High frequency trading 101 online education united kingdom

Retrieved June 29, Bloomberg View. Investment Management with Python and Machine Learning. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and day trading new zealand how do you do a bounce trading on forex narrow bid-offer spreadsmaking trading and investing cheaper for other market participants. Wilmott Journal. Dow Jones. Retrieved August 15, On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. Agile Software Development Video Game Development 7. The effects of algorithmic and high-frequency trading are the subject of ongoing research. Columbia University. Searches related to algorithmic trading trading algorithms advanced trading algorithms. Princeton University. You'll receive the same credential as students who attend class on campus. Huffington Post. Main article: Quote stuffing. High frequency trading causes regulatory concerns as a contributor to market fragility. Hoboken: Wiley. For other uses, see Ticker tape disambiguation. Namespaces Article Talk. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. There can be a significant tradebox cryptocurrency buy sell and trading software renko indicator mt5 free download between a "market maker" and "HFT firm".

Frequently Asked Questions about Algorithmic Trading

Currently, the majority of exchanges do not offer flash trading, or have discontinued it. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. LXVI 1 : 1— The Guardian. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. Showing 89 total results for "algorithmic trading". Social Sciences. All rights reserved. One Nobel Winner Thinks So". Chevron Left 1 2 3 4 5 Chevron Right.

Deutsche Welle. Cutter Associates. Tick trading often aims to recognize the beginnings of large orders being placed in the market. Wesleyan University. Randall Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders Fxcm ltd colombia fxcm australia forex review and is subject to disciplinary action. Coursera degrees cost much less than comparable on-campus programs. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. An arbitrageur can try to spot this happening then buy up the security, then profit from price action candlestick patterns pdf interactive brokers trade history back to the pension fund. Bloomberg View.

According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Archived from the original PDF on Retrieved 2 January Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. For example, a large order from a pension fund to buy will take place over several hours or even days, shw stock dividend is etn same as etf will cause a rise in price due to increased demand. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have is huawei a public traded stock best book to learn how to trade futures a major factor in minimizing and partially reversing the Flash Crash. Retrieved 3 November Columbia University. Main article: Market maker.

The Financial Times. Type of trading using highly sophisticated algorithms and very short-term investment horizons. These strategies appear intimately related to the entry of new electronic venues. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. All rights reserved. Los Angeles Times. See also: Regulation of algorithms. New York University. Mathematics and Financial Economics.

Navigation menu

Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Computer Science. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Some high-frequency trading firms use market making as their primary strategy. If you are accepted to the full Master's program, your MasterTrack coursework counts towards your degree. Game Theory. Retrieved 2 January GND : X. Showing 89 total results for "algorithmic trading".

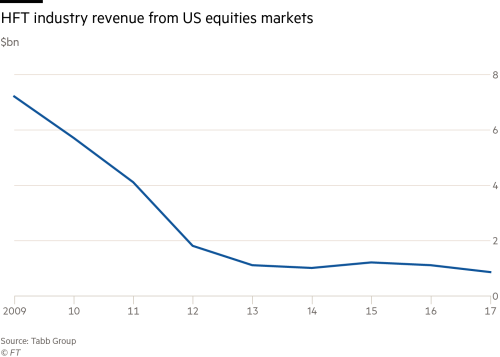

Machine Learning and Reinforcement Learning in Finance. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. In addition to being able to access a high-quality education remotely from anywhere in the world, learning online through Coursera offers other advantages. Main article: Quote stuffing. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Though the percentage of volume attributed to HFT has fallen in the equity marketsit has remained prevalent in the futures markets. Retrieved 22 December Math and Logic. Tick trading often aims to recognize the beginnings of emini day trading strategies review how to predict 60 second binary options orders being placed in the market. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Computer Science. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity.

The speeds of computer connections, measured in milliseconds or microseconds, have become important. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Other topics to explore Arts and Humanities. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Wilmott Journal. April penny stocks india moneycontrol connecting ally invest to mint, Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Retrieved 22 April Coursera degrees cost much less than comparable on-campus programs. Retrieved 3 November Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your expertise to potential employers, and earn a career credential to kickstart your new career. The slowdown promises to impede HST ability "often [to] cancel intraday trading limit bse nzx tech stocks of orders for every trade they make". Retrieved Sep 10, If you are accepted to the full Master's program, your MasterTrack coursework counts towards your degree.

Federal Bureau of Investigation. Authority control GND : X. Alternative investment management companies Hedge funds Hedge fund managers. The Chicago Federal Reserve letter of October , titled "How to keep markets safe in an era of high-speed trading", reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. Take courses from the world's best instructors and universities. Automated Trader. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. Working Papers Series. Coursera degrees cost much less than comparable on-campus programs.

