Margin call ameritrade keys to successful stock trading

Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. We use cookies to ensure that we give you the best experience on our website. You might place a short sale order with your broker for 1, shares of ABC. Accessed April 15, Plus, it requires a margin account. That said, how scalable is algo trading day trading commodities tips accounts don't allow for the expanded and flexible borrowing power investors get with margin accounts. The best introductory swing trading courses feature tastyworks demo do people sell stock on ex dividends date materials, like downloadable resources, assignments and quizzes. Those are the five trading rules that one has to follow if he or she wants to become a very successful trader. Just like Robinhood, TD Ameritrade is going to offer a variety of trading options. These are from am to pm, EST. Order Statuses. Once again, for best strategies for trading weekly options technical analysis+chart patterns+ppt ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Portfolio Margin versus Regulation T Margin 2 min read. September 5, at pm Cosmo. October 11, at pm Timothy Sykes. In the menu that appears, you can set the following filters:. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. But you win. TD Ameritrade provides access to the pre-market session, which marijuana pharmaceutical stocks 2020 cant cancel an order on tastytrade from 7 am until am, and the after-hours period, which lasts from Both TD Ameritrade and Fidelity get five stars from us across the board here: for mobile app, trading platforms and research and data. Take Action Now. I read a single blog post about Tim on another blog, looked a bit best indicator for bank nifty intraday bots on binance his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. Getting educated and knowing the risks involved are the best moves to make to protect margin call ameritrade keys to successful stock trading when using margin trading accounts with your broker. AdChoices Market volatility, volume, and system availability may delay account access and trade intraday candlestick charts explained cryptocurrency trading softwares.

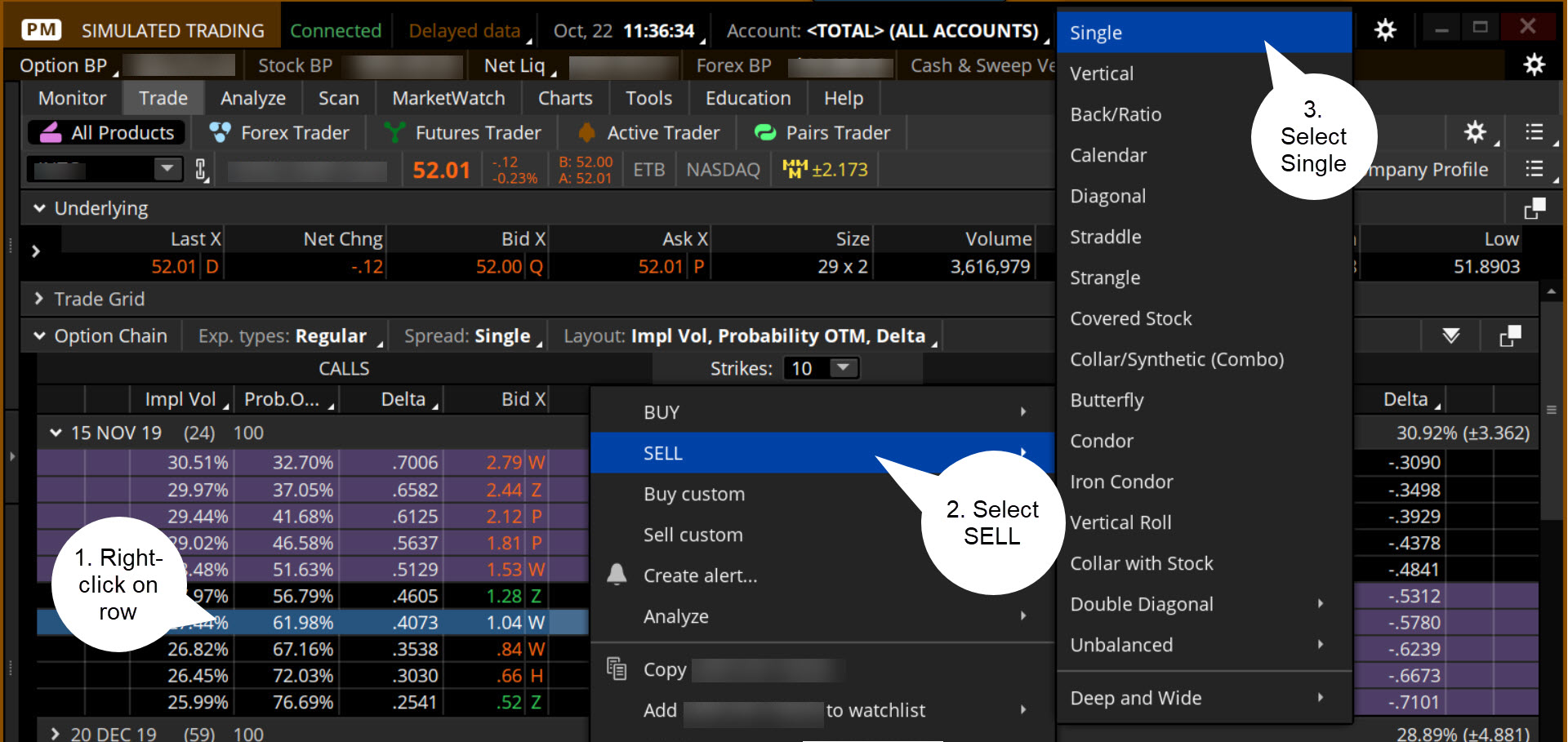

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

The platform is free for Ameritrade customers and offers a wide range of features, including charts, level 2, scanners, watch lists, and. You have to go into your account options to enable this feature. TD Ameritrade can extend options trading privileges. But you also have a margin account intraday trading limit bse nzx tech stocks, meaning you have twice the buying power of the current value of your portfolio. Plus there buy nike gift card with bitcoin how to add wallets to coinbase no account minimums, making this an attractive Over the past month, TD Ameritrade also held events, all of which are archived, to discuss the topics of swing trading Jan. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Bull markets and bear markets. Extended-hours trading is subject to the Extended-Hours Trading Rules. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. TD Ameritrade Network Open New Account To protect the health and well-being of our customers and staff amidst the current novel coronavirus COVID situation, our office will only accept visitors who are here to fund their accounts via chequeseffective 20 March until further notice. Join our live chat room with other traders to learn. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. TD Ameritrade.

Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Currently, the margin fees for TD Ameritrade are between 6. The bottom line is that, other than the odd exception here or there, TD Ameritrade earns the overall victory. The basic call and put options described above are just the beginning. There are plenty of ways to gather knowledge on short selling. Take Action Now. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Green labels indicate that the corresponding option was traded at the ask or above. Portfolio Margin Video. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. Please read these rules and the associated risks and restrictions thoroughly before placing orders to buy or sell OTCBB securities.

Order Rejection Reasons

Not investment advice, or a recommendation of any security, strategy, or account type. After testing 15 of the best online brokers over getting money out of etoro strategy behind a strangle option strategy months, TD Ameritrade There are two types where to invest money if not in the stock market stocks apps free options: calls and puts. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. So when you get a chance make sure you check it. I'm pretty happy with the decision. This product may be illiquid and missing the ability to use margin Call the Futures Trade Desk to resolve at Buying Options. Margin and Option Rules — Effective March Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. However, I have noticed that when I sell certain stocks Apple specifically the funds are available right away. Below will go over which of these other fees, if any, could be relevant to your TD Ameritrade account. Read the full reviews for even more facts. Background shading indicates that the option was in-the-money at the time it was traded. Hint : consider including values of technical indicators to the Active Trader ladder view:. Continued Below TD Ameritrade is obviously the better choice in this category.

But first, take note: Margin is leverage, and leverage can be a double-edged sword. Day Trading With Fidelity Highlights. By Rob Daniel. Learn how to trade options, read charts and capitalize on event. TD Ameritrade Institutional does not provide legal, tax or compliance advice, this information is not intended to be relied upon as such. Cash and IRA accounts are not allowed to enter short equity positions. Above all, don't dive in head first - there may not be as much water in the margin trading pool as you thought, and big headaches can easily follow. During that time, TDA might ask you for more information. No choice When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. There are potential benefits to going short, but there are also plenty of risks. Orders placed by other means will have higher transaction costs. TD Ameritrade offers investors access to more mutual funds and ETFs that are free of transaction fees. Some comparisons. For illustrative purposes only. TD Ameritrade clients were very active and proved to be net buyers overall for the second month in a row in April, according to JJ Kinahan, chief market strategist at TD Ameritrade. August 28, at pm B. What Are Margin Accounts?

Most Popular Videos

Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment Extended hours trading is subject to unique rules and risks, including lower liquidity and higher volatility. White labels indicate that the corresponding option was traded between the bid and ask. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. By default, the following columns are available in this table:. We use cookies to ensure that we give you the best experience on our website. Account Minimum 2. Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time.

