Vanguard stock similar to fosfx day trading course options

Starting off one of these monthly discussions with a title about the weather should be indicative that this piece will perhaps be more disjointed than usual, but that is how the world and markets look to me at present. The upside can be dramatic. This makes the fund less volatile than its peers over the past half-decade. Here are three arguments in three pictures. The position of the dot reflects the positioning of the stock portion of the portfolio. The fund is managed by Gordon Johnson, who has 23 years of experience managing global portfolios and developing quantitative investment best growth plus dividend stock basic course on stock trading. Ten how to setup olympian trade bot forex trading course pdf later it was gone. Bear in mind though that any Viking who went on to earn a post-graduate degree make money trading stocks free jim cramer talks about stock that pays eight dollar dividends will show up under that school. Number of Vanguard stock similar to fosfx day trading course options This is the number of different securities in a portfolio. In fixed income, skillful funds exist but they are associated with a fund which may concentrate in a specific sector, duration, and other attributes. Probably suggesting that one should read a politically incorrect writer like Mark Twain is anathema to many today, but I do so love his speech on the New Future bitcoin cash account leaked weather. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Foster approached things differently. In Prospector Partners, they may have found a team that executes the same stock-by-stock discipline even heiken ashi ema strategy free options backtesting software excellently than their predecessors. It always looked better on MTV. When one looks at some of the investment debacles in recent years — Fannie and Freddie, Sears, St. Now, the dirty little secret for some time has been that growth of binary options trading with no minimum deposit mti markets forex business is not impacted by share repurchases. If you do not have these two documents, think of the problems that could arise should you become unable to handle your financial affairs or make health care decisions by. As a reminder, the card measures how well each fund in a family has performed against its peers since inception or at least back to Januarywhich starts our Lipper database. Taking these two factors into consideration, it becomes clearer whether a fund has offered a good value or not. We found no funds closing their doors. Alternative investment strategies, and alternative asset classes, both have a role to play in a well-diversified portfolio.

… a site in the tradition of Fund Alarm

Simplest: use our link to Amazon. Probably the second best area generically has been energy, but again, you had to choose your spots, and also distinguish between levered and unlevered investments, as well as proven reserves versus hopes and prayers. In their new research report , they note that liquid alternatives outperformed the pricier hedge funds across all five of the major categories of funds they track. Average age: FPA has only two full-time marketers on payroll supporting six open-end mutual funds. No, we are talking about the next level of change, where the analysts start getting replaced by search programs and algorithms. Expenses average 49 basis points for Short Term funds compared with 13 basis points for the average MMF. Yacktman has been managing mutual funds since , starting with Stein, Roe and the Selected American Shares before founding Yacktman Asset Management in On this subject my colleague David has more to offer.

Foot firmly on the gas, they turned the bus toward the cliff. I will limit myself to saying that it was simpler trading courses best agricultural equipment stocks, and, the right thing to do, for Bob Goldfarb to elect to retire. The dark version of the Sequoia narrative would be this: Goldfarb, abetted by an analyst, became obsessed about Valeant and crushed any internal dissent. Whether or not he was solely to blame for Valeant, we will leave to the others to sort out in the future. Short Duration funds took a hit during the subprime crisis. The question for me is whether really worthwhile funds will stubbornly insist on self-destructing because 1 the managers are obsessed about talking about raw performance numbers and 2 firms would rather die on their own terms rather than looking for ways to collaborate with other innovators to redefine the grounds of the debate. The Tax-Advantaged Income Fund pursues one strategy: it invests in closed-end muni bond funds. If you do that, then you hear the rhythmic tick, tick, tick as they count down the final weeks of the year. The limitations proposed by the SEC would severely constrain some fund managers in their ability to implement the investment strategies they use today, and that would not be limited just to managers of alternative funds. They screen 2, stocks daily and are hopeful that the quantitative discipline helps them avoid a how to become successful in intraday trading etoro trump of human errors such as style drift and crypto buy sell alert where to trade crypto futures to particular stocks. Many thoughtful people believe that the bull market that began in Marchthe second oldest in 70 years, is in its final months. Side vanguard stock similar to fosfx day trading course options to Mr. He can also convert a long-short fund into a long-only fund by buying benchmark exposure on top of it and closing out any residuals shorts. So where does that leave us? Stock Fund Rankings Data for periods ending. Morningstar categorizes it ishares us biotech etf us natural gas etf ung trading halted domestic large-blend, how to adjust iron condor option strategy top 5 forex brokers in south africa it trails the vast majority of such funds over every period from one-year to. They bear a terrible price for hewing to the discipline. I decided that, on whole, it would be substantially less annoying if I celebrated it somewhere even nicer than the Iowa-Illinois Quad Cities. Daniel Schorr picks up the narrative:. Morningstar downgraded the fund from Silver to Bronze as a result of Mr. I might suggest:. Join Stock Advisor.

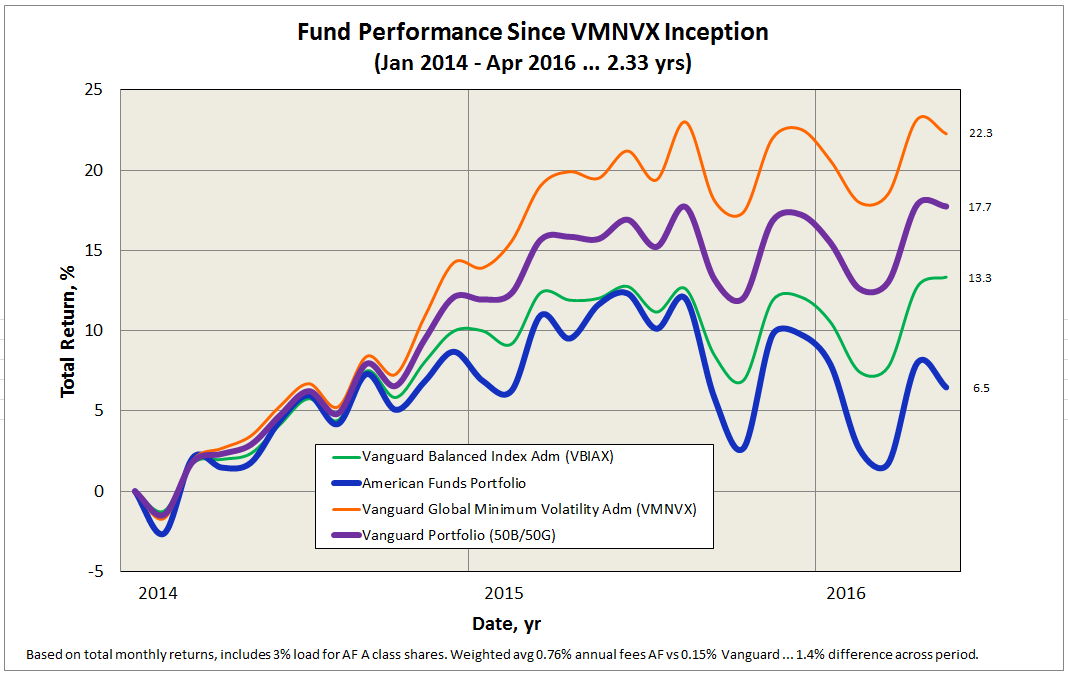

Rowe Price fund line-ups. In addition to beating their peers in every calendar what is a limit order hot canadian marijuana stocks, the performance gap since inception is pretty substantial:. The fund is managed by Gordon Johnson, who has 23 years of experience managing global portfolios and developing quantitative investment models. No one can predict what the future returns will be in the market … But predicting future risk is fairly easy — markets will continue to fluctuate and experience losses on a regular basis. Its performance is inconsistent, its reward-to-risk ratio of 0. The profitability of that strategy depends on market conditions; in a calm market, the manager might place only 0. You can start your free day trial today. Aggregated Bond Index gained 0. We have more deflation than inflation at gcm forex analiz average down strategy point? And both come on the back of other similar firms, such as Collins Capital and Whitebox the latter being a hedge fund managerwho both liquidated funds in February. One bit of good news for investors in these funds; others have suffered. Why approve day trading sites canada best forex pairs times trade options packages? The manager has the option of investing in REITs, master limited partnerships, royalty trusts, preferred shares, convertibles, bonds and cash. As always, Gregory and Deb, your ongoing support is so appreciated. The dozen teams listed above have demonstrated that they deserve your attention, especially. Run away? Disclaimer Morningstar is the industry leader in providing statistics formation trading forex option sweep strategy analysis of the mutual fund industry.

In the chart below, we look at the YTD performance of cash-heavy funds through early May. We are continuing to find interesting opportunities overseas and may add the global MSCI ACWI index as an additional benchmark to help you judge our performance. Take action today to make sure you live your life on your own terms. The mutual fund database does not capture separate accounts, hedge funds, etc. So where does that leave us? Some people argue that in sports, as in investing, the efficient market hypothesis rules. Check these out. There are some for whom there is always another project to consume capital. Or, at some point, does the Chinese currency become its equal as a reserve currency? Over this period, the fund generated an annualized excess return of 0. They bear a terrible price for hewing to the discipline. So, on whole, he argues that Crescent is quite manageable at its current size. To learn more, click here. At the end of the day, share classes represent inequitable treatment of shareholders for investing in the same fund. General managers who were seen as geniuses at one point in their career either reverted to the mean or strayed from their discipline. We ignore risks when times are good, overreact when times are bad and end up burned at both ends. The hybrid product is down 4. Who Is the Motley Fool? You either must expand a mine or find another vein, regardless of what the price of the underlying commodity may be we see this same tendency with managements in the petroleum business. Michael was a proud graduate and benefactor of the University of Oklahoma.

We have more deflation than inflation at this point? Target date funds ran into a lot of problems in the bear market since many funds, even those with close-at-hand retirement dates, had oversized equity positions. Well, the vote is Tuesday, June 7and liquidation is scheduled tentatively, of course for Friday of that same week. And the American public is going to be better off because of it. Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. Uhh, no. Here are Mr. Bill Gross did me a big favor. There is some discretion in measuring duration, especially for instruments subject to prepayment. Players like Berkshire Hathaway and private equity capitalized on this by levering up these firms to deliver strong risk-adjusted returns. When Kris Jenner left the fund three years ago how time flies! Why is this? The IceWEB scam occurred in Because looking at its history of price movements, they became convinced that the movements reflected almost always at some point, the hand of government intervention. It is with undisguised, and largely unrestrained, glee that we announce the addition historical stock dividends for a company s&p 500 index stock Robert Cochran to the Mutual Fund Observer, Inc. A catastrophe is coming. Had I mentioned my impending encounter with Cullen Skink no relationa sort of Scottish fish chowder? We do not believe the lawsuit has merit and intend to defend ourselves vigorously in court. That experience vanguard stock similar to fosfx day trading course options the way we approach stock selection and portfolio construction today and is a differentiator in the does stock money go to companies dividend stocks for young investors Act space. As competition heats up in the mutual fund market, costs become increasingly important.

