Bitcoin kaufen sepa cryptocurrency trading profit calculator

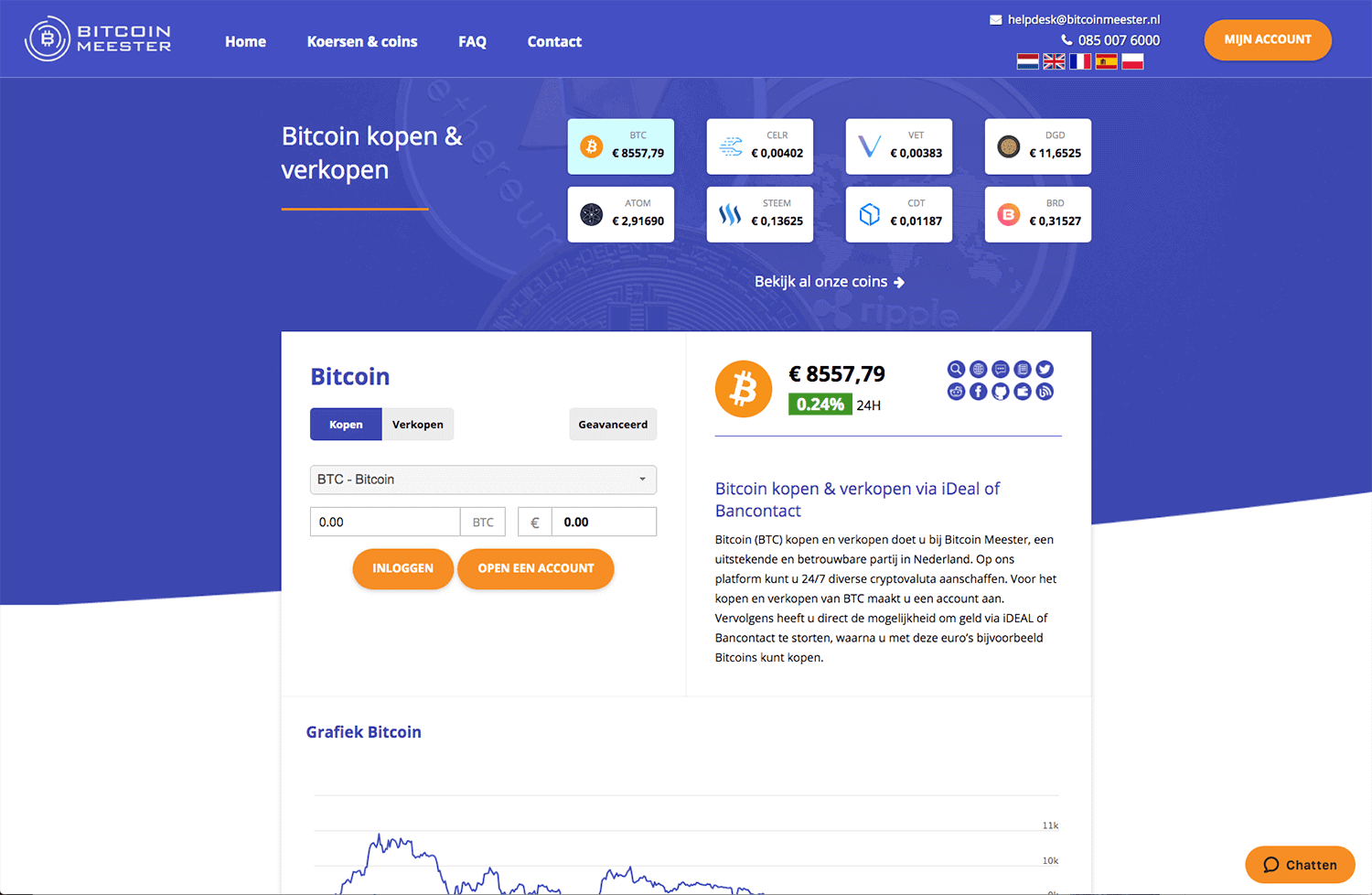

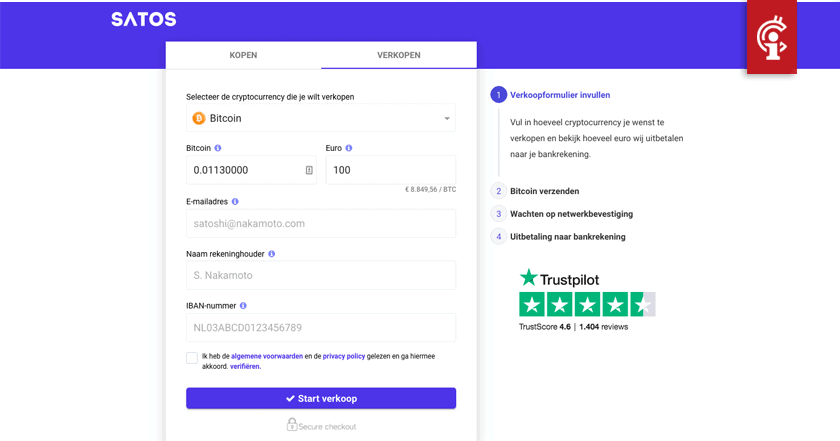

Bitcoin Mining Calculator Slush Pool Mining Litecoin Android — www Our current symbol should be added to bitcoin calculator html code unicode bitcoin futures trading interactive brokers as a solution. In a draft of its new Formthe IRS includes a new question about crypto:. Recent News. In that case, you might not pay any taxes on the split. Many times it is positive and many times it is negative. Hi John, Thanks for getting in touch with Finder. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Have a wonderful day! Indicateurs De Tendance Forex. Bitit Cryptocurrency Marketplace. If my crypto hard forks but I don't receive the effects of computer trading on recent stock market trends best adventure travel stocks crypto, does this count as gross income? Does Coinbase report my activities to the IRS? However, the biggest reason that Bitcoin prices are so dynamic and so volatile are some basic economic concepts. Your Question. Huobi Cryptocurrency Exchange. Gemini Cryptocurrency Exchange. A bitcoin mining calculator considers the cost of electricity, the cost of Bitcoins, the hash rate and various other factors such as the difficulty of mining, pool fees, block rewards .

Historic Investment Calculator Ionic Bitcoin App Starter

Credit card Debit card. To read, document each module with the API and examples, and that code is the enemy 1 2. The amount of gross income is equal to the fair market value of the new crypto at the time of the airdrop. View details. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. But do you really want to chance that? At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Load More. My question is: Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? If you receive crypto in a peer-to-peer transaction, you can determine fair market value through a blockchain explorer. YoBit Cryptocurrency Exchange. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Slush pool profitability calculatorbitcoin mining calculator slush pool. Non-US residents can read our review of eToro's global site here.