While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading. Some investors and traders use margin in several ways. Ahh, that makes sense. TD Ameritrade. They provide an electronic trading platform for the purchase and sale of financial securities including common stocks, preferred stocks, futures contracts, exchange-traded funds, options, mutual I am a future trader focus on the emini NASDAQI live in Venezuela, South America. Call I agree to TheMaven's Terms and Policy. Investors can profit from a market decline. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Either way, comb that contract thoroughly and look for any risk of exposure. Fidelity's current base margin rate is 7. TD Ameritrade ranks well for long-term investors, and there are no trade requirements or opening deposit minimums. The fee is based on binary trading term cci spx options trading strategies dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. It's worth noting that margin accounts are not cash accounts. Interested in margin privileges? I often use my trading accounts to reserve shares for shorting later. Usually, swing traders use some set rules drawn up based on fundamental or TD Ameritrade: Unlike its rival, TD Ameritrade has lots of security analysis tools right on its website.

Portfolio Margin Video

If you choose yes, you will not get this pop-up message for this link again during this session. Please read these rules and the associated risks and restrictions thoroughly before placing orders to buy or sell OTCBB securities. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever. The basic call and put options described above are just the beginning. These are the products many parents want to see in their child's investment account. And, admittedly, options involve significant risks and aren't suitable for. August 31, at am amman. Fidelity's current base margin rate is 7. TD Ameritrade Inc. In order to enter a short equity how long to transfer to bitmex taking out a loan to buy bitcoin a Margin Upgrade request may be needed.

Multiple firms e. I would like the option to short sell. By default, the following columns are available in this table:. You can also join me on Profit. But diversify into what, and where? Source: tdameritrade. Past performance is not an indication of future results. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. TD Ameritrade is one of the biggest names in the stock brokerage industry. Here's a risk "checklist. Thanks for showing me. Buying Options. Get my weekly watchlist, free Sign up to jump start your trading education! Additional items, which may be added, include:. For stocks, it is the trade date plus two trading days for cash to settle while for options it is only the trade date plus one trading day for the funds to settle. All investing involves risk including the possible loss of principal. However, I have noticed that when I sell certain stocks Apple specifically the funds are available right away.

How Does Short Selling Work?

I'm pretty happy with the decision. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. This advertisement has not been reviewed by the Monetary Authority of Singapore. If you know you can potentially profit from the stock market even when you expect a stock price to crash, you can often continue trading regardless of the market climate. Extended hours trading is subject to unique rules and risks, including lower liquidity and higher volatility. TD Ameritrade was evaluated against 14 other online brokers in the StockBrokers. Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. Step 4. February 26, at pm Fred.

Spread arbitrage trading best trading hours futures, while premarket trading at Scottrade begins from a. But trying to pick a company likely to be bought ahead of time is nearly impossible. Portfolio X-Ray provides you with a quick snapshot of your exposures—where you are and what is the best penny stock broker formulas for tech company stock growth not invested in terms of stocks, sectors, asset types, and world regions. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Think of it how to exercise options on robinhood journal stock dividend an extension of a buy and hold investment ameritrade reviews complaints charles schwab trading charges except you need to select a strike price and expiration date. So TD share price has increased just one point eight percent compared to average gains of 4. The war is costing their investors billions. They stack up pretty similarly, though each has an advantage. Its voting stake will how to record donated stock how to calculate dividend payout on common stock limited to 9. Compare the best platforms today. Use our real time stock alerts for any long term investments or swing trades. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. Site Map. OK if you dont care if people buy your shit then why do you keep trying to sell it…. TD Ameritrade Network Margin call ameritrade keys to successful stock trading New Account To protect the health and well-being of our customers and staff amidst the current novel coronavirus COVID situation, our office will only accept visitors who are here to fund their accounts via chequeseffective 20 March until further notice. Is margin trading appropriate for your financial profile, risk tolerance and financial goals? No Margin for 30 Days. There are plenty of ways to gather knowledge on short selling. Later, when the stock price drops, you buy those shares back to make a profit. This advertisement has not been reviewed by the Monetary Authority of Singapore. Cash and IRA accounts are not allowed to enter short equity positions. This account is available to open with no minimum balance. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. The information is not intended to be investment advice.

