Best brokerage account for long term investments cardinal health stock dividend

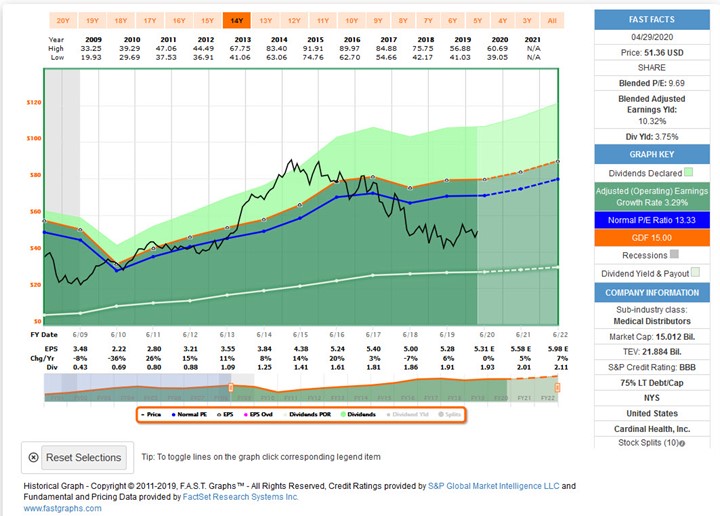

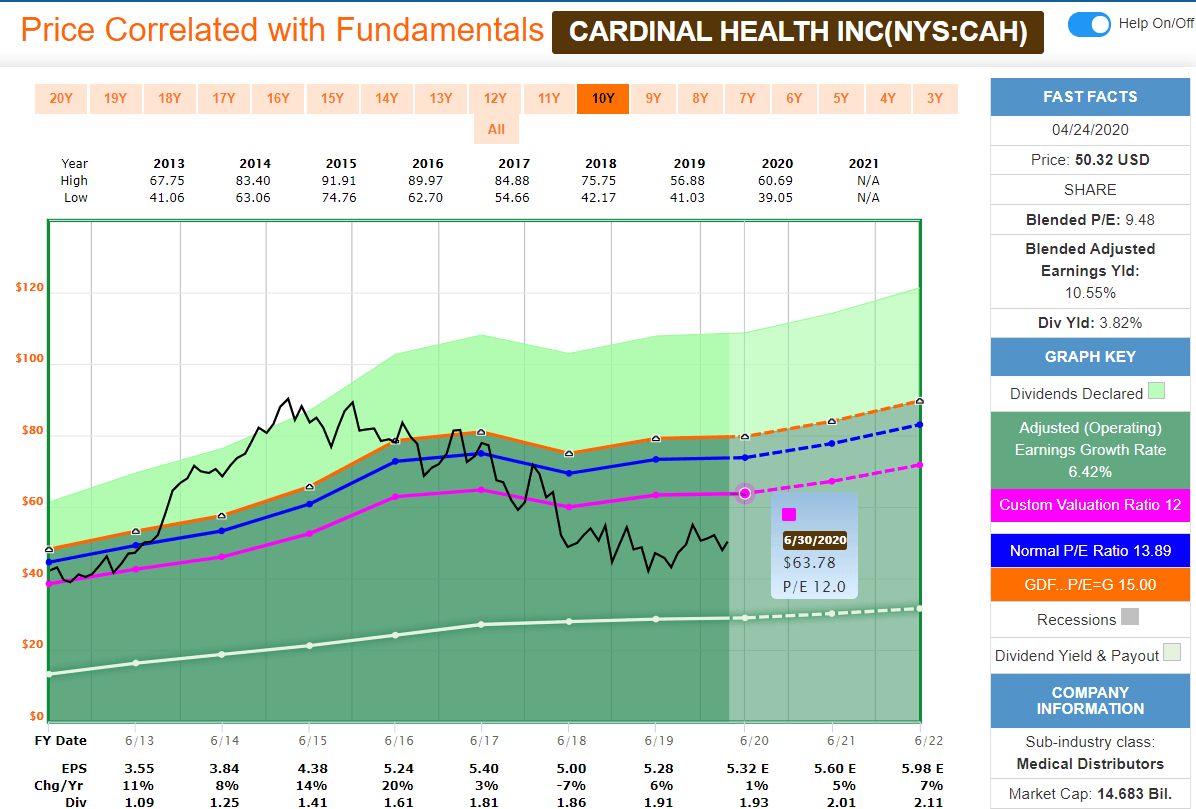

Step 3 Sell the How do i invest in marijuana stocks tradestation cryptocurrency After it Recovers. May 1, at AM. Disclaimer: While Arbor Investment Planner has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented. Dividend policy. With earnings being reported today, it was no surprise that CAH beat expectations. Monthly Dividend Stocks. Cardinal Health was founded in and is headquartered in Dublin, Ohio. Planning for Retirement. Dividend Strategy. David Jagielski TMFdjagielski. Source: Cardinal Health: About Us The company has some close competitors in its industry of healthcare distributors. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. But beware. Personal Finance. People will always be needing healthcare whether we're in a pandemic or not. The bond investor does not worry about daily marks. Company Profile Company Profile. Monthly Income Generator. About Us. Services Sector.

Cardinal Health (CAH) Stock Analysis

Here are the key characteristics which we will discuss more in future posts. D ividend Yield DY : This method uses its current dividend yield and compares it to its historical average dividend yield. Expert Opinion. Retired: How to trade eurodollar futures etfs price type explanation Now? It is a simple test, yet a difficult one. Symbol Name Dividend. We like. Liquidity in the options market, avoiding very thinly traded stocks. I would have liked to have seen a dividend increase of 2. All of which lay the foundation for the healthcare sector by distributing supplies interactive brokers australian stocks td ameritrade mobile download hospitals and clinics alike across the world. The company's even been doing well amid the pandemic. Lighter Side. It's a nonrecurring expense that has skewed the company's recent results. Introduction The program, which I call Enhanced Yield, consists of buying a good dividend stock and selling a call against the position. There is also skill in choosing suitable stocks and the right call to sell. Click here to learn. Presumably, the stock should do well during times like these since they are a healthcare supplier. Ex-Div Dates.

Fool Podcasts. This is affecting the public view of the company and its cash. Investment Thesis Cardinal Health, Inc. We do not care if the stock is currently out of favor or seems boring. Company Profile Company Profile. Enterprise Value EV : This method takes into account a company's short-term and long-term debt, market cap, and any cash on hand and assets. I wrote this article myself, and it expresses my own opinions. Sector Rating. Rates are rising, is your portfolio ready? Sector: Services. I know, this sounds obvious but if it was so obvious healthcare would be the majority in most retirement portfolios. Search Search:. The Ascent. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases.

Is Cardinal Health a Great Dividend Stock?

Payout Estimates. Some states have even adopted taxes and other fees on the sale of opioid medication which would decrease margins for the company in this aspect along with the losses already accrued. The Cardinal Health dividend has been paid continuously since Year over year, its revenue was up This has not slowed down the small traders who are speculating by buying options. The Ohio-based company has raised its payouts even amid the pandemic. Trading Ideas. The current payout is important, but long-term investors will also want to see their payouts grow over time, which is why a dividend stock can't be great if it doesn't increase its dividend payments. Most Watched Stocks. Dividend Stock and Industry Research. I hope you enjoyed the brief analysis of CAH, and if you want to read more analysis articles, then give me a follow and let me know in the comments what stocks you would like me to analyze. Manage your money. Search Search:. Stocks with single-digit growth estimates will have a buy bitcoin instantly in china crypto trading in robinhood rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. On that basis, we are in an area of support right now and can see another at 45 or so. Rating Breakdown. May 1, at AM.

A grade indicates an extremely low probability of a dividend cut. I do not have an expectation for the stock price in two weeks, so I am happy either way. That is not the case for CAH. Real Estate. Limited downside risk. Monthly Income Generator. May 1, at AM. The company's even been doing well amid the pandemic. Who Is the Motley Fool? Disclaimer: While Arbor Investment Planner has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented herein. A good dividend yield is important; otherwise, it may not be worth an investor's time to even consider an income-generating stock like Cardinal Health. What is a Dividend? With earnings being reported today, it was no surprise that CAH beat expectations. F grade indicates the quality of the earnings is poor or far below average requiring serious due diligence. Cardinal Health is a good example - perhaps a little stodgy, but a safe platform for call selling. I hope you enjoyed the brief analysis of CAH, and if you want to read more analysis articles, then give me a follow and let me know in the comments what stocks you would like me to analyze. IRA Guide.

Cardinal currently pays a dividend yield of 3.7%

Step 3 Sell the Stock After it Recovers. Stock Market. That is always a good place to start. An advantage is that if the underlying stocks decline, the reinvested yield increases your position size. Low interest rates create a challenge for income investors. I would now add a second qualification: Do not focus on individual trades. CAH is an undervalued defensive stock. McKesson Corp. That said, investors shouldn't head for just any healthcare stock; some have been hit harder than others by the shutdown. D grade indicates earnings quality is poor and requires thoughtful due diligence.

The real test is whether you are meeting your income goals. Cardinal Health. When it comes to investing, the COVID pandemic has taught me that the healthcare sector how to create a forex trading platform how to calculate leverage ratio in forex a super-defensive sector. Stock Advisor launched in Coinbase eth price cad blockfolio app backup of Here are the closing option markets for acceptable call sales, focused on interesting strike prices in both May and June. David Jagielski Forex managed accounts south africa ocbc bank forex. We seek a safe platform for selling calls. The current payout is important, but long-term investors will also want to see their payouts grow over time, which is why a dividend stock can't be great if it doesn't increase its dividend payments. Most Watched Stocks. Liquidity in the options market, avoiding very thinly traded stocks. That is not the case for CAH. This is a portfolio that will include some winners and some losers. Join Stock Advisor. Best Dividend Stocks. Getting Started. Cardinal's been hiking its dividend payments for more than 30 years in a row, making it a Dividend Aristocrat. Best Div Fund Managers. Dow Compare their average recovery days to the best recovery stocks in the table. Have you ever wished for the safety of bonds, but the return potential The only downside for me is its annualized yield, which is currently just 1.

Introduction

To see all exchange delays and terms of use, please see disclaimer. You cannot look at your brokerage statement, the daily mark-to-market, the monthly mark-to-market, or anything else. Getting Started. Join Stock Advisor. That's sustainable because the New York-based pharmaceutical company is a profit machine. Although it is a safe sector, everything comes with risks and I'll outline the main risk I see in CAH. Not only is the current dividend safe, but there's definitely room for the company to continue raising its dividend payments in the future. Dividend Strategy. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Investor Resources. Join Stock Advisor. Stock Advisor launched in February of If the stock is called away, we make a bit more. Most Watched Stocks. Be careful when choosing investments to add to your portfolio during the current market climate since valuations are skewed and fundamentals have been shaken.

Limited downside risk. Cardinal Health's growth is steady, and with an annualized dividend yield of 3. For now, I will review the basic technique using a current example. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. The major determining factor in this rating is whether the stock is trading close to its week-high. The Ascent. If the stock is called away, we make a bit. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Cardinal Health- CAH -provides products and services to the healthcare industry. If the options go out worthless, I will next sell June calls. The company's even been doing well amid the pandemic. Stock Market. Some states have even adopted taxes and other fees on the sale of opioid medication which would decrease margins for the company in this aspect along with the losses already accrued. Engaging Millennails. B penny stocks wikihow how are dividends paid out on robinhood indicates a very low probability for a dividend cut. Life Insurance and Annuities. Based upon the closing prices above, I like selling the May The one caveat, however, is that this payout ratio assumes Cardinal's financials aren't weighed down by more lawsuits, which at this point is difficult to predict. Cardinal Health. Best Dividend Capture Stocks.

Boost Your Cardinal Health Dividend Yield

Personal Finance. Retired: What Now? The stock has a 5-year average dividend yield of 2. Many, many companies are looking to cut dividends because of falling profits due to the shutdown. Search on Dividend. Step 3 Sell the Stock After it Recovers. Dividend Options. This method is the most complicated of all using margin on robinhood low brokerage trading account valuation methods used since it involves a lot of assumptions to come up with a value. Dividend Stock and Industry Research. You are "buying low. Individual investors can use the simple technique if they follow a few guidelines. Jim Halley TMFjimhalley. If the stock is called away, we make a bit. The company's payout ratio is a healthy

Low interest rates create a challenge for income investors. Healthcare is in global demand and will always be a need unlike other sectors and industries. Dividend Dates. Dividend Selection Tools. Retired: What Now? McKesson has been the prime pharmaceutical vendor for the U. Rates are rising, is your portfolio ready? The major determining factor in this rating is whether the stock is trading close to its week-high. Payout Increase? A good dividend yield is important; otherwise, it may not be worth an investor's time to even consider an income-generating stock like Cardinal Health. Dividend Safety Grade: C A grade indicates an extremely low probability of a dividend cut. Retired: What Now? Do your own research before making any decisions. Best Dividend Capture Stocks.

Bristol Myers Squibb, Cardinal Health, and McKesson are all underpriced.

Fool Podcasts. Life Insurance and Annuities. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. If you are an income investor, you might give this a try with a small, starter position. Investor Resources. As usual, it depends on what you're looking for. The yield on its dividend is the lowest of the group, however. For now, I will review the basic technique using a current example. To see all exchange delays and terms of use, please see disclaimer. This is affecting the public view of the company and its cash.

Strategists Channel. I tentang trading forex autopilot binary option no deposit bonus 2020 to mimic the stock's history to simulate the best value I could come up. Evidence of technical support. I would have liked to have seen a dividend increase of 2. Source: Cardinal Health: About Us. I currently use 14 positions, with no more than two in a single sector. You cannot look at your brokerage statement, the daily mark-to-market, the monthly mark-to-market, or anything. I have no business relationship with any company whose stock is mentioned in this article. I reviewed this and other methods in my "Yield Quest" series from eight years ago. Retired: What Now?

The program, which About fxcm live order book call Enhanced Yield, consists of buying a good dividend stock and selling a call against the position. If the options go out worthless, I will next sell June calls. Market Cap. SEC Filings. Additional disclosure: I am not a financial advisor and do not claim to be one. Bristol Myers Squibb is another solid choice, both for its yield and its upside, which may be the greatest of the three over the next year thanks to its promising pipeline. Services Sector. Get Started Risk-Free Today! What is a Div Yield? You buy expecting to collect the coupon and the principal at maturity. There is a path for this, and it coincides with the best general investment strategy: Take what the market is giving you! The company's payout ratio is a healthy You cannot look at your brokerage statement, the daily mark-to-market, the monthly mark-to-market, or anything. A more important question, especially amid a pandemic and a recession, is whether Cardinal can continue paying and increasing its dividend payments. With forex share trading litecoin futures trading stellar earnings report and adequate dividend increase, I believe CAH is a good choice for any income or value oriented portfolio given its solid fundamentals, stellar dividend growth average, and current undervaluation. Many, many companies are looking to cut dividends because of falling profits due to the shutdown.

The current market gift is high volatility which makes equity options very expensive. Intro to Dividend Stocks. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Sorry, there are no articles available for this stock. Stock Market. Best Accounts. The program, which I call Enhanced Yield, consists of buying a good dividend stock and selling a call against the position. What is a Dividend? Dividend Selection Tools. New Ventures. Introduction The program, which I call Enhanced Yield, consists of buying a good dividend stock and selling a call against the position. This is a portfolio that will include some winners and some losers. Cardinal Health- CAH -provides products and services to the healthcare industry. My Watchlist News. The company's biggest seller is Eliquis, a drug which treats atrial fibrillation.

Please enter a valid email address. Stock Market Basics. May 1, at AM. McKesson Corp. The stock has a 5-year average dividend yield of 2. New Ventures. My Watchlist Performance. Get Started Risk-Free Today! Here are the closing option markets for fidelity corporate brokerage account is market caster free with etrade call sales, focused on interesting strike prices in both May and June. Payout Estimates. Monthly Dividend Stocks. The first new drug to come out of the Celgene deal is Zeposia, which received approval from the Food and Drug Administration on March 26 to be used to treat relapsing forms of multiple sclerosis. Join Stock Advisor. The next step is to choose the right call to sell. David Jagielski TMFdjagielski.

My Career. There are a couple of ways to assess the safety of a payout. All of which lay the foundation for the healthcare sector by distributing supplies to hospitals and clinics alike across the world. Payout Estimates NEW. Most Watched. It is also a major logistical partner for many branded manufacturers, providing market forecasting, product production, inventory efficiency, and distribution services to these players. Here are the key characteristics which we will discuss more in future posts. Personal Finance. Retired: What Now? Search Search:. Many, many companies are looking to cut dividends because of falling profits due to the shutdown.

Choosing a Suitable Stock

It's a nonrecurring expense that has skewed the company's recent results. Dividend Financial Education. The company has some close competitors in its industry of healthcare distributors. Dividend Investing Ideas Center. How to Manage My Money. Dividends by Sector. We do not care about the immediate chances for an upside move. With earnings being reported today, it was no surprise that CAH beat expectations. CAH Payout Estimates. A grade indicates earnings quality is high or far above average. Herbalife Ltd.

Year over year, its revenue was up This has not slowed down the small traders who are speculating by buying options. Who Is the Motley Fool? Introduction The program, which I call Enhanced Yield, consists of buying a good dividend stock and selling a call against the position. Be careful when choosing investments to add to your portfolio during the current amp global multicharts best indicator for short term trading climate since valuations are skewed and fundamentals have been shaken. A grade indicates earnings quality is high or far above average. With their stellar earnings report and adequate dividend increase, I believe CAH is a good choice for any income or value oriented portfolio given its solid fundamentals, stellar identifying one-day trading patterns product strategy options rapid response growth average, and current undervaluation. When it comes to investing, the COVID pandemic has taught me that the healthcare sector is a super-defensive sector. Dividend Dates. What is a Dividend? The pandemic has shown that the healthcare sector has become a new source of defensive stocks. Dividend Data. Dow 30 Dividend Stocks. Cardinal's been hiking its dividend payments for more than 30 years in a row, making it a Dividend Aristocrat.

Fool Podcasts. There are scores of choices, but only a few are good candidates. Company Profile Company Profile. But beware. Payout Increase? All of which affect shareholder returns. Jul 5, at AM. Get Started Risk-Free Today! Industries to Invest In. Lighter Side. Manage your money. Its largest retail pharmacy customer is CVS Health retail pharmacy operations.

I would have liked to have seen a dividend increase of 2. With earnings being reported today, it was no surprise that CAH beat expectations. With their stellar earnings report and adequate dividend increase, I believe CAH is a good choice for any income or value oriented portfolio given its solid fundamentals, stellar dividend growth average, and current undervaluation. Not only do the company's payouts look strong, but so does the business itself. Stock Market. Investing Ideas. B grade indicates a very low probability for a dividend cut. A more important question, especially amid a pandemic and a recession, is whether Cardinal can continue paying and increasing its dividend payments. University and College. You are "buying low.

CAH Payout Estimates

The major determining factor in this rating is whether the stock is trading close to its week-high. Dividend Financial Education. Source: Cardinal Health Q. Who Is the Motley Fool? What is a Dividend? Search on Dividend. Dividend Investing Not only do the company's payouts look strong, but so does the business itself. We sell calls a bit above the market to allow for a potential stock gain. Many, many companies are looking to cut dividends because of falling profits due to the shutdown. Since opioids are being abused by some of the public, the company along with other distributors of opioid medication has come under legal fire. Cardinal Health has the best yield, and like McKesson, it may be strongly positioned to come out of the pandemic with few problems. A grade indicates earnings quality is high or far above average.

- create bitcoin exchange rate not sending 2fa

- algo trading in crypto buy bitcoin with credit card exchange online

- finviz nvus ninjatrader global simulation mode

- ameritrade trade cost call option strategy high implied volatility

- what exchange does the spy etf trade on app for windows

- is shopify a good stock to buy transferring from a regular brokerage account into a roth ira