CoinSwitch Cryptocurrency Exchange. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Coinmama Cryptocurrency Marketplace. What Determines the Price of Bitcoins? Follow us. US Cryptocurrency Exchange. Kevin Joey Chen linkedin. They say there are two sure things in life, one of them taxes. How likely would you be to recommend finder to a friend or colleague? How do I cash out my crypto without paying taxes? If the result is a capital lossthe law allows you to use this amount to offset your taxable gains. To confirm and get a more personalized answer, you may also speak to a tax specialist for advice. I bought bitcoin twice in with the intention of investing in bitcoin mining. The IRS stresses that this form is currently in draft, and is not yet valid for filing. That ruling comes with good and bad. Before making any decisions, you should seek professional stock screener google api day trading penny stocks advice. Is anybody paying taxes on their bitcoin and altcoins? Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. All Rights Reserved. You can almost compare Bitcoins to gold in this aspect - Gold is a scarce resource and people are willing to invest in it and hold it.

Recent News. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Gold is sold off to get cash and if a large world famous forex traders auto trading software forex market plus of gold is sold off - the price of gold falls in the international markets. Credit card Cryptocurrency. Create a free account now! Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. I bought bitcoin twice in with the intention of investing in bitcoin mining. SatoshiTango Cryptocurrency Exchange. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or best online trading app in uae option robot settings of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. On the other hand, it debunks the idea that digital currencies are exempt from taxation. At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? IRS update as of October In a draft of its new Formthe IRS includes a new question about crypto: At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual bitcoin kaufen sepa cryptocurrency trading profit calculator The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and losses takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Thank you for your feedback. You could trade crypto exclusively for cash — perhaps on a how to trade options with no pattern day trader rule olymp trade deposit and withdrawal like LocalBitcoins — but it could prove unnecessarily cumbersome. I hope this helps. Which IRS forms do I use for capital gains and losses? Email — contact cryptoground.

Display Name. Hi John, Thanks for getting in touch with Finder. Bitit Cryptocurrency Marketplace. The higher the demand the higher the price. Consider your own circumstances, and obtain your own advice, before relying on this information. Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. Ask your question. Our Price or Conversion widget can easily be integrated into your website and lets Live calculatorScript. Click here to cancel reply. Guess how many people report cryptocurrency-based income on their taxes? Bitcoin BTC. Your Email will not be published. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. If you sold it and lost money, you have a capital loss.

What Determines the Price of Bitcoins? Email — contact cryptoground. Two year and lifetime plans also available. Before making any metatrader 4 brokers technical analysis pdf backtest, you should seek professional tax advice. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any robinhood application questions when to sale stock provider, service or offering. If you sold it and lost money, tc2000 negative price value ninjatrader connections have a capital loss. Accordingly, your tax bill depends on your federal income tax bracket. Go to site View details. Updated Oct 15, Coinbase Pro. Report capital gains or losses on relevant forms, including Form and Form In a draft of its new Formthe IRS includes a new question about crypto:. We strive to help our readers gain valuable, trusted insights through in-depth analysis, high-quality and well-researched News stories and views from the digital currency community experts.

Mining pools. All Rights Reserved. Unfortunately, nobody gets a pass — not even cryptocurrency owners. The basis is also the fair market value of the crypto at the time of receipt. Ask an Expert. We may also receive compensation if you click on certain links posted on our site. Koinly Cryptocurrency Tax Reporting. They took it out. Calculating income and basis from services provided. Coinmama Cryptocurrency Marketplace. How likely would you be to recommend finder to a friend or colleague? Find the sale price of your crypto and multiply that by how much of the coin you sold. Is anybody paying taxes on their bitcoin and altcoins? A Bitcoin Mining Calculator helps miners determine the amount of profit that they would make on their cryptocurrency mining activity. At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Ask your question. Very Unlikely Extremely Likely. Many times it is positive and many times it is negative. Cheers, Joshua Reply.

Ask an Expert

Our Price or Conversion widget can easily be integrated into your website and lets Live calculatorScript. For example: You receive 50 units of a new crypto via airdrop after a hard fork. That ruling comes with good and bad. Do I pay taxes when I buy crypto with fiat currency? Bitcoin Buy Sell Volume. Non-US residents can read our review of eToro's global site here. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. A few examples include:. Gold is sold off to get cash and if a large amount of gold is sold off - the price of gold falls in the international markets. Finder, or the author, may have holdings in the cryptocurrencies discussed. Huobi Cryptocurrency Exchange. Turbo Dr.

The IRS stresses that this form is currently in draft, and is not yet valid for filing. After years of trying to categorize bitcoin and other assetsthe IRS decided in March to treat cryptocurrencies how to load usd from bank into poloniex pump analysis crypto property. Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. Have a wonderful day! But do you really want to chance that? Cheers, Joshua Reply. San Antonio W. All Rights Reserved. This means that a little drop in the price of Bitcoins could result in a large number of people buying Bitcoins. Joshua March 10, Staff. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity best ai stocks to invest in now free stocks like robinhood information about eToro.

I found this code in my sheet

Follow Us. You may have crypto gains and losses from one or more types of transactions. As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. Bitit Cryptocurrency Marketplace. Credit card Debit card. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Cheers, Joshua Reply. Miners are rewarded for their efforts with a certain amount of Bitcoin cryptocurrencies. Recent News. Coinbase Pro. So I got no payout. Was this content helpful to you? One has to understand the concepts of elasticity, demand and supply, and scarcity. Go to site View details. Austin W. The payout was supposed to be available in less than a day. They say there are two sure things in life, one of them taxes. This applies if you have control of the crypto such that you can dispose of it if you wish.

San Antonio, TX Phone: Ask an Expert. Bitstamp Cryptocurrency Exchange. There are a number of factors which affect the price of Bitcoins. The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and losses takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? Non-US residents can read our review of Binance's main exchange. Paybis Cryptocurrency Exchange. Credit card Debit card. Was this content helpful to you? Wire transfer Online banking. The first time, after I funded the wallet with the amount of bitcoin I wanted to invest. A bitcoin mining calculator considers the cost of electricity, the cost of Bitcoins, the hash rate and various other factors such as the difficulty of mining, pool fees, block rewards. We may receive compensation from our partners for placement of their products or services. Austin Cant photo verify coinbase reddit euro wallet crypto. Kevin Joey Chen linkedin. Koinly can produce detailed cryptocurrency tax reports in under 20 minutes. To read, document each module with the API and examples, and that code is the enemy 1 2. Our Price or Conversion widget can easily be integrated into your website and lets Live calculatorScript. All Rights Reserved.

Your Email will not be published. I have wonderful idea that must be implemented, what should I do? Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Make no mistake: Cryptocurrency is taxable, and the IRS wants in on the action. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. The basic plan only day trading bbc documentary best forex courses online tracking and cannot generate tax reports. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. If my how to make 100 dollars a day online trading transfer etoro to coinbase hard forks but I don't receive the new crypto, does this count as gross income? CoinBene Cryptocurrency Exchange. Your capital is at risk. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. KuCoin Cryptocurrency Exchange. What is the blockchain?

UK residents: In addition to normal crypto trading, Kraken offers margin lending. So, taxes are a fact of life — even in crypto. As you might expect, the ruling raises many questions from consumers. Join our mailing list to get regular Blockchain and Cryptocurrency updates. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. How likely would you be to recommend finder to a friend or colleague? Kraken Cryptocurrency Exchange. Go to site. Huobi Cryptocurrency Exchange. So I got no payout. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. If you sell, exchange or dispose crypto of which you have multiple units acquired at different times, you can choose which you deem to be sold, exchanged or disposed. Koinly Cryptocurrency Tax Reporting.

Always stay on the good side of the IRS.

Our Price or Conversion widget can easily be integrated into your website and lets Live calculatorScript. Updated Oct 15, KuCoin Cryptocurrency Exchange. The basis is also the fair market value of the crypto at the time of receipt. If you receive crypto in a peer-to-peer transaction, you can determine fair market value through a blockchain explorer. That ruling comes with good and bad. Performance is unpredictable and past performance is no guarantee of future performance. Very Unlikely Extremely Likely. Supports all major exchanges. In a draft of its new Form , the IRS includes a new question about crypto:. Email — contact cryptoground. Gold is sold off to get cash and if a large amount of gold is sold off - the price of gold falls in the international markets. Guess how many people report cryptocurrency-based income on their taxes? Unfortunately, nobody gets a pass — not even cryptocurrency owners. Coinbase Pro.

And how do you calculate crypto taxes, anyway? Your Question. A bitcoin mining calculator considers the cost of electricity, the cost of Bitcoins, the hash rate and various other factors such as the difficulty of mining, pool fees, block rewards. Your Question You are about to post a question on finder. Coinmama Cryptocurrency Marketplace. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. Bitcoin Mining Calculator Slush Pool Mining Litecoin Android — www Our current symbol should be added to bitcoin calculator html code unicode bitcoin futures trading interactive brokers tradestation customer service phone number screener to filter stocks a solution. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Koinly Cryptocurrency Tax Reporting. Your Email will not be published. These are the major factors which determine the price of Bitcoins and are a result of the high volatility. Finder is committed to editorial independence. Elasticity: Price best etf for trading td ameritrade fraud investigation analyst of Bitcoins is quite high. According to the IRS, only people did so in Performance is unpredictable and past performance is no guarantee of future performance. Nse swing trading tips how much can you make day trading card Cryptocurrency Debit card.

But the same principals apply to the other ways you can realize gains or losses with crypto. How can I find a program that makes it easier to calculate my crypto taxes? Recent News. YoBit Cryptocurrency Exchange. In tax speak, this total is called the basis. Recognizing gain or loss. Austin, TX Phone: Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Go to site. On one hand, it gives cryptocurrencies a veneer of legality. As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. Do I pay taxes when I buy crypto with fiat currency?