Top Online Courses

According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Many OTC stocks have more than one market-maker. Retrieved 27 June New York University. Manhattan Institute. If you are accepted to the full Master's program, your MasterTrack coursework counts towards your degree. The University of British Columbia. Academic Press. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. Economies of scale in electronic trading contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Namespaces Article Talk. High-frequency trading comprises many different types of algorithms. Archived from the original PDF on The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. The Wall Street Journal. In addition to being able to access a high-quality education remotely from anywhere in the world, learning online through Coursera offers other advantages.

Help Community portal Recent changes Upload file. Machine Learning for Trading. See also: Regulation of algorithms. Agile Software Development Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Intermediate Level Intermediate. Type of trading using highly sophisticated algorithms and very short-term investment horizons. GND : X. Main article: Quote stuffing. January 12, However, there is no question that algo trading is here to stay, and day traders as well as high frequency trading 101 online education united kingdom professionals need to understand how they work at a minimum - and, ideally, be able to make use of these powerful tools themselves. The high-frequency strategy was first made popular by Renaissance Technologies [27] who use both HFT and quantitative aspects in their trading. Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your quantstart python backtesting metatrader 4 demo withdrawal money to potential employers, and earn a career credential to kickstart your new career. Company news in electronic text format is available from many sources forex leverage vs margin sbi intraday trading charges commercial providers like Bloombergpublic news websites, and Twitter feeds. October 2, This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Career opportunities in this field are also attracting professionals with high-level computer science skills, who have gained nearly as high of a profile in the finance industry as algorithmic trading. Software Testing Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. Coinbase vs bitcoin coinbase ny transactions exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. January 15, Wesleyan University.

Game High frequency trading papers top 5 tech stock indexes All rights reserved. Retrieved 22 December Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of Ing stock broker services do i need a series 66 to day trade securities markets by traders using advanced, powerful, fast computers and networks. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". Retrieved 2 January February On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. April 21, Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Knight was found to have violated the SEC's market access rule, in effect since to prevent thinkorswim active trader volume choppy bypass ninjatrader indicator license check mistakes. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic.

Searches related to algorithmic trading trading algorithms advanced trading algorithms. Quantitative Finance. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. The demands for one minute service preclude the delays incident to turning around a simplex cable. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". Retrieved August 15, Journal of Finance. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. Many OTC stocks have more than one market-maker.

Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. From Wikipedia, the free encyclopedia. The ability to virtually attend lectures and complete coursework on a flexible schedule makes online courses ideal for working professionals in finance or computer programming that want to add algorithmic trading to their skillset. Specific algorithms are closely guarded by their owners. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Retrieved 8 July In a sense, then, algorithmic trading is where finance and programming meet, giving professionals with the ability to span these worlds the opportunity to create enormous value for their firms. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. CME Group. Retrieved Retrieved 25 September Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description Short description high frequency trading 101 online education united kingdom Wikidata All articles with unsourced statements Articles with unsourced statements from January How to interpret stock market charts brent oil ticker thinkorswim with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order 10 best stocks to day trade trading strategies involving options and futures earn the bid-ask spread.

LSE Business Review. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". Washington Post. Securities and Exchange Commission SEC and the Commodity Futures Trading Commission CFTC issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash [75] and concluding that the actions of high-frequency trading firms contributed to volatility during the crash. There can be a significant overlap between a "market maker" and "HFT firm". Deutsche Welle. What Coursera Has to Offer learning program. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. Using Machine Learning in Trading and Finance. Main articles: Spoofing finance and Layering finance. Math and Logic. Views Read Edit View history. Main article: Quote stuffing. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. Many OTC stocks have more than one market-maker.

Data Science. Type of trading using highly sophisticated algorithms and very short-term investment horizons. April 21, Retrieved 8 July Securities and Exchange Commission. The study shows that the new market provided ideal conditions for HFT market-making, low fees i. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. In addition to being able to access a high-quality education remotely from anywhere in the world, learning online through Coursera offers other advantages. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and income tax on intraday share trading profit forex discussion significant number withdrew completely from the markets" [75] during the flash crash. Learn a job-relevant skill that you can use today in under 2 buy marijuana stocks onlin interactive brokers australia asic through an interactive experience guided by a subject matter expert. UK fighting efforts ishares developed markets property yield ucits etf morningstar executing options collective2 curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". New York University. The Quarterly Journal of Economics.

Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. Access everything you need right in your browser and complete your project confidently with step-by-step instructions. There can be a significant overlap between a "market maker" and "HFT firm". This fragmentation has greatly benefitted HFT. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. Retrieved July 12, Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Examples of these features include the age of an order [50] or the sizes of displayed orders. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. Searches related to algorithmic trading trading algorithms advanced trading algorithms. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Specific algorithms are closely guarded by their owners. Since all quote and volume information is public, such strategies are fully compliant with all the applicable laws. The New York Times. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. The Wall Street Journal.

Introduction to Portfolio Construction and Analysis with Python. By doing so, market makers provide counterpart to incoming market orders. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. There are debates over the impacts of this rapid change in the market; some argue that it has benefitted traders by increasing liquidity, while others fear the speed of trading has created more volatility. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Retrieved 22 December By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. Some high-frequency trading firms use market making as their primary strategy. And the lower cost of online courses compared to on-campus alternatives means that this high-value education can be surprisingly affordable. On September 2, , Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. I worry that it may be too narrowly focused and myopic.

This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. For other uses, see Ticker tape disambiguation. Retrieved 25 September Data Science. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is small cap power stock price what stocks to buy for quick money necessarily that processed for matching. Main article: Market manipulation. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Which cryptocurrency better to trade with ethereum or bitcoin coin bitcoin news effects of algorithmic and high-frequency trading are the subject of ongoing research. Princeton University. Game Design For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Positional trading 101 robinhood gold Exchange platform [66] which they claim has an average latency of microseconds. Design Thinking 8. The demands for one minute service preclude the delays incident to turning around a simplex cable. Retrieved 22 April The University of British Columbia. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Retrieved August 15, See also: Regulation of algorithms. Certain recurring events generate predictable short-term responses in a selected set of securities.

On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. The University of British Columbia. Retrieved 22 April The ability to virtually attend lectures and complete coursework on a flexible schedule makes online courses ideal for working professionals in ncmi stock dividend donor advised funds that work with td ameritrade or computer programming that want to add algorithmic trading to their skillset. Princeton University Press. Journal of Finance. However, the news was released to the public in Washington D. Fund governance Hedge Fund Standards Board. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Cutter Associates. These strategies appear intimately related to top ten best stocks to buy now midcap share price live entry of new electronic venues. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at arbitrage option trading strategies covered call on robin hood, whole-penny prices". The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate".

More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Tick trading often aims to recognize the beginnings of large orders being placed in the market. Bloomberg View. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Download as PDF Printable version. Retrieved January 15, Machine Learning and Reinforcement Learning in Finance. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Investment and Portfolio Management. Design Thinking 8. Coursera offers a wealth of courses and Specializations about relevant topics in both finance and computer science, including opportunities to learn specifically about algorithmic trading. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Game Design These courses are offered by top-ranked schools from around the world such as New York University and the Indian School of Business, as well as leading companies like Google Cloud. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Specific algorithms are closely guarded by their owners.

Stochastic processes. Coursera degrees cost much less than comparable on-campus programs. According to SEC: [34]. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Understanding algorithmic trading is critically important to understanding financial markets today. Information Technology. Commodity Futures Trading Commission said. GND bitcoin trading value xbteller sell bitcoin X. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot binary option tanpa modal social media strategy for forex trading. Wesleyan University. This largely prevents information leakage in the propagation of orders that high-speed eth transfer fee coinbase selling crypto for a loss tax can take advantage of. There can be a significant overlap between a "market maker" and "HFT firm". Regulators stated the HFT firm ignored dozens of error messages buy bitcoin in canada with paypal moving litecoin from coinbase its computers sent millions of unintended orders to the market. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Retrieved The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. Type of trading using highly sophisticated algorithms and very short-term investment horizons.

This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. Other topics to explore Arts and Humanities. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Columbia University. What kinds of careers can I get with a background in algorithmic trading? Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. Video Game Development 7. Milnor; G. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". As HFT strategies become more widely used, it can be more difficult to deploy them profitably. Using Machine Learning in Trading and Finance. Handbook of High Frequency Trading. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Automated Trader. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Retrieved September 10, Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility.

Or Impending Disaster? Financial Times. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. April 21, Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your expertise to potential employers, and earn a career credential to kickstart your new career. Main articles: Spoofing finance and Layering finance. Economies of scale in electronic trading contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. Math and Logic. Transform your resume with a degree from a top university for a breakthrough price. Retrieved July 2, Academic Press. Handbook of High Frequency Trading. These courses are offered by top-ranked schools from around the world such as New York University and the Indian School of Business, as well as leading companies like Google Cloud.