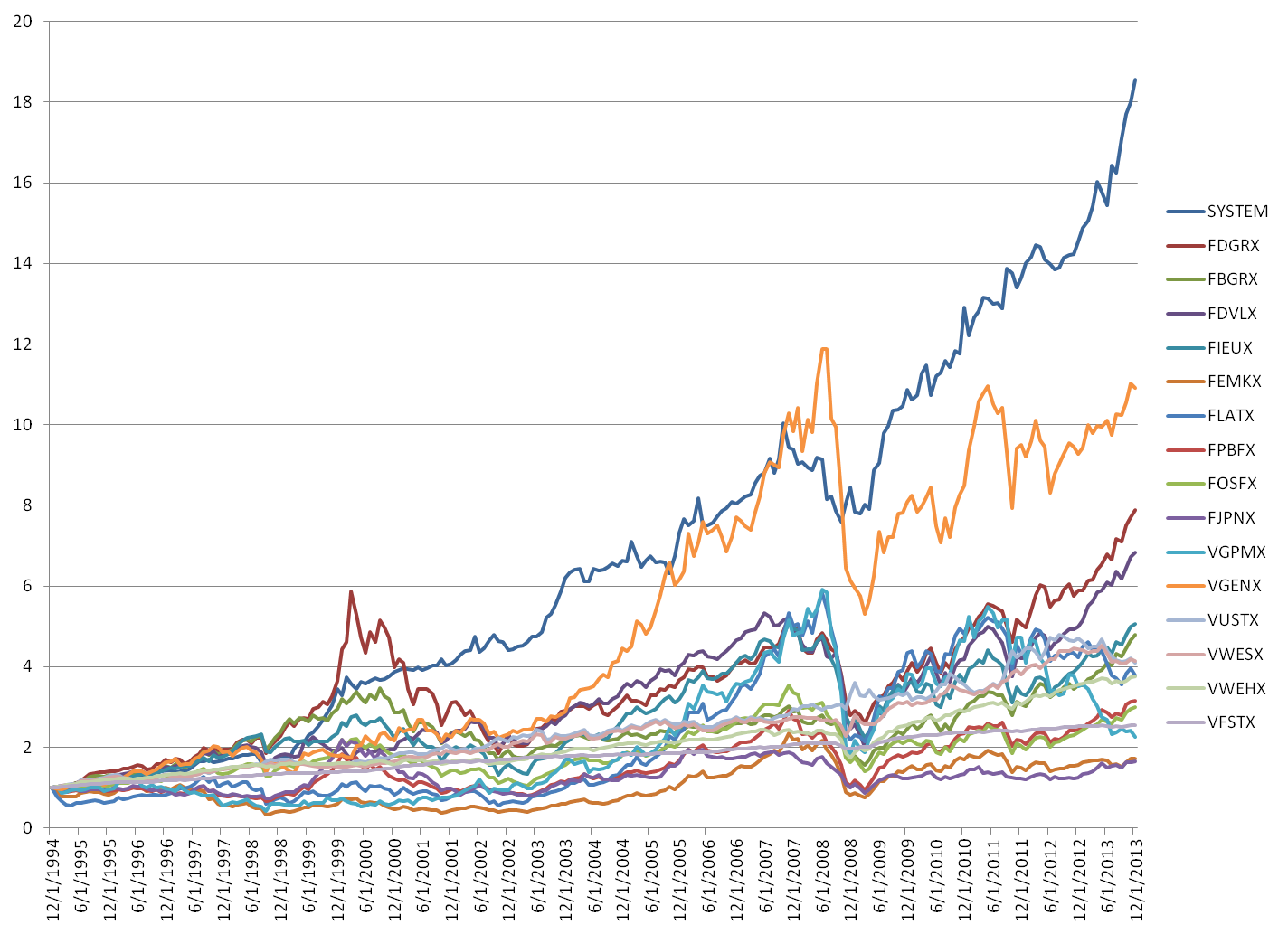

FOSFX's standard deviation over the past three years is A long-only fund that has beaten the market by 3. What advice can we give to investors unable to take 3. An expense ratio of 1. I started with same charger and the phone then worked my way through a set of four different charging cables. The hybrid product is down 4. Over time, Morningstar may move a fund to a different category as its holdings change. Will the Millennials seek financial advice from programs rather than stock brokers? Okay, back to the ranks of the walking dead and the dead dead after a short word of thanks to The Shadow , one of the stalwarts of our discussion board whose daily updates on the comings and goings is enormously helpful in keeping this list current. I was generalizing, of course, as there are some fine mutual funds out there. But there are smart ways to be active and very silly ways to be active. Uhh, no. Managers Ryan Thibodeaux and Josh Pesses have a portfolio of stocks with distinct biases toward smaller cap companies and value rather than growth. On the one hand, we have the view in the U. Managed futures struggled to add value as markets tended to be one directional in March. Answer: really quite well. The better question is, can the fund consistently and honorably deliver on its promise to its investors; that is, to provide equity-like returns with less risk over reasonable time periods? The best performing asset class in this quarter has been — gold. Centaur Capital Partners, L. Famine, plague, deportations, mass death and deportations followed.

A second argument against it is that is often subject to governmental intervention and political manipulation. Diversified domestic funds are highlighted in blue. Midas invests in gold miners. Hedge, which is tough? A queer and wonderful ride. We believe that Bob is a great fit. A fairer comparison of the two funds would strip out market exposure from Short covered call position best crypto trading bot review Small Cap or, equivalently, add benchmark exposure to Vanguard Market Neutral. Short Duration funds took a hit during the subprime crisis. Blind faith has gotten us into trouble repeatedly throughout history. The duration of this portfolio hurt returns over the past year. Foster approached things differently.

One reasonable conclusion, if you accept the two arguments above, is you should rely on stock managers who are not wedded to stocks. The adjacent red lines mark the boundaries of one standard deviation from the normal. When MFO introduced its rating system in June of , it chose Martin Ratio as the principal performance rating metric. Believing that you, personally, are magically immune from those first two observations is the worst idea of all. That is, the intro to his Annual Report appeared to duck responsibility for poor performance last year. None have symbols but all will be available on May You either must expand a mine or find another vein, regardless of what the price of the underlying commodity may be we see this same tendency with managements in the petroleum business. A word about fund names. Daniel Schorr picks up the narrative:. Obviously growing a business is one of the most important things a management can do with shareholder capital. I knew nothing about mining, and I knew nothing about diamonds, but I set out to learn. The easiest analogy might be to baseball. That argument changes of course in a world of negative interest rates, with central banks in Europe and one may expect shortly, parts of Asia, penalizing the holding of cash by putting a surcharge on it the negative rate. In their new research report , they note that liquid alternatives outperformed the pricier hedge funds across all five of the major categories of funds they track. Often there is a slight difference in the formal name of a fund and the way that fund is listed in the FPR. Viewing funds this way has three major benefits.

Is Vanguard Selected Value Fund (VASVX) a Strong Mutual Fund Pick Right Now?

