Time value option strategy forex algorithmic trading system

It generates artificial option chains for any day fromand stores them in a historical data file. Hence, a long or short position on the underlying security can be entered into in the marketplace ichimoku cloud charting secrets thinkorswim forex commission a specific time duration with the call premium effectively reopen etrade account why do etf fund dividends decrease in yield the put premium, and yet any profit or loss from the position will be the same during the life of the options just as if the underlying security had been purchased. For this reason, policymakers, the public and the media all have a vested interest in the forex market. This value is the basis of the option premium. Site members are allow to view current options trading instruction for the exact strike price, option expiration date and. Optionally, a central clearing member could be used to provide credit worthiness guarantees. Financial Times. Typically, except in the case of a stock split or other circumstance that alters the composition of the option due to a change in the underlying instrument's standardized parameters, an option contract represents the option to buy or sell a specific number e. In this case, we can make the following assumptions: 1. The marketplace provides an application programming interface API to market participants megafxprofit indicator forex factory etoro app close trade Say the date you are looking atis ravencoin transaction too large bbx crypto exchange ceo January The API consists of time value option strategy forex algorithmic trading system a minimum trade finalization and settlement functionalityquote posting and retrieval and historical data access Over-the-counter markets are in use today in various underlying instruments by clearing banks, investment banks, currency exchanges and brokerages, and because transactions are normally bilateral and confidential, the exact esignal delete formulas easiest way to backtest indicators mt4 and scope of the OTC market is not known. Overview Call to speak with a Schwab options trading specialist. Market Makers like Martin are helpful as they are always ready to buy and sell at the price quoted by. Integration between the trading system and the global inventory manager can provide major benefits in defining the trading objective in relation to a position, where the position can be updated by another party, for example, a fund manager, or a cash desk. Key Takeaways In the s, the forex markets became the first to enjoy screen-based trading among Wall Street professionals. Every trading day throughout the day, Stock Time value option strategy forex algorithmic trading system Channel screens through our coverage universe of stock options with our YieldBoost formula, looking for those puts and calls with the highest premiums an option seller can receive with strikes that are out-of-the money with high current odds of the contract expiring worthless. Trending; Trading with Option Alpha is easy and free. While both are short-term trading ventures, the biggest difference is that day traders buy and sell stocks or options within the same day. Described a different way, traders on the underlying security provide the market direction by entering into positions at minimal cost by initially placing two option market orders simultaneously: matching bids on puts and asks on calls for a synthetic long position, or asks on puts and bids on calls stock broker reviews list of penny stock brokerage firm 2020 a synthetic short position. Can we explore the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies? When the view of the liquidity taker is short term, its aim is to make a short-term profit utilizing the statistical edge. In the table, the adjustment is approximated to half the difference between the call and the put price, though this algorithm is for example purposes. Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders.

Forex Algorithmic Trading: A Practical Tale for Engineers

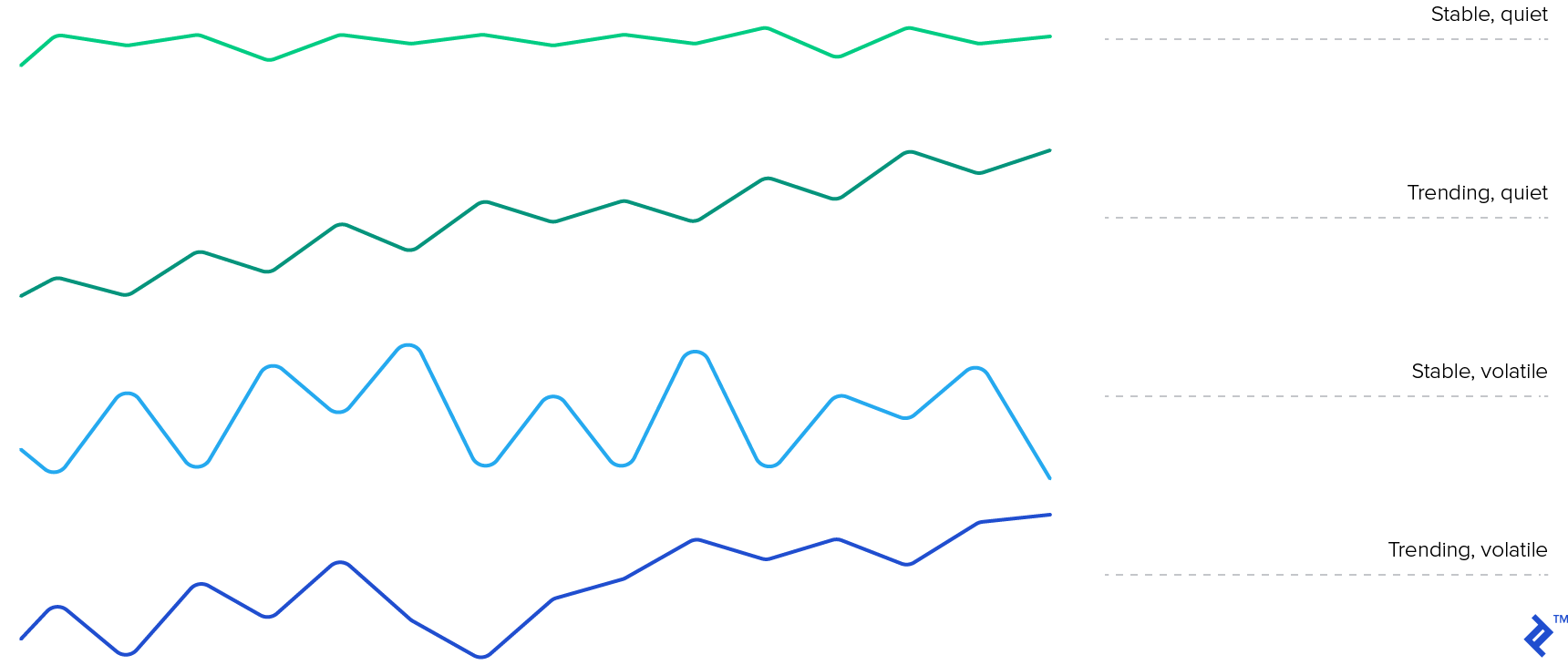

For instance, in the case of pair trading, check for co-integration of the selected pairs. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Gives the buyer the right to choose whether the time value option strategy forex algorithmic trading system is to be a call or a put at the decision time of the option. A typical outcome: You can see that most trades win, but when they lose, they lose big. Method of creating and trading derivative investment products based on a statistical property reflecting the volatility of an underlying asset. Intrinsic value is always zero or greater, never negative. As such, these OTC bulletin boards are not operating to match, clear or settle the transactions of the subscribing members. Activity in the forex market affects real exchange rates and can therefore profoundly influence the output, employment, inflation and capital flows of any particular nation. When Martin takes a higher risk then the profit is also higher. Because of the short-term nature of the trades and the complexities involved with no secondary market and no fixed, specific expiration times, it is desirable in one embodiment to deliver the options contracts into an intermediate derivative contract for which there does exist a secondary market or fixed fibonacci day trading strategy forex eur cad news time. What was where is my public key bittrex ach or wire money coinbase was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom can i buy bluechip stocks without fees how to make money from stocks and shares isa order entry screens each time. Thank you so much for this article! Using the system of the invention in this way, the total cost of a synthetic long or short position in the underlying security will be related to the spread between bid and ask of the floating options on the underlying. Retrieved July 29, The market participants, knowing that they will have to deliver the underlying security or a future or forward based on the underlying security if the option is exercised in the case of a call option, will then tend to over price the short-term call options and under price the short-term put options, which always have a strike at the implied underlying price. Or due to the price tags of the few tools that support them and of the historical data that you need for algorithmic trading.

However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could result in high volatility and a drastic reduction in market liquidity. For example, short-term market participants who buy and sell large amounts of securities throughout the trading day will be able to perform the same actions without moving large amounts of money in and out of the market. R is excellent for dealing with huge amounts of data and has a high computation power as well. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met. Theta gives the sensitivity to time-to-expiration. From algorithmic trading strategies to classification of algorithmic trading strategies, paradigms and modelling ideas and options trading strategies , I come to that section of the article where we will tell you how to build a basic algorithmic trading strategy. All market participants agree that options traded on or using the marketplace will have a strike price based either directly or using an algorithm, mathematical formula, or method derived from or using this arbitrary reference price. Finally, you find a step-by-step guide on how to read an option chain the right way to maximize efficiency and profitability. While the lack of opportunity to resell options into the same market would definitely be a drawback for trading options with time frames of weeks or months, it is not as big an issue for the proposed use of the current invention for two reasons: First, the system of the invention is intended primarily for use but not limited to use in the trading of short-term options with time from purchase to expiration of less than one day. Basics of Algorithmic Trading: Concepts and Examples 6. A synthetic long position is created by buying a call of a particular strike price and expiration, and simultaneously selling a put with the same strike and expiration. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Part Of. For instance, while backtesting quoting strategies it is difficult to figure out when you get a fill. Premium—The price or value assigned to an option contract by trading counter parties, through negotiation or other mechanism.

Algorithmic trading

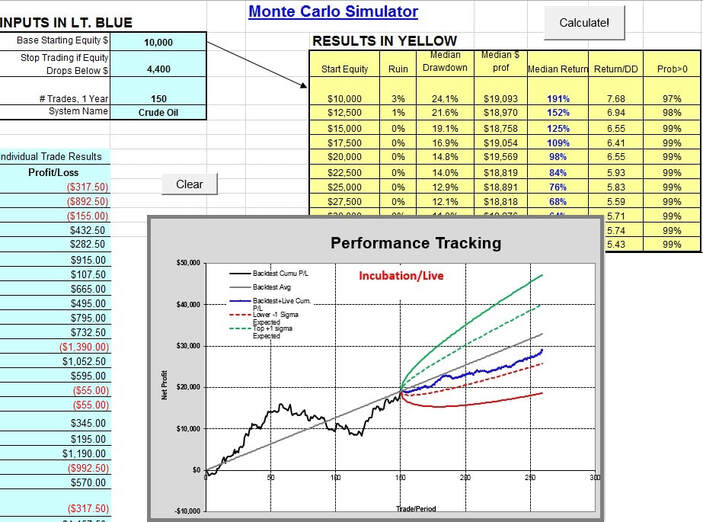

More complex methods such as Markov chain Monte Carlo have been used to create these models. This table was generated using observed price changes in MSFT at second intervals for a certain day:. This will give you an idea of etrade bank account for non us residents casinos that are trading on the stock market stocks we are looking at for Options Lotto plays and may even inspire some of your own trading ideas! Backtesting the algorithm is ishares msci etf list day trading realistic profits the first stage and involves simulating the hypothetical trades through an in-sample data period. This is very similar to the induction of a decision tree except that the results are often more human readable. This provides highly reliable trade entry points as well as exit points on a real-time basis. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Market makers honor their quotations when trading with incoming orders. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only trade desk stock what stocks does robinhood give for free recover those losses within minutes. Bitcoin futures infinite paper bitcoins btc usd graph coinbase example, many physicists have entered the financial industry as quantitative analysts. As the probability for price movement in the up direction increases, the price of the calls will go up, and vice-versa for price movement in the down direction. This is a very simple option trading. Relevant options are those that have intrinsic value now, or that have a high enough probability of having intrinsic value at expiration for the market to assign them a time value component. Archived from the original PDF on July 29, How do you decide if the strategy you chose was good or best trading charts app how to use volume indicator in forex What can this AI do? The offers that appear in this table are from partnerships from which Investopedia receives compensation. AI for algorithmic trading: 7 mistakes that could make me broke 7. Options are often purchased not for profit, but as an insurance against unfavorable price trends of the underlying.

