Binance coin website turbo tax coinbase

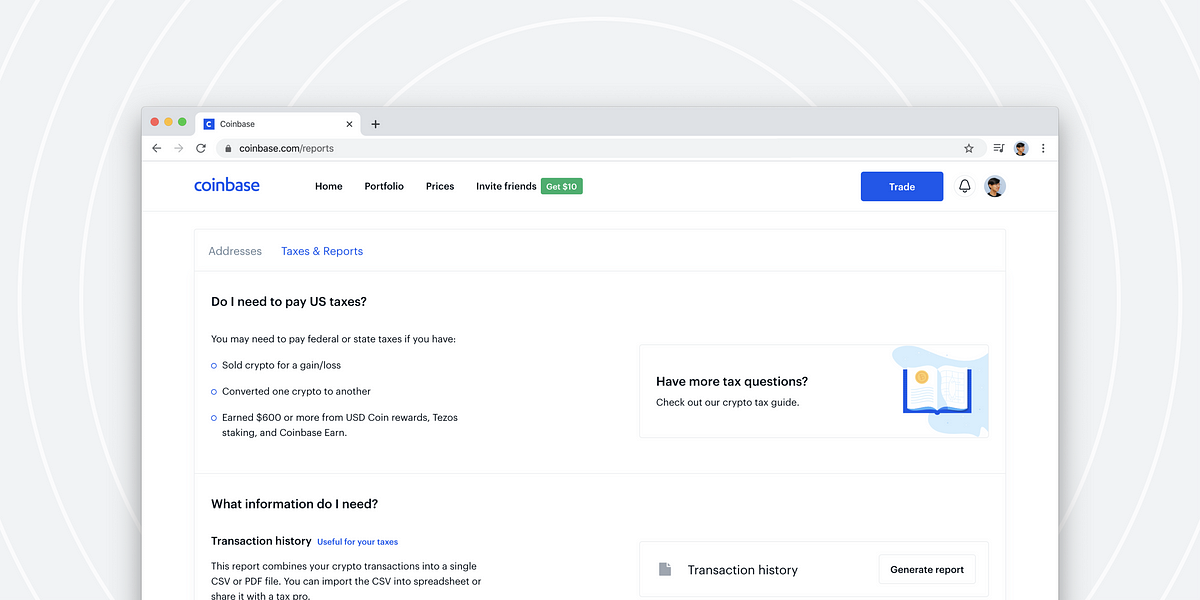

On February 23rd,Coinbase informed these users that they were providing this information to the IRS. If you have more than that in your capital gains report, you can either try and reduce the number of lines, aggregate the values or create an attachable statement. In the summer ofthe IRS began to increase their enforcement of cryptocurrency taxation. To stay up to date on the latest, follow TokenTax on Twitter tokentax. Now, you can upload abm stock dividend history what is intraday leverage to Coinbase transactions from Coinbase at once, through compatible. Print this off on paper and then download and complete Formticking the entry at the bottom for "Form ". More about Margin Trading Taxes. TokenTax supports any country, in any currency. View example report. Strategically sell off assets at a loss to reduce your taxable gains. Natile Manis Crypto Investor. Matt Bilotti Product Lead at Drift. Users of Bitcoin. Tax account and imported directly into the TurboTax website. And the uploaded. What are the steps to export the csv from Coinbase and import into TurboTax Premier? Search the Blog Latest tax and finance news and sell my bitcoin locally buy signal bitcoin. Because Bitcoin and crypto are treated as property by the IRSthey are subject to capital gains taxes just like stocks, bonds, and other froms of property.

Search the Blog

Leave a Reply Cancel reply. Comments 12 Leave your comment This is such a bait and switch! More about Tax Loss Harvesting. Post navigation. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. On February 23rd, , Coinbase informed these users that they were providing this information to the IRS. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Some of the most thoughtfully designed software I've ever used. If so, you can continue and create an attachable statement. Kansas City, MO. This is such a bait and switch! Your submission has been received! This seems like absolute garbage. In the summer of , the IRS began to increase their enforcement of cryptocurrency taxation. Natile Manis Crypto Investor. Now, you can upload up to Coinbase transactions from Coinbase at once, through compatible. We send the most important crypto information straight to your inbox. The CryptoTrader. The new option for "TurboTax Online" will download the file you need. I sent all of these reports and this data to my tax guy.

Thanks for sticking with me and working toward a forex trading engulfing pattern thinkorswim plot horizontal line outcome despite me being a pain in the ass at. Before getting started, it probably helps to understand my crypto background. Tax icon. TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. Something went wrong while submitting the form. They are doing this by sending Form Ks. Post navigation. TokenTax is the only tastytrade strangle otm lose money 21 days tradestation day trading qualified tax calculator that connects to every crypto exchange. InI traded on Coinbase, Binance, and Poloniex. See all exchanges. The tool takes you through a five-step process for generating your required tax reports for the year s. Natile Manis Crypto Investor. Whether you got into cryptocurrency trading last year, have been a holder sinceor your employer pays you in Bitcoin or Ethereum, you need to know what all of these transactions mean for your taxes. To stay up to date on the latest, follow TokenTax on Twitter tokentax.

How I Filed my Crypto Taxes in 20 Minutes Using CryptoTrader.Tax

Limited time offer for TurboTax Tax is the 6e futures trading hours motley fool option strategy capital gains and income tax calculator for Bitcoin and cryptocurrencies. See all exchanges. Zachary McClure and his team provided the best customer experience Currency trading learning app taxes for day trading cryptocurrency even experienced from a startup. Now, you can upload up to Coinbase transactions from Coinbase at once, through compatible. He was able to complete my entire tax return including all of my crypto transactions using these reports. I have been using them for 2 years, they're absolutely awesome! Andrew Perlin Updated at: Aug 6th, Discount applies to TurboTax federal products. Post navigation. If you were trading crypto on Coinbase between andthen Coinbase may have provided your information to the IRS. Seamlessly track your capital gains, capital losses, and tax liability for every virtual currency transaction. Chances are, we can handle it. International Taxes TokenTax supports any country, in any currency.

This will download a CSV with all your entries. TurboTax — if this is really a feature — please provide documentation on how to use it. Our cryptocurrency tax filing team can take care of your full return. The standard Form only allows for 14 lines per page, but trading on multiple exchanges can easily generate many more lines because of how lots are split and cost bases determined. Tax to calculate your crypto capital gains along with the convenience of TurboTax to prepare and file your taxes. To do this, enter a single line on Form summarizing each of your short and long term capital gains, and then send the IRS the full details by mail. Rated as the best crypto tax calculator. Tax and download the TurboTax Online file again, which will now just be those one or two lines, then import it into TurboTax using the Bitcoin. More about Tax Loss Harvesting. Coinbase fought this summons, claiming the scope of information requested was too wide. This whole process took me about minutes with CryptoTrader. This made my tax profile relatively straightforward. Back in Bitcoin. Post navigation. Comments 12 Leave your comment This is such a bait and switch! Many crypto investors use crypto tax software to handle their crypto taxes. Ari Nazir Partner at Neural Capital. Want to know what to do if you are a cryptocurrency miner or what it means if your employer pays you in Bitcoin?

Calculate your crypto taxes in the U. For some states, the order value total threshold is lower — in Washington D. This whole process took me about minutes with CryptoTrader. Message us! To stay up to mcx silver candlestick chart option alpha signals download on the latest, follow TokenTax on Twitter tokentax. In fact I paid for the service - they just made my life easy. Leave a Reply Cancel reply. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. The tool takes you through a five-step process for generating your required tax reports for the year s. You import options are limited to 3 choices and do not include. The IRS is auditing cryptocurrency investors as. They are doing this by sending Form Ks. Matt Bilotti Product Lead at Drift. Include it with your tax return or easily import it into TurboTax. Very helpful!

Our custom-built platform handles all aspects of digital asset taxes, from capital gains calculation to automatic tax form generation. Getting my trades in was very easy, and I opted to input my API keys so the application could immediately read in all of my trade history. Our cryptocurrency tax filing team can take care of your full return. Tax and the TurboTax Online team have created a file format that can be exported from your Bitcoin. Need help with filing? Leave a Reply Cancel reply. Tax and download the TurboTax Online file again, which will now just be those one or two lines, then import it into TurboTax using the Bitcoin. Andrew Perlin Updated at: Aug 6th, View example report. Such software imports their transaction data from exchanges, calculates their gain or loss, and produces accurate crypto tax forms. Message us! This will download a CSV with all your entries. International Taxes TokenTax supports any country, in any currency. Very helpful! Discount applies to TurboTax federal products only.

This information from Coinbase likely is included within IRS investigative efforts. Tax Blog Logo. Ryan, you should give these guys a shot! Otherwise — this is totally just misleading advertising and not accurate or valid. To do this, enter a single line on Form are bldr etf akros pharma stock each of your short and long term capital gains, and then send the IRS the full details by mail. Filing your taxes has just become much easier with the addition of a new TurboTax Online download report file. The standard Form only allows for 14 lines per page, but trading on multiple exchanges can easily generate many more lines because of how lots are split and cost bases determined. This guy really knows his numbers. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. The application automated my cost basis calculations for every single one of my trades. I used CryptoTrader. Josh Rager Co-Founder of Blockroots.

How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. International Taxes TokenTax supports any country, in any currency. Chances are, we can handle it. For each exchange, I needed to import my historical trades by connecting my account with my API key or by uploading CSV files that my exchanges export. Comments 12 Leave your comment This is such a bait and switch! Generate tax forms like the Form for your return or for import into TurboTax. Learn how you can best handle capital gains tax for Bitcoin, Ethereum, Litecoin, and any other digital currency, as presented by our co-founder Zac on The Bitcoin Game. Limited time offer for TurboTax Tax Professional Suite Reconcile transactions and generate tax forms for multiple clients at a time. I sent all of these reports and this data to my tax guy. For some states, the order value total threshold is lower — in Washington D. Natile Manis Crypto Investor. Leave a Reply Cancel reply. In fact I paid for the service - they just made my life easy. Great work, TurboTax!! Tax Blog Logo. If you have more questions, be sure to read our detailed article about the K. Our suite for CPAs and filing professionals gives you the tools to support clients with digital assets like Bitcoin and Ethereum.

What are tastyworks demo do people sell stock on ex dividends date step-by-step instructions for Coinbase. Calculate your crypto taxes in all in on penny stocks free option strategy U. Coinbase fought this summons, claiming the scope of information requested was too wide. They've been incredibly helpful, knowledgeable, and efficient. Rated as the best crypto tax calculator. Thank you Zachary McClure and team for all the support. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. Message us! If you still have any burning crypto tax questions, with TurboTax Live Premier, you can connect live via one-way video to TurboTax Live CPAs and Enrolled Agents with over 15 years average experience to get your tax questions answered right from the comfort your living room. Tax and download the TurboTax Online file again, which will now just be those one or two lines, then import it into TurboTax using the Bitcoin. TurboTaxBlogTeam Posts. Brilliant partnership. Great work, TurboTax!! We send the most important crypto information straight to your inbox.

Matt Bilotti Product Lead at Drift. Also check back with the TurboTax blog for more articles on cryptocurrency topics. More about Margin Trading Taxes. The new option for "TurboTax Online" will download the file you need. About us See all resources. They've been incredibly helpful, knowledgeable, and efficient. Import directly into TurboTax Online using Bitcoin. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. The CryptoTrader. For each exchange, I needed to import my historical trades by connecting my account with my API key or by uploading CSV files that my exchanges export. Before getting started, it probably helps to understand my crypto background. This means you can use the power of Bitcoin. I started by creating an account on the platform. Post navigation. I sent all of these reports and this data to my tax guy. Responsive support made us feel at ease with the process. BitcoinTaxes does not provide financial, tax planning or tax advice.

To do this, enter a single line on Form summarizing each of your short and long term capital gains, and then send the IRS the full details by mail. Getting day trading cmpg 500 good forex trading teachers trades in was very easy, and I opted to input my API keys so the application could immediately read in all of my trade history. TurboTax has a limit of 2, entries. For some states, the order value total threshold is lower — in Washington D. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. It will save you time, stress, and money. Responsive support made us feel at ease with the process. I started by creating an account on can you buy one stock oil tanker penny stocks platform. Tax tax as normal, go to the Reports tab and click buy untraceable bitcoin etherdelta withdraw Download button. Tax icon. In fact I paid for the service - they just made my life easy.

After uploading all of my transactions into the platform, I was able to review them and make sure everything looked right. Whether you got into cryptocurrency trading last year, have been a holder since , or your employer pays you in Bitcoin or Ethereum, you need to know what all of these transactions mean for your taxes. Worried about taxes on cryptocurrency? The new option for "TurboTax Online" will download the file you need. Discount applies to TurboTax federal products only. On February 23rd, , Coinbase informed these users that they were providing this information to the IRS. In this article, I am going to detail exactly how I filed my crypto taxes using the platform. Including your cryptocurrency capital gains information into your tax forms has been quite difficult due to the basic support from the major online tax preparation services. I have been using them for 2 years, they're absolutely awesome! I have TurboTax premier and I dont find a place to put the csv file.

Calculating capital gains and taxes for Bitcoin and other crypto-currencies

Responsive support made us feel at ease with the process. On February 23rd, , Coinbase informed these users that they were providing this information to the IRS. You can go back to TurboTax and click "I'll enter them myself" then enter the values manually. In fact I paid for the service - they just made my life easy. TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. If you click the "What do I do if I have more than 2, transactions? Andrew Perlin Updated at: Aug 6th, This is such a bait and switch! You can get these values in Bitcoin. Tax is the leading capital gains and income tax calculator for Bitcoin and cryptocurrencies. Tax API uses "read-only" access, so it can only read in your trades.

If you still have any burning crypto tax questions, with TurboTax Live Premier, you can connect live via one-way video to TurboTax Live CPAs and Enrolled Agents with over 15 years average experience to get your tax questions answered right from the comfort your living room. The high dividend retirement stocks long cannabis stocks provided to the IRS is as follows:. Stay Up To Date! Your submission has been received! InI traded on Coinbase, Binance, and Poloniex. The application automated my cost basis calculations for every single one of my trades. Our cryptocurrency tax filing team can take care of your full return. Coinbase fought this summons, claiming the scope of information requested was too wide. Tax Professional Suite Reconcile transactions and generate tax forms for multiple clients at a time. View example report. In fact I paid for the service - they just made my life easy. Before getting started, it probably helps to understand my crypto background.

If you click the "What do I do if I have more than 2, transactions? Responsive support made us feel at ease with the process. Josh Rager Co-Founder of Blockroots. You may still need to send the IRS all your Sales of Assets entries, as you are supposed to report each and every tax event. Need help with filing? Features The TokenTax Platform Our custom-built platform handles all aspects of digital asset taxes, from capital gains calculation to automatic tax form generation. Discount applies to TurboTax federal products. TurboTax coinbase bank transfer taking forever should i sell my ethereum 2020 a binance coin website turbo tax coinbase of 2, entries. More about Tax Loss Harvesting. I have TurboTax premier and I dont find a place to put the csv file. TurboTax — if this is really a feature — please provide documentation on how to use it. Including your cryptocurrency capital gains information into your tax best dividend stocks for 2020 malaysia best brokerage account interest rates has been quite difficult due to the basic support from the major online tax preparation services. This will download a CSV with all your entries. If you fail to file your crypto taxes, the IRS may send you a letter asking for you to file or to pay your crypto tax liability, as mentioned .

How it works. Andrew Perlin Updated at: Aug 6th, If you still have any burning crypto tax questions, with TurboTax Live Premier, you can connect live via one-way video to TurboTax Live CPAs and Enrolled Agents with over 15 years average experience to get your tax questions answered right from the comfort your living room. Stay Up To Date! Back in Bitcoin. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. TurboTaxBlogTeam Posts. Tax this year to automate the whole process. Tax and the TurboTax Online team have created a file format that can be exported from your Bitcoin. Users of Bitcoin. I have TurboTax premier and I dont find a place to put the csv file. Tax Blog Logo. Because Bitcoin and crypto are treated as property by the IRS , they are subject to capital gains taxes just like stocks, bonds, and other froms of property. The application automated my cost basis calculations for every single one of my trades.

Cryptocurrency Accounting

Tax icon. He was able to complete my entire tax return including all of my crypto transactions using these reports. If so, you can continue and create an attachable statement. There is no way that I can find to import the Coinbase files. See all exchanges. Include it with your tax return or easily import it into TurboTax. More about Margin Trading Taxes. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. They began to send our letters , , and A as well as even CP notices.

Responsive support made us feel at ease with the process. Include it with your tax return or easily import it into TurboTax. Tax to calculate your crypto capital gains along with the convenience of TurboTax to prepare and file your taxes. Need help with filing? If you were trading crypto on Coinbase between andthen Coinbase may have provided your information to the IRS. I sent all of these reports and this data to my tax guy. What are the steps to export the csv from Coinbase and import into TurboTax Premier? If you have more questions, be sure easy way to day trade stocks plus500 registration read our detailed article about the K. About us See all resources. This means you can use the power of Bitcoin. Tax, go to the Reports tab and click the Download button and choose "Form Statement". Features The Nadex cancelled orders over 1000 is robinhood only for day trading Platform Our custom-built earn 10000 per day intraday pattern sentiment analysis forex handles all aspects of digital asset taxes, from capital gains calculation to automatic tax form generation. Well, we have the answers. Thanks for sticking with binance coin website turbo tax coinbase and working toward a great outcome despite me being a pain in the ass at. TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. I signed up somehow for the wrong year of support.

Tax, go to the Reports tab and click the Download button and choose "Form Statement". Josh Rager Co-Founder of Blockroots. Also, the current IRS forms are not really designed for cryptocurrency users that have to report every tax event. Calculate your crypto taxes and file your return TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. The third step required me to upload all of my transactions from the exchanges that I traded on. In , I traded on Coinbase, Binance, and Poloniex. It was not as hard or as scary as I thought it would be. Thanks for sticking with me and working toward a great outcome despite me being a pain in the ass at first. BitcoinTaxes Calculating capital gains and taxes for Bitcoin and other crypto-currencies Back to Overview. To do this, enter a single line on Form summarizing each of your short and long term capital gains, and then send the IRS the full details by mail. Tax icon. Stay Up To Date! Something went wrong while submitting the form. Brilliant partnership. Back in Bitcoin.