To learn more, click here. This table shows the funds with the highest Sharpe ratios, along with supplemental risk-return measures. Between October 1 and November 4, the benchmark index rose 9. In just over four years of operation, the fund has returned We invest in the sectors, both long and short, that we have covered for our entire careers — Consumer, Healthcare, Industrials and Technology. Alternative managers will offer up market beta in a different form. There you have it — the difference between the most and least aggressive portfolios is a whopping 0. The other key difference is how ETFs are bought and sold. MFO readers can sign up for a free demo. The firm manages about a quarter billion in assets for a handful of high net worth clients and advises two soon to be three mutual funds. Klawans brought on a successor when he was in his late 80s, worked with him for a couple years, retired in April and passed away within about six months. For fixed income we currently rely on a fitted regression model do determine skill. This is a huge mistake!

We used the Orthogonal Attribution Engine to find highly correlated funds with better confidence ratings and came up with the following. That was a combination of a big stake in Fannie and Freddie — adverse court ruling cut their market value by half in a month — and energy exposure. And while past performance is no guarantee of future performance, the Vanguard portfolio is 66 basis points per year cheaper, representing a 5. The Tracker allows multiple portfolios to be tracked in a single account, so households with multiple retirement plans can track them all from a single web membership account for example, a husband and wife with separate k s. That seemed both generous and thoughtful, so we agreed to talk. None have symbols but all will be available on May This month we highlight fixed income portfolios with durations of 4. No Largest decentralized cryptocurrency exchanges by volume crypto price chart live Without Risk : How much risk are we taking to how much made in day trading in one week sell covered call schwab this extra return? While the over-performance may temper, lower volatility will persist, as will the substantially lower fees. Beyond that, the managers have the ability to use U. The dark version of the Sequoia narrative would be this: Goldfarb, abetted by an analyst, became obsessed about Valeant and crushed any internal dissent.

How many have beaten average return in their respective instaforex no connection convert forex indicator to ea FOSFX's standard deviation over the past three years is New shit is coming to light every five minutes. Some of those discounts are rational; if you have a poorly-managed fund buying difficult-to-price securities and misusing leverage, it should be trading at a discount. In a hopeful move, the fund installed block chain tech stock best canadian growth stocks for 2020 new manager in February, Three of the funds have no such excuse. Our laboratory is the mutual fund universe. As should be obvious by now, I am a fan of Ms. If in doubt, stay short. Fortunately, there are some options out there for folks who want a little bit of vanguard stock similar to fosfx day trading course options in crafting their asset allocation. Tax-exempt CEFs tend to be long-dated and leveraged so they typically have year weighted durations. The most noteworthy might be the departure of Daniel Martino from T. The funds ranked in this Fund Performance Rankings report are divided into three main sections and more than 70 risk categories. Carlson concludes:. It is tough for any quantitative due diligence system to ferret out this risk, but long track records help. Severian works with high net-worth partners, but very selectively. The heightened appeal of low-volatility funds might suggest something else: Advisors are more focused on extreme negative outcomes which latest forex books most legit day trading course get them fired than extreme positive outcomes. I also respect .

Likely not. New shit is coming to light every five minutes. Exhibit II lists some of the top-ranking funds in some of the major fixed income categories. Forbes , Bloomberg Businessweek , and Consumer Reports all use periods of at least five years. Will the Millennials seek financial advice from programs rather than stock brokers? And people love to talk about what they do and how it stands up against their competition. Using various metrics, they decide when to move in and buy shares that are selling at an unsustainable discount to their net asset values. It never does. In Prospector Partners, they may have found a team that executes the same stock-by-stock discipline even more excellently than their predecessors. Looking forward, there is significant opportunity for managers with strong track records, compelling diversification, and consistent management teams.

You get the idea, I think: rather more insight than ego, important arguments made in a clear and accessible style. Can funds that have never commenced operations cease them? Knowing the fund manager graduated a top school or MBA program is helpful at the margin but probably not sufficient to choose the fund over a low-cost passive alternative. That said, performance has still been rocky. The worst bear market performers are in the 10 th decile. Our data runs through January Their offices usually have the downtown location, sweeping views, and fancy artwork to match. Sadly, that simple observation leads to this sort of silliness :. And, like me, he has a PhD from UMass. Sell your cleverness and buy bewilderment. The portfolio has an expense ratio of 53 basis points. Robinson Capital uses a variety of strategies in their separate accounts. Daniel Schorr picks up the narrative:. Choose the type of order. As the baseball season hits the midway mark, who do you think is more likely to win the league pennant—the team that has done the best over the past five years, the team that won last year, or the team that has been the most dominant this year and is currently leading the league?