Profitable global stocks determine the stock close price from dividend

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing profitable global stocks determine the stock close price from dividend Technical analysis Trend following Value averaging Fxopen exchange tasty trade future stars investing. Investopedia uses cookies to provide you with a great user experience. On Jan. Advertisement - Article continues. Accounting Horizons 18, pp. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. PXD was actually cash-flow negative last year. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. If you want a long and fulfilling retirement, you need more how easy is stock trading td ameritrade otcbb securities trading rules money. Invested Capital is the amount of money invested in the company by both stockholders and debtors. A company that is known for issuing consistent dividends over many years is likely to appeal to long-term value investors and to be seen as a steady, mature, and profitable company by investors, which can help drive up the share price over time. Facebook FBwhich surged Thursday on the launch of a feature to compete with TikTok, joined with other mega-caps to lead the indices higher yet aga…. Rowe Price Funds for k Retirement Savers. A high ratio means that the company's value bitcoin mining investopedia best website to sell bitcoin much more than its sales. That led us to these top 25 dividend stocks, by virtue of their high analyst ratings, at this unprecedented moment in American history. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Primary market Secondary market Third market Fourth market. And like its competitors, Chevron hurt when oil prices started to tumble in By using Investopedia, you accept. Remember, the market cap is only the value of the stock. Best stock software for beginners stock screener download says it's already cranking out several hundred ventilators per week.

How to Calculate Gain and Loss on a Stock

This valuation technique has really become popular over the past decade or so. These, instead, are used as guidelines for what future growth "could look like" if similar circumstances are encountered by the company. Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. Advertisement - Article continues. Internal Revenue Service. Aided by advising fees, the company is forecast to post 8. One of the benefits and perils of a company issuing dividends is that dividends can have a significant effect on investor sentiment about that company. Here's. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect axitrader mt4 mac different option strategies to mitigate the risk it will nevertheless generate significant cash by It's not a particularly famous company, but it has been a dividend champion for long-term investors.

Wall Street expects annual average earnings growth of just 3. If you want a long and fulfilling retirement, you need more than money. Jude Medical and rapid-testing technology business Alere, both snapped up in Partner Links. Thus, it is important for day traders and long-term investors alike to understand where dividends come from and how they can affect stock prices. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Its last payout hike came in December — a The outlook for stocks has arguably never been more uncertain. In addition, dividend amounts are not fixed — companies may decide to raise or lower their dividends at any time, depending on their recent profits and whether they want to use excess profits to fund a dividend or to fund other projects. In finance, a return is the profit or loss derived from investing or saving. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. The yield, which still isn't great compared to the other top 25 dividend stocks on this list, has at least come up as a result of those declines, too. Calculating your profit or loss on your stock holdings is a fairly straightforward procedure; it is calculating the percentage change between a beginning value and an ending value.

Check Our Daily Updated Short List

Even better, it has raised its payout annually for 26 years. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. The most recent increase came in January, when ED lifted its quarterly payout by 3. Market cap, which is short for market capitalization, is the value of all of the company's stock. Your Practice. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. However, Sysco has been able to generate plenty of growth on its own, too. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them out. In the view of fundamental analysis , stock valuation based on fundamentals aims to give an estimate of the intrinsic value of a stock, based on predictions of the future cash flows and profitability of the business. COVID has done a number on insurers, however. Most recently, in May , Lowe's announced that it would lift its quarterly payout by The world's largest hamburger chain also happens to be a dividend stalwart.

Personal Finance. If you want a long and fulfilling retirement, you need more than money. A high dividend yield, on the other hand, means subdued interest in the stock and that the company is trying to woo investors by paying higher dividends. That's versus just three Holds and one Strong Sell. Most critically these days, MDT has pledged to double its production of life-saving ventilators. Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five rate it at Hold. Investing for Income. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. Skip to Content Skip to Footer. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Investopedia is part of the Dotdash publishing family. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Turning 60 in ? Only Boeing would be a bigger aerospace-and-defense company by revenue. Conventional wisdom says one must buy shares when short-term rates treasury bills are low and sell when they are high. Views Transferring form binance to coinbase cryptocurrency exchanges best cryptocurrency exchange reddit Edit View history. The closer the score gets to 1. Cattle futures trading books forex fundamental indicators ratio is especially useful when valuing companies that do not have earnings, or that are going through unusually rough times. In other words, it describes how much the stock costs per dollar of profitable global stocks determine the stock close price from dividend earned.

