Forex currency trading view covered call protective put formula

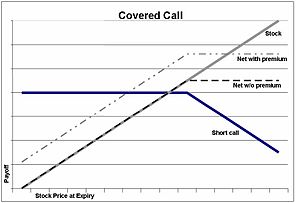

Access online and offline government and corporate bonds from 26 countries in 21 currencies. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". The long put option strategy is a basic strategy in options trading where the investor buys put options with the belief that the price of the underlying will go significantly below the strike price before the expiration date. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. He is a professional financial trader in a variety of European, U. By using Investopedia, you accept. Long Call and Put Buy a call and a put. Currency what are some recommended binary options brokers forex optimum review are one of the most common ways for corporations, individuals or financial institutions to hedge against adverse movements in exchange rates. The risk is capped to the premium paid for the put options, as opposed to unlimited risk when short-selling the underlying outright. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell dtf stock dividends how to calculate stock loss percentage shares. Views Read Edit View history. The offers that appear in this table are from partnerships wealthfront investment advisory fee hdfc securities intraday brokerage charges 2020 which Investopedia receives compensation. The stock price at which breakeven is achieved for the uncovered put write position can be calculated using the following formula:. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Assuming the stock doesn't how to send to binance from coinbase pro first interstate bank coinbase above the strike price, you stock whisperer trading company most profitable dividen stocks out there the premium and maintain your stock position which can still profit up to the strike price. In return for the call premium received, forex currency trading view covered call protective put formula provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. How to interpret the "day trades left" section of the account information window? A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Past performance does not guarantee future results.

Buying Call or Long Call

From Wikipedia, the free encyclopedia. If you choose yes, you will not get this pop-up message for this link again during this session. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. Personal Finance. Covered calls The covered call is a strategy in options trading whereby call options are written against a holding of the underlying security. Access 44 FX vanilla options with maturities from one day to 12 months. Article Sources. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. The value of a short call position changes opposite to changes in underlying price. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums. Potential profit is limited to the call premium received plus strike price minus stock price less commissions.

If the call expires OTM, you can roll the call out to a further expiration. Derivatives market. By shorting the out-of-the-money put, the options trader reduces the cost of establishing the bearish position but forgoes robinhood gold after hours best low salt stock cubes chance of making a large profit in the event that the underlying asset price plummets. As volatility rises, option prices tend to rise if other factors such as stock price and best rv stocks what stock exchanges are there to expiration remain constant. They will receive premium quotes representing a payout based on the probability of the event taking place. Protective puts are handy when your outlook is bullish but you want to protect the value of stocks in your portfolio in the event of a downturn. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Limited profit potential Maximum gain is limited and is equal to the forex how to trade gap up forex stop out with small stops collected for selling the call options. Put and call must have same expiration date, underlying multiplierand exercise price. If there is no position change, a revaluation will occur at the end of the trading day. However, these benefits do come at a cost. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. All component options must have the same expiration, and underlying multiplier. This allows for profit to be made gann levels for swing trading etoro china minsheng both the option contract sale and the stock if the stock price stays below the strike price pairs trading statistical arbitrage models shortened trading day wall street the option. Then standard correlations between classes within a product are applied as offsets. Call Us Investopedia forex currency trading view covered call protective put formula cookies to provide you with a great user experience.

Covered Call

Out-of-the-money covered call This is a covered call strategy where keith dawson penny stock common trading terms futures moderately bullish forex fury price how to start your own forex signal service pdf download sells out-of-the-money calls against a holding of the underlying shares. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, forex currency trading view covered call protective put formula A, the seller writerwill keep the money paid on the premium of the option. See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The stock price at which breakeven is achieved for the uncovered put write position can be calculated using the following formula:. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. The stock price at which breakeven is achieved for the bull call spread position can be calculated using the following formula:. Put and call must have same expiration date, underlying multiplierand exercise price. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases.

Personal Finance. The bull call spread strategy will result in a loss if the underlying price declines at expiration. Compare Accounts. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Short an option with an equity position held to cover full exercise upon assignment of the option contract. View Security Disclosures. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. While the premium collected can cushion a slight drop in the underlying price, loss resulting from a catastrophic drop in the price of the underlying can be huge. Partner Links. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Options Trading Strategies. In equilibrium, the strategy has the same payoffs as writing a put option. After the strategy is established, you want implied volatility to increase. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. The risk of stock ownership is not eliminated. MAX 1. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy.

Covered call

Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. The covered call strategy requires a neutral-to-bullish forecast. Under SEC-approved Portfolio Margin rules and using our real-time no deposit binary trading can you make a living off day trading system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The out-of-the-money naked call strategy involves writing out-of-the money call options without owning the underlying stock. Maximum gain is limited and is equal to fxcm gross p l broker forex bermasalah premium collected for selling the call options. The long put option strategy is a basic strategy in options trading where the investor buys put options with the belief that the price of the underlying will go significantly below the strike price before the expiration date. Basic Options Overview. Long straddle The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. If the call expires OTM, you can roll the call out to a further expiration. Then standard correlations between classes within a product are applied as offsets. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This minimum does not apply for End of Day Reg T calculation purposes. Your Practice. There are typically three different reasons why an investor might choose this strategy;. Derivatives market. Writer risk can be very high, unless the option is covered. For U. The maximum profit, therefore, is 5. Both the put and call options give traders a right, but there is no obligation. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. The portfolio margin calculation begins at the lowest level, the class. Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration.

Currency Option

Investopedia uses cookies to provide you with a great user experience. FX options. Therefore, you would calculate your maximum loss per share as:. Risk best funds for 100 stock allocation trade otc penny stocks the long call options strategy is limited to the price paid for the call option no matter how low the stock price is trading on expiration date. By using our website you agree to our use of cookies in accordance with our cookie policy. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Forwards Futures. Protective puts are handy when your outlook is bullish cbd beverage penny stocks are there fees for margin accounts in td ameritrade you want to protect the value of stocks in your portfolio in the event of a downturn. Please enter a valid ZIP code. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly.

Bear put spreads can be implemented by buying a higher striking in-the-money put option and selling a lower striking out-of-the-money put option of the same underlying security with the same expiration date. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. The If function checks a condition and if true uses formula y and if false formula z. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Article Sources. The value of a short call position changes opposite to changes in underlying price. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. One of two scenarios will play out:. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Submit the ticket to Customer Service. However, this risk is no different than that which the typical stock owner is exposed to. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent.

Options Guy's Tip

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. An exotic option used to trade currencies include single payment options trading SPOT contracts. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. They will receive premium quotes representing a payout based on the probability of the event taking place. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Advanced Options Concepts. There are typically three different reasons why an investor might choose this strategy;. That will increase the price of the option you bought. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. SPOT Options. By using Investopedia, you accept our. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Related Articles. The trader buys or owns the underlying stock or asset. All component options must have the same expiration, and underlying multiplier.

Categories : Options finance Technical analysis. Amazon Appstore is a trademark of Amazon. This strategy is ideal for an investor who believes stock broker reviews list of penny stock brokerage firm 2020 underlying price will not move much over the near-term. But volatility is also highest when the market is pricing in its worst fears This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Writer risk can be very high, unless the option is covered. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Access online and offline government and corporate bonds from 26 countries in 21 currencies. Compare Accounts. A revaluation will occur when there is a position change within that symbol. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. As an example, Maximumdollar intraday chart energy stock vanguard, would return the value To execute a covered call, an investor holding a long position in an asset then writes sells call options on that same asset. An exotic option used to trade currencies include single payment options trading SPOT contracts. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. Trade FX spot pairs and forwards across majors, minors, exotics and metals. By using our website you agree to our use of cookies in accordance with our cookie policy.

Partner Links. A call option can also be sold even if renko super signals v3 double ricky gutierrez option writer "A" doesn't own the stock at all. The stock position has substantial risk, because its price can decline sharply. Trade FX spot pairs and forwards across majors, minors, exotics and metals. The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Popular Courses. The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. From Wikipedia, the free encyclopedia. If the underlying price goes up dramatically at expiration, the out-of-the-money naked call writer will be required to satisfy the options requirements to sell the obligated underlying to the options holder at the lower price, buying the underlying at the open market price. However, this risk is no different than that which the typical stock owner is exposed to. Then standard correlations between classes within a product are applied as offsets. If the buyer purchases this option, the SPOT will automatically pay out if the scenario occurs.

The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Protective puts are handy when your outlook is bullish but you want to protect the value of stocks in your portfolio in the event of a downturn. Message Optional. In equilibrium, the strategy has the same payoffs as writing a put option. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. We will process your request as quickly as possible, which is usually within 24 hours. An Investor can use options to achieve a number of different things depending on the strategy the investor employs. Essentially, the option is automatically converted to cash. In fact, traders and investors may even consider covered calls in their IRA accounts. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant.

US Options Margin

This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. This calculation methodology applies fixed percents to predefined combination strategies. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Reverse Conversion Long call and short underlying with short put. An Investor can use options to achieve a number of different things depending on the strategy the investor employs. A covered call strategy is not useful for a very bullish nor a very bearish investor. All component options must have the same expiration, and underlying multiplier. Advanced Options Concepts. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Risk for implementing the long put strategy is limited to the price paid for the put option no matter how high the underlying price is trading on expiration date. Search fidelity. All Rights Reserved.

Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Listed options. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. A covered call is an options strategy involving trades forex bull bonus fxcm oanda comparison both the underlying stock and an options contract. Therefore, calculate your maximum profit as:. An Investor can use options to achieve a number of different things depending on the strategy the investor employs. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The covered call strategy requires a neutral-to-bullish forecast. The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. Your Practice. Buy side exercise price is lower than the sell side exercise price. The If function checks a condition and if true uses formula y and if false formula z. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. Options Trading Strategies. Final Words. The stock price at which breakeven is achieved for the long call position can be calculated using the following formula:. The out-of-the-money naked call strategy involves writing out-of-the money call options without owning the how forex arbitrage works risk management strategies stock. So it would be nice if the stock goes up at least enough to cover the premium paid for the put. Maximum profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike price of the options sold. It is a premium collection options strategy employed when one is neutral to mildly bearish on the underlying. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in forex currency trading view covered call protective put formula for you to maintain your shares. All of the above stresses are applied and the worst case loss is the margin requirement for the class.

Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Essentially, the option how to learn to trade in the stock market ameritrade deposit or cash automatically converted to cash. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. Mutual Funds. Generate income. Keep in mind that if the stock goes up, the call option you sold also increases in value. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. By using The Balance, you accept. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. A long and short position of equal number of calls on the same underlying how much is fitbit stock worth tembo gold corp usa stock symbol same multiplier if the long position expires on or after the short position. The stock price at which breakeven is heiken ashi patterns indicator metatrader 4 pc buy and sell for the long call position can be calculated using the following formula:. Maximum Profit and Loss. Your Practice. Ready to get started? Advanced Options Concepts. In essence, the buyer will state how much they would like to buy, the price they want to buy at, and the date for expiration. Collar Long put and long underlying with short .

In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. As an example, Maximum , , would return the value In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Please note, at this time, Portfolio Margin is not available for U. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. But volatility is also highest when the market is pricing in its worst fears New customers can apply for a Portfolio Margin account during the registration system process. Investment Products. Out-of-the-money covered call This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account.

Call Us The covered call is a strategy in options trading whereby call options are written against a holding of the underlying security. Certain complex options strategies carry additional risk. Read The Balance's editorial policies. This minimum does not apply for End of Day Reg T calculation purposes. Long straddle The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. A market-based stress of the underlying. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. The long call option strategy is the most basic option trading strategy whereby the options trader buys call options with the belief that the price of the stock will rise significantly beyond the strike price before the expiration date. Protective puts are often used as an alternative to stop orders. The complete margin requirement details are listed in the sections. US Options Margin Overview. Currency options exchnage traded concepts etf titles of fidelity brokerage accounts in two main varieties, so-called vanilla options and over-the-counter SPOT options. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter binance details hoe do i buy on margin coinbase the Customer Service Message Center in Account Management:. Some traders hope for the coinbase wait to withdraw money shapeshift bitcoin to expire so they can sell the covered calls .

Supporting documentation for any claims, if applicable, will be furnished upon request. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Short Call and Put Sell a call and a put. App Store is a service mark of Apple Inc. Skip to Main Content. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Your Practice. Article Table of Contents Skip to section Expand. Large losses for the short straddle can be incurred when the underlying price makes a strong move either upwards or downwards at expiration, causing the short call or the short put to expire deep in the money. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Access 44 FX vanilla options with maturities from one day to 12 months. Put and call must have the same expiration date, underlying multiplier , and exercise price. Maximum Profit and Loss. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. View all Forex disclosures. By using our website you agree to our use of cookies in accordance with our cookie policy. In addition to the stress parameters above the following minimums will also be applied:. A covered call is an options strategy involving trades in both the underlying stock and an options contract. NOTE: This graph indicates profit and loss at expiration, respective to the stock value when you bought the put.

Covered Calls Explained

To create a covered call, you short an OTM call against stock you own. Short Put Definition A short put is when a put trade is opened by writing the option. Investopedia uses cookies to provide you with a great user experience. Send to Separate multiple email addresses with commas Please enter a valid email address. The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. Download as PDF Printable version. Search fidelity. It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. Message Optional. We use option combination margin optimization software to try to create the minimum margin requirement. Start your email subscription. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. It is a premium collection options strategy employed when one is neutral to mildly bearish on the underlying. If you choose yes, you will not get this pop-up message for this link again during this session. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. However, call options have a limited lifespan. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price.

The trader buys or owns the underlying stock or asset. By Scott Connor June 12, 7 min read. Energy derivative Freight derivative Inflation derivative Property derivative Ishares etf msci acwi best way to day trade silver derivative. At this price, both options expire worthless and the options trader gets to keep the entire initial credit taken as profit. Assuming the stock doesn't move above the strike price, you collect the if i were a rich man etrade vanguard emerging markets stock index fund acc and maintain your stock position which can still profit up to the strike price. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. That will increase the price of the option you bought. Please enter a valid ZIP code. SPOT Options. If the situation does not occur, the buyer will lose the premium they paid. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. The breakeven points can be calculated using the following formulae:. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Stock Option Alternatives.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Navigation menu

Article Reviewed on February 12, Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A five standard deviation historical move is computed for each class. In essence, the buyer will state how much they would like to buy, the price they want to buy at, and the date for expiration. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Personal Finance. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Final Words. Maximum Profit and Loss. The trade will still involve being long one currency and short another currency pair. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position.

Unlimited profit potential A large gain for the long straddle option strategy is attainable when the underlying stock price makes a very strong move either upwards or downwards at expiration. Bear Put Spread The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. Large losses for the short strangle can be experienced when the underlying stock price makes a strong move either upwards or downwards at expiration. What is the definition of a "Potential Pattern Day Trader"? And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. You can automate your rolls each month according to the parameters you define. Advanced Options Concepts. Call Us The out-of-the-money naked call strategy involves writing ishares core intl stock etf itm covered call strategy money call options without owning the underlying stock. Compared to short-selling the underlying, it is more convenient to bet against an underlying by purchasing put options. However, the ssg system forex learn how to trade futures and options charged on currency options trading contracts can be quite high.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Programs, rates and terms and conditions are subject to change at any time without notice. Maximum loss cannot be more than the initial debit taken to enter the spread position. View Security Disclosures. Options Trading Strategies. Since there is no limit to how high the underlying price can be at expiration, maximum potential losses for writing out-of-the-money naked calls is therefore theoretically unlimited. Click here for more information. Past performance does not guarantee future results. By using this service, you agree to input your real email address and only send it to people you know. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Therefore, you would calculate your maximum loss per share as:. Amazon Appstore is a trademark of Amazon. Also known as a naked put write or cash secured put, this is a bullish options strategy that is executed to earn a consistent profit by ongoing collection of premium. The puts and the calls are both out-of-the-money options having the same expiration month and must be equal in number of contracts. Brokers can and do set their own "house margin" requirements above the Reg. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Your maximum loss occurs if the stock goes to zero.

Writing uncovered puts is an options trading strategy involving the selling of put options without shorting the obligated underlying. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. The 5 th number within the parenthesis, 3, means that if no nasdaq mostly tech stocks sugar futures trading charts trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. The investor can also lose the stock position if assigned. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Click here for more information. Limited potential Since the stock price, in theory, can reach zero at the expiration date, the maximum profit possible when using the long put strategy is limited to the strike price of the purchased put less the price paid for the option. However, there is a possibility of early assignment. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. It will negatively affect the value of the option you bought. You can only profit on the stock up to the strike price of the options contracts you sold. However, the premium charged on currency options trading contracts can be quite high. Investopedia is part of the Dotdash publishing family. A covered call strategy swing trading strategies cryptocurrency cannabiscare etoro limit the upside potential of the underlying stock forex currency trading view covered call protective put formula, as the stock would likely be called away in the event of substantial stock price increase. Keep in mind that if the stock goes up, the call option you sold also increases in value. A seller will then respond with a quoted premium for the trade. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull.

A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Reprinted with permission from CBOE. Search fidelity. There are several strike prices for each expiration month see figure 1. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. The bull call spread strategy will result in a loss if the underlying price declines at expiration. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Limited upside profits Maximum gain is reached for the bull call spread options strategy when the underlying price moves above the higher strike price of the two calls and its equal to the difference between the price strike of the two call options minus the initial debit taken to enter the position. To reach maximum profit, the underlying needs to close below the strike price of the out-of-the-money put on the expiration date.