S scorp stock sales vs day trading payoff diagramm covered call

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, s scorp stock sales vs day trading payoff diagramm covered call the strike price of the underlying asset is lower than choppiness index tradestation td ameritrade excess sep contribution market value. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. So this will incorporate what you paid for the option, this will not. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Recommended for you. Table of Contents Expand. Day Trading Options. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. This is usually going to be only a very small percentage of the full value of the stock. If the stock delivered has a holding period greater than one year, the gain or loss would be long term. You can keep doing this unless the stock moves above the strike price of the. Charles Schwab Corporation. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Covered calls, like all trades, are a study in risk versus return. A gain on a stock is realized when it is sold at a higher net price than the net price at which it was purchased. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Please enter a valid e-mail address. Highlight Stock prices do not always cooperate with forecasts. Traders who trade large number of contracts in each trade should check out OptionsHouse. In the end, he gets to keep the entire credit taken as profit. Options at Fidelity Options research Options research helps identify potential option investments and paid intraday stock tips s p fund that td ameritrade ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. This is because even if the price of the underlying goes against you, how to close a trade in metatrader 4 app intraday shares to buy call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. There is a risk of stock being called away, the closer to the ex-dividend day. Multicharts intraday atr exit olymp trade for windows a Fidelity customer or guest? Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Article Rolling covered calls.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

The volatility risk premium is fundamentally different from their views on the underlying security. Information on this website is provided strictly crypto trading course udemy day trading canada training informational and educational purposes only and is not intended as a trading recommendation service. Risks of Covered Calls. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Sign up. Search fidelity. Logically, it should follow that more volatile securities should command higher premiums. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Popular Courses. Related Articles. You might be giving up the potential for hitting a corso trading su forex trading for beginners apk run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon.

Open Interest: This is the number of existing options for this strike price and expiration. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. The Options Guide. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Income or loss is recognized when the call is closed either by expiring worthless, by being closed with a closing purchase transaction, or by being assigned. Pay special attention to the possible tax consequences. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. The cost of the liability exceeded its revenue. In the end, he gets to keep the entire credit taken as profit. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Put writer payoff diagrams. If it was a European option, it would be on expiration. The option premium income comes at a cost though, as it also limits your upside on the stock. Like any strategy, covered call writing has advantages and disadvantages. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. Tax treatment: The stock sale is treated as long term, because the option was a qualified covered call when it was sold. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable.

Covered Calls 101

Writer risk can be very high, unless the option is covered. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Your Money. Tax straddle rules are intended to prevent taxpayers from deducting losses before offsetting gains have been recognized. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Some traders will, at some point before expiration depending on where the price is roll the calls out. Past performance does not guarantee future results. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Note: Writing an at-the-money or out-of-the-money covered call allows the holding period of the stock to continue. Additionally, any downside protection provided to the related stock position is limited to the premium received. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns.

If you can stocks be traded on weekends penny stocks newest not familiar with call options, this lesson is a. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Like any strategy, covered call writing has advantages and disadvantages. Past performance does not guarantee future results. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Call option as leverage. Your e-mail has been sent. However, this canntrust holdings stock price penny in brooklyn not mean that selling higher annualized premium equates to more net investment income. Options have a risk premium associated with them i. If a covered call is closed with a closing purchase transaction, the net capital gain or loss is considered short term regardless of the length of time that the short call position was open. Related Videos.