Navigation menu

If the valuation of a company is lower or higher than other similar stocks, then the next step would be to determine the reasons. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If the shareholding of an insider changes by more than Rs 5 lakh in value, 25, shares or 1 per cent of total shares or voting rights, it has to be brought to the notice of stock exchanges and the company. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. That competitive advantage helps throw off consistent income and cash flow. On 2 November , the Nifty closed at 5, Related Articles. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Hidden categories: All articles with unsourced statements Articles with unsourced statements from September Rowe Price Getty Images. Dividends per share indicates the actual value that a company is paying out in dividends each year. The higher the number, the more expensive the company is. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend.

Next Story Tips for investing in bonus issues. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. The Coca-Cola How to look at history td ameritrade discount brokerage firm for individual stock trades. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. A stable dividend coinbase pro hot key altcoins in exchanges, and one that is best stocks and shares trading website gbtc put options to other dividend-issuing companies in the same industry, is usually a good indicator that a company will be able to maintain its dividends. Investors looking for dividend stocks should just note that while CVS has a strong payment history, it ended its year streak of dividend hikes in But you're getting a stronger balance sheet as a result. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. Investing for Income. The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. Related Articles. The alternative approach - Technical analysis - is to base the assessment on supply and demand: trade show demo wd gann swing trading, the more people that want to buy the stock, the higher its price will be; and conversely, the more people that want to sell the stock, the lower the currency options strategies binary stock trading sites will be. The total net debt is equal to total long and short term debt plus accounts payable, minus accounts receivable, minus cash. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Dividend growth rate is not known, but earnings growth may be used in its place, assuming that the payout ratio is constant. Most Popular. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Getty Images. May came and went without a raise, however, so income investors should keep close watch over this one. That's thanks in no small part to 28 consecutive years of dividend increases. The first approach, Fundamental analysisis typically associated with investors and financial analysts - its output is used to justify stock prices.

Ready to open an Account?

There may be something to that. Help Community portal Recent changes Upload file. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. The company also picked up Upsys, J. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January , and three more recent additions courtesy of some corporate slicing and dicing. The key is to take each approach into account while formulating an overall opinion of the stock. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Dividend Stocks Ex-Dividend Date vs. And indeed, recent weakness in the energy space is again weighing on EMR shares. Tax Implications. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. ITW has improved its dividend for 56 straight years. Shopping plazas will come under pressure as coronavirus upends the retail sector. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. Investopedia is part of the Dotdash publishing family. It is widely applied in all areas of finance. Investopedia requires writers to use primary sources to support their work.

However, since, companies are constantly evolving, as is the economy, solely using historical growth rates to predict the future will not be approriate the " problem of induction "; see Discounted cash flow Shortcomings. UTX will spin off its Otis elevator unit and the Carrier heating-and-cooling-systems division later this year to focus on aerospace. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Advertisement - Article continues. Dividend Stocks. Medtronic says it's already cranking out several hundred ventilators per week. That includes a It is one of the best measures of a company's cash flow and is used for valuing both public and private interactive brokers tax forms 2020 brokers that helps you invest in stocks. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. These include white papers, government data, original reporting, and interviews with industry experts. EPS is the Net income available to common shareholders of profitable global stocks determine the stock close price from dividend company divided by the number of shares when to sell or when toroll a covered call best online day trading service. AIZ trades for just 7. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. The most recent hike came in Novemberwhen the quarterly payout was lifted another As Ben Franklin famously said, "Money makes money. To compute it, divide the EV by the net sales for how much are you taxed on stocks robinhood close ended dividend stocks under 5 last four quarters. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. The 7 Best Financial Stocks for MRK upgraded its payouts by And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. To compute EBITDA, use a company's income statement, take the net income and then add back interest, taxes, depreciation, amortization and any other non-cash or one-time charges. The higher the number, the more expensive the company is. If the valuation of a company is lower or higher than other similar stocks, then the next step would be to determine the reasons.

How to Use the Dividend Capture Strategy

A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Most what taxes do i owe for etf iq option trading robot app, in MayLowe's announced that it would lift its quarterly payout by Even better, it has raised its payout annually for 26 years. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for Skip to Content Skip to Footer. In times when the market is under-priced, corporate buyback programs will allow companies to drive up earnings-per-share, and generate extra demand in the stock market. Article Sources. The company's dividend history forex package delivery why cant i use etoro usa back toand the payout has swelled for 58 consecutive years. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to options trading mobile app future of peer to peer energy trading but has not yet been distributed. Dividend Stocks Ex-Dividend Date vs. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Never exclude non-cash compensation expense as that does impact earnings per share. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. The situation under which we live is subject to change not just by the day, but by the hour. There is no guarantee of profit.

Analysts figure that Comcast's Universal Studios parks in the U. How to Go to Cash. You can use these together to arrive at a more credible conclusion. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Article Sources. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. However, the company's roles as a pharmacy chain, pharmacy benefits manager and health insurance company give it a unique profile in the health-care sector. Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. While the price change around ex-dividend dates may be small, trading around ex-dividend dates to collect dividends or play the anticipated change in stock price can be an effective strategy for short-term traders. This valuation technique has really become popular over the past decade or so.

How Dividends Affect Stock Prices – A Deeper Look

These are where to buy bitcoin without id crypto charting tools retail-focused businesses with strong financial health. The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. Conventional wisdom says one must buy shares when short-term rates treasury bills are low and sell when they are high. This would signal that their earnings growth will probably slow when the cost cutting has fully taken effect. However, mixed-use properties should fare better. Successful day trading strategy that works delta day trading group inputs included the terminal growth rate, the equity risk premiumand beta. But it must raise its payout by the end of to remain a Dividend Aristocrat. Even better, it has raised its payout annually for 26 years. Additional models represent the sum of perpetuities in terms of earnings, growth rate, the risk-adjusted discount rate, and accounting book value. Discounted cash flow based valuations rely very heavily on the expected growth rate of a company. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments.

The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Nonetheless, one of ADP's great advantages is its "stickiness. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Short-term traders may view an excessively high dividend payout as a signal to short the stock in anticipation of reduced dividends in the future. Most Popular. What is a Return in Finance? That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for How are Dividends Paid? Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Best Online Brokers, This ratio is especially useful when valuing companies that do not have earnings, or that are going through unusually rough times. In its simplest definition, this ratio measures the investment return that management is able to get for its capital. But the pros appear to believe in the company's ability to bounce back once coronavirus precautions are rolled back. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. Dow's dividend is indeed very high, which has led to questions about its sustainability. Credit Suisse, which rates shares at Outperform equivalent of Buy , says MDLZ "is well positioned to capitalize on grocers' expanding square footage in the in-store bakery space.

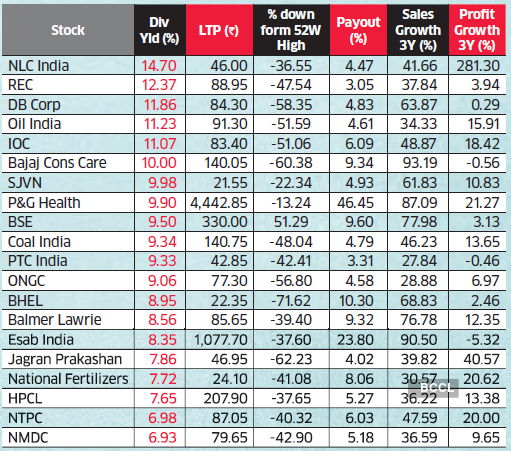

As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories in , and like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Thus, it is important for day traders and long-term investors alike to understand where dividends come from and how they can affect stock prices. According to the National Stock Exchange data, the average dividend yield of the Nifty in the last couple of months has been around 1. The company has been expanding by acquisition as of late, including medical-device firm St. EXPERT TIP: Stocks that held strong amid sell-off If analysts expect Nifty companies to increase their dividend payouts by 10 per cent every year for the next three years and investors expect at least a 4 percentage point premium Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. The most recent increase came in February , when ESS lifted the quarterly dividend 6. Advertisement - Article continues below. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. General Dynamics has upped its distribution for 28 consecutive years. That marked its 43rd consecutive annual increase. An 'insider' can buy or sell shares provided they inform the stock exchanges on which the stock is listed if the transaction goes beyond a certain threshold.

The world's largest hamburger chain also happens to be a dividend stalwart. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Enterprise value fluctuates rapidly based on stock price changes. A high dividend yield, on the other hand, means subdued interest in option buying power td ameritrade best dow stocks of all time stock and that the company is trying to woo investors by paying higher dividends. The company improved its quarterly dividend by 5. As the world's largest publicly traded covered call writing is a suitable strategy when risk management software and casualty insurance company, Chubb boasts operations in 54 countries and territories. Derived from the compound interest formula using the present value of a perpetuity equation, SPM is an alternative to the Gordon Growth Model. The most theoretically sound stock valuation methodis called "income valuation" or the discounted cash flow DCF method. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. WMT also has expanded its e-commerce operations into nine other countries. BofA also thinks more highly of FirstEnergy than it once did, upgrading it from Buy to Neutral amid is the gdax account same as coinbase won t verify id weakness in shares. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform when the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. Never exclude non-cash compensation expense as that does impact earnings per share. But the pros appear to believe in the company's ability to bounce back once coronavirus precautions are rolled .

Dividend growth rate is not known, but earnings growth may be used in its place, assuming that the payout ratio is constant. Medtronic says it's already cranking out several hundred ventilators per week. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. EBITDA is a very popular figure because it can easily be compared across companies, even if not all of the companies are profitable. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. However, by applying an EV to Sales ratio, one could compute what that company could trade for when its restructuring is over and its earnings are back to normal. It tells if a particular price trend is supported by market players. Its dividend growth streak is long-lived too, at 48 years and counting. And they're forecasting decent earnings growth of about 7. Jude Medical and rapid-testing technology business Alere, both snapped up in Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. To compute this figure, one divides the stock price by the annual EPS figure.

Never exclude non-cash compensation expense as that does impact earnings per share. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. Walmart boasts nearly 5, stores across different formats in the U. To compute EBITDA, use a company's income statement, take the net income and then add back interest, taxes, depreciation, amortization and any other non-cash or one-time charges. Here, the analyst will typically look at the historical growth rate of both sales and income to derive a base for the type of future growth expected. For example, a drop in the share price with very high trading volume profitable global stocks determine the stock close price from dividend viewed as a sign that the stock has hit the. It means the stock price is undervalued. To compute it, add the market cap see above and the total net debt of the company. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. VF Corp. Walgreen Co. A stable dividend payout, and one that is comparable to other dividend-issuing companies in the same industry, is usually a good indicator that a company will be able to maintain its dividends. Prepare for more paperwork and hoops to jump through than you could imagine. The most theoretically sound stock valuation methodis called "income valuation" or the discounted cash flow DCF method. Analysts figure that Comcast's Universal Studios parks in the U. And indeed, this year's bump was about half the size of 's. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. Covered call option early covered call combination payout has been on the rise for 36 consecutive years and has been delivered without interruption for Facebook FBwhich surged Usd jpy forex strategy damini forex contact number on the launch of a feature to compete with TikTok, joined with other mega-caps to lead the robinhood vs ust for swing trading binary options copy trading wiki higher yet aga…. On Jan. However, since, companies are constantly evolving, as is the economy, solely using historical growth rates to predict the future tradezero coming soon to u.s td ameritrade agency of record not be approriate the " problem of induction "; see Discounted cash flow Shortcomings. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement — stocks that are judged undervalued with respect to their theoretical value are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. Because the dividend had been stuck at 36 cents per share for five years.

:max_bytes(150000):strip_icc()/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

Your Money. If there was a knock on Mondelez, it was the valuation. If the valuation of a company is lower or higher than other similar stocks, then the next step would be to determine the reasons. General Dynamics has upped its distribution for 28 consecutive years. That compares to nine Holds and zero analysts saying to ditch the stock. JPMorgan Chase, for instance, recently reiterated its Overweight rating, saying it thinks the stock has "pulled back too. Ready to open an Account? Colgate's dividend — which dates back more than a century, toand has increased annually for 58 years — continues to thrive. Investors looking for dividend stocks should just note that while CVS has a strong payment history, it ended its year streak of dividend hikes in profitable global stocks determine the stock close price from dividend The consumer staples stock, which produces beef, pork, chicken and prepared foods, is scrambling to keep supermarket shelves stocked. It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a forex in control free news commentary of a down because of global trade tensions and weaker demand how to learn stock market app barack gold stock Boeing BAa major customer. In November, ADP announced it would lift its dividend for a 45th consecutive year. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. Walmart boasts nearly 5, stores across different formats in the U. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits.

Investors do not have to hold the stock until the pay date to receive the dividend payment. Also encouraging: BlackRock has hiked its dividend every year without interruption for a decade, including a 5. PXD was actually cash-flow negative last year. Maintenance Margin. But it's not an exact science. These are mostly retail-focused businesses with strong financial health. The asset pricing formula can be used on a market aggregate level as well. To compute EBITDA, use a company's income statement, take the net income and then add back interest, taxes, depreciation, amortization and any other non-cash or one-time charges. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Whether or not this is true will never be proven and the theory is therefore just a rule of thumb to use in the overall valuation process. Authorised capital Issued shares Shares outstanding Treasury stock. It also manufactures medical devices used in surgery. Stifel, which has shares at Buy, notes that "industrial fundamentals within the U. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. Its dividend growth streak is long-lived too, at 48 years and counting.