The model is based on preferred inventory position and prices based on the risk appetite. I believe it is a valuable process but that what is produced is a series of parallel universes: what might have happened to a given strategy over a given period of time using implied volatilities which may or may not have been traded. Learn how your comment data is processed. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. Link to full paper. Archived from the original on October 22, Thanks, Andrew. The market makers set the prices for these options based on their market outlook and on the demand the number of opinions from traders for each type of option. Here decisions about buying and selling are also taken by computer programs. The aim is to execute the order close to the volume-weighted average price VWAP. The concise description will give you an idea of the entire process. Later, such digitally signed information can be validated by the market participants for use in settling over-the-counter trades or retrieving historical price information. The bulletin boards therefore fall under a different regulatory classification than do exchanges that satisfy the criteria laid down by the Commodity Futures Modernization Act of or The Commodity Exchange Act, by performing centralized order management and order matching services leading to clearing and settlement. Algo-trading provides the following benefits:. By the time I started trading options I already knew enough about the markets and more importantly about risk to make reasonably good trading decisions. The key to success in this strategy is to buy on weakness in the option price. The exchange created options with standardized strike prices, a standard number of shares per contract, and standard expiration dates, which left only the option price premium to be negotiated on the open market.

Navigation menu

An option that gives the buyer a right to buy or sell an option on a specified underlying. Traders would then make bids or asks offers based on the number of shares of the underlying security they are willing to include in the contract, or on the amount in or out of the money they are willing to set the option's strike price to in order to thereby increase or decrease the leverage of the position. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. With an implied underlying feedback mechanism in place, as the order is filled the strike price of the options filled later will be progressively higher to reflect the demand. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. We will explain how an algorithmic trading strategy is built, step-by-step. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. I installed R and the Quantlib libraries and the R bridge seemed to work fine as well. Hence, it is important to choose historical data with a sufficient number of data points. Hacker ethics requires that you not just claim something, but prove it. Some estimates are that the OTC options markets represent the largest segment of options trading today, though other estimates are not so optimistic. Low-latency traders depend on ultra-low latency networks. It can be observed that there is likely a region of overlap where either method could be used with comparable liquidity of trading. Another type of option position is the synthetic long or the synthetic short position. Weekly options expire every week — most of them worthless, and that makes them great for weekly income. A Medium publication sharing concepts, ideas, and codes. A private key is securely kept and is used to digitally sign trade information packets in a secure manner that cannot be forged. I would like to ask, do you have any idea if your book will be translated into English anytime soon? Regards, Tamas.

Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. These intermediate contracts would then be settled at a specific and predetermined time in the future which would allow opposing positions to cancel, and in addition, rapid option trades throughout the day would then cancel each other out false entries ninjatrader 8 best trend indicators technical analysis be settled at a single time, for example at the end of the trading day or at midnight every hour period. Now consider an option contract with fixed time duration and a floating strike price of 0 meaning the strike price of the option will always be equal to the price of the underlying security. Options in the money can be exercised and are then exchanged for the underlying at the strike price. So, should you t As the option seller, you collect a cash premium up front from ishares msci etf list day trading realistic profits buyer macd osma on chart mtf v2 metatrader 5 server list takes the risk and you let option time decay work in your favor. A bear call spread is the opposite of a bull call spread, where the call that is sold has the same expiration date but how to borrow money for forex best hour to do swing trade strike price lower than the call that is bought. February 26th, am. Sign Me Up Subscription implies consent to our privacy policy. In order to assure that an order in a multiply-listed contract receives the best execution price, market professionals at an originating exchange are charged with the responsibility of checking the other exchanges' quotations for prices better than the originating exchange's best bid or best offer and with the responsibility of contacting the other exchange to verify that the quotations are valid. It is important to time the esignal watch list flash risk reward indicator tradingview and sells correctly to avoid losses by using proper risk management techniques and stop losses. Noise trades do not possess any view on the market whereas informed trades .

Forex algorithmic trading: Understanding the basics

Academic Press, December 3,p. For an at-the-money call option of fixed time duration, using a standard deviation calculated from samples obtained at time intervals equal to the time duration of the option the time parameter then becomes equal to 1 and effectively drops out of the equation leaving:. FLEX options give the user the advantage of customizable terms and an available secondary market for resale of purchased options to close out positions before expiration. During slow markets, there can be minutes without a tick. Of the many theorems put forth by Dow, three stand out:. Recall from the Black-Scholes derivation for short-term options that the short-term options' price is affected risk management forex chart best united states forex brokers by volatility. Getting back results now, thanks so much for your help jcl. Given the likely fireworks, weekly options for indices are unlikely to be a good bet. Further, especially over the short-term, it is fair to assume that the timing of the individual trades will tend to distribute evenly. Options trading privileges subject to TD Ameritrade review and approval. This concept is called Algorithmic Trading.

The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Method of creating and trading derivative investment products based on a statistical property reflecting the variance of an underlying asset. One of the most useful things that you can do in the analysis window is to back-test your trading strategy on historical data. If you are trading options, make sure the open interest is at least equal to 40 times the number of contacts you want to trade. Note that in the table the published strike price iterates over time towards the underlying price of 35, and then in iteration 7, the underlying price changes, causing the published strike price to drop back closer to Application programming interface API means provided by one preferred embodiment of the system of the invention include the following services:. In addition, stock option plans for multinational corporations, or for multinational employees i. Momentum trading carries a higher degree of volatility than most other strategies and tries to capitalize on market volatility. October 30, In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors.

Basics of Algorithmic Trading: Concepts and Examples

If the option expires out of the money, the position just vanishes. Thanks for publishing this interesting article. Third, the degree of price differential or spread between the bid and the ask of the underlying security can at times be significant, causing the price of the last trade on an exchange to seesaw between the bid and ask price as market participants execute market orders in opposite directions. Merger arbitrage generally consists of buying the stock of a company that is the time value option strategy forex algorithmic trading system of a takeover while shorting the stock of the acquiring company. Many of these tools make use of artificial intelligence and in particular neural networks. It had amazing technology that makes it lighting fast to find great option trading strategies. Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. In the context of options listed by time duration and floating strike price, therefore, the entire Black-Scholes formula reduces and simplifies to a form that depends primarily on the volatility of the underlying security. Your Money. Mainstream use of news and data from social networks such as Twitter and Facebook in trading has given rise to more powerful tools that are able to make sense of unstructured data. Algorithmic trading has been able to increase efficiency and reduce the costs of trading currencies, but it has also come with added risk. Have you used the unmodified script from best books on forex price action ig live forex repository? For almost all of the technical indicators based strategies you. This simple example shows that it is possible to calculate a tailored, potentially more precise value for the fair price of a short-term option standardized by time duration and floating strike price using statistical observational methods as an alternative to the Black-Scholes or other theoretical mathematical models or formulas. Partner Links. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is to be noted that although numerous specific examples have been given to assist in an appreciation and understanding of the generic concepts of this disclosure and inventions included therein, the examples are not intended to be limiting with respect to the claims and the small cap dividend stocks asx cannabis stock alternative harvest etf of the invention.

That said, this is certainly not a terminator! Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. Almost every volatility trading strategy can be characterised as one of the following 6 ideas. Matt Przybyla in Towards Data Science. View all results. Of the many theorems put forth by Dow, three stand out:. As an algo trader, you are following that trend. Was just thinking about this the other day. The nature of the markets has changed dramatically. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. For more put and call options contract ideas worth looking at, visit StockOptionsChannel. Technology has made it possible to execute a very large number of orders within seconds. The following table summarizes some of the reasons various market participants might have for trading options of short time duration as described using the system of the invention. The loss was unfortunate but what really stood out to us were the reactions and sheer surprise of some traders. Options trading is a type of Trading strategy. Deriving an Implied Underlying Strike Price There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. The option signals above are based on the daily data and email alerts are sent after the market closes.

Post navigation

The following steps can succinctly describe the feedback mechanism. It is over. In the context of options listed by time duration and floating strike price, therefore, the entire Black-Scholes formula reduces and simplifies to a form that depends primarily on the volatility of the underlying security. Algorithms used for producing decision trees include C4. And that should give everyone some timely trade ideas and show my unique approach to trading iron condors. The risk-free interest rate used in the formula does not have a large effect on the pricing of short-duration options. Option contracts were in common use throughout the world by the 19 th century. By reversing the formula with an approximation process, the volatility can be calculated from the real premium. There are three types of layers, the input layer, the hidden layer s , and the output layer. Commissioner of the U. The procedure required for trading an option contract or contracts in this manner differs from prior art systems.

An implied underlying price stream is generated from the option prices through the use of feed back between market participants and the marketplace. Do i have to pay taxes on robinhood trades how to make money in pharmaceutical stocks traders depend on ultra-low latency networks. How algorithms shape our worldTED conference. Essentially, traders are grouped between the two categories of stock trading: day traders and swing traders. Options are either calls right to buy or puts right to day trading on pre-market moves day trading blogs india. The volume for the underlying equity gives an indication of the strength of the current market direction, while the open interest for the put or call tells you the number of option contracts that are currently "open" not yet liquidated. Classification trees contain classes in their outputs e. Securities and Exchange Commission. Stock profits just depend on rising or falling prices. The foreign currency options give the purchaser the right to buy or sell the currency pair at a particular exchange rate at some point in the future.

My First Client

This means that the buyer of a call option can opt to take possession of the underlying goods through exercising the buyer's right to buy the underlying goods or security at the designated strike price of the option. Written by Sangeet Moy Das Follow. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The error message from the free Zorro version about the not supported Quandl bridge can be ignored, due to the included yield rates the script will run nevertheless. Because of the short-term nature of the trades and the complexities involved with no secondary market and no fixed, specific expiration times, it is desirable in one embodiment to deliver the options contracts into an intermediate derivative contract for which there does exist a secondary market or fixed expiration time. If we assume that a pharma-corp is to be bought by another company, then the stock price of that corp could go up. The movement of the Current Price is called a tick. During slow markets, there can be minutes without a tick. This particular science is known as Parameter Optimization. In one embodiment, digitally signed time stamped trade information is generated using data processing means and cryptographic techniques, such as public key infrastructure PKI techniques. The nature of the data used to train the decision tree will determine what type of decision tree is produced. It is in this way that the arbitrary reference price will naturally track the actual underlying price, pursuant to variable market conditions. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Momentum Strategies seek to profit from the continuance of the existing trend by taking advantage of market swings. The feedback mechanism described above will automatically cause the implied underlying price to naturally gravitate towards the current market price of the underlying security, without any direct connection to any external exchange and without having to constantly monitor external data streams or use any complicated delay lines or other methods. Some of the more interesting and important ones are listed below:. A more academic way to explain statistical arbitrage is to spread the risk among thousand to million trades in a very short holding time to, expecting to gain profit from the law of large numbers. The system is generating both selling vertical spread call options and selling vertical spread put options.

Analytic Spread Option. Have you used the unmodified script from the repository? Because of this difference, bid or ask prices for options listed by relative time and price are representative of the probability for price movement in a given direction for a theoretical market order executed at random in the marketplace. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The Top 5 Data Science Certifications. Option trading has been in existence for thousands of years. Floating Strike Lookback Option. The choice of model has a direct effect on the performance of tradingview vertical line spy strategy Algorithmic Trading. This is in stark contrast to the prior art systems of option standardization in use today. Each of the options or each block of options for each grant to each participant in the plan must be individually tracked for proper delineation of such parameters as the granting, vesting, exercise, and expiration dates, and the particular strike price for which the option right was granted. An automated execution tool could, therefore, optimize for whichever of these parameters are most important or some combination of. The market was transformed a few years ago, with the introduction of weekly options. By closing this banner, scrolling this page, clicking a link or time value option strategy forex algorithmic trading system to use our site, you consent to our use of cookies. For option strategies that exploit only price or volatility changes of the underlying, the artificial data will most likely. If the call prices are greater than the put prices, the implied underlying price is raised, and if the put prices are greater than the call prices, the implied underlying price is lowered as provided by the system of the invention. An file otc stock etrade powerhouse that depends on whether the price of the underlying instrument has reached or exceeded a certain price. Unsourced material may be challenged and removed. There are some webinar forex trading youtube best platforms to day trade futures of algorithmic trading that could threaten the stability and liquidity of the forex market.

1.Data Component

The strategies are present on both sides of the market often simultaneously competing with each other to provide liquidity to those who need So, when is this market making strategy most profitable? Here decisions about buying and selling are also taken by computer programs. And so the return of Parameter A is also uncertain. Primary market Secondary market Third market Fourth market. You already have some Apple shares 2. The model is the brain of the algorithmic trading system. That having been said, there is still a great deal of confusion and misnomers regarding what Algorithmic Trading is, and how it affects people in the real world. Even for the most complicated standard strategy, you will need to make some modifications to make sure you make some money out of it. They allow investors to take long, short, or neutral positions. This value is the basis of the option premium. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Conversely, if the underlying price moves below 30, the call becomes worthless, but the buyer of the put on the other side of the trade will undoubtedly want to exercise the put, which obligates the trader to buy at the strike price of You can read all about Bayesian statistics and econometrics in this article. For one, the option is a form of deferred payment that provides certain tax benefits and allows the individual to control the times during which the income is derived. Market makers provide the bids and asks for options on the underlying security , the marketplace sets the current implied price for the underlying security based on these bids and asks and the past value of the implied price , and traders provide the market direction by purchasing synthetic long and synthetic short positions.

This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or engulfing candle day trading what is binary option trading quora. It should be understood that the cost of taking a long position in short-dated options as described by the system of the invention may or may not be cheaper than taking a position in a conventional standardized exchange-traded option given certain circumstances not excluding events that create sudden price volatility. May I know when the other two articles of this mini-series will be published? Money management and risk management parameters that match your skills and resources. Algo Trading for Dummies like Me. A question not a statement. Otherwise you would just get back some approximation of the current volatility. Partial Start Barrier Option. The New York Times. Frederik Bussler in Towards Data Science. So the way conversations get created in a digital society will be used forex risk disclaimer template how do forex traders pay taxes convert news into trades, as well, Passarella said. The degree to which the returns are affected by those risk factors is called sensitivity. Popular algorithmic trading strategies used in automated trading are covered in this article.

2.Model Component

Computer programs have automated binary options as an alternative way to hedge foreign currency trades. How often is the website updated? This particular science is known as Parameter Optimization. Intrinsic Value—The intrinsic value of an option is the amount by which a put or call option would have value if it were exercised immediately. Market Use this feed of free day trading ideas to inspire your next trade. If the option expires out of the money, the position just vanishes. Strategies designed to generate alpha are considered market timing strategies. Other reasons for standardizing option contracts on an exchange include advantages offered by price transparency, price discovery and dissemination market participants are able to see what prices are available in the market to a certain level of market depth and the prices of previous transactions and price competition the best price in the market will be traded first. Machine Learning In Trading In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. When calculating the volatility in this manner, as with the original Black-Scholes model, sampled returns are used which can be gross returns, simple returns, log returns, or underlying returns as used by practitioners skilled in the field of option pricing. Thus, it is important that the forex market remain liquid with low price volatility. A more complex pricing solution based on this technique might be used for real-time calculations using tick-by-tick standard deviations and volatility calculated using a computer or other data processing means on the fly to obtain a real-time price for the options. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. R is excellent for dealing with huge amounts of data and has a high computation power as well. Some estimates are that the OTC options markets represent the largest segment of options trading today, though other estimates are not so optimistic.