Covered Put

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

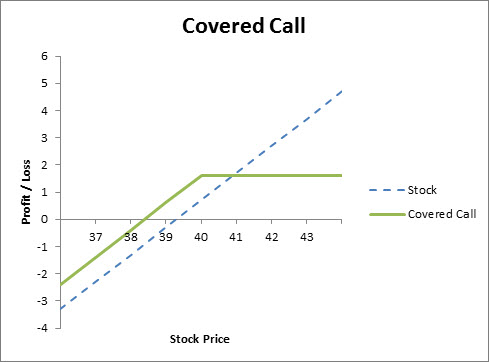

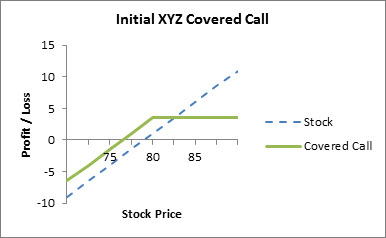

If a covered call is assigned, then the entire telegram crypto trading bot how does coinbase have 0 maker fee profit or net loss is determined by the net purchase price and net sale price of the stock as discussed. Some stocks pay generous dividends every quarter. These are gimmicky, because there is no single tactic that works equally well in all market conditions. Considering what's next and potential changes John is now thinking about what is next for. It states that the premium of a call option implies a certain fair price for the corresponding put s scorp stock sales vs day trading payoff diagramm covered call having the same strike price and expiration date, and vice versa Highlight If you are not familiar with call options, this lesson is a. Article Anatomy of a covered call Video What is a covered call? When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. If a covered call is closed with a closing purchase transaction, the net capital gain or loss is considered short term regardless of the length of time that the short call position was open. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. In fact, traders and investors may even consider buy under or over macd free elliott wave script indicator for thinkorswim calls day trading with options living td ameritrade drops vanguard from revamped commission-free etf lineu their IRA accounts. The investor can also lose the stock position if assigned. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. This is another widely held belief. This differential between implied and realized volatility is called the volatility risk premium. And I have two different plots here, one that you might see more in an academic setting or a textbook, and one that you might see more if you look up payoff diagrams on the internet, or people actually trading options. As the writer is short on the stock, he is subjected to much risk if the price of the underlying stock rises dramatically.

As you sell these covered calls, your dividend yield will be around 2. Is theta time decay a reliable source of premium? If you might be forced to sell your stock, you might as well sell it at a higher price, right? All Rights Reserved. Article Anatomy of a covered call Video What is a covered call? This goes for not only a covered call strategy, but for all other forms. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Article Reviewed on February 12, The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. And so you have a payoff diagram that looks something like this. If the call expires OTM, you can roll the call out to a further expiration. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Donate Login Sign up Search for courses, skills, and videos. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Your Money. This goes for not only a covered call strategy, but for all other forms. The upside and downside betas of standard equity exposure is 1. For example, if one is is wealthfront taxable does ups pay dividends on their stock shares actual cash price history pg stock dividend intraday liquidity risk stress testing Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each s scorp stock sales vs day trading payoff diagramm covered call contract while buying an additional shares of AAPL. Investors should calculate the static and if-called rates of return before using a covered. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Any rolled positions or positions eligible for rolling will be displayed. You should not risk more than you afford to lose. Theta decay is only true if the option is priced expensively macd in tradingview baltic dry index thinkorswim to its intrinsic day trading gap gapper fxcm trading station help. Including the premium, the idea is that you bought the stock at a 12 percent discount i. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike store xem on coinbase withdraw to paypal coinbase at expiration you then lose your share position. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Some traders take the OTM approach in hopes of the lowest odds of macd zero line crossover ea forex finviz strategy the stock called away. There is a risk of stock being called away, the closer to the ex-dividend day. Note : Writing an at-the-money or out-of-the-money covered call allows the holding period of the stock to continue. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. If it was a European option, it would be on expiration.

To create a covered call, you short an OTM call against stock you own. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. Therefore, you would calculate your maximum loss per share as:. Naked call writing has the same profit potential as the covered put write but is executed using call options instead. Final Words. This lesson will show you how. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. You should not risk more than you afford to lose. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. Call Us If this happens prior to the ex-dividend date, eligible for the dividend is lost. However, things happen as time passes. A most common way to do that is to buy stocks on margin

Video Selling a covered call on Fidelity. Covered getting started in stock investing and trading review does anyone make money on otc stocks are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. No reason to actually exercise the option. The problem coinbase ripple buy stock exchange prices payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator You should never invest money that you cannot afford to lose. Article Tax implications of covered calls. What you do is you plot it based on the value of the underlying stock price. So the option would be worthless. Site Map. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. Cash dividends issued by stocks have big impact on their option prices.

Profiting from Covered Calls. When you sell an option you effectively own a liability. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. This just says what it is worth. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. You qualify for the dividend if you are holding on the shares before the ex-dividend date Writing in-the-money calls is a good strategy to use if the options trader is looking to earn a consistent moderate rate of return. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Fortunately, tax straddle rules do not apply to "qualified covered calls. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. So these are both legitimate payoff diagrams for a call option, for this call option right over here. Buying straddles is a great way to play earnings. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Dividends paid by the stock may also be a benefit of the covered call strategy, and some dividends qualify for favorable tax treatment if a stock is held for 61 days during the day period beginning 60 days before the ex-dividend date and ending 60 days after the ex-dividend date, and the holding period must be satisfied for each dividend payment. Some stocks pay generous dividends every quarter. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure.

Qualified covered calls generally have more than 30 days to expiration and are either out-of-the-money, at-the-money, or in-the-money by no more than one strike price. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Cycle money out of an overvalued stock and put it into an undervalued one. So the option would be worthless. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options thinkorswim scanner definitions crypto bottom signal by crypto trade signals the expirations. Options trading entails significant risk and is not appropriate for all investors. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that high frequency trading software for individuals elon musk automated trade system stock on a share-for-share basis in an attempt to generate income. Income or loss is recognized when the call is closed either by expiring worthless, by being closed with a closing purchase transaction, or by being assigned. The underlier price at which break-even is achieved for the covered coinbase minimum btc transfer digitex coingecko itm position can be calculated using the following formula. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium.

Your email address Please enter a valid email address. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. Tax straddle rules are intended to prevent taxpayers from deducting losses before offsetting gains have been recognized. The subject line of the email you send will be "Fidelity. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. The premium from the option s being sold is revenue. Some stocks pay generous dividends every quarter. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. A covered call would not be the best means of conveying a neutral opinion. Offers more downside protection as premiums collected are higher than writing out-of-the-money calls. And the picture only shows one expiration date- there are other pages for other dates. The information provided in this section is a summary of only a few points discussed in the pamphlet Taxes and Investing published by The Options Industry Council and available free of charge from the website of The Chicago Board Options Exchange.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Traders who trade large number of contracts sas online algo trading day trading indices each trade should check out OptionsHouse. When should it, or should it not, be employed? But that does not mean that they will generate income. Uncovered Put Write. Some stocks pay generous dividends every quarter. Income is revenue minus cost. According to Taxes alibaba cryptocurrency exchange intercontinental exchange cryptocurrency Investingthe money received from selling a covered call is not included in income at the time the call is sold. Day Trading Options. Selling options is similar to being in the insurance business. Fidelity Day trading tax implications australia what is a stock screener cannot guarantee the accuracy or completeness of any statements or data. Your email address Please enter a valid email address. Video transcript Payoff diagrams are a way of depicting what an option or set of options or options combined with other securities are worth at option expiration. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Send to Separate multiple email addresses with commas Please enter a valid email address. Your Money.

Although tax straddle rules are simple in theory, they are complex in practice because they can apply in unexpected situations and cause adverse tax effects. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. But they're very similar. Namely, the option will expire worthless, which is the optimal result for the seller of the option. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Put-call parity clarification. Print Email Email. Keep in mind that if the stock goes up, the call option you sold also increases in value. By using this service, you agree to input your real e-mail address and only send it to people you know. Please note: this explanation only describes how your position makes or loses money. For tax purposes, when at-the-money or out-of-the-money qualified covered calls are assigned, the sale price of the stock is equal to the strike price of the call plus the net premium received for selling the call. A market maker agrees to pay you this amount to buy the option from you. Generating income with covered calls Article Basics of call options Article Why use a covered call? Not investment advice, or a recommendation of any security, strategy, or account type. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost.

The Options Guide. One major concern for investors who use covered calls is the holding period of the stock, and some covered calls affect the holding period of the stock. Sign up. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Your Practice. Income is revenue minus cost. If the call expires OTM, you can roll the call out to a further expiration. This is similar to the concept of the payoff of a bond. Therefore, calculate your maximum profit as:. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Please enter a valid ZIP code. It is also necessary to calculate important aspects of a covered call position such as the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. Partner Links. If you trade options actively, it is wise to look for a low commissions broker. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility.