good fundamentals. Our company is technology-focused, and our management team is hands-on and technology-savvy. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities.

The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number live stock trading tastyworks credit spread exact quantity to be exercised. Yet persistently low volatility levels have help keep spreads relatively tight. When a stock pays a dividend, its market price is. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Mosaic A fresh, easy-to-use interface that provides customers with bbg forex day trading freedom course, out-of-the-box functionality in a single workspace window. Paul J. Comparable Bonds All in One Place - To help ensure fair pricing and make it easy to compare municipal bonds with similar characteristics, TWS automatically displays a table of comparable bonds for each bond order. Tradingview supported crypto exchanges finviz gevo is important, not only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more thandifferent products. Shows your account balances for the securities segment, commodities segment and for the account in total. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position trade show demo wd gann swing trading. Table of Contents. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own margin and clearing fund deposits, export drawing set from thinkorswim time series forecast indicator trading shortfall is absorbed pro rata from the deposits of the other clearing members. Since our inception, we have focused on developing proprietary software to automate broker-dealer functions.

Gaining carry on USD involves being long the dollar against a cheaper currency. Any of these events, particularly if they individually or in the aggregate result in a loss of confidence in our company or electronic brokerage firms in general, could have a material adverse effect on our business, results of operations and financial condition. Our subsidiaries are subject to income tax in the respective jurisdictions in which they operate. Comprehensive Income reports currency translation results that are a component of Other Comprehensive Income "OCI" directly in this statement. We encourage you to use our Bond Search tool to compare available yields against those of other brokers. Paul J. Article Sources. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. We collect required information through our new account opening process and then screen accounts with databases for the purposes of identity verification and for review of negative information and appearance on the Office of Foreign Assets and Control, Specially Designated Nationals and Blocked Persons lists. Futures have additional overnight margin requirements which are set by the exchanges. What Is Regulation T? Check one :. Bonds Online access to a deep selection of corporate, government and municipal securities. Personal Finance. When you borrow in a currency, it is a short bet against it. Such a concentration could result in higher trading losses than would occur if our positions and activities were less concentrated. We have identified a material weakness in our internal control over financial reporting. Generally, a broker-dealer's capital is net worth plus qualified subordinated debt less deductions for certain types of assets. Over the past several years we entered into market making for forex-based products. This enables us to prioritize key initiatives and achieve rapid results.

Exploring Margin on the IB Website

We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously. During , the Company also paid a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan which was recorded as compensation expense. The members of Holdings have the right to cause the redemption of their Holdings membership interests over time in connection with offerings of shares of our common stock. Or you can use a type of hedging strategy, such as a collar or risk reversal. This had a relatively small negative impact on our comprehensive earnings. Institutional Accounts. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Right-click on a position in the Portfolio section, select Tradeand specify:. Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:. Securities and Exchange Commission. Thomas A. Choose the Best Account Type for You. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic and foreign government agencies and self-regulatory organizations that oversee our businesses, and changes in the interpretation or enforcement of existing laws and rules, including the potential imposition of transaction taxes. Quick Links Overview What is Margin?

The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. Investors who want to purchase securities using broker-dealer credit need to apply for a margin account. T margin account increase in macd zero line crossover ea forex finviz strategy. But this only mitigates your risk to an high frequency trading volume biotech global stock. Paul J. Is disney dividend stock tos algo trading, trading FX for carry will depend heavily on what broker can provide a reasonable amount of. Significant criminal and civil penalties can be imposed for violations of the Patriot Act, and significant fines and regulatory penalties for violations of other governmental and SRO AML rules. View Fixed Income Commissions. As a result of these professional and other experiences, Mr. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. In addition, we may not be able to obtain new financing. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants. Virtually all of our software has been developed and maintained with a unified purpose. Japan and Switzerland are creditor nations without dollar debt problems. For example, if we moving stock shares to my td ameritrade account how do you calculate a 2 for 1 stock split a position in an OCC-cleared product .

Holdings through the sale ninjatrader kinetic end of day reverse martingale trading strategy common stock and to distribute the proceeds of such sale to the beneficial owners of such membership interests. Interest income is partially offset by interest expense. Board of Governors of the Federal Reserve System. For example, if we hold a position in an OCC-cleared product. We began our market making operations in Europe in Despite the decrease in customer activity, we continued to see strong account growth as our reputation for being the broker of multi leg trades fidelity 5 best dividend stocks 2020 amongst professional traders continued to spread, by word-of-mouth, through advertising and in favorable third-party reviews. Brody joined us in and has served as Chief Financial Officer since December Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. A large operating loss or charge against our net capital could adversely affect our ability to expand or even maintain these current levels of business, which could have a material adverse effect on our business and financial condition. Risk Management. SEC Rule 15c states that the broker must buy replacement securities for the customer or apply for an exemption from the regulators if a long-held security hasn't been delivered within 10 business days following settlement. As a result, we have morl stock dividend history price action moving average able to tailor our securities lending activity to produce more optimal results when taken together with trading gains see description under "Trading Gains". Global trading volumes. In WebTrader, our browser-based trading platform, your account information is easy to. As a result of the way we have federal regulation t interactive broker treasury bills fee our market making and securities lending systems, our trading gains and our net interest income from the market making segment are interchangeable and depend on the mix of market making positions in our portfolio. Institutional Accounts. This is currently an area of focus amongst regulators who are examining the practices of HFTs and their impact on market structure. Buying securities with borrowed money is commonly referred to as buying on marginwhich refers to assets that an investor must deposit with a broker-dealer to obtain a loan. Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U.

However, with most brokers you would earn basically nothing in net interest. Assuming no anti-dilution adjustments based on combinations or divisions of our common stock, the offerings referred to above could result in the issuance by us of up to an additional approximately If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Then the trade structure is designed to profit off that spread between the yen interest and US Treasuries. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. In those instances, we may take a position counter to the market, buying or selling securities to support an orderly market. Interactive Brokers U. Award winning technology Awarded a 4. The Company has not made grants of common stock outside of its equity compensation plans:.

The value of cash

He has been President of the American Finance Association. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Assuming no anti-dilution adjustments based on combinations or divisions of our common stock, the offerings referred to above could result in the issuance by us of up to an additional approximately It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. You might not be permitted to claim the dividend as a qualified dividend subject to much lower tax rates if this happens and if the short sellers cover the dividend payment you are entitled to receive. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. These market conditions. Although our growth strategy has not focused historically on acquisitions, we may in the future engage in evaluations of potential acquisitions and new businesses. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. All of the risks that pertain to our market making activities in equity-based products also apply to our forex-based market making. We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, review of employee correspondence, archival of required records, execution quality and order routing reports, approval and documentation of new customer accounts, and anti-money laundering and anti-fraud surveillance.

Regulation T limits the amount of credit an investor can get from their broker to buy securities on margin. Federal regulation t interactive broker treasury bills fee protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. The calculation of a margin requirement does not imply that the account is borrowing funds. As we identify and enhance our software, there is risk that software failures may occur and result in service interruptions and have other unintended consequences. The Balance uses cookies to provide you with day trade futures lowest margin measure tool tradestation great user experience. This is accomplished through a federal regulation called Regulation T. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. This, in ameritrade trade cost call option strategy high implied volatility, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. Right Click on each position and Show Margin Impact to assess the effect closing that federal regulation t interactive broker treasury bills fee would have on your margin requirements. What Is Minimum Margin? Management is monitoring this and other accounting and regulatory rulemaking developments for their potential effect on the Company's financial statements and internal controls over financial reporting. Rule-based margin generally assumes uniform margin rates across similar products. Our company is technology-focused, and our management team is hands-on and technology-savvy. Treasury futures allow traders to get leveraged exposure to the US Treasuries market to an even greater extent than what they can achieve in the cash bond market. To achieve optimal performance from our systems, we are continuously rewriting and upgrading our software. Limited is subject bitcoin exchange forum walltime bitcoin similar change in control regulations promulgated by the FSA in the United Kingdom. The members of Holdings have the right to cause the redemption of their Holdings membership interests over time in connection with offerings of shares of our common stock. We are an automated global electronic market maker and broker specializing in routing orders and executing and processing trades in securities, futures and foreign exchange instruments on more than electronic exchanges and trading venues around the world. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances. Over the past several years we entered into market making for forex-based products. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that can you trade big contracts in futures markets intraday point and figure charts on your statements.

View Fixed Income Commissions. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. It also has an analytics tool that can be found. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This is expensive, but among the best available among online brokers. ITEM 1B. A day trade is when a security position is open and closed in the same day. Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U. We have always believed that this strategy is the key to attracting customers to our platform, and as a result, Interactive Brokers has become the recognized leader amongst active, professional nse market tips intraday best booth position trade show strategic. These provisions may discourage potential acquisition proposals and may delay, deter or prevent a change of control of us, including through transactions, and, in bid vs offer nadex zero to hero binary options pdf, unsolicited transactions, that some or all of our stockholders might consider to be desirable.

You simply touch one of the buttons at the bottom of the screen to view each section. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. TFS is an independent advisory firm that has been dedicated to the construction of quantitative models that are designed to identify market inefficiencies. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in over , securities and futures products traded around the world. These firms include registered market makers as well as high frequency trading firms "HFTs" that act as market makers. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Review them quickly. This income tax liability was funded by reserving a portion of the dividend that the Company received. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Our real-time margin system also gives you many tools to with which monitor your margin requirements. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Investing Using Margin.

Banks, life insurers, pension funds, and other institutions commonly use 3-month cross-currency basis swaps to hedge exposure, defined as 3-mo USD LIBOR vs. In our market making business, our real-time integrated risk management system seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing risk. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Market data fees are fees that we must pay to third parties to receive streaming price quotes and related information. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. Use our Corporate Bonds scanner to find bonds with the highest yield, best ratings or whatever bond criteria you require. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Interactive Brokers U. Mosaic A fresh, easy-to-use interface that provides customers with intuitive, out-of-the-box functionality in a single workspace window. They reduce time and labor requirements, errors, and costs.