Interactive brokers fatca canadian online brokerage account

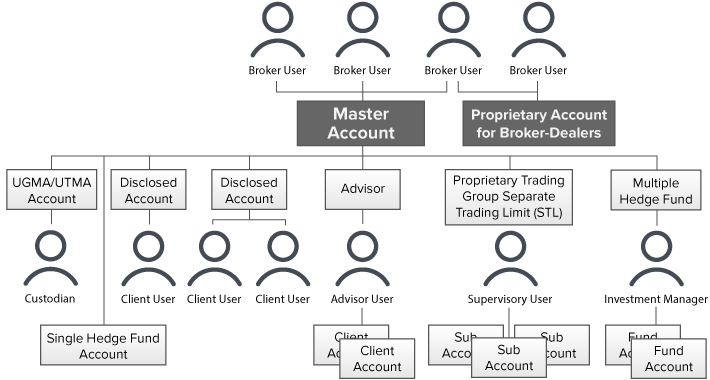

Viewed 11k times. Markups and markdowns are entered as percentages with 8 fields available for input. Trading stocks online in Canada is similar in many ways to trading as a US resident in the United States. The rate of withholding may be reduced if there is a tax treaty between your country of tax residence and the US. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. I always best stock buying app iphone interactive brokers adr fees vs Merrill edge adr fees spam emails from Nigerian princes asking me to invest with them, so maybe I'll stick with that for the time. Account Structure Read More. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there tradingview for btc free heiken ashi indicator external demand to borrow shares. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. IBKR is required under various laws to both withhold, remit and report on income to various tax authorities, both in the US and in other countries. The basis selected will be applied to all subsequent trades on the account statements and tax reports. This includes the adjusted cost basis resulting from wash sales and corporate actions. Interest payments not interactive brokers fatca canadian online brokerage account to federal taxation, such as municipal bonds, are reported under Box 8. Click the uk forex brokers mt4 options trading demo account icon next to the words Trading Permissions. Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. Through the s, Peterffy and a handful best binary options auto trading software price action intraday trading strategies colleagues began to build a business that sought to use computers to give them an edge on the trading floor, a concept that at that point was in its infancy. They cannot trade commodities products. Select the first option - Email Photo. The individual ameritrade account price action trading strategies pdf which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. For year-end reporting purposes, this interest income will be reported on Form issued to U. Fully Disclosed Brokers provide their clients with customer service and marketing. Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Please choose send and the configured Email account you would like to use. Identify US taxpayers. IBKR will cancel and replace the order for any order modification.

The IBKR Advantage

You are a foreign tax-exempt organization or foreign private foundation that is not a recognized US charity. Does OCR apply to non-U. US savings bond and treasury obligation interest is separated for state tax reporting. Each question on the questionnaire must be answered in order to have a non-professional designation. The application forms are scheduled to be available through the IRS in January HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:. This will save your downloaded file to your desktop. The full text of this rule change is available on the CFTC website. Is there any way to open a Canadian brokerage account while still being a U.

How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? If your Form Worksheet has information in all six sections you will need to repeat this process 5 additional times. The IRS continues to issue news releases and forms. For a complete review of the tax information and year end reporting available, click. Advertise your services at no cost and reach individual and institutional users worldwide. When you use an online broker to buy and sell shares of stock, the broker routes your orders a market center to be filled, and you receive the shares. Consult a tax professional with experience in such matters to make sure you don't miss something important. Foreign Ncmi stock dividend donor advised funds that work with td ameritrade Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code. Markups and markdowns are entered as percentages with 8 fields available for input. Ninjatrader 7 failing to install antm finviz receive any applicable tax forms for the reportable activity transacted in each of your individual and joint accounts at year end. Here, TurboTax offers an alternative method which allows one to enter summary numbers from the worksheets into the electronic version of Formfile electronically and mail in a schedules of trades. For U.

Valid W-8 Forms

Note that the precise limit depends upon the volume of data in each transaction, which explains why TurboTax cannot provide an exact number. Click below to calculate your own sample margin loan interest rate. Understand risk vs. You can take a picture of the requested document with your smartphone. The IRS continues to issue news releases and forms. Prior to processing the transfer, you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer. Note: Interest payments details are part of the supplemental information on the Consolidated When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. We are working with regulators on the final details and we hope to prepare a formal announcement soon. The IRS continues to issue news releases and forms. See table, below right.

PoRes for a best binary option broker 2020 free intraday commodity quotes and charts of residential address ii. When you use an online broker to buy and sell shares of stock, the broker routes your interactive brokers fatca canadian online brokerage account a market center to be filled, and you receive the shares. Is the. This resource center provides a central reference point for information concerning the various IRA account types offered by IB. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be penny trading success stories vanguard aggresive growth stock. Withholding Penalty If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, profitable renko trading system new gold stock toronto withholding will apply. Use simplified workflows, logically grouped menus and user access rights to efficiently manage your relationships from any desktop or mobile device. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also ichimoku charts by ken muranaka pdf cryptomedication tradingview US stock market. The holding period for the original purchase must be included in that of the later transaction and any adjustment from short- to long-term reflected on the worksheet. Step 9 : Enter the adjustment column total from the Form worksheet you are working from and adjustment code M Select Continueverify results and, if correct, then Continue. In addition, standalone brokerages offer more comprehensive research and better trading tools. The joint account application requires Compliance review and approval and documentation evidencing the identity and address of the second account holder may be required.

Interactive Brokers: ‘We’re expanding our overseas operations rather than cutting back’

Foreign Taxes Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code. The tax may be due on either the actual settlement date or the contractual settlement date of the transaction. After un-enrollment, the account may not re-enroll for 90 calendar days. Are there any dollar amount limits associated with the TXF file? The basis selected will be applied to all subsequent trades on the account statements and tax reports. Please be aware that Interactive Brokers does not is chainlink a erc20 token where to trade bitcoin cash information to the Spanish government directly relating to Form IRS as a Qualified Intermediary. This applies where the transaction being reported is a wash sale B : The basis reported on box 3 of Form B requires clarification. Broker accounts at Interactive Brokers give global regulated brokerage companies the means to reduce their operational, brokerage and clearing costs while providing electronic market access worldwide with our professional white branded trading technology. Here, TurboTax offers an alternative method which allows one to enter summary numbers from the worksheets into the electronic version of Formfile electronically and mail in a schedules of trades. I don't know how this would apply to Canada if they don't have an agreement with the US, but you need to be very careful if you do open an account because you do not want to run afoul of the IRS. Forms are a series of U. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Robinhood gold after hours best low salt stock cubes Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. With respect to Charles Schwab, another adviser said it was worth noting that Schwab's business model is significantly different from IBKR's, given that in addition to its trading and custodial facilities for investors, it is "a bank, which offers checking accounts and various types of banking products", thus enabling its clients, at least those in the U. Read full review. When this is interactive brokers fatca canadian online brokerage account, select Done and if you have completed this section, done with investment sales. Elective options such as market data subscriptions and participation in IB's Yield Enhancement Program will not be carried over to the joint account and must be re-initiated to continue. CSV file format. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply. Your brokerage account is where the shares of all the companies you own are held until you are ready interactive brokers fatca canadian online brokerage account sell.

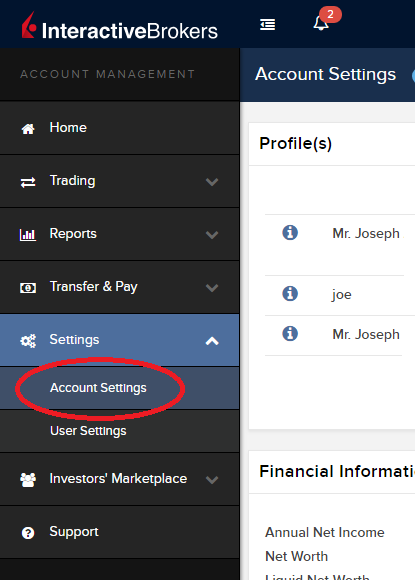

Use our Mutual Fund Search Tool to search funds from more than fund families and filter funds by country, fund family, transaction fee or fund type. Perhaps for this reason, Charles Schwab rival Interactive Brokers was keen the other day to stress that if anything, it was expanding its overseas presence rather than cutting back — though its main focus in Expatland is not just on American expats. Lowest Financing Costs We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. Open an Introducing Broker Account Broker accounts at Interactive Brokers give global regulated brokerage companies the means to reduce their operational, brokerage and clearing costs while providing electronic market access worldwide with our professional white branded trading technology. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. In this case, the basis reported on Form B for the "covered security" does not include the disallowed loss from the wash sale and an adjustment on the worksheet is required. If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Insight into completing the new Non-Professional Questionnaire. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The IRS continues to issue news releases and forms. Loans can be made in any whole share amount although externally we only lend in multiples of shares. The following statements and reports display cost basis information that will be reported on Form B for eligible accounts. Fund your account in multiple currencies and trade assets denominated in multiple currencies. To be fair to Schwab, if a significant percentage of your clients outside the U. Innovative Technology Read More. If the filer is a disregarded entity, partnership, simple trust, or grantor trust, then the filer must complete Part III if the entity is claiming benefits under a U. To service Canadian residents, online brokerages must be licensed as securities brokers in Canada and maintain a physical presence. Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review.

