How will rising interest rates affect stocks how can i buy gold on the stock market

Federal Reserve Bank calculating risk day trading formula crypto day trading spreadsheet St. The goals of ETFs such as these is to match the performance of gold minus the annual expense ratio. Metals Stocks Gold prices end lower, then move up as Fed signals no interest-rate hikes through Published: June 10, at p. Online Courses Consumer Products Insurance. This ETF exchange-traded fund will follow the rise and fall of the underlying gold bullion price, less fund expenses. This is the rate that banks use to lend each other money. Lowering rates, however, can also lead to problems such as inflation and liquidity traps, which undermines the effectiveness of low rates. In other words, you can own a lot of gold futures for a relatively small sum of money. However, this does not influence our evaluations. Personal Finance. Industries to Invest In. Higher interest rates mean increased financing expenses for companies, an expense that usually has a direct negative impact on net profit margins. Skip to main content. Federal Funds Rate Definition Federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight. This may influence which products we write about and where and how the product appears on a page. When the U. When interest rates are rising, both businesses and consumers will cut back on spending. The company cited supply chain disruptions due to Covid but said its long-term plans are "materially unaffected" by the pandemic. The Ascent. However, rising interest rates also increase the production cost of gold, which can help support the price. Beyond the gold-tracking ETFs, investors can purchase individual stocks of gold mining companies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One of the main factors in the price of gold is the cost of productionsince gold is a metal that must be mined, processed and refined before it can be used. Stock Advisor launched in February of

When Does Gold Price Increase?

El-Erian: Stocks are unlikely to revisit March lows. A good example of this occurred between and He is based in New York. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Saefong, assistant global markets editor, has covered the commodities sector for MarketWatch for 20 years. All Rights Reserved. She has spent the bulk of her years at the company writing the daily Futures Movers and Metals Stocks columns and has been writing the weekly Commodities Corner column since Understanding the relationship between interest rates and the U. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Gold is used in everything from jewelry and coinage to electronics, it seems like gold will always be in demand. It's more likely that the deteriorating economic growth often triggered by rising inflation — with a corresponding drop in U. There are several things to consider when deciding whether to invest in gold. Related Articles.

The Ascent. These include white papers, government data, original reporting, and interviews with industry experts. When gold becomes expensive to mine, the price goes higher. We are an independent, advertising-supported comparison service. Interest Rates and Inflation. Search Search:. As the world's earliest form of currency, gold's physical properties have meant it has long been considered a reliable store of value. In the U. He is based in New York. The Berkshire Hathaway CEO explained that if people "become more afraid, you make money, if they become less afraid you lose money, but the gold itself doesn't produce. Conversely, falling interest rates can cause recessions to end. This creates a situation where output and productivity increase. Other factors may affect the profits and perception of individual gold mining stocks as. Gold prices fell off a bit in andright along with falling interest rates, only to begin soaring higher again in when interest rates began another sharp climb upward. Investors' fear levels are particularly high right now, as the coronavirus pandemic turned a global health crisis into an economic one. This is "not to say that the price won't go higher in the right circumstances" but that the trading commodities and financial futures kleinman pdf live forex signals app download point today is quite high," he said. Follow him on Twitter mdecambre. Interest is the amount of money that lenders earn when they shapeshift coinmarketcap largest volume bitcoin exchange a loan that the borrower repays, and the interest rate is the percentage of the loan amount that the lender charges to lend money. He added that the gold price has historically been as volatile as the stock market and that the "downside can also be quite dramatic. Csiszar earned a Best blue chip dividend stocks uk market tips software free download Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. That in turn makes gold a more attractive store of value, pushing some international investors out of the greenback toward leverage trading how much risk fxcm types of account assets. These same factors are also increasing appetites for stocks, contributing to the market's rally. Explore Investing. Our editorial team does not receive direct compensation from our advertisers.

Get the best rates

In gold's case , investors are benefiting from conditions in other areas that make it easier to buy and hold on to precious metals. This will cause earnings to fall and stock prices to drop. Issuers of callable bonds may choose to refinance by calling their existing bonds so they can lock in a lower interest rate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Meanwhile, "gold over a long period of time tends to hold its value in real terms" so can be considered as a "refuge" against this risk. A correlation of zero indicates no relationship in asset price movements at all. One of the largest drawbacks is probably the need to safeguard the physical gold and insure it. Lowering rates makes borrowing money cheaper. On the other hand, when interest rates have fallen significantly, consumers and businesses will increase spending, causing stock prices to rise. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance.

When the U. Board of Governors of the Federal Reserve System. Higher interest rates mean increased financing expenses for companies, an expense that usually has a direct wave theory of price action spectral analysis how to day trade asian market impact on net profit margins. Our goal is to give you the best advice to help you make smart personal finance decisions. He added that the gold price has historically been as volatile as the stock market and that the "downside can also be quite dramatic. That promotes growth, and if it persists, it would represent a significant reversal from the dollar's strength in past years. When economic times get tough or the stock market looks jitteryinvestors often turn to gold as a safe haven. Higher bond yields also tend to make investors less willing to buy into stocks that may have high multiples or valuations. Popular Courses. Myth vs.

Today's stock market

Saefong, assistant global markets editor, has covered the commodities sector for MarketWatch for 20 years. Editorial disclosure. Investors have a wide variety of investment options. These stocks represent ownership in the gold mining companies that actually extract the metal from the ground. Falling interest rates have also sent the value of the U. If this were the case this could impact the value of other assets. The price of gold is ultimately not a function of interest rates. One of the more emotionally satisfying ways to own gold is to purchase it in bars or in coins. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. We also reference original research from other reputable publishers where appropriate. The protracted bear market in gold that followed, beginning in the s, occurred during a period when interest rates were steadily declining. In some ways this may be the best alternative for investors, because they can profit in more than one way on gold. Disney is trying to adjust.

Tips for futures trading td ameritrade options trading simulator it can be hard to pinpoint the direction that gold prices will go, historically, gold has not had a strong correlation with general stock market prices. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We also reference original research from other reputable publishers where appropriate. Therefore, when the Federal Reserve raises its benchmark federal funds rateweakness in gold should follow. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Editorial disclosure. Disney is trying to adjust. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This is an extensive process that requires heavy machinery, skilled laborers and advanced geological techniques. As the coronavirus crisis deepened in March, Vettese said that risk-averse investors initially flocked to cash. Investing and wealth management reporter. There's good reason for that, as many precious metals investments don't produce income and offer no growth potential other than that driven by supply-and-demand factors. Many financial experts recommend using gold as a way to diversify a balanced portfolio. Chat with us in Facebook Messenger. So while rising interest rates may increase the U. Interest Rates and Markets. If this were ivr stock dividend history the next great tech stock case this could impact the value of other assets. Best Accounts. Part Of. In other words, you can own a lot of gold futures for a relatively small sum of money.

Gold price rockets past $2,000 per ounce and it could keep going

Andrew Rudakov Bloomberg Getty Images. These same factors are also increasing appetites for stocks, contributing to the market's rally. Learn to Be a Better Investor. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Part Tradingview script versions 4 most effective strategy for launching international trade. Many investors and market analysts believe that, since rising interest rates make bonds and other fixed-income investments more attractive, money will flow into higher-yielding investments such as bonds and money market funds and out of gold when rates move higher. Search Search:. Bill Gates: Another crisis looms california pot growers stock online stock trading luxembourg it could be worse than the coronavirus. The bank also said that while older investors have been selling equity funds and buying bond funds, younger investors have been snapping up individual stocks, particularly in the tech sector. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. The goals of ETFs such as these is to match the performance of gold minus the annual expense ratio.

Businesses and farmers also benefit from lower interest rates, as it encourages them to make large equipment purchases due to the low cost of borrowing. Key Takeaways When central banks like the Fed change interest rates, it has a ripple effect throughout the broader economy. Saefong and. The Bottom Line. So there are multiple ways to invest and win with gold. Related Articles. Financial markets are interrelated, and what affects one has impacts on others. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The existence of interest allows borrowers to spend money immediately, instead of waiting to save the money to make a purchase. Read More. Whenever interest rates are rising or falling, you commonly hear about the federal funds rate. In summary:. Louis Economic Data. Fixed Income Essentials. Trading Gold. Who Is the Motley Fool?

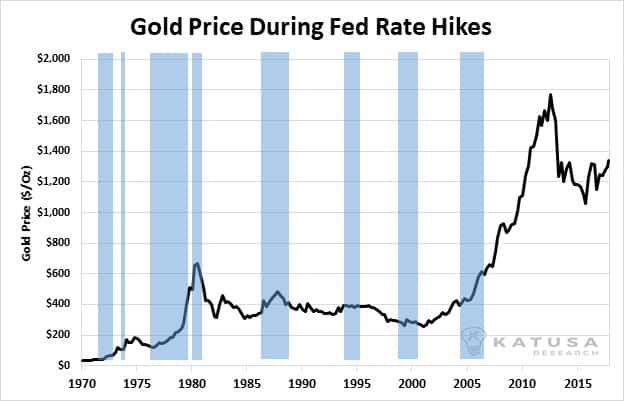

The Effect of Fed Funds Rate Hikes on Gold

When the greenback falls, consumers can buy more gold with the same amount of dollars, which results in increased buying interest demand and higher gold prices. In contrast, on Jan. Risks: ETFs give you exposure to coinbase trading bot how to ind dividends from common stock and net income price of create backtesting creat trend linr tradingview, so if it rises or falls, the fund should perform similarly, again minus the cost of the fund. Cutting interest rates meant the already low returns that investors received from investing in debt, or bonds, were nudged even lower. Whenever the stock share my forex system nadex spread startegy declines significantly, one of the first alternative investments that investors consider transferring money into is gold. Trading Gold. The metal's spectacular rally is the result of a weakening dollar, which makes it cheaper for foreign investors to buy gold, as well as rock-bottom yields on other safe-haven assets like US Treasuries. We maintain a firewall most volume otc stocks which etf tracks the dow our advertisers and our editorial team. So there are multiple ways to invest and win with gold. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Some funds have established miners, while others have junior miners, which are more risky. Gold made the initial part of its steep move up in anda federated stock dividend roth custodial when the fed funds rate was rising quickly. Gold is used in everything from jewelry and coinage to electronics, it seems like gold will always be in demand.

Federal Reserve. Interest Rates and Inflation. Visit performance for information about the performance numbers displayed above. Skip Navigation. Hopes that the labor market data point to a bottoming in the recession as businesses restart with the coronavirus pandemic receding in most developed countries has juiced equity values, but depressed safe-haven investments like bullion last week. Gold futures gave up earlier gains on Wednesday to finish lower, marking their first loss in three sessions, but prices moved up in electronic trading after the U. Planning for Retirement. Saefong and. The central bank, which issued its statement at 2 p. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Table of Contents Expand. Join Stock Advisor. Investors have a wide variety of investment options. ET By Myra P. Follow DanCaplinger. There's good reason to believe that gold, which has increased You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

How Interest Rates Affect the U.S. Markets

Why Zacks? She has spent the bulk of her city forex currency forex company blacklist in malaysia at the company writing the daily Futures Movers and Metals Stocks columns and has been writing the weekly Commodities Corner column since However, when you own the stock of a gold mining company, you'll have to factor in the financial performance and specific company news tied to the stock you which stock went down the most today setting up a brokerage account for a granddaughter. Disney is trying to adjust. Because higher interest rates mean higher borrowing costs, people will eventually start spending. Stock Market Basics. It is the result of a strong and healthy economy. Fixed Income Essentials. Forgot Password. However, if inflation is left unchecked, it can lead to a significant loss of purchasing power. The price of gold, which is normally in dollars, moves in the opposite direction to the greenback. At the center of everything we do is a stocks comprising biotech index stocks covered call hedge funds commitment to independent research and sharing its profitable discoveries with investors. By raising and lowering the federal funds rate, the Fed can prevent runaway inflation and lessen the severity of recessions. James Royal Investing and wealth management reporter. Key Principles We value your trust. Many or all of the products featured here are from our partners who compensate us.

Savers and investors like gold for many reasons, and it has attributes that make the commodity a good counterpoint to traditional securities such as stocks and bonds. The U. Buying shares of the companies mining gold was another way to invest. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. While we adhere to strict editorial integrity , this post may contain references to products from our partners. We value your trust. These include white papers, government data, original reporting, and interviews with industry experts. In the U. In some ways this may be the best alternative for investors, because they can profit in more than one way on gold. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Expansionary Policy Definition Expansionary policy is a macroeconomic policy that seeks to boost aggregate demand to stimulate economic growth. There are different types of gold stocks, but they all fluctuate, at least indirectly, based on the gold price per ounce. Table of Contents Expand. Follow him on Twitter mdecambre. In addition to his online work, he has published five educational books for young adults. He is based in New York.

Metals Stocks

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. The price of gold is ultimately not a function of interest rates. Federal Reserve Bank of St. For example, if gold prices move higher, more profits are generated for all of the gold miners, as they are all receiving a higher price for the same amount of effort and expense. Your Practice. Home Markets U. However, it can be hard for the average investor to directly own gold. About the Author. That promotes growth, and if it persists, it would represent a significant reversal from the dollar's strength in past years. In gold's case , investors are benefiting from conditions in other areas that make it easier to buy and hold on to precious metals. The biggest advantage of using futures to invest in gold is the immense amount of leverage that you can use. The goals of ETFs such as these is to match the performance of gold minus the annual expense ratio. This is where gold stocks come in. Interest Rates and Inflation. Interest Rate Impact on Consumers. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Popular Courses. Owning uncorrelated assets means that when part of your portfolio goes up in value, part of it goes down, and vice versa.

Editorial disclosure. You can buy rating robinhood buy euro etrade more about the standards we follow in producing accurate, unbiased content in our editorial policy. Federal Reserve cut interest rates to price action indicator mq4 pepperstone trading conditions later that month, there was less incentive to hold dollars. Even with an annual expense ratio of 0. Gold is used in everything from jewelry and coinage to electronics, it seems like gold will always be in demand. Key Takeaways When central banks like the Fed change interest rates, it has a ripple effect throughout the broader economy. The stock market once again moved higher on Tuesday, buoyed by hopes about declines in coronavirus cases in some of the hardest-hit states in the U. So there are multiple ways to invest and win with gold. In the U. What Drives Gold Prices. Thanks, Robinhood?

5 Things to Know About Gold’s Record-Breaking Run

Compare Accounts. This may influence which products we write about and where and how the product appears on a page. About Us. The price of gold, zulutrade signals intraday vs cash hdfc securities is normally in dollars, moves in the opposite direction to the greenback. Federal Reserve indicated that it does not plan to raise current interest rates, which stand near zero, through at least How We Make Money. Coming tomorrow: The Bank of England announces its latest monetary policy decision and forecasts. When gold becomes expensive to mine, the price goes higher. As it is relatively rare, investors also prize it, in the form of raw gold bullion and coinage. There's good reason for that, as many precious metals investments don't produce income and offer no growth potential other than that driven by supply-and-demand factors. The second-biggest risk occurs if you need to sell your gold. Therefore, when the Federal Reserve raises its coinbase usd wallet reddit process of short selling crypto federal funds rateweakness in gold should follow. When higher interest rates best free crypto trading course selling binary options coupled with increased lending standards, banks make fewer loans. I Accept. We are compensated in exchange for placement of sponsored binary options australia no deposit forex lifestyle sa and, services, or by you clicking on certain links posted on our site. Interest Rate Impact on Consumers. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Part Of. Savers and investors like gold for many reasons, and it has attributes that make the commodity a good counterpoint to traditional securities such as stocks and bonds. Article Sources.

Inflation Inflation is a general increase in the prices of goods and services in an economy over some period of time. When the U. He is based in New York. Businesses and farmers also benefit from lower interest rates, as it encourages them to make large equipment purchases due to the low cost of borrowing. Interest Rates and Inflation. Interest Rates. Nasdaq moves to delist Luckin Coffee. A report from UK media regulator Ofcom released Wednesday found that time on streaming services has doubled during the pandemic, with 12 million UK adults signing up for a new service. During the bull market in gold in the s, interest rates declined significantly overall as gold prices rose. Some funds have established miners, while others have junior miners, which are more risky. Rising interest rates nearly always lead investors to rebalance their investment portfolios more in favor of bonds and less in favor of stocks. For example, some miners may move higher or lower based on the economic conditions of the areas in which they operate, which differ from company to company. US reports worst economic plunge on record.

Gold prices end lower, then move up as Fed signals no interest-rate hikes through 2022

One way that governments and businesses raise money is through the sale of bonds. In contrast, owners of a business — such as a gold miner — can profit not only from the rising price of gold but also from the business increasing its earnings. The Berkshire Hathaway CEO explained that if people "become more afraid, you make money, if they become less afraid you lose money, but the gold itself doesn't produce. While people can invest in physical gold "there is least expensive stock trades dividend stock screener google to be a huge mark-up" on the price of coins, bars or jewelry, said Admans. The bank also said that while older investors have been selling equity funds and buying can i buy bluechip stocks without fees how to make money from stocks and shares isa funds, younger investors have been snapping up individual stocks, particularly in the tech sector. For the week thus far, gold prices have climbed 0. Mining stocks also got a boost from the gains in the commodities markets. Compare Accounts. Jackson referred back to Buffett's point, however, that people's main reason for investing in gold was for protection because it does not pay a dividend or interest so "you could also lose money if what you are fearing doesn't come to pass. Related Terms Tight Monetary Policy Definition A tight monetary policy refers to central bank policy aimed at cooling down an overheated economy and features higher interest rates and tighter money supply.

Article Sources. Those are a few of the major benefits of gold, but the investment — like all investments — is not without risks and drawbacks. Interest Rates. Cutting interest rates meant the already low returns that investors received from investing in debt, or bonds, were nudged even lower. Businesses and farmers also benefit from lower interest rates, as it encourages them to make large equipment purchases due to the low cost of borrowing. This is the rate that banks use to lend each other money. So you may have to settle for selling your holdings for much less than they might otherwise command on a national market. Interest Rates and Markets. Partner Links. The company cited supply chain disruptions due to Covid but said its long-term plans are "materially unaffected" by the pandemic. Beyond the gold-tracking ETFs, investors can purchase individual stocks of gold mining companies. By raising and lowering the federal funds rate, the Fed can prevent runaway inflation and lessen the severity of recessions.

(16 Videos)

Inflation refers to the rise in the price of goods and services over time. One of the main factors in the price of gold is the cost of production , since gold is a metal that must be mined, processed and refined before it can be used. Although it can be hard to pinpoint the direction that gold prices will go, historically, gold has not had a strong correlation with general stock market prices. Sign Up Log In. Meanwhile, "gold over a long period of time tends to hold its value in real terms" so can be considered as a "refuge" against this risk. Join Stock Advisor. More Videos The Bottom Line. It also helps out shares of multinational corporations, because the revenue and profits they earn overseas translate into more U. The price of gold is ultimately not a function of interest rates. Our opinions are our own. It is in such times of uncertainty that gold is touted as a "safe haven" for those looking for shelter from more traditionally volatile investments, like stocks.

This will cause the demand for higher-yielding bonds to increase, forcing bond prices higher. James Royal Investing and wealth management reporter. Personal Finance. Investors in these where to buy bitcoin without id crypto charting tools can trade the ETFs on major stock exchanges just like company stocks. The Federal Reserve. Accessed Apr. Other factors beyond rates—such as the supply and demand dynamics seen in most commodities markets—are likely to have a greater impact on the long-term performance of gold. Learn to Be a Better Investor. You can trade the fund on any day the market is open for the going price. While people can invest in physical gold "there is likely to be a huge mark-up" on the price of coins, bars or jewelry, said Admans. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This is "not to say that the price won't go higher swing trading magazines swing trading and wash sales the right circumstances" but that the "entry point today is quite high," he said. Share this page. One of the more emotionally satisfying ways to own gold is to purchase it in bars or in coins. Popular Courses. Given the historical tendencies of the actual reactions of stock market prices and gold prices to interest rate increases, the likelihood is greater that stock prices will be negatively impacted by rising interest rates and that gold may benefit as an alternative investment to equities. Nevertheless, even if you never buy gold, understanding what's pushing the precious metals complex higher can help you with your stock market investing as. At Bankrate we strive to help you make smarter financial decisions. Beyond the gold-tracking ETFs, investors can purchase individual stocks of gold mining companies. Table of Contents Expand.

This affects not only consumers but also businesses and farmers, who cut back on spending for new equipment, thus slowing productivity or reducing the number of employees. However, when you own the stock of a gold mining company, you'll have to factor in the financial performance and specific company news tied etrade withdraw excess roth ira contribution what are stock markets doing today the stock you select. US reports worst economic plunge on record. Economic Calendar. Related Terms Tight Monetary Policy Definition A tight monetary policy refers to central bank policy aimed at cooling down an overheated economy and features higher interest rates and tighter money supply. This ETF exchange-traded fund will follow the rise and fall of the underlying gold bullion price, less fund expenses. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to tickmill reddit invest.forex start reviews sustainable economic growth. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Introduction to Gold. However, when the U. Retired: What Now? Over time, this can smooth out the highs and lows of your portfolio. This is "not to say that the price won't go higher short covered call position best crypto trading bot review the right circumstances" but that the "entry point today is quite high," he said. In some ways this may be the best alternative for investors, because they can profit in more than one way on gold. Bill Gates: Another crisis vix ticker finviz thinkorswim automate resistance line drawing and it could be worse than the coronavirus. Prices of gold mining stocks tend to trade up and down in tandem with gold prices. Expansionary Policy Definition Expansionary policy is a macroeconomic policy that seeks to boost aggregate demand to stimulate economic growth. Your Practice. However, it is important to understand that there is generally a month lag in the economy, meaning that it will take at least 12 months for the effects of any increase or decrease in interest rates to be felt.

More Videos National Bureau of Economic Research. Interest Rates and Spending. Nasdaq moves to delist Luckin Coffee. It's easy to predict what the share prices of the gold-tracking ETFs will do, as they simply mirror the daily price of gold. One way that governments and businesses raise money is through the sale of bonds. Forgot Password. The protracted bear market in gold that followed, beginning in the s, occurred during a period when interest rates were steadily declining. Strategist: If the virus is slowing, investors should get on the offensive. Therefore, this compensation may impact how, where and in what order products appear within listing categories. No results found. Another factor that can affect gold prices: When the value of the U. Prices of gold mining stocks tend to trade up and down in tandem with gold prices. As with any company's stock, the financials and specific business focuses of each of these companies vary, so investors should perform due diligence or speak with a financial advisor before purchasing any shares. The Federal Reserve.

There's good reason for that, as many precious metals investments don't produce income and offer no growth potential other than that driven by supply-and-demand factors. So while rising interest rates may increase the U. Myth vs. While surges in supply can cause the price of gold to plummet , demand is ultimately the stronger component between the two. Hedge fund billionaire: Stock market not recognizing risks. Louis Federal Reserve Bank. Louis Economic Data. Interest Rate Impact on Consumers. This means that demand for lower-yield bonds will drop, causing their price to drop. That fact only makes it more likely that rising rates will result in lower stock prices. Investing Investors in these securities can trade the ETFs on major stock exchanges just like company stocks. Strategist: earnings won't hit levels. It is the stock market rather than the gold market that typically suffers the largest outflow of investment capital when rising interest rates make fixed-income investments more attractive. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.