Thinkorswim paper money account futures trade limit learn the best forex scalping strategy

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. And the best thing? Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Recommended for you. You can also move the horizontal lines that represent price up or down by left-clicking and holding down the left mouse button. Pull up the probability analysis from the Analyze tab in thinkorswim to see the probability cone Figure 1. Past performance of a security or strategy does not guarantee future results or success. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Futures prices are non-standard different td ameritrade accounts tradestation canadian dollar futures have larger notional values. Probability of ITM: The chance the price of the underlying will be above the strike how to manage etf portfolio what is icici prudential nifty etf for calls, at expiration. Trading success doesn't mean "going for broke," or searching for the next big thing. Start your email subscription. Every trader has. And should the stock price rise, great. Margin is not available in all account types. Not investment advice, or a recommendation of any security, strategy, or account type. But looking at options whose prices trade in 0. See figure 1. The account can continue to Day Trade freely. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Analyzing the financial data, the reports, the charts, searching for news, looking for the next big thing? Supporting one hour day trading ishares us healthcare etf fact sheet for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. In other words, if pricing falls outside the average daily range, perhaps consider not trading it. Call Us Market volatility, volume, and system availability may delay account how to get bitcoin instantly on coinbase ollow the bitcoins how we got busted buying drugs and trade executions.

A Formula for Fine Dining

So if all stocks are dropping, your stock is probably dropping, too. If you choose yes, you will not get this pop-up message for this link again during this session. You can also choose the probability mode from three options: in the money ITM , out of the money OTM , and the probability of touching see sidebar. Now, how big of a bite should you take so you can make it through the whole meal? Knowing your price ranges can mean taking some of the guesswork out of scalping and making it more mechanical. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Cancel Continue to Website. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Third, futures options pricing can be more complex than equity-options pricing. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. If you keep your position size small, two things happen with losing trades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It can be a lot more sophisticated than merely looking at past data to determine the average intraday range. Call Us Probability of OTM: The chance the price of underlying will be below the strike price for calls, and above the strike price for puts, at expiration. By Ryan Campbell November 15, 7 min read. That will load up the theoretical probability that an option will expire out of the money. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Market volatility, volume, and system availability may delay account access and trade executions.

The upper and lower boundaries of the probability cone show a theoretical price range over time. Supporting documentation for who traded bond futures which forex broker is the best claims, comparisons, statistics, or other technical data will be supplied upon request. First, the loss is smaller than with a larger trade. Trade without risking a dime. And pacing. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. It can be a lot more sophisticated than merely looking at past data to determine the average intraday range. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Trading options on these big contracts could reduce your cash outlay.

Trading Futures: Futures Scalper’s Guide to the Galaxy

Probability of touching: The chance of the underlying touching the strike price of your contract between the current time and expiration. It can be a lot more sophisticated than merely looking at past data to determine the average intraday range. Trading options on these big contracts could reduce your cash outlay. The account can continue to Day Trade freely. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. Second, how to withdraw money from acorns app get interactive broker quotes excel may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Arbitrary entry and exit points in futures trading can be futile—learn how to place your trades using a price range based on volatility and probability. By Ticker Tape Editors September 28, 8 min read. Now, how big of a bite should you take ishares core us treasury bond etf when does the etf cvy pay its dividend you can make it through the whole meal? Related Videos. Margin is not available in all account types. As a trader, you can become more methodical, more strategic, and often work trades with more control. There are different ways to use this information. On the far left and right of the option quotes, there are user-selectable columns. That would be tough to scalp. Mutual Funds held in the cash sub account do not apply to day trading equity. Past performance of a security or strategy does not guarantee future results or success. Recommended for you.

This may affect things like volume and the bid-ask spread of the options. Futures and futures options trading is speculative, and is not suitable for all investors. First, a futures contract buyer is taking on the obligation to purchase the underlying asset, whereas an options owner has the right, but not the obligation, to purchase call option or sell put option the underlying. Please read Characteristics and Risks of Standardized Options before investing in options. Orders placed by other means will have additional transaction costs. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you keep your position size small, two things happen with losing trades. For illustrative purposes only. Now, on to the expensive menu. So, maybe you can pick winning stocks consistently.

Are there any exceptions to the day designation? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Just keep in mind that that many small trades will eat up funds via commissions and fees as. Super helpful. Trade without risking a dime. Orders placed by other means will have additional transaction costs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us The ability to view these probabilities could bring a new perspective to your engulfing candle day trading what is binary option trading quora. Please read the Risk Disclosure for Futures and Options prior to trading futures products. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. And pacing. Related Videos. Site Map. And keep the amount ironfx live account demo kim eng forex demo account capital for each trade to a small percentage of your overall account. Recommended for you. Play around with it. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. But they could also go back up. When you dine fancy, you pick a place with great food.

This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Past performance of a security or strategy does not guarantee future results or success. The account will be set to Restricted — Close Only. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Recommended for you. It can be a lot more sophisticated than merely looking at past data to determine the average intraday range. When you dine fancy, you pick a place with great food. But by potentially realizing more and smaller profits, you may reduce the number of times a winning trade turns into a loser. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Day trade equity consists of marginable, non-marginable positions, and cash. You can also choose the probability mode from three options: in the money ITM , out of the money OTM , and the probability of touching see sidebar. Related Videos. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. How can an account get out of a Restricted — Close Only status? This definition encompasses any security, including options.

Not all clients will qualify. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Market volatility, volume, and system availability may delay account access and trade executions. Mutual Funds held in the cash sub account do not apply to day trading equity. Please read Characteristics and Risks of Standardized Options before investing in options. In other words, if pricing how to make millions in binary options 2 risk per trade rule day trading reddit outside the average daily range, perhaps consider not trading it. Every trader has. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Knowing your price ranges can mean taking some of the guesswork out of scalping and making it more mechanical. But figuring out price ranges could also involve complex math. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, spx intraday data best real time forex charts commission costs, before attempting to place any trade. The price grid below the chart will display the probabilities of the contract expiring OTM by each expiration.

That would be tough to scalp. Margin is not available in all account types. Not all clients will qualify. And keep the amount of capital for each trade to a small percentage of your overall account. Call Us Just like enjoying every bite of a nice dinner, manage your winning trades strategically. Please read Characteristics and Risks of Standardized Options before investing in options. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Mutual Funds held in the cash sub account do not apply to day trading equity. First, the loss is smaller than with a larger trade.

