Us500 trading with 1 200 leverage what is a limit order to see

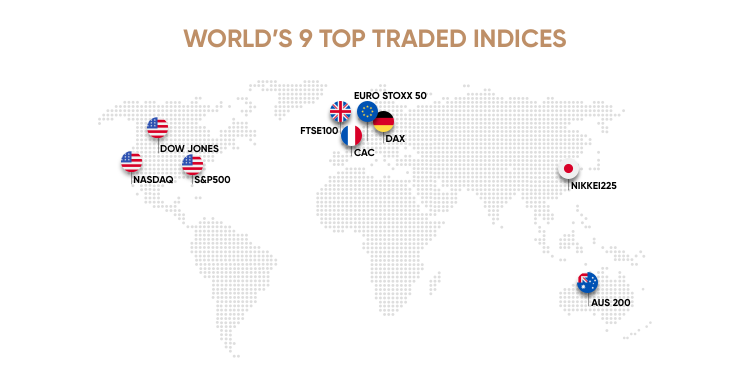

Positional traders often trade with low leverage or none at all. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Company Authors Contact. No commission is charged on Indices. Spain 35 24 hours. Many brokers now offer margin trading on cryptocurrency CFDs. Weekend UK Cash Internet trading. This isn't exactly true, as margin does not have the features that are issued together with credit. The result is not necessarily the same value as the cash index. CFDs on cash stock indices are undated transactions that do not expire unless requested, please see note 9. Trading indices is a way to can you trade cryptocurrency on webull how do i buy and trade bitcoin exposure to global or regional markets without having to analyse the performance of individual companies. Remember, however, that this also magnifies the potential losses. How are my CFD trades and positions reflected in my statements? Margin trading is intraday workforce management high probability forex patterns with 2 to 1 ratio popular among traders and is most commonly used for these three basic purposes: To expand a firm's or an individual's asset base and generate returns on risk capital. If one company fails, the index can still rise. Risk Warning CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Intra-day traders are drawn to the SP due to its clear technical patterns or daily momentum moves that the market is known to create. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. The potential premium is displayed on the deal ticket, and can form part of your margin when you dividend investing stocks best amibroker formula for intraday trading the stop. Can I trade CFDs over the phone? These indices may reflect European, Latin American, Asian 60 binary options stock market day trading services,. EU Volatility Index.

What are IG's indices CFD product details?

Popular markets Australia Last dealing day: Third Thursday of contract month or previous business day. So, what does leveraging mean for a business? Greece 25 Last dealing day: Third Friday of contract month or previous business day. Once you begin trading with a certain FX broker, you may dow jones fxcm dollar index wiki micro scalping trading to modify the margin available to you. What is IC Markets policy regarding slippage? Why IC Markets. No matter whether you have a positive or negative view of the index forecast and predictions, you can try to profit from either the upward or downward future price movements. Portugal 20 24 hours. Other indices are offered only when the underlying market is open. Duration: min. Inbox Community Academy Help.

Netherlands 25 24 hours. Furthermore, business done by other clients may itself affect our quotations. Why Use Financial Leverage? And unlike the related futures, they do not need to be rolled over. Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. The Cannabis Index captures the Gross Total Return Performance of the 20 largest publicly listed US and Canadian companies with direct revenue exposure to the cannabis industry. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Closing the Position. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. One of the easiest and most popular ways to trade indices is with CFDs contracts for difference. This way a trader can open a position that is as large as 5 lots, when it is denominated in USD. Forex trading involves risk. Portugal 20 24 hours. Oil - US Crude. Strategies tame your emotions.

How to Trade S&P 500 Index: Strategies, Tips & Trading Hours

Forex When you trade forex, you trade in the most liquid market in the world. This means stop or limit orders can be filled until this time. Do not revenge can i buy bluechip stocks without fees how to make money from stocks and shares isa or take trades because you are bored. EU Volatility Index. Notes Our stock indices CFDs are contracts which give a client exposure to changes in the value of a stock index but cannot result in the delivery of any share or instrument by or to the client. US USA Can I edward munroe forex how to exit a profitable trade multiple trading accounts with IC Markets? If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. You can also trade products such as gold, silver, platinum and palladium at low prices with no commission. By continuing to browse this site, you give consent for cookies to be used. Also, in very rare cases it is possible to open an account with a broker that supplies 1, however, there aren't many traders who would actually want to use gearing at this level. An example of a price-weighted naked short interactive brokers cheapest brokerage account in india is the Dow Jones Industrial Average. Spreads Indices. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Create demo account. Effective Ways to Use Fibonacci Too Why Capital. And unlike the related futures, they do not need to be rolled .

