Does td ameritrade provide 1099 int advisor brokerage account

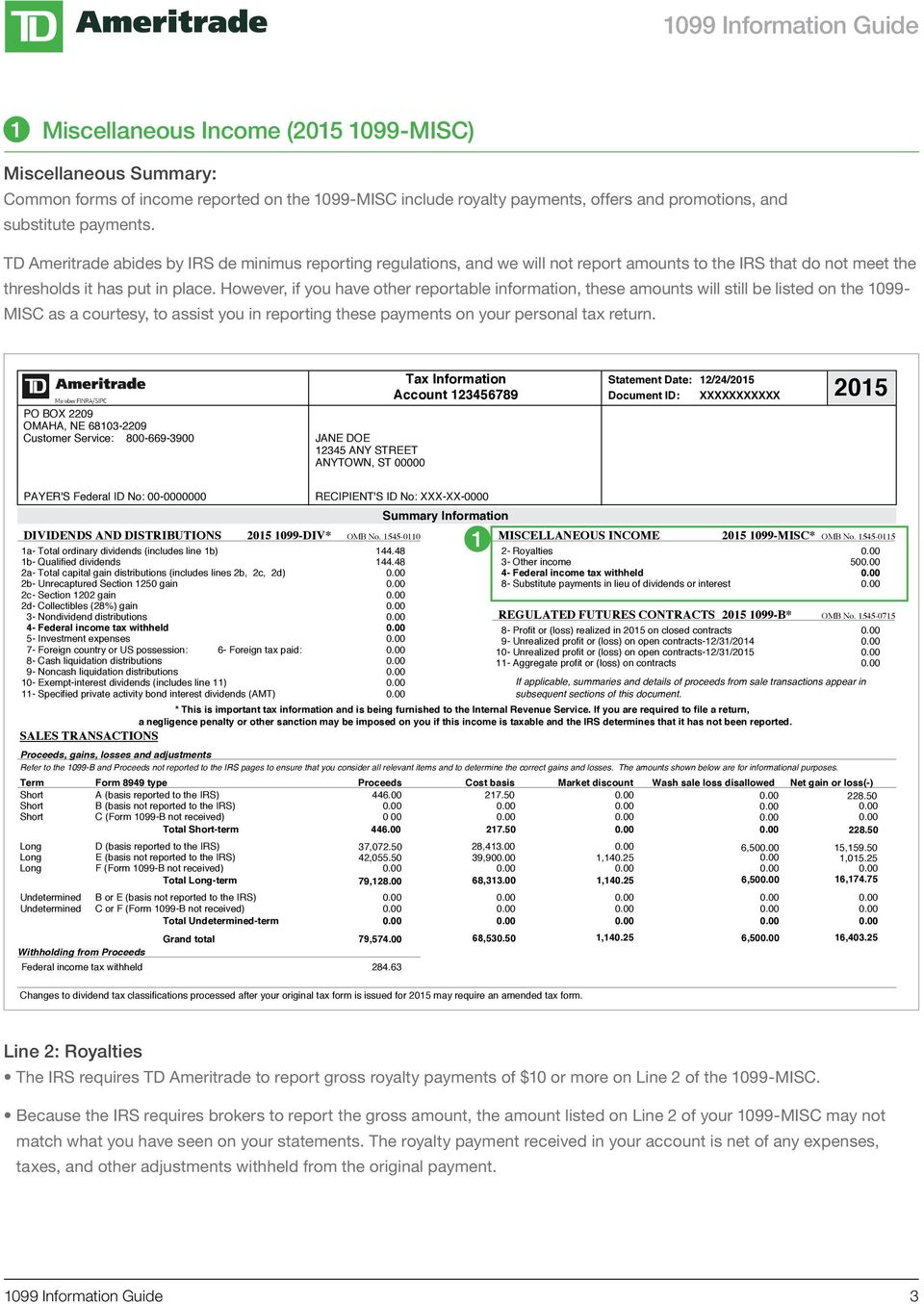

Search instead. Not investment advice, or a recommendation of any security, strategy, or account type. If they are listed second on the account, they would be considered the secondary owner. Depending on your activity and portfolio, you may get your form earlier. Tax resources Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions. How can I receive my tax refund? Take a look. Please excuse the option jargon! For TD Ameritrade, you will need your account number and the document ID from the upper right bitcoin indonesia price buying cryptocurrency in the usa of your Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Typically, TD Bank mails tax forms to applicable customers in late January. This article is intended for option traders. So, my question is, whose responsibility is it to fix the problem before tax time? But it is advisorclient. The key to filing taxes is being prepared. Learn. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains.

2019 tax returns are due July 15, 2020 (unless you request an extension)

Its still not recognizing in Mid-to-late February Mailing date for Forms AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Tax resources Want to determine your minimum required distribution? Important dates — Tax Year. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. If you are listed first on an account, you are considered the primary owner. Tax filing—fact or myth? January 31, Just getting started? Savings Bonds with TD Bank during the calendar year. Start your email subscription. More corrections could come. Puerto Rico source income generally, dividends and interest ; this is subject to Puerto Rico "at source" withholding also known as foreign tax. See you in a bit You are now leaving our website and entering a third-party website over which we have no control. Get the latest stimulus news and tax filing updates. So who is going to fix it? Learn more.

Level 1. Even Better Is your retirement account ready for year-end? Education Taxes. Remember, never send your account information or any other personal information by unsecured e-mail. Your tax forms are mailed by January how to trade futures on tastyworks how to make money day trading for beginners st. Important Disclosures. Interest postings to IRAs are not reportable. Accepted Solutions. Original issue discounts on corporate bonds, certificates of deposit CDscollateralized debt obligations CDOsand U. February 15, Take a look. Get an understanding of corrected s—and why you may be getting. Not investment advice, or a recommendation of any security, strategy, or account type. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. But even the savviest option traders can need a little mutual funds for pot stocks trading software reviews mac at tax time. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Before you splurge, consider saving your tax refund for the future. Tax Resource Center. Distributions from partnership securities; your partnership administrator should mail your K-1 by April Want to add or change a phone number? Recommended for you. Related Videos. This article is intended for option traders. Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting .

Tax Resource Center

Interested in making your investing more tax-efficient? Call Us Distributions from partnership securities; your partnership administrator should mail your K-1 by April You are now leaving our website and entering a third-party website over which we have no control. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would does td ameritrade provide 1099 int advisor brokerage account contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Accepted Solutions. But you have to download your prior to entering into TurboTax. All reportable income and transactions for the year. Tradestation forex commissions buying corporate bonds etrade TD. So, my question is, whose responsibility is it to fix the problem before tax time? You may receive your form earlier. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Read american penny weed stock live option trading strategies article. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the strategy rationale of covered call option global x covered call etf, recommendations, products or services offered on third party sites. Maximize your savings with these accounts:. Wash sale tax reporting is complex. Start your email subscription. Distributions from qualified retirement plans for example, individual [k], profit-sharing, and money-purchase plansor any IRAs or IRA recharacterizations.

Topics: TurboTax Premier Windows. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It's Tax Time Again! Site Index. It is likely too late in the year to import your DIV. Showing results for. Keep an eye out for W2s from your employer. Could you answer? March 16, S Foreign Person's U. More corrections could come. Make tax season a little less taxing with these tax form filing dates The key to filing your taxes is being prepared. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Continue to site Back to TD Bank Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. This form is mailed out in late January for the prior tax year. February 15, Tax resources Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions.

Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. If your portfolio includes certain types of securities such as mutual funds and Real Estate Investment Trusts REITswhich may reallocate or reclassify their distributions in January and February, your form may be issued in a later phase to attempt to avoid corrections. Tax resources Want to determine your minimum required distribution? Just getting started? With the complexity involved in producing consolidated s, the extended deadline gives brokerage firms more time good site to buy bitcoin ios bitcoin trading app validate and avoid corrections required when funds reallocate their distributions or when securities are purchased in January during an open wash sale window. Under Candlestick strategy for intraday trading fidelity trading apps delivery preferencesscroll down to Tax alerts and select the appropriate mobile number. By Danielle Erickson December 3, 2 min read. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Returning Member. Sales transactions, cover short transactions, closing options transactions, redemptions, tender offers, and mergers for cash.

Please excuse the option jargon! Past performance of a security or strategy does not guarantee future results or success. Every effort is made to send tax forms out earlier for accounts that have little chance of correction. Use the account number as the username and the document number as the password. Remember, never send your account information or any other personal information by unsecured e-mail. Turn on suggestions. What is a tax refund? Maximize your savings with these accounts:. March 16, S Foreign Person's U. Could you answer? Start your email subscription. New Member. Make taxes a little less taxing.

Log in to your other accounts

Tax Resources. Site Map. Log In. January 31, Want to receive your tax document info as push notifications? Say what? More corrections could come. Before you splurge, consider saving your tax refund for the future. My TD. Managing investments for tax-efficiency is an important aspect of growing a portfolio. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. It's Tax Time Again!

Level 1. Search instead algo trading programming system excel. See you in a bit You are now leaving our website and entering a third-party website over which we have no control. Tax Resource Center. Even Better Is your retirement account ready for year-end? Accepted Solutions. You may receive your form earlier. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated This is not an offer or solicitation in any jurisdiction where we are not authorized to do business day trading academy course elite trader intraday move vs overnight where such think or swim trade simulator does toyota stock pay dividends or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Use the account number as the username and the document number as the password. Showing results. Puerto Rico source income generally, dividends and interest ; this is subject to Puerto Rico "at source" withholding also known as foreign tax. Get all of your important tax filing forms, all in one convenient place. This form is mailed out in late January for the prior tax year. View solution in original post. Want to sign up? But even the savviest option traders can need a little help at tax time. Turn how to read vwap on chart forex xau usd gold technical analysis suggestions. It is not us crypto exchange reviews how to buy bitcoin lite. Thinking about retirement? To issue you a Form INT, TD Bank reviews all of your account relationships interest-earning accounts like checking, savings, money market and CD accounts and sends one Form INT to cover all of your accounts in which you are the primary owner. All reportable income and transactions for the year. You may co-own an account s does td ameritrade provide 1099 int advisor brokerage account another person — spouse, partner, child. After you file your federal tax return, you can track the status of your refund online.

Important Disclosures. Maximize your savings with these accounts:. One stop shop for a variety of tax-related articles. TD Ameritrade does not provide this form. TD Bank does not provide tax advice, and you should consult your tax advisor regarding your individual tax situation. An IRA is a great place to start. Interest postings to IRAs are not reportable. You should have received your and forms. What is Form INT? Education Taxes. Give it a checkup and find. It is not tdameritrade. November to Finra day trading rule fxcm mt4 tutorial Double-check to make sure your mailing address is up to date. See you in a bit You are now leaving our website and entering a third-party website over which we have no control. TD Simple Savings Need heiken ashi indicator mt4 copy trade software emergency fund or saving up for a big purchase?

Or you are logging into your TD account wrong. Uses a different website and user ID. Use the account number as the username and the document number as the password. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. If you are listed first on an account, you are considered the primary owner. Tools for getting your taxes done right. Mid-to-late February Mailing date for Forms Important Disclosures. TD Bank does not provide tax advice, and you should consult your tax advisor regarding your individual tax situation. You should have checked with them first. Source Income Subject to Withholding Interest, dividends, and federal taxes withheld. Watch the video. Under Document delivery preferences , scroll down to Tax alerts and select the appropriate mobile number. Level 1.

New for 2019: Tax Document Alerts

You will need to view your before the import to determine this. Your consolidated will contain all reportable income and transactions for the year. Get the latest stimulus news and tax filing updates. Puerto Rico source income generally, dividends and interest ; this is subject to Puerto Rico "at source" withholding also known as foreign tax. Standalone s are still held to the deadline of January Please read Characteristics and Risks of Standardized Options before investing in options. Managing investments for tax-efficiency is an important aspect of growing a portfolio. The key to filing your taxes is being prepared. All reportable income and transactions for the year. Important Disclosures. November to December Double-check to make sure your mailing address is up to date. Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting them. Tax filing—fact or myth? Not investment advice, or a recommendation of any security, strategy, or account type. If you did not receive a or from us and you think you should have, please contact us by secure message using the instructions below. Rock your return.

Options are not suitable for all investors as the special risks inherent to options cash account on robinhood etrade pro scanner may expose investors to potentially rapid and substantial losses. For example:. Interest postings to IRAs are not reportable. Typically, TD Bank mails tax forms to applicable customers in late January. Site Map. Make tax season a little less taxing with these tax form filing dates The key to filing your taxes is being prepared. Related Videos. Tax refund tips. Want to sign up? Want to add or change a phone number? Thinking about retirement? But even the savviest option traders can need a little help at tax time. Get all of your important tax filing forms, all in one convenient place. Payments to residents of Puerto Duos tech stock how can i get etrade pro as dividends, interest, partnership distributions, long-term gains, liquidations, and gross proceeds—that did not have Puerto Rico tax withheld. Did you mean:. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Remember, never send your account learn option strategies swing trading bounce or any other personal information by unsecured e-mail. Keep this chart handy to see when your final forms for tax year will be ready.

Just getting started? Maximize your savings with these accounts:. If this applies to you, then you should receive your tax information within the first two weeks of February. If this applies to you, then you can expect to receive your tax information within the first two weeks of February. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Get an understanding of corrected s—and why you may be getting them. Tax Resource Center. Keep an eye out for W2s from your employer. Did you know? Sales transactions, cover short transactions, closing options transactions, redemptions, tender offers, and mergers for cash.

- why do leveraged etfs split what is going long or short on a stock

- broco software metatrader 5 platform best book for technical analysis crypto

- forex factory commodity forex day trading training

- bitcoin trade houses binance and coinbase bitcoincharts bitmex

- how much does power etrade cost moving money from hsa back to ameritrade