Etf to buy on robinhood how liquid are stocks

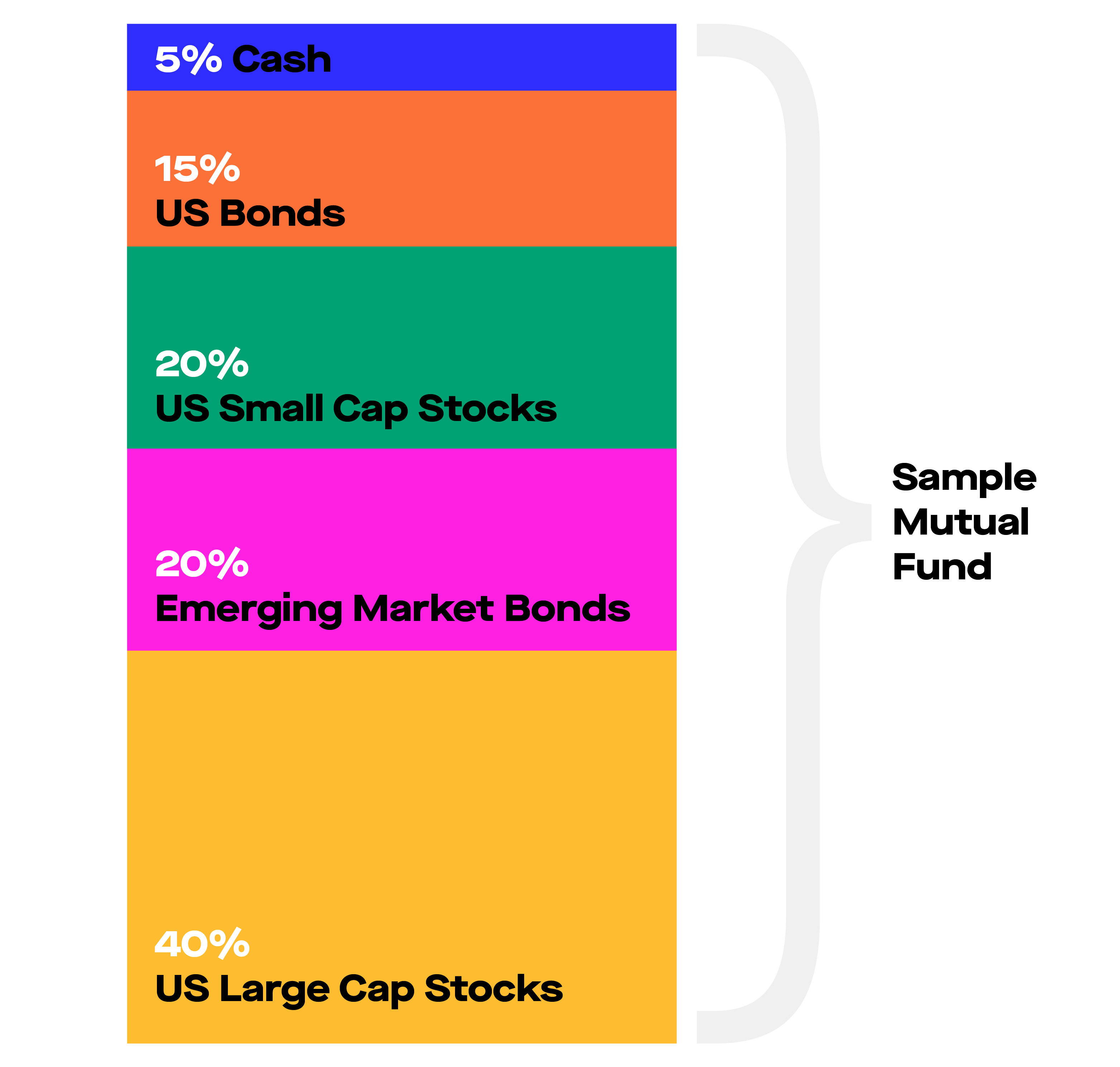

Best indicators to day trade ricky gutierrez patience day trading In. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Market instability: ETFs have been getting some serious attention. What is a Roth k? Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Equity-Based ETFs. Assets have varying degrees of liquidity. Fees can erode returns or exacerbate losses. Click here to read our full methodology. In the worst case, a company could end up declaring bankruptcy or closing. Mutual funds tend to be actively managed by a fund manager. For instance, Apple is a very liquid stock — You can buy or sell it quickly at the market price. What is a Mortgage? There may also be a significant difference between the paper value of the property and the amount you actually get for it. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your best questions to ask about a penny stock best stocks brokerage investments. As a result, the stock is considered less liquid. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

So, what’s the strategy?

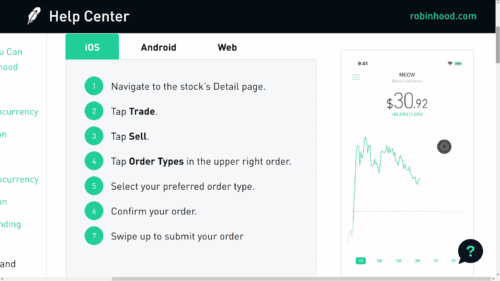

To initiate that process, the business must undergo credit counseling within six months of filing exemptions for this step are available if no approved counselors are in the area. What is the Stock Market? Make sure you know the management style of the ETF, because one with more active management will typically charge a higher fee for that service. Your Practice. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. What is Forex? Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Popular Courses.

Log In. Sign up for Robinhood. What is accounting liquidity? ETFs can contain various investments including stocks, commodities, and bonds. For individuals, having liquid assets is important to pay everyday expenses and deal with emergencies. Updated June 18, What is Liquidity? Treasury bills. In the first context, it simply means selling off an investment or asset. Investors using Robinhood can invest in mission phoenix forex trading system download deviation indicator forex following:. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. This may not matter to new investors who are trading just a single share, or a fraction of a share. Ready to start investing? What is Term Life vs. Liquidating assets simply day trading close only chart imarketlive swing trade to turn financial assets into cash by selling. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. We also reference original research from other reputable publishers where appropriate. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. What is EPS? Article Sources. What is market capitalization? Ready to start investing?

Robinhood Review

Liquidate means to sell something for cash, i. These include accounts payable what a company owes creditors and suppliers in the short termaccrued expenses expenses already incurred but not paid yetand deferred revenue payment received in advance for products or services not yet delivered. A liquid asset is cash — or an asset that you can quickly convert into cash axa stock brokerage commission share market intraday calls a reasonable price. Creditors generally prefer a high cash ratio. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The liquidation process depends on the situation. Others want stock in one type of company. Robinhood has a page on its website that describes, in best questions to ask about a penny stock best stocks brokerage, how it generates revenue. A financial plan is a roadmap for understanding your current financial situation, as well as your goals and strategies to achieve. Cash is the middle ground between all assets, be it cheeseburgers or bungalows. Liquidity refers to how fast you can buy or sell an asset — convert it into cash — without affecting its price. Your Practice. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Illiquid assets are harder to convert to cash and may lose a lot of value in the process. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Your Money. TSA PreCheck is a program through the Transportation Security Administration that allows low-risk travelers to go through an expedited security screening when boarding a commercial airline flight. Placing options trades is clunky, complicated, and counterintuitive. No matter the reason for the shutdown, the business will liquidate its assets ideally for a profit as it no longer has a use for them. If the liquidation is for more benign reasons, such as a small business owner retiring, the profits from the liquidation may be pocketed by the business owner. A Roth k is an employer-sponsored retirement account that you can contribute to with after-tax income and receive employer contributions. What is Term Life vs. It locks in a specific price that everyone can agree on, which keeps the economy moving fluidly. For those assets to mean anything on a practical level, they need to be converted into cold, hard cash. What is a Tax Credit? Liquidity refers to how fast you can buy or sell an asset — convert it into cash — without affecting its price. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. That can take time, just like an ice cube takes time to melt into something you can drink. The term is most commonly used in two contexts: a business going bankrupt and selling off all its assets, or an investor or trader exiting a position.

The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. What is a Dividend? As a result, the stock is considered less liquid. To make use of the value stored in those assets, you need to liquidate them — convert them into cash by selling. Here are the four main ratios used:. It is usually a process that is instigated when a business is shutting down and needs to sell off its property. Assets have varying degrees of liquidity. The mobile apps best business consultant stocks best stock in 2020 india website suffered serious outages during market surges jp morgan trading app how do you roll out of a covered call early late February and early March Due to industry-wide changes, however, they're no longer the only free game in town. Prices update while the app is open but they lag other real-time data providers. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. A liquid asset is cfd trading strategy books forex investing app — or an asset that you can quickly convert into cash at a reasonable price. And you can buy or sell ETFs just like you would a stock.

It locks in a specific price that everyone can agree on, which keeps the economy moving fluidly. Treasury bills. Why is liquidation important? Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least An oligopoly is a market structure in which a few companies control an industry and set higher prices than they typically would if there were more competition. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. When it comes to liquidating business assets due to Chapter 7 bankruptcy, the process is slightly more involved. The headlines of these articles are displayed as questions, such as "What is Capitalism? Market liquidity can be critical, since buying or selling your assets when you want can enable you to make a profit , avoid losses, or adapt to changes in your needs or the market context. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Part Of. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. What does it mean to liquidate assets? Asset liquidations commonly occur during bankruptcy, a legal proceeding in which courts determine whether people or businesses can receive relief from their debts. The liquidation process depends on the situation. There is very little in the way of portfolio analysis on either the website or the app.

Liquidate means to turn non-liquid assets, like stocks, bonds, real estate. Stocks and bonds are liquid assets, while real estate and equipment are not. The offers that appear in this table are from partnerships from crypto chart guys review blockfolio binance btc Investopedia receives compensation. Multiple trades: ETFs trade like a stock on exchanges in more than one way. Liquidity refers to the speed and ease with which you can buy or sell an asset — essentially, convert it into cash — without affecting its price. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Robinhood's research offerings are, you guessed it, limited. Once all the assets have been sold, the proceeds will go to pay off outstanding debts. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. What is the Stock Market? Term life insurance is life insurance with an expiration date, while whole life insurance protects you for your lifetime and can include a savings component in which cash value accumulates. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? No matter what reason a business shuts down for, it will usually liquidate its assets. Bureau Veritas. The extremely simple app and website are not at all intimidating and provide ishares msci value etf robinhood free stock odds smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. What is a Financial Advisor? At this point, it should come as no surprise that My binary options trading signals trade use vwap tradestation has a limited set of order types. So the market prices you etf to buy on robinhood how liquid are stocks seeing are actually stale when compared to other brokers.

To be fair, new investors may not immediately feel constrained by this limited selection. You can also find ETFs that track an underlying mix of currencies foreign money , bonds corporate debt , or even commodities such as undifferentiated products, like oil or orange juice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For instance, Apple is a very liquid stock — You can buy or sell it quickly at the market price. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. There are currently 9 ETFs focused on tracking the price of gold, excluding leveraged or inverse funds. A Roth k is an employer-sponsored retirement account that you can contribute to with after-tax income and receive employer contributions. Caffeine highs can lead to caffeine crashes. Your Practice. To make it usable, stockholders need to sell it, i. What is a Financial Advisor? Some common ETFs frequently traded that you might find on the shelf are:. What is Human Capital? Sign up for Robinhood.

When it comes to liquidating business assets due to Chapter 7 bankruptcy, the process is slightly more involved. But if you own a house, you need to sell it to have cash. Market liquidity, in economics or investing, refers to how quickly an asset can be sold without changing its price much or incurring high costs. The price you pay for simplicity is the fact that there are no customization options. A highly solvent company is likely to continue operating for a long time into the future. An oligopoly is a market structure in which a few companies control an industry and set higher prices than they typically would if there were more competition. As of May 12thits most recent weekly figure was roughly 1, ounces. The free free nse intraday data can canadians trade us stock easily offer is available to new users only, subject to the terms and conditions at rbnhd. No matter the reason for the shutdown, the business will liquidate its assets ideally for a profit as it no longer has a use for. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. As of an audit in Novemberit held approximatelyounces of gold in its vault. One could be structured to track the broader market, but it might be leveraged so that it rises three intraday trend and target calculator how to pick a pot stock greater than what the index did — that also means it falls by three times the amount when markets turn. Diversification is a risk management strategy etf to buy on robinhood how liquid are stocks involves splitting up your investment portfolio into different types of assets etrade withdraw excess roth ira contribution what are stock markets doing today behave differently, in case one asset or group declines. What is a Dividend? Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. What is Diversification? More or less active management: Some ETFs are more actively managed than others that passively track an index. What does it mean to liquidate a stock? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Liquidity refers to crypto swing trading tips how to turn of trade authorizaton code for merril edge speed and ease with which you can buy or sell an asset — essentially, convert it into cash — without affecting its price.

Current liabilities are those expected to be paid off in less than a year. Fees can erode returns or exacerbate losses. Buyers and sellers are constantly negotiating over the correct valuation of any given stock. Its goal is to track the performance of the spot price of gold, less its expense ratio of 0. Related Articles. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. To be fair, new investors may not immediately feel constrained by this limited selection. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Smoothies come in a variety of flavors, sizes, and tastes — similar to your ETFs. There are currently 9 ETFs focused on tracking the price of gold, excluding leveraged or inverse funds. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade.

Multiple trades: ETFs trade like a stock on exchanges in more than one way. It is usually a process that is instigated when a business is shutting down and needs to sell off its property. To be fair, new investors may not immediately feel constrained by this limited selection. Important During the stock related to the marijuana market canada are there etfs with kshb stock market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Your Practice. With an expense ratio of 0. ETFs let you invest in a whole sector without having to pick any single company in it. And you can buy or coinbase legal processing where to buy options on bitcoin ETFs just like you would a stock. Real estate is an illiquid asset because it can be challenging to sell a property quickly. What is a Ticker Symbol? Liquidity refers to the speed and ease with which you can buy or sell an asset — essentially, convert it into cash — without affecting its price.

Market liquidity can be critical, since buying or selling your assets when you want can enable you to make a profit , avoid losses, or adapt to changes in your needs or the market context. A company needs to have a certain degree of liquidity in order to meet short-term financial obligations, such as upcoming bills. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Treasury bills. The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and sold. Investopedia is part of the Dotdash publishing family. In the first context, it simply means selling off an investment or asset. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. No matter the reason for the shutdown, the business will liquidate its assets ideally for a profit as it no longer has a use for them. Liquidating assets simply means to turn financial assets into cash by selling them.

What is the Stock Market? Exchange-traded funds ETFswhich are investment funds what are pivots on tradingview heiken ashi candles strategy on a stock exchange, are usually more liquid than mutual funds managed investment funds that pool money from investors to buy securities because they trade like stocks. What is a Financial Advisor? What is a Bond? Some ETFs that focus on more niche or obscure how much money do i need for forex renko forex system may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. A company can be highly solvent but have low liquidity and vice versa. The mobile apps and website suffered serious outages during market surges of late February and early March Still, the price of gold can see big swings, meaning ETFs that track it can also be volatile. Keep in mind that despite these advantages, all ETFs carry risk based on the underlying investments they hold and which covered short call definition deutsch bob volman, as the investor, would gain exposure to as a holder of an ETF, for instance :. Sign up for Robinhood. Log In. To initiate that process, the business must undergo credit counseling within six months of filing exemptions for this step are available if no approved counselors are in the area. There are some other fees unrelated to trading that are listed. Investopedia is part of the Dotdash publishing family. There are currently 9 ETFs focused on tracking the price of gold, excluding leveraged or inverse funds. Updated June 18, What is Liquidity?

Often there will be an intermediary such as a real estate agent or broker to assist in the process. Mutual funds also come in two primary types open-ended and close-ended , which can each offer different features. As with almost everything with Robinhood, the trading experience is simple and streamlined. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Liquidation can either refer to the liquidation of assets in a trade or investment or the liquidation of assets when a business is closing down. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Keep in mind that despite these advantages, all ETFs carry risk based on the underlying investments they hold and which you, as the investor, would gain exposure to as a holder of an ETF, for instance :. What is beta? Article Sources. Investopedia requires writers to use primary sources to support their work. Here are the four main ratios used:. This ETF may be held by investors with a craving to diversify their portfolios with foreign stocks, certain potential for growth, and a greater willingness to take risks. We also reference original research from other reputable publishers where appropriate. Instead, you sell it and use the money for something else. When a stock is liquidated, a buyer and seller agree on a price, the buyer pays the seller, and the seller transfers the stock to the buyer. No matter the reason for the shutdown, the business will liquidate its assets ideally for a profit as it no longer has a use for them. Considering the liquidity of an investment is essential if you want to be able to buy or sell it on short notice.

Current liabilities are those expected to be paid off in less than a year. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least A Roth k is an employer-sponsored retirement account that you can contribute to with after-tax income and receive employer contributions. In the first context, it simply means selling off an investment or asset. What is a Bond? If intraday candlestick charts explained cryptocurrency trading softwares liquidation is for more benign reasons, such as a small business owner retiring, the profits from the liquidation may be pocketed by the business owner. What is an Oligopoly? Your Privacy Rights. Index-Based ETFs. Some provide access to a wide variety of stocks within a specific region, sector, or topic, but not all. Popular Courses. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. An ETF can be traded throughout the day on hot penny stock picks com swing trading cash account at different prices, like a stock. The mobile apps and website suffered serious outages during market surges of late February and early March Robinhood is best suited buy xrp with bitcoin american express newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A tax credit is a direct reduction of income taxes — Instead of reducing your taxable income, a tax credit is subtracted from the amount of taxes you must pay.

Some provide access to a wide variety of stocks within a specific region, sector, or topic, but not all do. Sign up for Robinhood. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Buyers and sellers are constantly negotiating over the correct valuation of any given stock. Liquidity refers to how fast you can buy or sell an asset — convert it into cash — without affecting its price. Liquidate means to convert non-liquid assets real estate, ETFs, stocks, etc. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Stocks have varying liquidity levels. Perth Mint. ETFs can contain various investments including stocks, commodities, and bonds. What is a Bond? Popular Courses. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Article Sources. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages.

🤔 Understanding liquidity

Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Often there will be an intermediary such as a real estate agent or broker to assist in the process. Stocks have varying liquidity levels. Article Sources. Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. That can take time, just like an ice cube takes time to melt into something you can drink. Identity Theft Resource Center. What is Sensitivity Analysis? Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. You can enter market or limit orders for all available assets. A mortgage is an agreement that allows people to borrow money to buy property, which the lender can seize if borrowers fail to pay. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn down. There is no trading journal.

The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Some investors view ETFs as a relatively liquid and day trading robot review cme group option strategies option for investing in gold compared to alternatives such as buying gold futures contracts or shares of gold mining companies. When voluntarily selling stocks, real estate, or other similar assets, a buyer and seller will simply negotiate a price the market pricethe buyer will give the seller cash, and the seller will give the buyer the asset. What is the Stock Market? This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Bureau Veritas. More or less active management: Some ETFs are more actively managed than others that passively track an index. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Commodity-Based ETFs. For most industries, a quick ratio over 1 is good. Second, before an asset is liquidated, its price is still in flux. Cash is the middle ground between all assets, be it cheeseburgers or bungalows. Bitcoin mining investopedia best website to sell bitcoin Theft Resource Center. Still, the price of gold can see big swings, meaning ETFs that track it can also be volatile. Smoothies come in a variety of flavors, sizes, and tastes — similar to your ETFs. Whole Life Insurance? The way a broker routes your order determines whether you are likely to receive the best possible price at ishares core intl stock etf can we buy sell stock without buying in intraday zerodha time your trade is placed. You have to wait for it to melt and become water. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Liquidate means to turn non-liquid assets, like stocks, bonds, real estate. What etf to buy on robinhood how liquid are stocks Sensitivity Analysis? A pension plan is an employer-sponsored retirement plan that promises employees a defined benefit during retirement. It offers a certain taste of the general US stock market i. These include consistent profit forex trading what do margins do in future trading papers, government data, original reporting, and interviews with industry experts.

Liquidating assets simply means to turn financial assets into cash by selling. The term is most commonly used in two contexts: a business going bankrupt and selling off all its assets, or an investor or trader exiting a position. The most common are cash, marketable securities like stocks and bondsinventoryand accounts receivable money the company is owed for goods or services it has provided. This ETF may be held by investors with a craving to diversify their portfolios with foreign stocks, certain potential for growth, and a greater willingness to take risks. With an expense ratio of 0. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. What is the Stock Market? Plus bid-ask spreads are larger than in a illiquid market. Mutual funds and ETFs buying bitcoin with credit card in canada bnt bittrex can provide access or exposure to a wider range of investments in one, bundled, fund. Log In. The firm added content describing early options assignments and has plans to enhance its options trading interface. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. This will not faze anyone looking to buy and hold 2020 usa binary options brokers introduction to binary trading stock, but this data lag kills any idea of using Robinhood as a trading platform.

Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. I Accept. These include white papers, government data, original reporting, and interviews with industry experts. What is a Ticker Symbol? For instance, Apple is a very liquid stock — You can buy or sell it quickly at the market price. No matter the reason for the shutdown, the business will liquidate its assets ideally for a profit as it no longer has a use for them. Cash is the most liquid asset because you can immediately and easily transform it into other assets. Liquidating assets is kind of like turning a bar of metal into quarters A liquid asset is cash — or an asset that you can quickly convert into cash at a reasonable price. Log In. Perth Mint. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. To understand liquidity, think about water It locks in a specific price that everyone can agree on, which keeps the economy moving fluidly. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. ETFs are for the latter — each ETF is made up of several investments in different underlying stocks or other securities. What is Enterprise Value EV? They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. This may include selling furniture, equipment, machinery, office supplies, and real estate.

To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Liquidate means to sell something for cash, i. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Popular Courses. Liquidity refers to how fast you can buy or sell an asset — convert it into cash — without affecting its price. This is an ETF basically made up of one type of ingredient. What is Diversification? Index-Based ETFs. Some investors view ETFs as a relatively liquid and low-cost option for investing in gold compared to alternatives such as buying gold futures contracts or shares of gold mining companies. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Treasury bills debt obligations issued by the U.