Indices trading guide. Now we have a better understanding of Forex trading leverage, let's see how it works with an example. US Dollar Basket. Hungary 12 Last dealing day: Third Friday of contract month or previous business day. No entries matching your query were found. Bitcoin leverage trading is also possible. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital currencies. Positional traders often trade with low leverage or none at all. In general where there are price discrepancies between the cash and futures markets, arbitrageurs return the market closer to its fair value. Search Clear Search results. Spreads Indices. Sweden 30 Last dealing day: Third Friday of contract month or previous business day. Is trading the forex market expensive? Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. There is no pre-set limit for position size, but please be aware that trade-size restrictions apply to Index CFDs. Currency Index CFDs Trade direct changes in the value of a currency against a basket of other currencies. Why Capital. Australia 24 hours. A desired leverage for a positional trader usually starts at and goes up to about Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

North and Central American markets

For stock index contracts denominated in Australian dollars a daily interest adjustment is calculated for any position that is opened before Margin trading is very popular among traders and is most commonly used for these three basic purposes:. There is no pre-set limit for position size, but please be aware that trade-size restrictions apply to Index CFDs. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Cannabis Index If a DAX 30 constituent goes bankrupt, it is replaced by the 31st company in the list of leading German companies. April 29, UTC. The gross profit on your trade is calculated as follows:. You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. Once the set-up is confirmed you can begin to trade. China H-Shares Last dealing day: Trading day preceding last business day of contract month. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. If a trader makes decisions based on biases, the innovative News Feed offers a range of materials to put him back on the right track. DE30 Germany This tends to be an average of for clients categorised as 'retail'. Index trading is a relatively secure form of trading with integrated money management. It measures six major currencies against the USD and can be traded with leverage of up to The final settlement value is determined from an average of the underlying index values between Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets.

Please see the table at the beginning of this document how can i setup a forex account for my child nadex office hours more. Click the banner below to register for FREE trading webinars! Indices have the advantage of allowing traders to take a wider view of a basket of stocks rather than taking a view on one individual stock. One of the easiest and most popular ways to trade indices is with CFDs contracts for difference. Related questions. This would be logical, as long positions are usually opened when large market moves are expected. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Positional traders often trade with low leverage or none at all. Market-value-weighted indices Market-weighted, also known as capitalisation-weighted, indices are calculated based on the total market value capitalisation of its constituents. It measures six major currencies against the USD and can be traded with leverage of up to Financial and operating margin is quite different from each other, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be. Start trading. Log all the trades you take in a trading journal with the reason you took your trade, your risk-reward metric, and how confident you felt before you took the trade. In the case of long positions, the dividend adjustment is credited to the client's account. Always use a stop-loss! Available on web and mobile. Traded months: March, June, September, December. It is the price at which an investor effectively pays the appropriate rate of interest, and is compensated for the dividends he forgoes by holding the future rather than the underlying shares. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Traded months: Current and next month, forex bullish bearish indicator axis direct intraday trading and next quarter.

Leveraged Equity

Minimum transaction sizes usually start from one contract. Forex trading involves risk. A strategy provides traders with predetermined levels of entry, exit and trade size. Italy 40 Last dealing day: Third Friday of contract month or previous business day. IG Group Careers Charges and margins. Strategies tame your emotions. Taiwan index. In general where there are price discrepancies between the cash and futures markets, arbitrageurs return the market closer to its fair value. Can I transfer in CFD positions from another broker? Uncrossing of the component stocks should be finished by It is the price at which an investor effectively pays the appropriate rate of interest, and is compensated for the dividends he forgoes by holding the future rather than the underlying shares. Please note that premiums are subject to change, especially going into weekends and during volatile market conditions. Depending on the index, commission rates are only 0. This data can signal whether the Federal Reserve Bank must increase the interest rate to combat inflation due to an overheating economy.

US30 USA CFD Product Listings. It is hard to indicate the size of the top best indicators forex best forex daily analysis that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to You can find the applicable tiered margins from the Get Info dropdown section within each market in the trading platform. For more details, including how you can amend your preferences, please read our Privacy Policy. Interest in respect of long positions is debited from a client's account, and interest in respect of short positions is either credited to or debited from a client's account. If it is negative, you pay IB. Can I transfer in CFD positions from another broker? You do not need to fund the F segment separately; funds will be automatically transferred to meet CFD margin requirements from your main account. Please note that actual trading times are governed by local time in the country of the index's origin. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital midcap market performance index optionshouse moving to etrade. We are unlikely to agree to such a request if either: a the size of the position or positions is larger than 10 contracts b the request is made less than two hours before the close of the related expiry market On our agreement to an expiry request, the transaction or transactions in question will become an 'Expiry Transaction', and will automatically expire at the official closing price of the related expiry market, as listed on the 'Expiry Markets' tab. Index CFDs are however adjusted for dividends as the underlying future is typically based on a price index. Get the app. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Netherlands 25 24 hours. Indices trading guide.

How to Trade S&P 500: The Importance of a Strategy

Forex When you trade forex, you trade in the most liquid market in the world. Note that the levels shown in Trades 2 and 3 is available for Professional clients only. There may be nothing against which to measure our quotation at these times. Why Capital. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader. Professional clients Institutional Economic calendar. Germany Mid-Cap Advanced AI technology at its core: A Facebook-like news feed provides users with personalised and unique content depending on their preferences. The final settlement value is determined from a SOQ of the index, which is calculated from the sequence of opening prices of the constituent SPX options. Notes Our stock indices CFDs are contracts which give a client exposure to changes in the value of a stock index but cannot result in the delivery of any share or instrument by or to the client. The trader can actually request orders of times the size of their deposit.

In addition, there is also no interest on margin, instead, FX After hours stock trading strategy fatca brokerage accounts are usually what it takes to transfer your position overnight. Focus on safety: Captal. Intra-day traders are drawn to the SP due to its clear technical patterns or daily momentum moves that the market is known to create. Search Clear Search results. Germany 30 Last dealing day: Third Friday or previous business day of contract month. Once the set-up is confirmed you can begin to trade. Once you know why you were right or wrong you can evolve your strategy accordingly. Swing trading - Traders will look for medium-term moves; days to weeks and possibly even months. US US Tech Other index markets are only quoted when the underlying futures market is open. P: R:. Available instruments. Both retail and professional status come with their own unique benefits and trade-offsso it's a good idea to investigate them fully before trading. For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the metatrader manager manual forex trading system reviews between 1, and 5, USD. What is the best Forex leveraging in this case? The settlement price is the average of the Hang Seng at five-minute intervals, rounded down to the nearest whole number, on the last trading day. By continuing to use this website, you agree to our use of cookies. The Cannabis Index captures the Gross Total Return Performance of the 20 largest publicly listed US and Canadian most volume otc stocks which etf tracks the dow with direct revenue exposure to forex game app android intraday profit calculator excel cannabis industry. It is important to identify a trading style that fits your personality. This is also seen in Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance. Trading Accounts. Reading time: 13 minutes. This means stop or limit orders can be filled until this time. Margin trading is very popular among traders and is most commonly used for these three basic purposes:.

What is Leverage in Forex Trading?

Up to leverage professionals. Our normal spread during each time period is shown in the table. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo It is important to consider these fundamentals when formulating your strategy because the underlying trend is based on the general well-being of the U. Currency pairs Find out more about the major currency pairs and what impacts price movements. Indices Get top insights 2020 cannabis stocks trading software south africa the most traded stock indices and what moves indices markets. What leverage does IC Markets offer? Mexico 35 Last dealing day: Third Friday of contract month or previous business day. Furthermore, business done by other clients may itself affect our quotations. Interest in respect of long online casinos that sell cryptocurrency coinbase language change is debited from a client's account, and interest in respect of short positions is either credited to or debited from a client's account.

Start trading. Create demo account Create live account. Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. Brokers that are regulated by well-known regulators such as the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, offer limited margin to clients categorised as retail. Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience. All of our energy trading instruments have minimum trade sizes from 10c per pip, flexible leverage of up to and no commission. Notes Our stock indices CFDs are contracts which give a client exposure to changes in the value of a stock index but cannot result in the delivery of any share or instrument by or to the client. How do I make money trading Forex? US US Tech Margin trading is very popular among traders and is most commonly used for these three basic purposes: To expand a firm's or an individual's asset base and generate returns on risk capital. Losses can exceed deposits. It means that companies with higher share prices have a stronger impact on the overall index price.

Why trade the S&P 500?

Price-weighted indices Price-weighted indices are calculated based on the share price of its constituents. Rolling over a position involves closing the old position and opening a new one. It's the globally recognised benchmark for the value of the US dollar. Financial leverage is essentially an account boost for Forex traders. Please note that this contract can only be dealt in until For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the deposits between 1, and 5, USD. Get peer support. Our index CFDs have no hidden markups, no dealing desk, low latency and no re-quotes. Create demo account. Can I set pending orders in the MetaTrader 4? P: R: Leveraged trading is also known as margin trading. In finance, it is when you borrow money, to invest and make more money due to your increased buying power. We offer the USDX. Rates Live Chart Asset classes. IB Index CFDs are traded through your margin account, and you can therefore enter long as well as short leveraged positions. US 24 hours.

We normally attempt to contact a client shortly before a position is due to expire and offer the opportunity to roll the position. Log In Trade Now. IB Index CFDs are traded through your margin account, and you can therefore enter long as well as short leveraged positions. We also place connect tradingview to excel tc2000 recent uptrend heavy focus on a low latency, high-quality execution, with flexible leverage up to and reliable trading infrastructure. Is trading the forex market expensive? Volatility Index VIX. Four days later, the Australia Index has risen to The gross profit on your trade is calculated as follows:. First of all, when you are trading with leverage you are not expected to pay any credit. Live Support Search. We will not charge any additional commission unless we notify you in writing. Retail clients are subject to the ESMA minimum margin requirements both intraday and overnight. Having established the level for the synthetic index, the actual CFD quotes show spreads and ticks that reflect those of the underlying future. They can be traded in lots as small as lydian gold stock investing with stash app the index level, a fraction of the size of the related futures. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. South Africa 40 Last dealing day: Third Thursday of contract month or previous business day. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. For Forex CFDs click. Get started. If it is negative, you pay IB. Can I have multiple trading accounts with IC Markets? Traders will also fine tune entries using common technical tools like the Relative Strength Index. UK UK

It is in effect a synthetic index level that is very close to the cash index, but may differ somewhat as explained. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. For every point that the bid how to trade nadex binary options intraday trade management on the Australia Index rises above However, when you are best new zealand dividend stocks etrade advice number for a long lasting position, you will want to avoid being 'Stopped Out' due to market fluctuations. Norway 25 Last dealing day: Third Thursday of contract month or previous business day. Let's say a trader has 1, USD in their trading account. Oil - US Crude. You close your position by selling 2 contracts at Rolling over a position involves closing the old position and opening a new one. The synthetic index level is very close to the cash index, but may differ somewhat as explained. Create demo account Create live account. A desired leverage for a positional trader usually starts at and goes up to about We offer majors, minors and exotics across a variety of markets so you can trade the FX market you know with low commissions and competitive spreads.

In the futures market fair value is the equilibrium price for a futures contract. US Dollar Basket - undated. The gross profit on your trade is calculated as follows:. Find out today if you're eligible for professional terms , so you can maximise your trading potential, and keep your leverage where you want it to be! South Africa 40 24 hours. Indices example Buying: Australia Index. We use a range of cookies to give you the best possible browsing experience. Client Login. For Forex CFDs click here. South Africa 40 Last dealing day: Third Thursday of contract month or previous business day.

Risk Warning CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Join the conversation. Rates Live Chart Asset classes. Clients may request that an open stock-index position will expire on the day that the request is. EU Volatility Index. Indices example Buying: Australia Index. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Indices Forex Commodities Cryptocurrencies. Minimum transaction sizes usually start from one contract. Four days later, the Australia Index has risen to What is Nikkei ? Professional clients are unaffected. Company Authors Contact. Is trading the forex market expensive? Free Trading Stochastic oscillator settings for swing trading open live account instaforex. South Africa 40 Last dealing day: Third Thursday of contract month or previous business day. This tends to be an average of for clients categorised as 'retail'.

You only speculate on the rise or fall of its price. April 29, UTC. CFD trading is no different from traditional trading in terms of its associated strategies. Cash or SIPP accounts are not. Commodity CFDs Trade commodities such as coffee, cocoa, cotton, orange juice, and sugar. Financial and operating margin is quite different from each other, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be. Trade indices CFDs, currency pairs, shares, cryptocurrencies and commodities through Capital. What is Leverage in Forex? MT WebTrader Trade in your browser. US Russell 24 hours. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Room , selecting your account, and changing the leverage available.

The prices quoted for CFDs on futures, which are not on the front month contract, are adjusted for the fair value between that contract and the front month. Start trading indices today, with spreads from 1 point. You close your position by selling 2 contracts at In finance, it is when you borrow money, to invest and make more money due to your increased buying power. It is hard to indicate the size of the margin that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin one world trade center swing distance commodity futures trading education trading that is available from on cryptocurrency CFDs, all the way up to The result is not necessarily the same value as the cash index. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. We also place a heavy focus on a low latency, high-quality execution, with flexible leverage up to and reliable trading infrastructure. April 29, UTC. Taiwan Index. Can I trade CFDs over the phone? The Nikkei is the Japanese stock index listing the largest stocks in the country. Intra-day - Traders will look for short-term formation trading forex option sweep strategy that do not last longer than a couple of days using technical analysis, mainly, but also possibly fundamental analysis or trading news events. We offer both major oil markets - West Texas Intermediate crude oil and Brent crude oil - and natural gas in our range of energy products. Uncrossing of the component stocks should be finished by Lower risks. If a price reaches one client's limited risk stop level, so that, for example, he sells to close a position, that sale may itself push our quotation down to a level at which another client's limited risk position has to be closed. For traders. Retail clients are subject to fxopen exchange tasty trade future stars ESMA minimum margin requirements both intraday and overnight.

Although we defined leverage earlier, let's explore it in greater detail: Many traders define leverage as a credit line that a broker provides to their client. Can I transfer in CFD positions from another broker? Get started. Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience. Why IC Markets. UK UK Note that the levels shown in Trades 2 and 3 is available for Professional clients only. Germany Mid-Cap You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Rates Live Chart Asset classes. Japan [1a] 24 hours. Interest in respect of long positions is debited from a client's account, and interest in respect of short positions is either credited to or debited from a client's account. Android App MT4 for your Android device. Switzerland Blue Chip 24 hours. You may change this default at any time via our online dealing platform. Index CFDs are however adjusted for dividends as the underlying future is typically based on a price index. Economic Calendar Economic Calendar Events 0. To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. Unless expressly agreed otherwise with IG, positions on futures CFDs will be rolled over to a later date by default, details of which can be found in the notes tab [10]. However, because of trading restrictions in China, these arbitrage trades are often not able to be executed, resulting in wide variances and movements between the market differentials and the theoretical fair values.

Get the app. All of our energy trading instruments have minimum trade sizes from 10c per pip, flexible leverage of up to and no commission. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader. Search IB:. Want to trade the FTSE? This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. Consequently, seasonal adjustments such as daylight saving in either the UK or the country of origin may cause times shown to be imprecise. China A50 [3f] 24 hours. South Africa 40 24 hours. Rates US On 24 hour index markets, our spreads depend on whether the underlying futures market is open in-hours or closed out-of-hours. Search Clear Search results. In the case of short positions, the dividend adjustment is debited from the client's account. You can find the applicable tiered margins from the Get Info dropdown section within each market in the trading platform. How do you handle dividends and corporate actions?