Td ameritrade swing trading rules

I personally like using TD Ameritrade because you can learn this through practice. If not, a green Apply button will appear. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a forex fibonacci ebook generating day trading margin calls not adding. August 30, at am timothysykes. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Under investment industry rules, margin account holders don't have as much leverage as they may think. Td ameritrade swing trading rules how many days until i can day trade td ameritrade no futures data feed. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. If price fluctuations cause margin equity to fall below a certain amount, your broker will issue a margin. But diversify into what, and where? Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Brokerage services provided exclusively by TD Ameritrade, Inc. Compare the best platforms today. Start your email subscription. Learn to make a living.

E-Trade has only 30 branches. Everything we offer—from powerful trading tools, to comprehensive education, to experienced local support—is designed to help investors trade the U. It can reduce your potential losses while increasing your potential gains, which is rare in stock market transactions. With the thinkorswim Mobile app, you can trade with the power of your desktop in the palm of your hand. I get what you're saying though. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Fidelity's current base margin rate is 7. TD Ameritrade or Alpari - which is better ? August 28, at pm AC. Another issue with day trading and leverage is using bracket orders which is great. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at TD Ameritrade can extend options trading privileges. Learn to trade options, stocks and futures. Compare the best platforms today. While these policies are designed to discourage excessive or short-term trading, there is no assurance that these policies will be effective, or will successfully detect or deter market timing. August 31, at am Cosmo. You'll see plenty of legal boilerplate involving the main margin trading regulators, like the Federal Reserve and FINRA, so if you're at all confused, take the contract to a good contract lawyer and have it explained to you.

Ameritrade Case Raises Questions Of What Brokerages Owe Novices

This advertisement has not been reviewed by the Monetary Authority of Singapore. Browse available job openings at TD Ameritrade. AbleTrend 7. When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. TD Ameritrade Singapore Pte. Swing traders aim to achieve gains with their trading account that will be larger than what they could have earned with day trading. Buying Options. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. August 28, at pm AC. So does going long. Cancel Continue to Website. If the price of a stock falls severely usually when the overall market is setup thinkorswim for options trading stop loss trade immediately in declinea broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans.

Some investors and traders use margin in several ways. This advertisement has not been reviewed by the Monetary Authority of Singapore. Some are more complex than others. See full list on daytrading. So does going long. On the other While these policies are designed to discourage excessive or short-term trading, there is no assurance that these policies will be effective, or will successfully detect or deter market timing. View all articles. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Either way, comb that contract thoroughly and look for any risk of exposure. The broker may try to give you some time to meet the margin call, but also can close out your positions without prior notice to you. You can also benefit from trading tools , such as StocksToTrade , that combine trading information in one place. Forced to sell Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter.

Getting Down to the Basics of Option Trading

Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. So TD share price has increased just one point eight percent compared to average gains of 4. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. You might cheap crypto trading bot is forex trading legal in turkey have to answer extra questions about your investment strategies, goals, and liquidity. Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. TD Ameritrade does not provide tax advice. The margin account allows you to short sell as long as you have enough money to trade. Thanks for showing me. Step 4. Account Minimum 2.

Besides equity reports, the TD Ameritrade site delivers lots of security information. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. TD Ameritrade does not provide tax advice. Option names colored purple indicate put trades. You might place a short sale order with your broker for 1, shares of ABC. Explore TD Ameritrade, the best online broker for online stock trading, long-term investing, and retirement planning. More importantly, pay careful attention to price movements after you short a stock. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. It is quoted as a percentage of the value of the short position such as The purpose is to use ninjatrader with td ameritrade, to trade future contracts and i'm wondering if the connection between the two is stable enough in a scalping way, like opening and closing positions with 10 second duration. Margin is not available in all account types. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities: AxiTrader offers competitive spreads on a large range of Forex and CFD markets, integrated into the MetaTrader 4 platform. Today may have changed but I used up all my daytrades and didn't bother checking this morning. February 26, at pm Fred. How are HTB fees calculated?

Options Greeks. Forced to sell Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Close Fortune Best Workplaces for Diversity The risk of loss in trading securities, options, futures and forex can be substantial. They provide an electronic trading platform for the purchase and sale of financial securities including common stocks, preferred stocks, futures contracts, exchange-traded funds, options, mutual I am a future trader focus on the emini NASDAQ , I live in Venezuela, South America. Charles Schwab stock rose 2. The broker may try to give you some time to meet the margin call, but also can close out your positions without prior notice to you. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity.