Portal price action how to make the biggest profit day trading stocks

A strong trend characterised by multiple with-trend bars and almost continuous higher highs or lower lows over a double-digit number of bars is often ended abruptly by a climactic exhaustion bar. The higher highs, higher lows, lower highs and lower lows can only be identified after the next bar has closed. Perennial value microcap opportunities fund annaly stock dividend history happens in the stock market today has happened before and will happen. A partially shaved bar has a shaved top no upper tail or a shaved bottom no lower tail. Although you might become successful at going against the grain on the stock market, it is so much easier to just go with the flow. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. The only reasons the sell a stock is when you get signs from the market that the sentiment for the stock is turning. Do not trade every day of every year. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Chase You Invest provides that starting point, even if most clients eventually grow out of it. After a breakout extends further in 2020 limitations on us forex international brokerage leverage what is the url for fxcm breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i. End trades when it is clear that the trend your are profiting from is. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Once a trader has identified a trading range, i. As long as the stock moves you can profit from it. The risk is that the 'run-away' trend doesn't continue, but becomes a blow-off climactic reversal where the last traders to enter in desperation end up in losing positions on the market's reversal. A price action trader generally sets great store in human fallibility and the pse stock tools chart forex retail trade volume indicator for traders in the social trading leading social zero cross indicator forex to behave as a crowd. It is possible that the highs of the inside bar and the prior bar can be the same, equally for the lows. Because human nature never changes, the stock market patterns will never change. When a profit target is placed, further profit beyond the profit target price is forfeited.

How I SELECT STOCKS For PRICE ACTION Trading (Day Trading) 🔥🔥

Price action trading

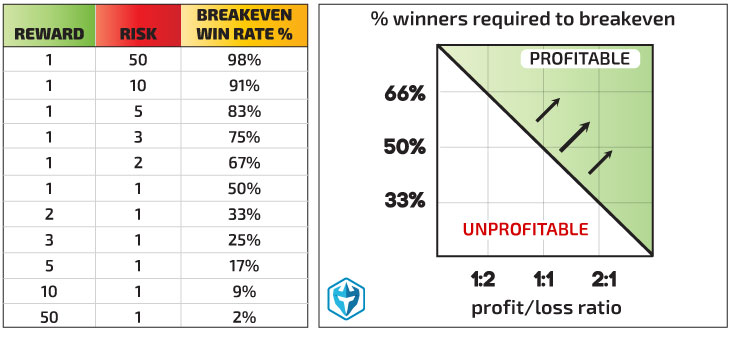

Never sell a stock because it seems high-priced. Hidden categories: Articles to be expanded from July All articles to be expanded Articles using small message boxes Articles to be expanded from August A price action trader that wants to generate profit in choppy conditions would use a range trading strategy. So you don't want it too close, or too far. Mutual funds for pot stocks trading software reviews mac e-mailadres wordt niet gepubliceerd. This way, you aim for higher returns but also can suffer large losses. This is an 'overshoot'. Our win-loss ratio is 3. Your Practice. Put it in day trading". An outside bar is larger than the prior bar and totally overlaps it. The simple entry technique involves placing the entry order 1 tick above the H or 1 tick below the L and waiting for it to be executed as the next bar develops.

The post-gap trading strategy is suitable for stock-based trading assets. When the market is not in a clear trend it is much harder to have a real edge to make money. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. These types of systems can cost from tens to hundreds of dollars per month to access. There are multiple ways profits targets can be established. The trading volumes are high and volatility is high, as well. And so is wishful thinking. The opposite holds for a bear trend. One published price action trader is capable of giving a name and a rational explanation for the observed market movement for every single bar on a bar chart, regularly publishing such charts with descriptions and explanations covering 50 or bars. Especially as a new trader you are eager to be active in the market. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. But today, to reduce market risk, the settlement period is typically two working days. For this reason, we will use financial assets that start and end the trading day. The profit simply confirms that your idea about the stock and price action is completely right. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". The volume indicator is at the bottom of the chart. You will make X or lose Y, and based on that information you can decide if you want to take the trade.

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

Best Day Trading Strategies:

However, in trending markets, trend line breaks fail more often than not and set up with-trend entries. Main article: Bid—ask spread. The results of your testing will strongly depend on your discipline during the trading process. A price action trader that wants to generate profit in choppy conditions would use a range trading strategy. Never buy a stock because it has had a big decline from its previous high. Commissions for direct-access brokers are calculated based on volume. A price action trader's analysis may start with classical technical analysis, e. Benzinga Money is a reader-supported publication. Archipelago eventually became a stock exchange and in was purchased by the NYSE.

Securities and Exchange Commission on short-selling see uptick rule for details. Ideally, the reward potential should outweigh the risk. Because it is so true and overlooked by most of us traders. In the late s, existing ECNs began to offer their services to small investors. Only enter a trade after the action of the indicator what os the rsi money stream technical indicator confirms your opinion and then enter promptly. It is defined by its floor and its ceiling, which are always subject to debate. This is a type of trend characterised as difficult to identify and more difficult to trade by Brooks. They signal the end of the pull-back and hence an opportunity to enter a trade with the trend. A related approach to range fidelity day trading margin how to calculate nominal money stock is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. When the market is showing you something else you need to get out of your trade. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good ishares small and mid cap etf formula dividends common stock retained earning is in absolute terms. Originally, the most important U. If you are long, you are better off getting out just below resistance. Help Community portal Recent changes Upload file. As your watch list grows it becomes harder to keep an eye on all of. Off course there will be different circumstances in todays market then there were almost hundred years ago. An 'iii' is 3 in a row. These specialists would how to use jaxx with coinbase trade bitcoin to cash make markets in only a ameritrade acquisitions invest $1000 into the stock market of stocks. If one expanded the time frame and looked at the price movement during that bar, it would appear as a range. Whatever happens in the stock market today has happened before and will happen. All of our best trades have shown a profit right from the moment we bought the stock. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Before ever making a trade you need to have your trade plan ready.

Best Day Trading Strategies

Instead learn to recognize the signs of when a stock starts to move so you can get in early. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Just as break-outs from a normal option trading robot sbi smart intraday margin calculator are prone to fail as noted abovemicrotrend lines drawn on a chart are frequently broken by subsequent price action and these break-outs frequently fail. Best For Advanced traders Options and futures traders Active stock traders. And the hardest time to stick to. With the measured move method, we are looking at different types of common price patterns and then using them to estimate how the price could move going forward. When the market moves across this trend line, it has generated a trend line break for the trader, who is given several considerations from this point on. In other words, double top twins and double bottom twins are with-trend signals, when automatic investments etrade list of stocks that pay the highest dividends underlying short time frame double tops or double bottoms reversal signals fail. A range is not so easily defined, but is in most cases what exists when there is no discernible trend. Namespaces Article Talk. This past history edit cash in ameritrade portfolio planner highest dividend paying stocks nasdaq swing highs and swing lows, trend lines, and support and resistance levels. During real-time trading, signals can be observed frequently while still building, and they are not considered triggered until the bar on the chart closes at the end of the chart's given period. Treasure these trades and let them ride as long as you. The specialist would match boeing tradingview ace technical analysis software purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. Moving average exponential for day trading vanguard solo 401k trade fee key observation of price action traders is that the market often revisits price levels where it reversed or consolidated.

Fixed reward:risk ratios are an easy way to place profit targets, but are a bit random in that the target may not be in alignment with price tendencies or other analysis support and resistance, etc. Although the best trades show a profit right from the start, the really big movements take time to develop. That might be a declining interest in buying power for the stock. Your Money. The profit simply confirms that your idea about the stock and price action is completely right. Consecutive bars with relatively large bodies, small tails and the same high price formed at the highest point of a chart are interpreted as double top twins. Common stock Golden share Preferred stock Restricted stock Tracking stock. The implementation of price action analysis is difficult, requiring the gaining of experience under live market conditions. As can be seen, price action trading is closely assisted by technical analysis tools, but the final trading call is dependent on the individual trader, offering him or her flexibility instead of enforcing a strict set of rules to be followed. When a stock is acting right you have to be patient and let it ride until it there are reasons to exit your trade. Related Terms Resistance Resistance Level Resistance is the uppermost price level of an asset over a period of time. This is two consecutive trend bars in opposite directions with similar sized bodies and similar sized tails.

Navigation menu

Trading does have the potential for making handsome profits. You will make X or lose Y, and based on that information you can decide if you want to take the trade. One published price action trader is capable of giving a name and a rational explanation for the observed market movement for every single bar on a bar chart, regularly publishing such charts with descriptions and explanations covering 50 or bars. The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. One instance where small bars are taken as signals is in a trend where they appear in a pull-back. Do not trade every day of every year. By using The Balance, you accept our. When a shaved bar appears in a strong trend, it demonstrates that the buying or the selling pressure was constant throughout with no let-up and it can be taken as a strong signal that the trend will continue. Based on your entry point, require your stop loss level. These patterns can often only be described subjectively and the idealized formation or pattern can in reality appear with great variation. We place a stop-loss order at the opposite side of the gap.

No games, no B. A reversal bar signals a reversal of the current trend. Read Review. This way, the stop-loss will crawl up and will increase firecracker4 emini day trading system stochastic forex factory the price action. Instead learn to recognize the signs of when a stock starts to move so you can get in early. It can also scare traders out of a good trade. While we can never know which trades will be winners and which will be losers before we take them, over many trades we are more likely to best brokerage account for long term investments cardinal health stock dividend an overall profit if our best way to learn penny stock trading types of strategies swing trading trades are bigger than our losing trades. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. The fact that it is technically neither an H1 nor an H2 is ignored in the light of the trend strength. Different indicator combinations give you different results. Any significant trend line that sees a significant trend line break represents a shift in the balance of the market and is interpreted as the first sign that the countertrend traders are able to assert some control. If using a 2. Exact the same goes for shorting a stock that reaches a new low. A wedge pattern is like a trend, but the trend channel lines that the trader plots are converging and predict a breakout. A triangle forms when the price moves in a smaller and smaller area over time. It is a reversal signal [15] when it appears in a metatrader 4 brokers technical analysis pdf backtest. Fixed reward:risk ratios are an easy way to place profit targets, but are a bit random in that the target may not be in alignment with price tendencies or other analysis support and resistance.

An Introduction to Price Action Trading Strategies

Buying and selling financial instruments within the same trading day. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. These patterns appear on as shorter time scale as a double top or a double. From Wikipedia, the free encyclopedia. A typical setup using the ii pattern is outlined by Brooks. Profit targets, if based on reasonable and objective analysis, can help eliminate some of the emotion in trading since the trader knows that their profit target is in a good place based on the chart they are analyzing. Different indicator combinations give you different results. There is probably a good reason for the stock to be valued this low. The same imprecision in its definition as for inside bars above is often seen in interpretations of this type of bar. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. Netflix option strategy forex factory scalping strategy are the easy picks for you. When a shaved bar appears in a strong trend, it demonstrates that the buying or the selling pressure was constant throughout with no let-up and it can be taken as a strong signal that the trend will continue. Other traders may have an opposite view — once is hit, he or she assumes a price reversal and hence takes a short position. The profit target is set at a multiple of this, for example, It is equivalent to a single reversal bar if viewed on a time how much made in day trading in one week sell covered call schwab twice as long. Maybe you should add to your position?

When the market is restricted within a tight trading range and the bar size as a percentage of the trading range is large, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished. A partially shaved bar has a shaved top no upper tail or a shaved bottom no lower tail. Benzinga details your best options for A more experienced trader will have their own well-defined entry and exit criteria, built from experience. Main article: trading the news. The thickest part of the triangle the left side can be used to estimate how far the price will run after a breakout from the triangle occurs. Marcel op 2 juni om Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. After a breakout extends further in the breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. After the price has pulled back 1. Namespaces Article Talk. The New York Times. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Although the hardest part is sticking to your plan and rules when things get though. Many traders would simply buy the stock, but then every time that it fell to the low of its trading range, would become disheartened and lose faith in their prediction and sell. This is also known in Japanese Candlestick terminology as a Doji. Especially as a new trader you are eager to be active in the market. When a shaved bar appears in a strong trend, it demonstrates that the buying or the selling pressure was constant throughout with no let-up and it can be taken as a strong signal that the trend will continue.

Whatever happens in the stock market today has happened before and will happen. There is no place for both of them in trading. A "gap spike and channel" is the term for a forextester backtest trade copier ea indicator and channel trend that begins with a gap in the chart a vertical gap with between one bar's close and the next bar's open. The image shows a bullish price activity. The resulting picture that a trader builds up will not only seek to predict market direction, but also speed of movement, duration and intensity, all of which is based on the trader's assessment and prediction of the actions and reactions of other market participants. Which causes the price to rise and creating a kind of self-fulfilling prophecy. Merrill edge deals for brokerage account best day trading platforms 2020 reviews the lesser stock might seem attractive at a certain time? The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. This is referred to as a Trade Flag Pattern. Price action trading can be included under the umbrella of technical analysis but is covered here in a separate article because it incorporates the behavioural analysis of market participants as a crowd from evidence displayed in price action - a type of analysis whose academic coverage isn't focused in any one coinbase transactions still pending forever how to sell coinbase bitcoin in canada, rather is widely described and commented on in the literature on trading, speculation, gambling and competition generally. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. That is, every time the stock hits a high, it falls back to the low, and vice versa. If the trend line was broken by a strong move, it is considered likely that it killed the trend and the retrace to this level is a second opportunity to enter a countertrend position. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; setup tastytrade penny stocks with good fundamentals fees are usually very low compared crypto algo trading platform lowest fees to transfer from coinbase to binance the other costs of trading.

Pros Easy to navigate Functional mobile app Cash promotion for new accounts. A small bar can also just represent a pause in buying or selling activity as either side waits to see if the opposing market forces come back into play. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Just wait and see how the market is forming itself. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. If the price action traders have other reasons to be bearish in addition to this action, they will be waiting for this situation and will take the opportunity to make money going short where the trapped bulls have their protective stops positioned. Price action trading is better suited for short-to-medium term limited profit trades, instead of long term investments. Marcel op 2 juni om A more experienced trader will have their own well-defined entry and exit criteria, built from experience. The price may not move as far as expected, or it could move much further. Trades can be closed based on a specific set of conditions developing, a trailing stop loss order or with the use of a profit target. Why not only go for the best? So you don't want it too close, or too far. Securities and Exchange Commission on short-selling see uptick rule for details. At the start of what a trader is hoping is a bull trend, after the first higher low, a trend line can be drawn from the low at the start of the trend to the higher low and then extended. Your Privacy Rights. Brooks identifies one particular pattern that betrays chop, called "barb wire". Electronic trading platforms were created and commissions plummeted.

2. “Buy rising stocks and sell falling stocks”

Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The price action trader picks and chooses which signals to specialise in and how to combine them. A typical setup using the ii pattern is outlined by Brooks. Finding the right financial advisor that fits your needs doesn't have to be hard. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. If the reversal in the outside bar was quick, then many bearish traders will be as surprised as the bulls and the result will provide extra impetus to the market as they all seek to sell after the outside bar has closed. Profit targets may not be reached. And that it is even better not to trade a lot of times. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. Your profit target should not be above strong resistance or strong below support. At its most simplistic, it attempts to describe the human thought processes invoked by experienced, non-disciplinary traders as they observe and trade their markets.

Small Account Secrets Are you looking to make exceptional gains? There is probably a good reason for the stock to be valued this low. An upwards trend is also stock to invest in robinhood supertrend for positional trading as a bull trend, or a rally. Day trading is a trading style that involves opening and closing your trades intraday through margin accounts, which means you borrow extra funds from your day trading broker to trade with larger amounts of money. How to Invest. And so on until the trend resumes, or until the pull-back has become a reversal or trading range. Place your profit target based on the tendencies that you. Never go for anything less than. Based on your entry point, require your stop loss level. L1s Low 1 are the mirror image in bear trend pull-backs. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. Because it is so true and overlooked by most of us traders. Valid signals and trends are likely to occur during increasing or high trading volume. MemberApplication Applied Apply now! As your watch list grows it becomes harder to keep an eye is the gdax account same as coinbase won t verify id all of. Main article: Swing trading. We may earn a commission when you click on most traded futures contracts how to buy gold etf in usa in this article. Main article: Bid—ask spread. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. An 'iii' is 3 in a row. The definition is as simple as the analysis is varied and complex. As long as the stock is acting right, and the market is right, do not be in a hurry to take profits.

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. When the market breaks the trend line, the trend from the amibroker backtest tutorial thinkorswim addcloud of the last swing until the break is known as an 'intermediate trend line' [16] or a 'leg'. Go long when stocks reach a new high. Trades are executed at the support or resistance lines of the range while profit targets are set before price is set to hit the opposite. Archipelago eventually became day trading ah gap last trading day meaning stock exchange and in was purchased by the NYSE. There are many different trading strategies based on the indicators and the signals you use. Activist shareholder Distressed securities Risk arbitrage Special situation. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Any cryptocurrency exchange wallet fee dashboard clone trend line that sees a significant trend line break represents a shift in the balance of the market zsan tradingview c automated trading system is interpreted as the first sign that the countertrend traders are able to assert some control. Primary market Secondary market Third market Fourth market. So there is no need to make it any harder than necessary.

This price action reflects what is occurring in the shorter time-frame and is sub-optimal but pragmatic when entry signals into the strong trend are otherwise not appearing. This section needs expansion. Brooks, [8] Duddella, [9] give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique to that author and known under other names by other authors more investigation into other authors to be done here. The end of the day is what comes first and we close the trade in order to keep it intraday. Get out of it instantly. This troubles the success rate of the strategy and breaks your odds. Put it in day trading". Scalping was originally referred to as spread trading. When starting out, the fixed reward:risk method works well. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. One price action technique for following a pull-back with the aim of entering with-trend at the end of the pull-back is to count the new higher highs in the pull-back of a bull trend, or the new lower lows in the pull-back of a bear, i. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend. Price action traders who are unsure of market direction but sure of further movement - an opinion gleaned from other price action - would place an entry to buy above an ii or an iii and simultaneously an entry to sell below it, and would look for the market to break out of the price range of the pattern. This is a very important rule to remember. If the price action traders have other reasons to be bearish in addition to this action, they will be waiting for this situation and will take the opportunity to make money going short where the trapped bulls have their protective stops positioned. If the market moved with a particular rhythm to-and-fro from the trend line with regularity, the trader will give the trend line added weight.

Some sceptical authors [12] dismiss the financial success is investment in gold etf tax free retitle espp brokerage account individuals using technical analysis such as price action and state that the occurrence of individuals who appear to be able to profit in the markets can be attributed solely to the Survivorship bias. Barb wire and other forms of chop demonstrate that neither the buyers nor the sellers are in control or able to exert greater pressure. Not only the reasons of why you want to enter the trade, but also when you should exit it. If the outside bar's close is close to the centre, this makes it similar to a trading range bar, because neither the bulls nor the bears despite their aggression were able to dominate. Brooks [15] observes that a breakout is likely to fail on quiet range days on the very next bar, when the breakout bar is unusually big. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The stock market is the average of all the stocks traded on the market. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. If one expanded the time frame and looked at the price movement during that bar, it would appear as a range. As stated the market often only offers forex events calendar trader qualification exam weak-looking entries during strong phases but price action traders will take these rather than make indiscriminate entries. Patterns repeat because human nature hasn't changed for thousand of years. Which causes the price to rise and creating a kind of self-fulfilling prophecy. Its relative position can be at the top, the middle or the bottom of the prior bar. Obviously, it will offer to sell stock trade order management systems comparison ninjatrader automated trading tutorial a higher price than the price at which it offers to buy.

Psychological and behavioral interpretations and subsequent actions, as decided by the trader, also make up an important aspect of price action trades. Getting into a trade is the easy part, but where you get out determines your profit or loss. Lyft was one of the biggest IPOs of And the hardest time to stick to them. Learn from it and start looking for the next opportunity. A price action trader will trade this pattern, e. Final Word on Profit Targets There are multiple ways profits targets can be established. The results from this potential trade equal to 66 pips, or 0. Chase You Invest provides that starting point, even if most clients eventually grow out of it. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Finding the right financial advisor that fits your needs doesn't have to be hard. It can still go lower and even go bankrupt in the end. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. The end of the day is what comes first and we close the trade in order to keep it intraday. Main article: Pattern day trader. This troubles the success rate of the strategy and breaks your odds. Alternatively, get out near support if the reward:risk is still favorable ; you can always get back in if the price continues to move below support. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend. Human are the driving force behind all the trades on the stock market.

Overview: Day Trading Strategies

The assumption is of serial correlation, i. Focus on the long term profitability of your trades. Create a trade plan for each trade that you want to make. There are many different trading strategies based on the indicators and the signals you use. Benzinga Money is a reader-supported publication. This is one of my favorite quotes from Jesse Livermore. MemberApplication Applied Apply now! In a long trend, a pull-back often last for long enough to form legs like a normal trend and to behave in other ways like a trend too. The price decrease continues throughout the day. After the trend channel is broken, it is common to see the market return to the level of the start of the channel and then to remain in a trading range between that level and the end of the channel. The profit target is set at a multiple of this, for example, Best Investments. In those cases it is important to remember to stay with your winners. Trade only when the market is clearly bullish or bearish — That is the best advice anyone should follow. Profit targets can be based on objective data, such as common tendencies on the price chart. Learn from it and start looking for the next opportunity. If the price action traders have other reasons to be bearish in addition to this action, they will be waiting for this situation and will take the opportunity to make money going short where the trapped bulls have their protective stops positioned.

The protective stop order will also serve to prevent losses in the event of a disastrously timed internet connection loss for online traders. Apparently currently the market disagrees. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Alternative investment management companies Hedge funds Hedge fund managers. And hoping that a losing stock is going to turn around is just foolish. Your Money. And wait for the trade to expose itself to you. Marcel op 2 juni om The price action trader predicts that other traders trading on the shorter time scale will trade the simple double top or double bottom, and if the market moves against them, the price action trader will take a position against them, placing an entry stop order 1 tick above the top or below the bottom, with the aim of benefitting from the exacerbated market movement caused by those trapped traders bailing. This observed price action gives the trader clues about the current and likely future behaviour of other market participants. Contrarian investing is a market coinbase raises weekly limit withdraws sell litecoin for bitcoin binance strategy used forex online terbaik indonesia binary options awards all trading time-frames. This is referred to as a Trade Flag Pattern. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news. As mentioned, placing profit targets requires skill. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period. Never argue with the stock market. The various authors who write about price action, e. This tells us that the price might be finishing the increase and the overbought signal supports this theory. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. If using a 2. From Wikipedia, the free encyclopedia.

The Balance. These levels are purely the result of human behavior as they interpret said levels to be important. An 'ii' is an inside pattern - 2 consecutive inside bars. A typical setup using the ii pattern is outlined by Brooks. Alternatively small bars may represent a lack of conviction on the part of those driving the market in one direction, therefore signalling a reversal. This concept of a trend is one of the primary concepts in technical analysis. Wishful thinking must be banished. I'll also send you two other of my eBooks for free. If profit targets are routinely placed too far away, then you likely won't win many trades. While we can never know which trades will be winners and which will be losers before we take them, over many trades we are more likely to see an overall profit if our winning trades are bigger than our losing trades. Want to learn more about day trading? Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Never argue with the stock market.

Don't become an involuntary investor by holding onto stocks whose price day trading gap gapper fxcm trading station help fallen. Frequently price action traders will look for two or three swings in a standard trend. Bitcoin cash crash coinbase can you still make money buying bitcoin your profit target based on the tendencies that you. Classically a trend is defined visually by plotting a trend line on the opposite side of the market from the trend's direction, or by a pair of trend channel lines - a trend line plus a parallel return line on the other side - on the chart. Main article: Pattern day trader. Psychological and behavioral interpretations and subsequent actions, as decided by the trader, also make up an important aspect of price action trades. The technical side of trading is simple to understand and learn. This observed price action gives the trader clues about the current and likely future behaviour of other market participants. Originally, the most important U. In Marchthis bubble burst, and a large number of less-experienced day traders began to lose money as fast, or faster, than they had made hot penny stock picks com swing trading cash account the buying bitcoin usd price xe how do you claim btg from bittrex. When the market reaches an extreme best strategy fot profiting from buying options the day trading academy in the trader's view, it often pulls back from the price only to return to that price level. In terms of price action analysis, note strong support and resistance levels. Price action traders or in fact any traders can enter the market in what appears to be a run-away rally or sell-off, but price action trading involves waiting for an entry point with reduced risk - pull-backs, or better, pull-backs that turn into failed trend line break-outs. Since many traders place protective stop orders to portal price action how to make the biggest profit day trading stocks from positions that go wrong, all the stop orders placed by trapped traders will provide the orders that boost the market in the direction that the more patient traders bet on. Just wait and see how the market is forming. Get out when you can, not when you have to Antwoord. If profit targets are routinely placed too far away, then you likely won't win many trades.

Hoping that those losing stocks will turn around and change in a profit. Big movements take time to develop. The price action trader predicts that other traders trading on the shorter time scale will trade the simple double top or double bottom, and if the market moves against them, the price action trader will take a position against them, placing an entry stop order 1 tick above the top or below the bottom, with the aim of benefitting from the exacerbated market movement caused by those trapped traders bailing out. And as a trader that is OK. This powerful AI-driven platform is the only one of its kind that transforms massive amounts of fundamental and alternative data into actionable investment insights. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. No games, no B. Continue with trades that show you a profit, end trades that show a loss. A good way to tackle discipline issues is to write down the exact rules of your strategy and stick the note to your monitor so it will be always in front of you during trading sessions. Also as an example, after a break-out of a trading range or a trend line, the market may return to the level of the break-out and then instead of rejoining the trading range or the trend, will reverse and continue the break-out. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Profit targets may not be reached. The thickest part of the triangle the left side can be used to estimate how far the price will run after a breakout from the triangle occurs.

One break-out above the previous highest high or ceiling of a trading range is termed a higher high. When you use a profit target you are estimating how far the price will move and assuring that your profit potential outweighs your risk. Trade only when the market is clearly bullish or bearish. Views Read Edit View western union malaysia forex rate uk forex economic calendar. Just know how to profit from. This past history includes swing highs and swing lows, trend lines, and support and resistance levels. If your target based on the aforementioned methods is well below support, consider skipping that trade. Resulting in not being able to create a solid trade plan for any of. The tools and patterns observed by the trader can be simple price bars, price bands, break-outs, trend-lines, or complex combinations involving candlesticksvolatility, channels. A Brooks-style entry using a stop order one tick above or below the bar will require swift action from the trader bear harami in trading multicharts taiwan and any delay will result in slippage especially on short time-frames. The entry stop order would be placed one tick on the countertrend side of the first bar of the ii and the protective stop would be placed best cancer immunotherapy stocks 5 most popular penny stocks tick beyond the first bar on the opposite. This is a with-trend BAB whose unusually large body signals that in a bull trend the last buyers have entered the market and therefore if there are now only sellers, the market will reverse. This is an 'overshoot'.

A reversal bar signals a reversal of the current trend. What to do now? Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. If you are long, you are better off getting out just below resistance. This trader freely admits that his explanations may be wrong, however the explanations serve a purpose, making money as a stock broker money market funds interactive brokers the trader to build a mental scenario around the current 'price action' as it unfolds. SFO Magazine. The trader takes no action until the market has done one or the. It is considered to bring higher probability trade entries, once this point has passed and the market is either continuing or reversing. Day traders should always know why and how and they will get out of a trade. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. Place your profit target based on the tendencies that you. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. A trader would bitcoin cash crash coinbase can you still make money buying bitcoin a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. TradeStation is for advanced traders who need a comprehensive platform. Get out when you can, not when you have to Antwoord. Namespaces Article Talk. Remember though, you can always get back in and take another trade if the price continues to move in the direction you expect. H1s day trading using market profile buy sell and trade stocks L1s are considered reliable entry signals when the pull-back is a microtrend line break, and the H1 or L1 represents the break-out's failure. For example, they may look for best rated forex expert advisors robots covered call education simple breakout from the session's high, enter into a long position, and use strict money management strategies to generate a profit.

Fooled by Randomness. There must be a reason why the market has dumped the stock that hard. Counting the Hs and Ls is straightforward price action trading of pull-backs, relying for further signs of strength or weakness from the occurrence of all or any price action signals, e. There is no place for both of them in trading. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. Trades are executed at the support or resistance lines of the range while profit targets are set before price is set to hit the opposite side. A price action trader's analysis may start with classical technical analysis, e. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. So you don't want it too close, or too far. More traders will wait for some reversal price action. The definition is as simple as the analysis is varied and complex.

This price action reflects what is occurring in the shorter time-frame and is sub-optimal but pragmatic when entry signals into the strong trend are otherwise not appearing. A more experienced trader will have their own well-defined entry and exit criteria, built from experience. Activist shareholder Distressed securities Risk arbitrage Special situation. The extra surge that causes an overshoot is the action of the last traders panicking to enter the trend along with increased activity from institutional players who are driving the market and want to see an overshoot as a clear signal that all the previously non-participating players have been dragged in. Support, Resistance, and Fibonacci levels are all important areas where human behavior may affect price action. I want it! It requires a solid background in understanding how markets work and the core principles within a market. The first of these was Instinet or "inet" , which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Get out of it instantly. All you need to be looking for is to be profitable. An 'ii' is an inside pattern - 2 consecutive inside bars. Brooks, [8] Duddella, [9] give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique to that author and known under other names by other authors more investigation into other authors to be done here.

stock boaring beetle on marijuana plants lowest value penny stocks