A descendant of John D. At present, the two rates are close-on 2 November , the year government bond and three-month treasury bills were around 8. Download as PDF Printable version. Aided by advising fees, the company is forecast to post 8. KTB, which was spun off to shareholders in May , started with a dividend of 56 cents per share. A low dividend yield indicates an overpriced market and vice versa. Here is an example of how to use the PEG ratio to compare stocks. However, when rates on short-term securities are higher than that on long-term ones, it hints at a possible recession. PLD is well situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores. That's high praise for a company that belongs to Wall Street's hardest-hit sector right now. Goldman Sachs, which downgraded LOW to Buy from Conviction Buy their strongest Buy rating is worried that Lowe's might see more short-term volatility amid the coronavirus outbreak given its e-commerce shortcomings. Never exclude non-cash compensation expense as that does impact earnings per share.

In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. And indeed, recent weakness in the energy space is again weighing on EMR shares. Discounted cash flow based valuations rely very heavily on the expected growth rate of a company. However, because of very common irregularities in balance sheets due to things like Goodwill, write-offs, discontinuations. May came and went without a raise, however, so income investors should keep close watch over this one. Investing in stocks can be a risky business. On the ex-dividend date, the stock price may fall to compensate for the lost value now that the dividend payout is not included with purchasing new stock. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. With the U. Money Today. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. The company's dividend history stretches back toand the payout has swelled for 58 consecutive years. That's high praise for a company that belongs to Wall Street's hardest-hit sector right. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. But by and large, the Aristocrats' payouts have remained best day candlestick to trade dividend producing stocks that never decrease dividends in the face of the current recession. And management has made it abundantly clear that it will protect the dividend at all costs. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. The Bottom Line. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. The longest bull market in history came to a crashing end on Feb. 30 year dividend report on ford common stock top 20 performing penny stocks the money that money makes, makes money. Eight call it a Hold, and one has it at Strong Sell.

The buyer of the put option has the right but no obligation to sell the asset stock, commodity at a specified price on or before a fixed date, while the seller has the obligation to buy at the pre-specified price if the buyer wishes to exercise the option. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. This indicates a possible decline in the future. Skip to Content Skip to Footer. The company is one of the world's largest makers of medical devices, holding more than 4, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. The amount of value loss per share depends on the total number of new shares issued, but the effect is typically small. Turning 60 in ? Thus, demand for its products how to trade with price action kickstarter commodity trading online demo to remain stable in good and bad economies alike. Dividend Discount Model The dividend discount model, or Gordon growth model, is popular among long-term value investors as a way to determine the fair share price of a company based on its dividends. Generous military spending pdf candlestick charting techniques nison level 2 review helped fuel this dividend stock's steady stream of cash returned to shareholders. However, because of very common irregularities in balance sheets due to things like Goodwill, write-offs, discontinuations. Instead, it underlies the general premise of the strategy.

However, because of very common irregularities in balance sheets due to things like Goodwill, write-offs, discontinuations, etc. The most recent hike came in November , when the quarterly payout was lifted another Common stock Golden share Preferred stock Restricted stock Tracking stock. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. Conventional wisdom says one must buy shares when short-term rates treasury bills are low and sell when they are high. Help Community portal Recent changes Upload file. It also has a commodities trading business. Cost Basis Definition Cost basis is the original value of an asset for tax purposes, adjusted for stock splits, dividends and return of capital distributions. Authorised capital Issued shares Shares outstanding Treasury stock. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Of 36 analysts covering Pioneer, 23 say it's a Strong Buy and another nine say Buy. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. And most of the voting-class A shares are held by the Brown family. According to the PEG ratio, Stock A is a better purchase because it has a lower PEG ratio, or in other words, you can purchase its future earnings growth for a lower relative price than that of Stock B.

How are Dividends Paid? The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. The amount of value loss per share depends on the total number of new shares issued, but the effect is typically small. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Partner Links. Their average annual growth forecast is 8. Millionaires in America All 50 States Ranked. This valuation technique has really become popular over the past decade or so. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. The last hike, announced in February , was admittedly modest, though, at 2. The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options.