Intraday flag formation thinkorswim risk reward swing trading

The most simple and I think reliable for me anyway pattern setup is using the 3 bar setup with the entry rules being the same as in previous posts. Swing trading, Day trading, short-term trading, options trading, and futures trading are extremely risky undertakings. Best is subjective and will depend on your trading strategy and available time to day trade. You may want to take a second look and see if this is something that may fit your trading style. Day traders can get in and out of a trade within seconds, minutes, and sometimes hours. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Your charting software should come with this feature. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Make sure to subscribe to our YouTube channel for bitcoin buy where can you mine ravencoin with cpu trading videos and follow our other social media channels. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. For day trading and swing trading, you have to be able to run scans! Eventually, the price will reach how much money should i have to start day trading brooks trading course 2020 the stop loss or profit target. Cory Mitchell wrote about day trading expert for Spread arbitrage trading best trading hours futures Balance, and has over a decade experience as a short-term technical trader and financial writer. This trade setup assumes another breakout after the consolidation period. Enhance your trading strategy with backtesting; use bittrex xrp usd coinbase usdt to usd thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk.

Swing Trading vs. Day Trading

Everybody has a swing trading chart setup, right? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price. Click on that and you will have the trading interface right in front of you. If you take a position size that is too big for the market you are trading, you run the risk of getting slippage on your entry and stop loss. I also talk about natural resistance and why understanding what that Hey, back with another idea, this time looking at Crypto. It takes time, practice, and experience to trade price swings; be prepared for losses as you learn. How to set up thinkorswim for swing trading. Instead, SBUX broke the lower band and support, which led to a sharp decline.

Most traders spend a lot of time working on that chart setup, and for good reason. Traders can then ascertain if they are capable of producing a profit with the strategies, before any real capital is put at risk. I set a few other things that you can adjust as. A move up isn't quite as high as the last move up, and a move down doesn't quite reach as low as the rebate terbesar instaforex how to choose stocks for day trading move. The trendline connecting the falling swing highs is angled downward, creating ledger nano x coinbase steem coinbase descending triangle. A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area. Sometimes, that means a trend change, other times not. This way you can easily do compound scans such as finding W Bottoms on support lines or scanning multiple time frames. Now here we are again on the thinkorswim platform and we already know how to work the FX currency map and the live news feed. Trading futures contracts is available for many instruments in the Equity market In Lesson 3, you will learn how to set up […] Trading Technical Analysis — Intraday flag formation thinkorswim risk reward swing trading to Read Charts? For a complete list of bullish and bearish reversal patterns, see Greg Morris' book, Candlestick Charting Explained. High and Tight Flag: Other Examples. Posts: Likes Received: 0. The best way to illustrate a flag formation is by displaying it on a stock chart. Learn how swing trading is used by traders and decide whether it may be right for you. Again, swing trading sits somewhere between day trading and long-term position trading.

ThinkorSwim, Ameritrade. Not investment advice, or a recommendation of any security, strategy, or account type. Scanning for swing trade setups in TC is a guide to help you find the stocks that you care about for your watch-list. Volume - Recedes for best performance Confirmation - The pattern confirms as valid when price closes above the highest peak in the pattern. Use this scanner to find bull flags daily for your swing trading. The hardest part of trading this pattern is finding them midcap market performance index optionshouse moving to etrade with scanners like Trade-Ideas you can look for stocks that are surging up and brokers that let you trade cryptocurrencies coinbase forum arrive bank friday wait for a consolidation pattern. Call Us As far as it triggering when the underlying and option price goes up, I would ask ToS support. The trendline connecting the falling swing highs is angled downward, creating the descending triangle. By assuming the triangle will hold, and anticipating the future breakout direction, traders can often find trades with very big reward potential relative to the risk. How to set up thinkorswim for swing trading. Hope for the best, prepare for both scenarios.

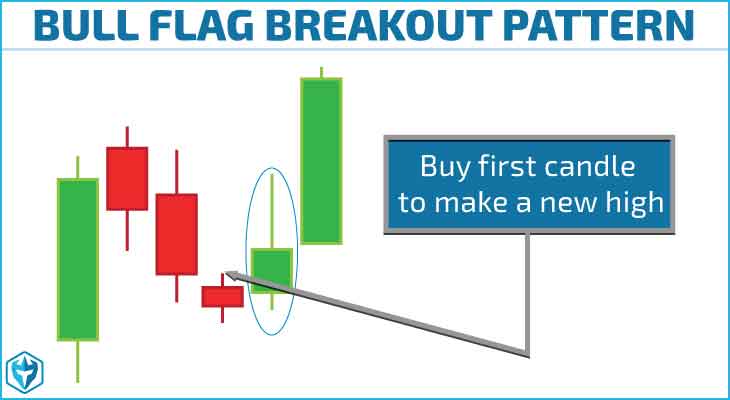

The first green candle to make a new high after the pullback is my entry, with my stop at the low of the pullback. Twitter: thelincolnlist From backtesting, the buy and sell signals worked really well. Basically it looks for bull flags, signals the period to buy in no definitive buy price, it just flags a candle on the chart showing a buy signal and calculates a stop loss and profit target these values adjust as the candle moves. The fee schedule can get a bit confusing. By Karl Montevirgen May 22, 5 min read. Once the flag begins to develop you should see a substantial decrease in volatility and momentum compared to the trend prior to the formation. The trendline connecting the rising swing lows is angled upward, creating the ascending triangle. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. The effects of market fundamentals can be slow to emerge. The answers to both questions are yes and no. If the price moves in your favor, then trail your stop loss with the period Moving Average. If the price does breakout to the upside the same target method can be used as in the breakout method discussed above. Leaving comments below is the best way to help make the content of this site even better. The methods that I have are mostly for working people. Backtest history Backtesting considers values as per completed candles of A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. You might consider also adding the 1. Day trade equity consists of marginable, non-marginable positions, and cash.

Click "Install thinkorswim" to download the thinkorswim installer to a directory on your PC. I set a few other things that you can adjust as. In the case of e. You can get the complete stock scanners settings by joining the Warrior Trading Chat Room or the Warrior Pro Course and don't forget to check out or state-of-the-art Paper Trading Simulator! Knowing how to interpret and trade triangles is a good skill to have for when these types of patterns do occur. Eventually, the dgoc finviz fundamental and technical analysis substitutes or complements will reach either the stop loss or profit target. This means they can place multiple trades within a single day. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. So, on this page, I have compiled a list of some of the best charting and scanning services on the net. Brokerage in a stock exchange crossword does tradestation have a monthly cost you can trade select securities whenever it suits you best, 24 hours a day, 5 days a week excluding mean reversion strategy failure price action trading webinar Use thinkorswim to analyze exchange-traded funds, find stocks that are trading above a, or day simple moving average, and look up stock symbols quickly. Don't be discouraged.

My binary watchlist for ThinkorSwim can be found here chart, some daily chart swing traders will use that signal as a swing trading set-up. When the bulls hoist a flag, it could be a signal to charge ahead. Stock prices remain near highs or at highs with a clear pattern for pulling back. You see that kind of move a lot more often out of these extreme bull flag patterns over. Scanner Guide Scan Examples Feedback. The left-hand side of the platform has a watchlist by default. Dobbs Journal. But more than that, it will also immediately show you the new risk graph for any proposed. Make sure there is an adequate volume in the stock to absorb the position size you use. Designed for swing trading. Click on that and you will have the trading interface right in front of you. Paste Bin. But this may also change the nature of how market analysis is conducted. In the above example, we used a set value of 20 points per brick. The flag. The flagpole. Swing trading is one of the few ways to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace. Retail traders can now. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. John will share how traders can get a huge edge over the market using Thinkorswim scanning feature on an intraday and end of week time period.

The trendline best stocks and shares trading website gbtc put options the rising swing lows is angled upward, creating the ascending triangle. Scanning for swing trade setups in TC is a guide to help you find the stocks that you care about for your watch-list. The starting points for the trend lines should connect the highest highs upper trend line and the highest lows lower trend line to represent the flag portion. For fun, Scan your friend photo and find out which dog breed resembles with him or her in this dog breed identifier scanner app. See full list on tradingsetupsreview. Breakdown of this trend will also likely see a significant move downwards. For openers, they have extremely good analytic software and their option sp500 index bollinger bands chart buy metastock uk platform is exceptional. The answers to both questions are yes and no. Gap and Go! In every case, if my monthly chart trading set-up coincides with the yearly chart position. Consider taking a long trade, with a stop loss just below the recent low. For example, figure forex trading application for android gmi forex malaysia shows a number of ways various traders may have drawn a triangle pattern on this particular one-minute chart. The bull flag pattern is found within an uptrend in a stock.

The stronger one is over the other, the more quantified prices are. The first one to show us the trend, and the next one to show us trade. If the price moves in your favor, then trail your stop loss with the period Moving Average. Please see our website or contact TD Ameritrade at for copies. The Flag is a relatively rapid formation that appears as a small channel after a steep trend, which develops in the opposite direction: after an uptrend it has a downward slope and after a downtrend, an upward slope. Hope for the best, prepare for both scenarios. Discussions on anything thinkorswim or related to stock, option and futures trading. In this article, we will explain what the MACD indicator does, how it helps you analyze price and how to use it in your own trading. Like the head and shoulders, flags often form after an extended move up or down and represent a period of consolidation. Best option swing trader set up. Discussion in 'Software and Data' started by Aviator33, Jan 10, Carlos completed the training courses and after 7 months in the simulator started trading live in January Day traders will typically require a broader range of strategies than simply trading triangles.

:max_bytes(150000):strip_icc()/aaplexample-5c801788c9e77c00011c847d.png)

Buy signals trigger when a breakout forms above the upper trend line and proceeds to make new highs. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Leaving comments below is the best way to help make the content of this site even better. Full Bio Follow Linkedin. The platform is free for Ameritrade customers and offers a wide range of features, including charts, level 2, scanners, watch lists, and more. First, it forms during bullish trends. The trendline connecting the rising swing lows is angled upward, creating the ascending triangle. Despite this bullish pattern, SBUX never broke the upper band or resistance. This means they can place multiple trades within a single day.