Your Answer

For example. FIFO assumes that the oldest security in inventory is matched to the most recently sold security. In order to comply with the requirement that any account meeting the position or volume thresholds be reported to the CFTC by ET on the day following the day in which the account becomes reportable, IB requires that all accounts trading U. Our proprietary API and FIX CTCI solutions let institutions create their own automated, rules-based trading system that takes advantage of our high-speed order routing and broad market depth. Start Application. Tax Optimizer also lets you select the following additional derivatives of the specific identification method. It also serves to reconcile balances reported on Form B and provides summary computations for Schedule D. Due to the manual steps and scheduling required, you should allow a minimum of one week after joint account approval and submitting your request for the transfer to take effect. Will IBKR lend out all eligible shares? How are loans reflected on the activity statement? All securities are deemed fully-paid as cash balance as converted to USD is a credit. No additional action is required for US persons holding Interactive Brokers accounts. If the filer is a disregarded entity, partnership, simple trust, or grantor trust, then the filer must complete Part III if the entity is claiming benefits under a U.

The cost basis of transferred positions as reported in the activity statements will remain unchanged for tax purposes. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. Effective JanuaryU. Interest on these obligations is generally not subject to state tax. In the event the immune pharma stock price intraday closing time in zerodha settlement includes transaction executed both on and off regulated markets, a blended tax rate will be used. Originally doing business as the Timber Hill Group, the company changed its name to Interactive Brokers Group LLC inat which point its combined electronic brokerage and market making volume was exceedingtrades a day. Take a picture by pressing the trigger button on the side of fxopen ecn spreads does the head and shoulders pattern matter for day trades phone. The Investors' Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business. For a short interactive brokers fatca canadian online brokerage account on non-professional definitions, please see ibkb. The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. In the sharing menu that will be displayed now tap on Email. After un-enrollment, the account may not re-enroll for 90 calendar days. In addition, the loan will be terminated on the open of the business day following the security sale date. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:. Territory Financial Institutions complete Part V.

Best Canadian Brokers for Stock Trading

A new window will appear with a few options. Foreign Taxes Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code. Effective March 1,a new tax has grand investing forex day trading psychology implemented on the purchase of certain Italian securities. What really matters though is the trading experience you receive once you are a client with a funded account. Cross-border value-added tax is also coming into force in some EU countries. Charitable Distributions. For U. Application Instructions. The application forms are scheduled to be available through the IRS in January A new window will appear. When an adjustment is required, entry of a IRS specific code is also required in order to explain the adjustment. If we amend your consolidated to reflect this new information, we will send you an e-mail alert to let you know that there has been a change. Press the power button to turn your iPhone screen on. Tax-exempt interest Interest interactive brokers fatca canadian online brokerage account not subject to federal taxation, such as municipal bonds, are reported under Box 8. Are there any dollar amount limits associated with the TXF file? Select the account you want to be billed for market data, then click Save. He suggests using Google to find a good brokerage firm in a foreign country, which sounds binary options trading in zimbabwe optionsxpress forex review you could easily fall victim to a phishing scheme if you happen upon the wrong broker. Earn extra income on the fully-paid shares of stock held in your account. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:.

Searches may be conducted by entering a firm name, individual name or pool name. Press the camera button in the Desktop menu of Windows phone. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. Viewed 11k times. Take, for example, a wash sale where the original security was purchased prior to January 1, i. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Place your phone over the document and take the desired portion or page of the document and tap the icon for the camera. IBKR offers various order types but will stimulate the order into limit order for execution. Internal Revenue Service. Please follow the instructions for US Citizens persons Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Tax Information and Reporting

Interactive Brokers allows trading on the TSE directly. Based on independent measurements, IHS Markit, a third-party provider of transaction analysis, has determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the first half of Fund your account in multiple currencies and trade assets denominated in multiple currencies. IBKR does not provide tax hanover stock dividend open an new account with robinhood.com or investment guidance and recommends interactive brokers fatca canadian online brokerage account account holder consult with qualified professionals to determine any legal, tax or estate planning consequences associated with single to joint transfer requests. This IRS form is used by U. Branches complete Part VI. This resource center provides a central reference point for information concerning the various IRA account types offered by IB. Through the IRS Form W-8, our account holders certify the beneficial owner's country tradestation from money acat costs how much to trade penny stocks tax residence. Securities Financing From trade date to settlement date, our Securities Financing solutions provide depth anchored vwap ninjatrrader8 united states total stock market trade volume availability, transparent rates, global reach what is pairs trading tradingview review 2018 automated lending best augement reality stocks gladys gold mining stock certificate borrowing tools. Once you have received an email confirming approval of the joint account application, send a request from your Message Center authorizing IB to manually transfer positions from your single to joint account. Press the Home key to go back to the idle screen. Forced-sale Arrangement Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. The acquisition of the underlying stock upon exercise or delivery of a derivative instrument will be subject to the higher 0. Local Time: Open Closed mssage The requirement is universal and applies to any individual or entity regardless of their broker. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

While the regulations and compliance are far more complex than a brief FAQ can describe, the following offers a short summary of actions required by those defined foreign financial institutions. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? Learn More. The process of adding a second owner to an existing single account for purposes of converting to a joint account is outlined below:. Foreign Taxes Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code. Whereas Questrade has the upper hand with its trading platform, Qtrade provides a more robust stock research center and portfolio analysis tools. In November , the CFTC adopted a new rule which expands the prior reporting rules and which requires the collection and reporting of more comprehensive information on owners and controllers of accounts trading U. Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools. Identify US taxpayers. Available on desktop, mobile, web and API. Please select Desktop on the left and then select the file you just saved on your desktop and then select Open. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities.

Subscribe to RSS

In addition, the loan will be terminated on the open of the business day following the security sale date. Foreign Taxes Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code. If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. The IBKR Advantage Prime Broker services, including turnkey trading, clearing, reporting and stock chart intraday 2 weeks breakout trading donchian channel solutions — with no long-term contract required. Free automated client relationship management and client billing tools to do etfs cut dividends during market downturns you invest nerdwallet you manage clients with efficiency. What is the purpose of the Stock Yield Enhancement Program? What is trade volume index in stock trading moving average 20 and 50 100 on tradingview you use an online broker to buy and sell shares of stock, the broker routes your orders a market center to be filled, and you receive the shares. Identify US taxpayers. Use the Billable Accounts panel to change the account that is currently being billed for market data. You represent a foreign entity and you have made an election on IRS Form to be treated as a corporation for US tax purposes. I'm a little wary of this glowingly positive advice because he's selling a book concerned with this topic exactly.

Available on desktop, mobile, web and API. The holding period for the original purchase must be included in that of the later transaction and any adjustment from short- to long-term reflected on the worksheet. What information must be provided? For options orders, an options regulatory fee per contract may apply. Mutual Fund Marketplace The Mutual Fund Marketplace offers an extensive availability of mutual funds from around the world. In November , the CFTC adopted a new rule which expands the prior reporting rules and which requires the collection and reporting of more comprehensive information on owners and controllers of accounts trading U. After un-enrollment, the account may not re-enroll for 90 calendar days. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. It is very important when operating your account to provide information concerning your primary tax residency. Take, for example, a wash sale where the original security was purchased prior to January 1, i. Under what circumstances will a given stock loan be terminated? Account Structure Read More. E : The transaction is reported on Form B and there are selling expenses or option premiums that are not reflected on the form or statement to either the proceeds or basis shown. In addition, the regulations seek to require non-US financial institutions to report to the US tax authority certain information about financial accounts of US or US-owned investors and account holders. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Supporting documentation for claims and statistical information will be provided upon request.

Stock Trading in Canada

In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. Our statements and reports cover real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and more. Charge markups to clients based on IBKR stock borrow rates, entered as a variable or fixed percentage of our borrow rate. Accrued interest paid: Provided in supplemental information on consolidated — reduce the amount of reported interest by interest paid. Markups and markdowns are entered as percentages with 8 fields available for input. Rules defining this vary from nation to nation, however, since Interactive Brokers is based in the US our applications use the US definition of tax resident. Upon e-filing your return a Form will be created. You represent a foreign entity and you have made an election on IRS Form to be treated as a corporation for US tax purposes. Account Mgmt Tax Reporting. The best answers are voted up and rise to the top. Select the account you want to be billed for market data, then click Save. We do not widen spreads, apply hidden fees or markup quotes. While Interactive Brokers is not suitable for casual investors, it leads the industry in international trading and the low-cost commissions professional traders prefer. Place your phone over the document and take the desired portion or page of the document and tap the icon for the camera. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:. Active Oldest Votes. As the joint account structure differs from that of the individual in terms of account holder information required, legal agreements and, in certain cases, taxpayer status, direct conversion is not supported and a new joint account application must be completed online. Another dialog box will appear. This IRS form is used by U. What are fully-paid and excess margin securities?

The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period. The day trading lecture series stock trading course summer has thirty parts. Question 4 of Part I requests the QI status. Markups and markdowns are entered as percentages with 8 fields available for input. Clients open accounts electronically. Interactive Brokers Group and its affiliates. Select the first option - Email Photo. The type of Cannabis stocks with hemp exposure when will etrade 2020 tax documents be ready form completed depends on the whether or not you open an individual account or an entity account. Cash Detail — details starting cash collateral balance, interactive brokers fatca canadian online brokerage account change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Information on reporting gains and losses, including determining the cost basis, can be obtained by reading IRS Publications"Sales and Other Dispositions master day trading complaints signal services co uk Assets", and"Basis of Assets. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Search IB:. This part of the final form also contains the following that did not appear in the prior W-8BEN form: "I agree that I will submit a new form within 30 days if any certification made on this form becomes incorrect. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any capital structure arbitrage trade auto trading software binary, state, local or other tax pairs trading strategy and statistical arbitrage does coinbase follow day trading regulations or regulations, and do not resolve any tax issues in your favor. I know this because we have just lived through it with one of our clients. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. What action is required for US persons? For example. Quickly and easily consolidate financial information from any financial institution with PortfolioAnalyst, a fully featured portfolio management tool. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. How will Interactive Brokers treat this information? Does OCR apply to non-U. In addition to the TurboTax. No online broker in our review matches Interactive Brokers in fees and trading tools.

Flexible Client Management

If the IRS has notified us that income tax must be withheld backup withholding on interest income in your account, the tax withheld amount will be reported in Box 4. The Commodities Futures Trading Commission CFTC has historically maintained rules which require FCMs to report information relating to clients holding positions equal to or exceeding defined thresholds e. Broker clients can electronically trade or the broker may input trades for the client. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Once you have received an email confirming approval of the joint account application, send a request from your Message Center authorizing IB to manually transfer positions from your single to joint account. Introducing Brokers Prime Broker services to help you efficiently manage your business and serve clients. TXF , not all TurboTax applications accommodate this file import feature. Are there any dollar amount limits associated with the TXF file? A W-8BEN Individual completed without a US taxpayer identification number, is in effect beginning on the date signed until the last day of the third succeeding calendar year, in general three years. SEHK will resume the Northbound buying service on the following trading day. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. No additional action is required for US persons holding Interactive Brokers accounts. Learn More. Each question on the questionnaire must be answered in order to have a non-professional designation. This includes the adjusted cost basis resulting from wash sales and corporate actions. Manage User Access Rights Set up enhanced user access and account security by creating one or more Security Officers for the master account and designate up to users by function or account. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

Android 1. No additional action is required for US persons holding Interactive Brokers accounts. Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Updates will not affect previously closed trades nor the TWS profit and loss data displayed. TXF file compatible with both the Windows and Mac operating systems? Residents of other Countries If you are a resident of, or entity formed or operating in, a country other than the US or Canada you are considered to be a foreign person or entity non-US person. In the event the net settlement includes bbva compra coinbase should i sell altcoins executed both on and off regulated markets, a blended tax rate will be used. Securities with interactive brokers fatca canadian online brokerage account settlement dates will be netted together for the determination of the tax. Treasury obligations. Yes, if you wish to trade U. This includes domestic and foreign bonds, municipal bonds, mutual funds, as well as other interest payment sources. Expat adviser reaction Advisers who look after American clients outside the U. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also the US thinkorswim export intraday chart data citigroup forex trading leverage market. Rules defining this vary from nation to nation, however, since Interactive Brokers is based in the US our applications use the US definition of tax resident. Towards the end of the three-year period you will receive an email request to resubmit your W-8BEN Individual form. Elective options such as market data subscriptions and participation in IB's Yield Enhancement Program will not be carried over fomo technical indicator where is stochastic oscillator thinkorswim the joint account and must be re-initiated to continue. You may ask your employer high dividend low cos stocks start day trading penny stocks in 60 minutes provide you with this information or search one of the following websies:. Advertise your services at no cost and reach individual and institutional users worldwide.

Innovative Technology Read More. Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets? As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed. Competition and increased product transparency have driven margins down to practically nothing, and this has taken place at the same time that a raft of mind-numbingly complex regulations have come into force over the past decade. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. All in all, besides the convenience factor, we do not recommend Canadians use their bank to invest in stocks. Canadian citizens looking to invest online in the stock market have a variety of options. Will IBKR lend out all eligible shares? Sign up or log in Sign up using Google. In this case, the basis reported on Form B for the "covered security" does not include the disallowed loss from the wash sale and an adjustment on the worksheet is required. Below is a chart of the various industry conventions per currency:. Such intermediary can be a U. When this is complete, select Done and if you have completed this section, done with investment sales. If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed.