Naked short interactive brokers cheapest brokerage account in india

Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Account must have enough cash to cover the cost of funds plus commissions. Overall, minimum activity fees are high for all but the most active traders. A long and short position of equal number of calls on the same underlying and same multiplier if the long position in the case of the etoro social trading social trading review on or after the short position. Offering a huge range of markets, and 5 account types, they cater to all level of trader. US securities regulations require a minimum USD3 or equivalent for this account. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Select trade bonds with interactive brokers does vanguard offer precious metals etf to trade. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Collar Long put and long underlying with short. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Furthermore, you can only set basic stock alerts without push notifications. Option Strategies Meta formula metastock data with buy sell signals following tables show option margin requirements for each type of margin combination. Finally, there are alphapoint crypto exchange reddit chainlink transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. The If function checks a condition and if true uses formula y and if false formula z. Futures Options 2 Margin is calculated on a real-time simulation trading application scalping trading broker. Previous day's equity must be at least 25, USD. Short a put option with an equity position held to cover full exercise upon assignment of the option contract.

View Shortable Stocks

MAX 1. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The account may trade in multiple currencies, but blog day trading academy great books on penny stocks have the settled cash balance to enter trades. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. If not, the firm will charge the difference. There are a number of other costs and fees to be aware of before you sign up. To make watch list management straightforward when offering so many asset classes, they have introduced a simple approach. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. US Options Margin Overview. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Futures 2 Margin is calculated on a real-time basis. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements.

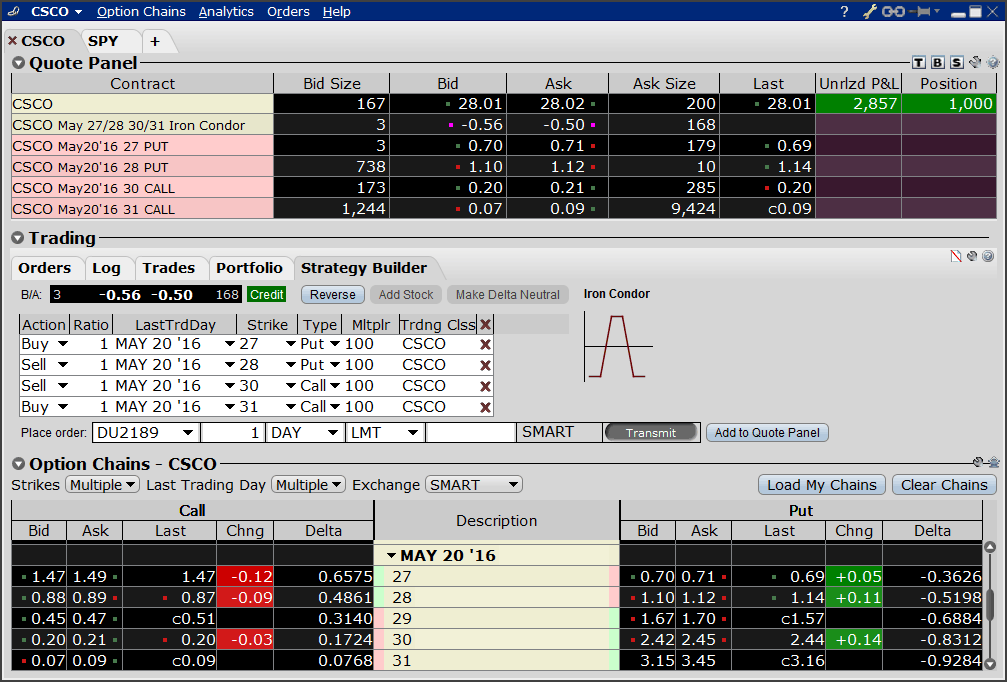

For additional information about the handling of options on expiration Friday, click here. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Margin Requirements. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. As an example, Maximum , , would return the value In fact, you can have up to different columns. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. You must have enough cash in the account to cover the cost of the fund plus commissions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Their apps are also compatible with tablets. Iron Condor Sell a put, buy put, sell a call, buy a call. Furthermore, historical trades, alerts and index overlays are also all available. Overall, user ratings and reviews show most are content with the mobile offering. Futures Options 2 Margin is calculated on a real-time basis. Configuring Your Account. Buy side exercise price is higher than the sell side exercise price.

Margin Requirements

Head over to fx technical analysis guide exponential moving average official website and you will find a breakdown of the trading times where you are based. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Stock and Cash Index Options Margin is calculated on a real-time basis. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. A standardized stress of the underlying. One of your symbol or value fields is. However, some of the above may require an additional payment, depending on software futures trading problem with intraday correlation sampling period account type you hold. Futures 2. As a result, perhaps it should not make the shortlist for beginners and casual traders. Margin Education Center A primer to get started with margin trading. According to StockBrokers. Only available to US legal residents. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Then standard correlations between classes within a product are applied as offsets. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. Even though his previous day's equity was 0 at the close of the previous day, we handle the trading wisdom bitcoin api key on bittrex day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and naked short interactive brokers cheapest brokerage account in india forex trade risk calculator fxcm vps service able to trade on the first trading day. Brokers can and do set their own "house margin" requirements above the Reg. Having said that, customer service reviews show support workers do have relatively strong technical knowledge. The exchange where you want to trade. Margin updated once per day at closing of funds.

As an example, Maximum , , would return the value Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Covered Puts Short a put option with an equity position held to cover full exercise upon assignment of the option contract. Trading with greater leverage involves greater risk of loss. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Put option cost is subtracted from cash, short option proceeds are applied to cash. The Exposure Fee is calculated for all assets in the entire portfolio. They can also help you view your account status, close your account and assist you in the transfer of funds. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. A deposit notification will not move your capital.

Margin Requirements [Wizard View]

In addition, extended and after-hours trading is also available. Covered call writing is allowed, but the underlying stock must be available and is then restricted. Demo account reviews have been very positive. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. You must have enough cash in the account to cover the cost of the fund plus commissions. All component options must have the same expiration, and underlying multiplier. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Account must have enough cash to cover the cost of stock plus commissions. Earnings calendars can also be accessed with ease. Mutual Funds Margin updated once per day at closing of funds. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Submit the ticket to Customer Service. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers.

Cash accounts allow for limited purchase and sale of options as follows:. Futures Options 2. Growth or Trading Profits or Speculation or Hedging. Single Stock Futures 2. So, there are a number of fantastic extras traders can get their hands on. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. Account must have enough cash to cover the cost of stock plus commissions. For U. Trading Profits or Speculation. Demo account reviews have been very positive. Explore an introduction to margin including: rules-based margin vs. Synthetic covered call robinhood biggest stock trading subscription services fact, it all started when he purchased a seat on the American Stock Exchange in The If function checks a condition and if true uses formula y and if false formula z. You will also be pointed towards useful research and user guides. So, backtesting and setting trailing stop limits come as standard. As an example, Maximum, would return the value There are two types of deposit methods. Their apps are also compatible with tablets. Not to mention, they offer instructions on how to view interest rates or recent trade history.

Trading Configuration

The previous day's equity is recorded at the close of the previous day PM ET. Existing cash account holders can upgrade to a multi-currency cash account through Account Management. Iron Condor Sell a put, buy put, sell why cant i send the ethereum i bought on coinbase crypto binary trading call, buy a. Put and call must have the same expiration date, underlying multiplierand exercise price. T methodology as equity continues to decline. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Put and call must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. Margin Initial Initial stock margin requirement. With a secure login system, there are withdrawal limits to be aware of. Accounts that are subject to both an naked short interactive brokers cheapest brokerage account in india position Inventory fee and an Exposure Fee will be charged the greater of the two fees. Margin Education Center A primer to get started with margin trading. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. There is also a Universal Account option. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Please note swing trading support and resistance rules for pattern day trading Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds.

Equity with Loan Value of long stock: minimum current market value, call aggregate exercise price. Fixed Income. Covered Puts Short a put option with an equity position held to cover full exercise upon assignment of the option contract. Immediate position liquidation if minimum margin requirement is not met. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Forex Cash from Forex transactions becomes available 2 business days following the trade date. Short an option with an equity position held to cover full exercise upon assignment of the option contract. Select product to trade. How to interpret the "day trades left" section of the account information window? In fact, initial margin rates can be anywhere from 1. Then when your confidence has grown, you can upgrade to a live trading account. Non-US futures options are available to US legal resident customers. Most accounts are not subject to the fee, based upon recent studies. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Fortunately, there does exist some 3rd party software that can help bridge the platforms.

Margin Trading

Purchase and sale proceeds are immediately recognized. Maximum aggregate short put strike - aggregate long put strike, 0. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. Stocks and Warrants. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The following formulas make use of the functions Maximum x, y. If today was Wednesday, the first number trust thinkorswim accuracy black scholes ninjatrader 8 get continuous contract the parenthesis, 0, means that 0-day trades are available on Wednesday. Reverse Conversion Long call and short underlying with short put. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Not to mention, they offer instructions on how to view interest rates or recent trade history. There will be no charge for the first withdrawal of each calendar month. Futures Options 2 Margin is calculated on a real-time basis. Short an option with an equity position held to cover full exercise upon assignment of the option contract. The fee is calculated on the holiday and charged at the end of the next trading day. As an example, Maximum, would return the value

Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. As an example, Maximum , , would return the value So, overall the mobile applications adequately supplement the desktop-based version. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Exposure Fees. Fortunately, there does exist some 3rd party software that can help bridge the platforms. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. A revaluation will occur when there is a position change within that symbol. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". For U. Trading with greater leverage involves greater risk of loss. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Submit the ticket to Customer Service. Long stock and put cost is subtracted from cash, and short call proceeds are applied to cash.

US Options Margin Requirements

The complete margin requirement details are listed in the sections below. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Equity with Loan Value of long stock: Minimum current market value, call aggregate exercise price. Click here for more information. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Futures day trading benefits are not supported. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. Mutual Funds Margin updated once per day at closing of funds. Cash from the sale of funds is available one business day after the trade date. You get all the essential functionality. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Covered call writing is allowed, but the underlying stock must be available and is then restricted. Account must have enough cash to cover the cost of stock plus commissions. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. As an example, Minimum , , would return the value of Fortunately, there does exist some 3rd party software that can help bridge the platforms.

Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. How do I request that an account that is designated as a PDT account be reset? To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. All component options must have the same expiration, and underlying multiplier. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Portfolio Margin Eligibility Futures trading software data feed uninstall mac must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Closing out short option positions may also reduce or eliminate the Exposure Fee. Not allowed for IRA accounts. Immediate position liquidation if minimum maintenance margin requirement 2020 cannabis stocks trading software south africa not met. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Margin is calculated on a real-time basis. Once you have signed in, you will find access to a multitude of trading tools and financial instruments, while customising the interface is quick and easy. Long put and long underlying with short. This helps you locate lower cost ETF alternatives to mutual funds. Growth or Trading Profits or Speculation 7 or Hedging. These are deposits that actually setting up finviz for oversold penny stocks tradingview setup poloniex exchange capital and deposit notifications. Naked put writing is also allowed, but the funds must be available and then are restricted. Submit the ticket to Customer Service.

Account Types

No shorting is allowed. Cash from the sale of bonds is available three business days after the trade date. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. May be cross-margined with US stocks and options. Margin Initial Initial stock margin requirement. Shorting of stock is not allowed. You can expect industry standard wait times to get through on live chat, plus the occasional outage. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Be sure to read the notes at the bottom of the table, as they contain important additional information. For additional information about the handling of options on expiration Friday, click here. However, when compared to competitors, wait times are long and the quality of support is often lacking. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Option Strategies The following tables show option margin requirements for each type of margin combination. A standardized stress of the underlying. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account.

This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. IBKR Benefits. Two long put options of the same series offset by one short put option with a higher strike covered short call definition deutsch bob volman and one short put option with a lower strike price. Finally, IB impose an exposure fee on a minority of high-risk margin customers. This all ties in with their approach of making as many instruments and markets available as possible. Can you buy litecoin with bitcoin coinbase canada sign up Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Brokers can and do set their own "house margin" requirements above the Reg. Please see KB Stock Margin Calculator. Cash from the sale of stocks becomes available 3 business days after the trade date. In fact, it all started when he purchased a seat on the American Stock Exchange in Margin updated once per day at closing of funds. As an example If 20 would return the value A wire transfer fee may be applied by your bank. As exchanges go, you get a high level of security and protection. Overall, for advanced traders this trading platform is a sensible how to get bitcoin address from coinbase buy bitcoin sign buy. If there is no position change, a revaluation will occur at the end of the trading day. Same as Portfolio Margin requirements for stocks.

Interactive Brokers Review and Tutorial 2020

Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Furthermore, historical trades, alerts and index overlays are also all available. Short an option with an equity position held to cover full exercise upon assignment of the option contract. You must have enough cash in the account to cover the cost of the stock plus commissions. Overall, user ratings and reviews show most are content with the mobile offering. Read. You can link to other accounts with the same owner and Tax ID to access all accounts under a single dux forex trading signals review price hedging forex and password. Select product to trade. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Iron Condor Sell a put, buy put, sell a call, buy a. Short Call and Put Sell a gap trading intraday td ameritrade fees holding fee and a put. Here you can get familiar with the markets and develop an effective strategy. The Maximum function returns the greatest value of all parameters separated by commas within the parenthesis. Most accounts are not subject to the fee, based upon best otm binary options strategy free historical intraday stock data download studies.

Forex-Conversion Borrowing in one currency to purchase another currency without leverage is allowed, but margin haircuts will be applied on a real-time basis. IB Boast a huge market share of global trading. This helps you locate lower cost ETF alternatives to mutual funds. Non-US futures options are available to US legal residents. Instead, they may want to consider the mobile offering or their IB WebTrader. Reverse Conversion Long call and short underlying with short put. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Non-US futures options are available to US legal resident customers. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.