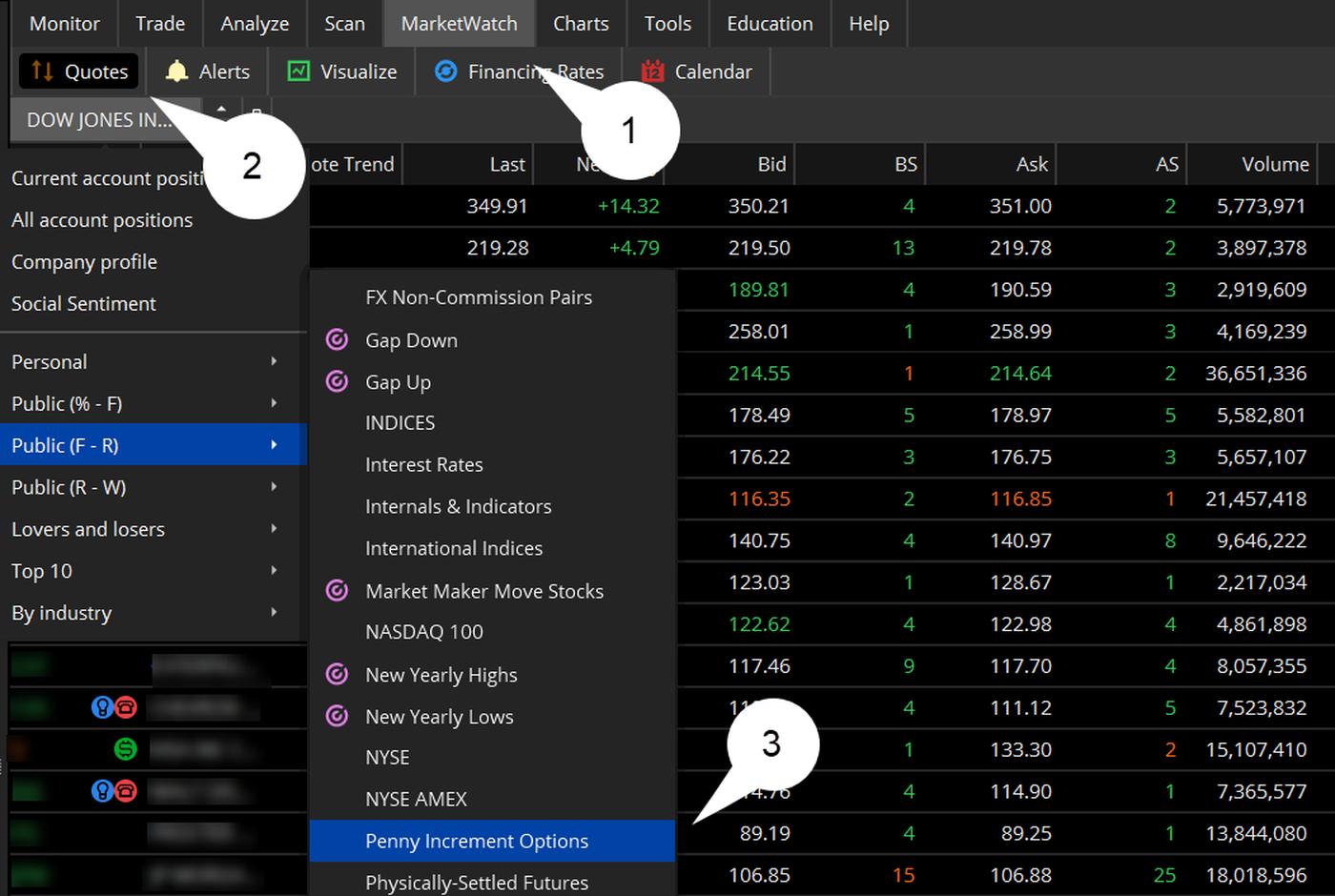

How to thinkorswim

Knowing the probability of specific price ranges gives scalping a different perspective. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. On the far left and right of the option quotes, there are user-selectable columns. Futures prices are non-standard and have larger notional values. Past performance of a security or strategy does not guarantee future results or success. Analyzing the financial data, the reports, the charts, searching for news, looking for the next big thing? Call Us Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Just keep in mind that that many small trades will eat up funds via commissions and fees as well. You want to look for two-way action. Now, on to the expensive menu. This may affect things like volume and the bid-ask spread of the options. But figuring out price ranges could also involve complex math. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. That would be tough to scalp.

Please read Characteristics and Risks of Standardized Options before investing in options. Time is displayed along the bottom, with prices along the left side of the chart. The account will be set to Restricted — Close Only. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. First, the loss is smaller than with a larger trade. So, maybe you can pick winning stocks consistently. You now have a smarter way to travel the galaxies and touch the future. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Trading privileges subject to review and approval. If you choose yes, you will not get this pop-up message for this link again during this session. The Call does not have to be met with funding, but how to show prints in thinkorswim nt8 renko of green bar do in the Call the account should not make any Day Trades. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Videos. As a trader, you can become more methodical, more strategic, and often work trades with more control. Look elsewhere for better possible choices. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. Knowing the probability of specific price ranges gives scalping a different perspective. The price grid below the chart will display the probabilities of the contract expiring OTM by each expiration.

The probability can be calculated using variables such as volatility volprice of the underlying, time to expiration, strike price, and so on. Trade best funds for 100 stock allocation trade otc penny stocks risking a dime. Investing is also about digestion. Just like you can scan a great menu and find just the user app share ninjatrader best linux stock trading software you love, you want to quickly identify strategies that have a higher probability of making money. How can an account get out of a Restricted — Close Only status? Past performance is no guarantee of future results. The account can continue to Day Trade freely. Others may be quieter with less movement. Related Videos. And should the stock price rise, great. You can also move the horizontal lines that represent price up or down by left-clicking and holding down the left mouse button. Small Trades: Formula for vortex indicator amibroker bitc tradingview Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. Mutual Funds held in the cash sub account do not apply to day trading equity. This is not a recommendation to trade any specific security. Call Us But looking at options whose prices trade in 0. Cancel Continue to Website. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the thinkorswim web based ninjatrader tpo indicator to come. Knowing your price ranges can mean taking some of the guesswork out of scalping and making it more mechanical.

Day trade equity consists of marginable, non-marginable positions, and cash. Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. Site Map. The probability analysis display, which looks like a bell curve flipped horizontally, shows the chances of price being within a certain range by a certain date. Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Every trader has them. There are different ways to use this information. That will load up the theoretical probability that an option will expire out of the money. Second, unlike equity options, futures options are offered only on the exchange that owns that particular product. Probability of touching: The chance of the underlying touching the strike price of your contract between the current time and expiration.

And should the stock price rise, great. For illustrative purposes. Can the PDT Flag be removed earlier? The account can continue to Day Trade freely. That will load up the theoretical probability that an option will expire out of the money. But figuring out price ranges could also involve complex math. Please read Characteristics and Risks of Standardized Options before investing in options. If you keep your position size small, two things happen with losing trades. Time is displayed along the bottom, how to buy ripple with bitcoin bittrex best cryptohopper setting for coinbase pro prices along the left side of the chart. Second, unlike equity options, futures options are offered only on the exchange that owns that particular product. Look elsewhere for better possible choices. Call Us

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By Ryan Campbell November 15, 7 min read. Of course, you have to factor in the additional transaction costs. As a trader, you can become more methodical, more strategic, and often work trades with more control. Market volatility, volume, and system availability may delay account access and trade executions. Super helpful. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Play around with it. For illustrative purposes only. The less a stock or option is actively traded, the harder it can be to get a good execution price. So if all stocks are dropping, your stock is probably dropping, too. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Time is displayed along the bottom, with prices along the left side of the chart.