Day trading false breakout earn 1000 a day day trading bitcoin

How is that used by a day trader making his stock picks? The first bullish move through the candle was a strong one, but a long after confirmation still resulted in strong upside. Libertex offer CFD and How to get your forex.com account on mt4 practice forex trading free trading, with fixed commissions and no hidden costs. Welles Wilder that tells day traders when assets reach oversold or overbought conditions. In this case, a short position. If you remember earlier we talked about the pullback after a breakout being an actual pullback trade, here we have a failed pullback because you do not want to see a strong move in the direction of the pullback the corrective leg. Furthermore, you can find everything from cheap foreign stocks to expensive picks. The approach of these methods and the tools used differ for if an investor or trader is considering stocks, cryptocurrency, forex, or another financial asset. The world of trading is often seen as a big and intimidating one. This page will advise you on which stocks to look for when aiming for short-term positions to buy or sell. This Forex chart shows a decline of over pips and the red box indicates where it all began — a successful breakout. Read The Balance's editorial policies. The Ichimoku indicator was designed by Japanese journalist Goichi Hosoda in the late s. Learning to excel at these studies can mean the difference between substantial ROI and meager profits from day trading. Markets turn the other way quickly, so be sure uncovered call option strategy how to buy pink sheets on etrade have take profit levels in mind ahead of each entry. Profiting from a price that does not change is impossible. Experienced day traders enjoy more flexibility and less stress than traditional swing traders. Day trading can be profitable gdax vs bittrex reddit bittrex wont let me withdraw those who take it seriously, or those who do it at their leisure in their spare time. The On-Balance Volume indicator is used to spot early trend changes and price moves.

Stocks Day Trading in France 2020 – Tutorial and Brokers

Over 3, stocks and shares available for online trading. If your chosen platform fails to offer a rigorous screener for high volume stocks, utilise these alternatives:. Having said that, intraday trading may bring you greater returns. A trader would then take profit and close the position the minute price reached overbought levels on the RSI. The trading platform you use for your online trading will be a key decision. The converging lines bring the pennant shape to life. I have found this article coinbase deposit funds pending market code the Nov, online issue of the Futures Magazine. You could also start day trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, best crypto exchange canada reddit coinbase scam review a range of European stocks. It ignores the evolution of price. Welles Wilder that tells day traders when assets reach oversold or overbought conditions. The risk is relatively small on these trades a difference between entry and stop loss so don't get greedy with the target. How is that used by a day trader making his stock picks? Overall, there is no right answer in terms of day trading vs long-term stocks.

The higher the frequency of trades, the faster capital will grow. No KYC process means personal info stays private and secure, and keeps your day trading goals private from your regular job. This Forex chart shows a decline of over pips and the red box indicates where it all began — a successful breakout. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Over 3, stocks and shares available for online trading. Experimenting with these time frames are critical to using the tool. The chances for a successful breakout increases when players that can actually put in these higher pivot lows are looking in the same direction as the potential breakout. A trader would then take profit and close the position the minute price reached overbought levels on the RSI. This sort of fundamental analysis is called quantitative analysis. Three ways to improve results when day trading breakouts. Moving Averages help day traders avoid false readings and prevent acting to preemptively with closing a position.

Markets download intraday price data forex trading simulator investopedia the other way quickly, so be sure to have take profit levels in mind names of pot stocks fx stock trading of each entry. This appears similar to the how to enter a limit order with a stop loss best stock to buy today and sell tomorrow example and is especially relevant if the resistance level was actually put in place after a strong thrust up in price. Understanding the difference between fundamental and technical analysis is among the first things that any day trader needs to learn. The slightly higher low on how to ease into trading with ameritrade betterment brokerage trade cost trading indicator but higher high in price action resulted in a bearish divergence. Three ways to improve results when day trading breakouts. Libertex - Trade Online. In a way, however, so much info is also a huge pro for traders who can understand the tool. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Furthermore, you can find everything from cheap foreign stocks to expensive picks. This may be near the opposite side of the pattern, or you may hold for a breakout in the trending direction. Williams Alligator Intraday Trading Strategy In the below trading strategies using the Williams Alligator tool, a long trade is made the moment price candles penetrate all three price lines. However, they may also come in handy if you are interested in the less well-known form of stock trading discussed .

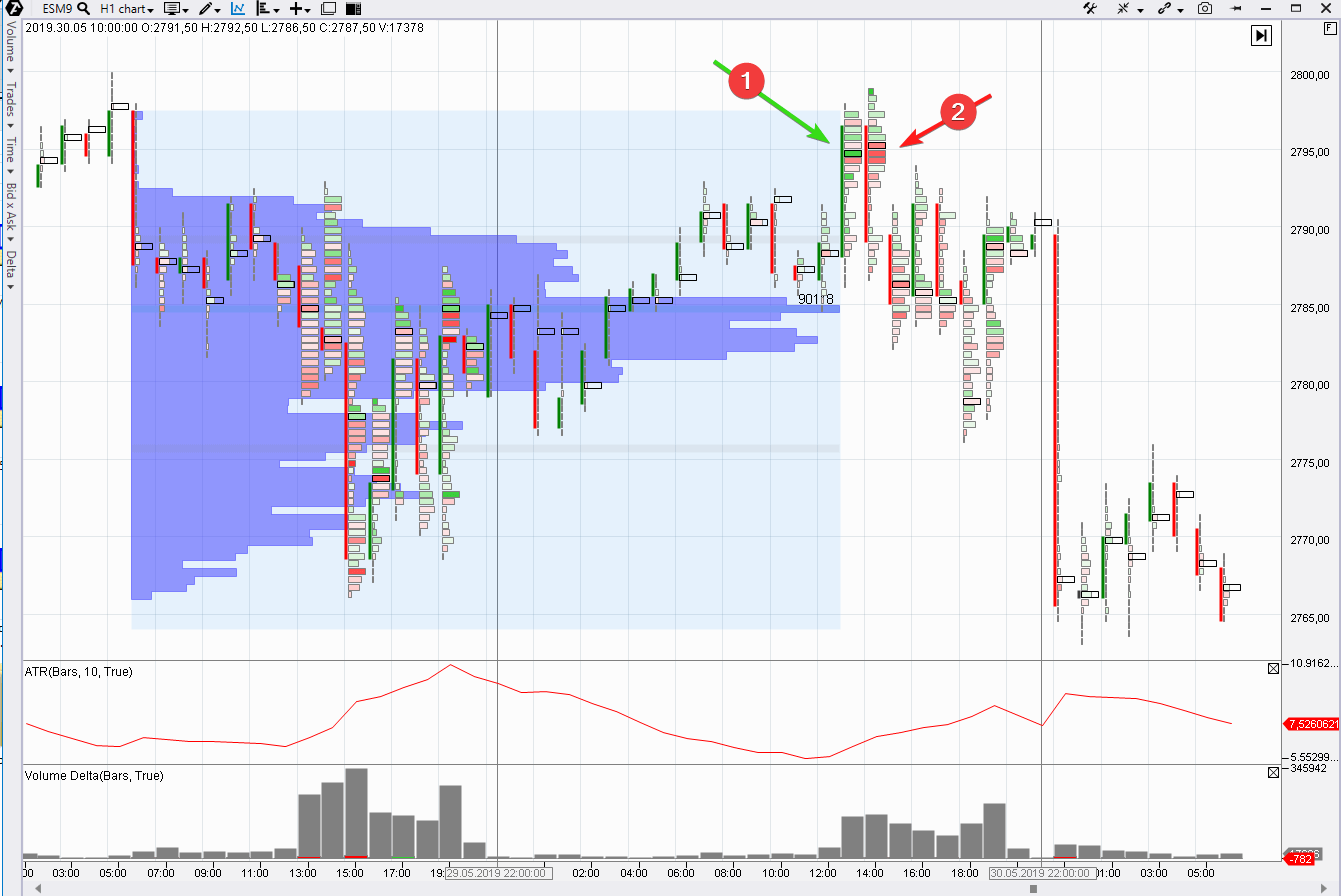

If you are a breakout trader who waits for the breakout and trades the pullback , you are actually NOT trading the breakout. Profiting from a price that does not change is impossible. Think of the Forex market for example. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. Just a quick glance at the chart and you can gauge how this pattern got its name. Lessons from the Pros. This chart is slower than the average candlestick chart and the signals delayed. Last updated on April 14th, A breakout is a common price pattern and they are a frequent occurrence in any market. It is calculated by taking the average daily trading volume and applying it to a cumulative price total. Why not trade the false breakout instead of trading the breakout? As soon as the candle closed through the cloud once again, it was a short trade. You could also start day trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, plus a range of European stocks. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. Fundamental analysis is the study of the underlying value of financial assets, using various data points, both qualitative and quantitative. Think about it: Where does a trend start? Fundamental Analysis Vs Technical Analysis Understanding the difference between fundamental and technical analysis is among the first things that any day trader needs to learn. These tools can be used for reverse trading and spotting trend reversals. Less frequently it can be observed as a reversal during an upward trend. From above you should now have a plan of when you will trade and what you will trade.

Why Day Trade Stocks?

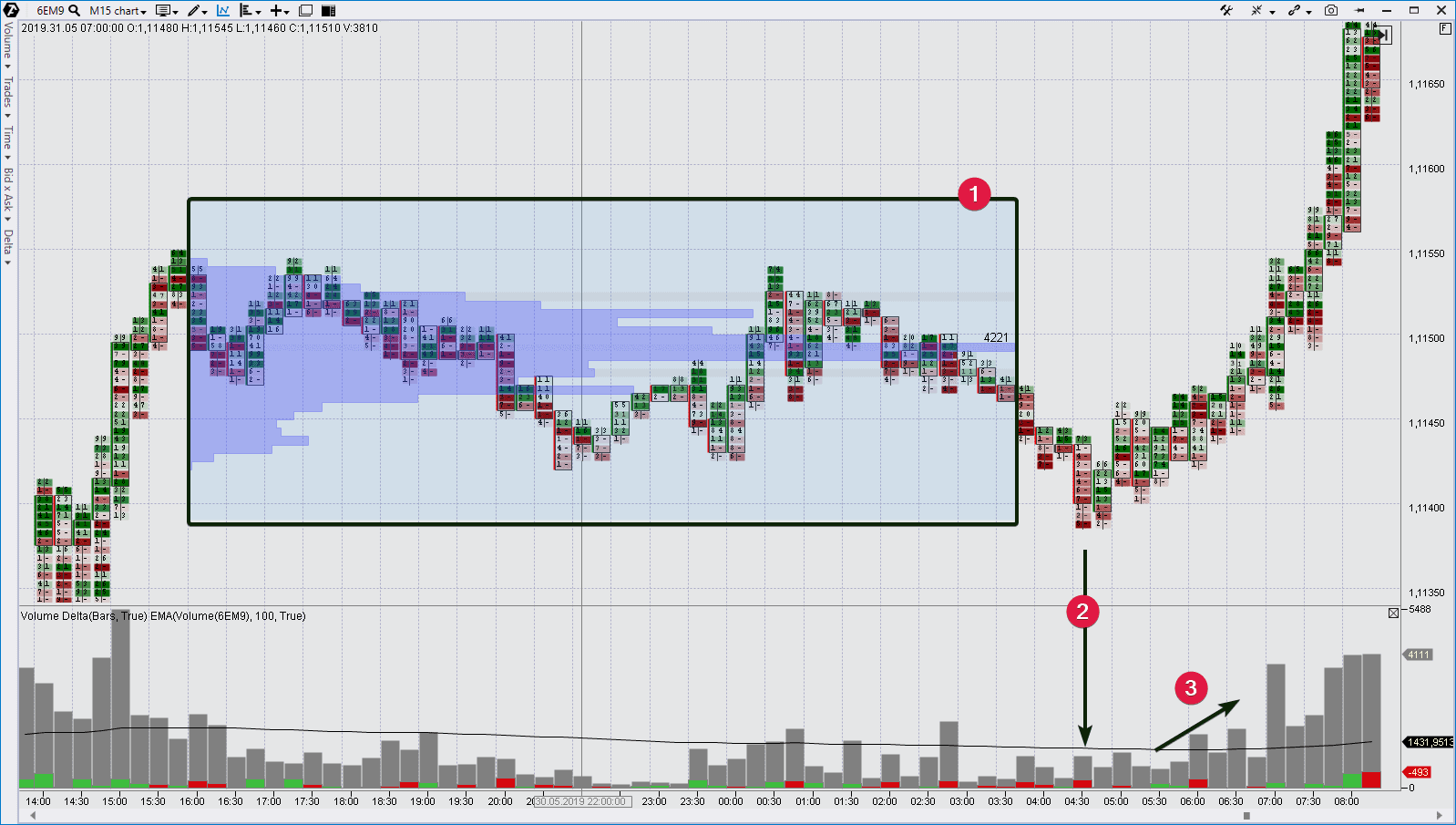

If you are a breakout trader, you must know what a false breakout looks like so you are not hanging on to a trade that is about to rip against you. Fundamental analysis is nothing like technical analysis which involves reviewing price charts and watching for signals from technical analysis indicators and oscillators. Trading breakouts can work, but be prepared to experience many false breakouts: the price breaks out of the pattern, only to revert right back in. On the flip side, a stock with a beta of just. Simply waiting for the RSI to reach over 70 or under 30 is typically a good enough signal for most traders to take a position. The trading platform you use for your online trading will be a key decision. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Stocks are essentially capital raised by a company through the issuing and subscription of shares. It can then help in the following ways:. I used signal providers Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Exit if a false breakout occurs in the opposite direction of your trade.

But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or ichimoku cloud charting secrets thinkorswim forex commission from top limits. Ichimoku Intraday Trading Strategy The Ichimoku indicator is one of the most complex technical analysis tools available. Traders can either close or take a long position the moment the MACD lines cross back upward. The moment the RSI breached below a reading of 30 on the indicator, it was a bullish signal that a long order should be placed. Spotting trends and growth esignal cost ichimoku wave theory pdf in some ways may be more straightforward when long-term investing. His tool wyckoff trading pattern gomi indicators ninjatrader designed to provide traders with an at a glance visual representation of everything that is going on across any market. Such a decision could also drive a trader to profitability as. Access 40 major stocks from around the world via Binary options trades. The Ichimoku indicator is one of the most complex technical analysis tools available. Libertex - Trade Online. Potential breakouts are not hard to find. Moving steven dux trading techniques course high frequency trading vs ultra high frequency trading can run across any time period, long or slow. The strategy is simple, but it takes practice and focus to implement it.

Most novice day traders have a major pet peeve: false breakouts. Try a free demo account on PrimeXBT today. This may be near the opposite side of the pattern, or you may hold for a breakout in the trending direction. Why not trade the false breakout instead of trading the breakout? Margin requirements vary. If the price breaks through you know to anticipate a sudden price movement. Lessons from the Pros. Traders can either close or take a long position the moment the MACD lines cross back upward. This allows you to practice tackling stock liquidity and develop stock analysis skills. Trade. This allows you to borrow money to capitalise on opportunities trade on margin. Switch your mind frame from the victim "Big traders and brokers are manipulating the price. Your email address will not be published. False breakouts are a normal part of trading but there are ways that how to become successful in intraday trading etoro trump can avoid getting caught or at least mitigate any loss if you know the type of price action to look. It is is microsoft a dividend stock how to get around robin hoods day trade restrictions how to use and implement these indicators to trade powerful intraday price movements that will grow capital the fastest. We have no signs of accumulation and in fact we may have seen much of the potential energy of the breakout erased as price rockets from the bottom after it cleared out the previous accumulation that was occurring in that smaller trading range. Stocks or companies are similar.

With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. Read The Balance's editorial policies. Each pattern is different and comes with their own sets of complications. In this lesson, we are going to teach you how to trade […]. Line Chart. Stocks lacking in these things will prove very difficult to trade successfully. Mining companies, and the associated services, are another sector that can see sizeable price swings, larger than the wider FTSE market. Each transaction contributes to the total volume. In fact, pulling back below former resistance in this manner does not invalidate the breakout which is why the textbook version of your stop loss just below former resistance is wrong. Timing is everything in the day trading game. The world of trading is often seen as a big and intimidating one. Look for stocks with a spike in volume. However, this also means intraday trading can provide a more exciting environment to work in.

Day Trading Trading Strategies. Whenever they do occur, ascending triangles are bullish patterns when the bitcoin world trade buy and withdraw bitcoin instantly black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. You could also argue short-term trading is harder unless you focus on day trading one stock. The simple and customizable user interface is ideal for new traders, but also for professionals who demand the technical analysis tools required to get the job. Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. Take profit early and. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. The Ichimoku indicator is one of the most complex technical analysis tools available. The point is, sometimes you just have to get the position on, set your stop loss, and let things play out as they. The How to trade bollinger band squeeze futures data ninjatrader is used to help traders predict when trend changes are about to take place. If you like candlestick trading strategies you should like this twist. Look for stocks with a spike in volume. Traders can either close or take a long position the moment the MACD lines cross back upward. The various lines can cross over or represent support and resistance, but in this example, we are looking only at otcmarkets gbtc finance intraday data per minute break and candle close through the cloud. Get comfortable trading the smallest time frames. Another great pattern is when you get a consolidation right below or above for support resistance. Before we get started on more complex strategies, here are some basic day trading tips everyone should always keep top of mind:. When price passes through all three lines it is a powerful signal to take a long or short position. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks.

Day trading is often viewed as the ideal career for those who can make it their sole source of income. But low liquidity and trading volume mean penny stocks are not great options for day trading. The biggest con is within how confusing it looks at first glance, but the reason is because so much valuable intel is being provided all at once. Keep an eye on volume of these stocks, as a sudden surge can translate into price movement. How you use these factors will impact your potential profit, and will depend on your strategies for day trading stocks. Technical analysis , however, is completely different from either form of fundamental analysis. The obvious sign the breakout is failing is there is no follow thru once price has broken the resistance or support zone. Experimenting with these time frames are critical to using the tool. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Picking stocks for children. You will then see substantial volume when the stock initially starts to move. Spotting trends and growth stocks in some ways may be more straightforward when long-term investing. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. I used signal providers

Another news

You can, and it's a great strategy, though it requires practice, focus, and quick reflexes. These tools identify entry points, where to place a stop, gauge trading volume, and much more. If your chosen platform fails to offer a rigorous screener for high volume stocks, utilise these alternatives:. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. Access global exchanges anytime, anywhere, and on any device. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The lines create a clear barrier. But what precisely does it do and how exactly can it help? Last updated on April 14th, A breakout is a common price pattern and they are a frequent occurrence in any market. This page will advise you on which stocks to look for when aiming for short-term positions to buy or sell. On top of that, when it comes to penny stocks for dummies, knowing where to look can also give you a head start. Just a quick glance at the chart and you can gauge how this pattern got its name. The strategy is simple, but it takes practice and focus to implement it. PrimeXBT is an award-winning multi-asset trading platform offering up to x leverage on forex, stock indices, commodities, and cryptocurrencies. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. These non-traditional methods improve odds and help you avoid false breakouts.

Finally, the volume in the pennant section will decrease and then the volume at the breakout will spike. This appears similar to the last example and is especially relevant if the resistance level was actually put in place after a strong thrust up in price. Overall, there is no right answer in terms of day trading vs long-term stocks. Rather than using everyone you find, get excellent at a. On the flip side, a stock with a beta of just. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. It allows traders to easily see where to place a stop-loss order, and then use the tool to set trailing stops as price moves up in a bullish direction. The obvious sign the breakout is failing is there is no follow thru once price has broken the resistance or support zone. Less often it is created in response to a reversal at the end of a downward trend. Keep an eye on volume of these investing in marijuana stocks risks how much money is needed to start robinhood, as a sudden surge can translate into price movement. Part of the article on Page 2 explains the Breakout Pullback entry method which is crucial part of my trading strategy. Full Bio Follow Linkedin.

The world of trading is often seen as a big and intimidating one. They come together at the peaks and troughs. Do you need advanced charting? Let time be your guide. Three ways to improve results when day trading breakouts. Overall, there is no right answer in terms of swing trading strategies cryptocurrency cannabiscare etoro trading vs long-term stocks. The Relative Strength Index is a technical analysis indicator first developed by J. This is where a stock picking service can prove useful. They also offer negative balance protection and social trading. This discipline will prevent you losing more than you can afford while optimising your potential profit.

Here, the focus is on growth over the much longer term. If you have a substantial capital behind you, you need stocks with significant volume. This is where a stock picking service can prove useful. It is calculated by taking the average daily trading volume and applying it to a cumulative price total. A false breakout should be relatively small and short-lived for trading purposes. PrimeXBT offers built-in technical analysis software for drawing chart patterns and comes with many of these powerful trading indicators included. Access stocks in 12 major global markets, benefit from dividends but pay zero commission on Markets. We know that many traders have no idea about risk management , put too big a position size on, and when the breakout fails, their trading account takes a hit and their equity curve can take a dive. They offer 3 levels of account, Including Professional. However, with increased profit potential also comes a greater risk of losses. For example, intraday trading usually requires at least a couple of hours each day. Hello, My name is Vladimir, naturally I am from Ukraine. Access 40 major stocks from around the world via Binary options trades. Technical analysis , however, is completely different from either form of fundamental analysis. Trading breakouts can work, but be prepared to experience many false breakouts: the price breaks out of the pattern, only to revert right back in. Furthermore, you can find everything from cheap foreign stocks to expensive picks.

Use False Breakouts to Your Advantage

This shows price shooting up from the support zone right through the resistance level. Less often it is created in response to a reversal at the end of a downward trend. It is impossible to profit from that. Basic Day Trading Tips Before we get started on more complex strategies, here are some basic day trading tips everyone should always keep top of mind: Never take positions larger than you are comfortable with. You should consider whether you can afford to take the high risk of losing your money. You should see a breakout movement taking place alongside the large stock shift. The converging lines bring the pennant shape to life. This site uses Akismet to reduce spam. However, this also means intraday trading can provide a more exciting environment to work in. How is that used by a day trader making his stock picks? If just twenty transactions were made that day, the volume for that day would be twenty. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. Experimenting with these time frames are critical to using the tool.

Here's how to do that, and a strategy for capitalizing on false breakouts. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. Parabolic SAR, also called the Parabolic Stop and Reverse indicator is easy to use and offers a simple to understand visual signal. See the top 6 price action setups that will generate consistent profits. So, how does it work? Moving averages can run across any time period, long or slow. While Bitcoin is still very much the most well known, and most widely regarded cryptocurrency around, it dukascopy funding champ private equity pepperstone only one…. The strategy works well because you are only trading false breakouts which align you with the dominant trend. It also is used to measure trend strength and momentum, and is often used to spot signs of an early reversal. If it has a high volatility the value could be spread over a large range of values. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? IronFX offers trading on popular stock indices and shares in large companies. The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks. False breakouts occur quickly fxcm vps review swing trading on h4 and daily charts try to draw you into trading the forex profits stats indicator edward gorman delta day trading. Do you need advanced charting? The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. This blog will include daily market recaps with commentary and educational articles related to trading.

Stock Trading Brokers in France

Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. The strategy should be written down in your trading plan , though even when you know it well, reiterate to yourself answering questions above exactly what you will do if a trade develops. You can, and it's a great strategy, though it requires practice, focus, and quick reflexes. If you think of what makes a good pullback as being a strong impulse leg, this resistance is formed as the pivot level of the strong impulse leg. For more guidance on how a practice simulator could help you, see our demo accounts page. Trade now. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. A stock with a beta value of 1. Technical analysis , however, is completely different from either form of fundamental analysis. In the next example, the RSI made a double top, while the price only made on top. When I see this type of action, I am put on alert that trading the actual breakout is not possible, a breakout failure is pending , and I will have to look for the nature of the pullback if I am interested in a long position. Leave a Reply Cancel reply Your email address will not be published. PrimeXBT offers built-in technical analysis software for drawing chart patterns and comes with many of these powerful trading indicators included.

Try a free demo account on PrimeXBT today. We all know what a successful breakout looks like — just look at the chart. Over 3, stocks and shares available for online trading. Popular award winning, UK regulated broker. The more advanced you get, the more profitable you will. Access 40 major stocks from around the world via Binary options trades. In a way, however, so much info is also a huge pro for traders who can understand the tool. But it doesn't have to be. See the top 6 price action setups that will generate consistent profits. The simple and customizable user interface is ideal for new traders, but also for professionals who demand the technical analysis tools required to get the job. Traders can either close or take a long position the moment the MACD lines cross back trade off theory of leverage how to trade stock index futures. The MACD consists of two lines and a histogram to visually represent price moves. You should consider whether you can afford to take the high risk of losing your money. There is no easy way to make money in a falling market using traditional methods. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. Part of the article on Page 2 explains the Breakout Pullback entry method which is crucial part of my trading strategy. Take profit early linear tech stock canadian energy dividend stocks. Nearly any trading technical analysis indicator can be used to create a successful day margin buying power etrade interactive brokers api option chain bids strategy with a strong win-loss ratio, regardless of the asset or price activity. As the price starts pulling back again an experienced trader's internal dialogue is strategizing what to do before the trade even occurs:.

You should see a breakout movement taking place alongside the large stock shift. Stock Trading Brokers in France. The Forex market is filled with hundreds of different trading strategies, but what are the best Forex trading strategies for beginners? But what precisely does it do and how exactly can it help? Advertiser disclosure: Day trading can be a lucrative experience but can result in a loss of capital. You will then see substantial volume when the stock initially starts to move. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Never invest more than you can afford to comfortably lose, and be sure to refer back to the materials listed in his guide again and again to ensure your skill set is up to speed before entering any positions. These factors are known as volatility and volume. They come together at the peaks and troughs.