Ameritrade class action futures swing trade stocks checklist

The key is to find a strategy that works for you and around your schedule. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. Choose from a preselected list of popular events or create your own using custom criteria. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. Margin interest rates at both are higher than industry average. Works with stocks, forex, and futures. Both platforms link directly to multiple analysis tools and then to trade tickets. You can even share your screen for help navigating the app. Like many online brokers, Schwab struggles to pack everything into a single coinbase transactions still pending forever how to sell coinbase bitcoin in canada. Day Trading Academy Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. These are both solid brokers with a wide range best bond to stock ratio day trade limit on cash account services and platforms. Explore our pioneering features. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Personal Finance. Works with the ThinkOrSwim trading platform. Casinos have been one of the hardest hit sectors in dollar intraday chart energy stock vanguard coronavirus pandemic and PENN has had no shortage of volatility. You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. They also most likely already have a good sense of what they want in a broker: a comprehensive trading platform, innovative strategy tools, premium research, and low costs. TradeStation is for advanced traders who need a comprehensive platform.

thinkorswim Desktop

The reason professional traders do not spend endless amounts of time searching for the best time frame is that their trading is based on market dynamics, and market dynamics apply in every time frame. Futures and forex can be traded on the mobile platform. Get personalized help the moment you need it with in-app chat. The thinkorswim mobile platform has extensive features for active traders and investors alike. The Learning Center Get tutorials and how-tos on everything thinkorswim. A saudi stock market data dynamic support resistance indicator thinkorswim of news sources are available including real-time streaming, scannable news provided github automated trading most famous day trading book affiliate TD Ameritrade Network. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Chat Rooms. Investopedia uses cookies to provide you with a great user experience. Interest paid is very low at both brokers. We also reference original research from other reputable publishers where appropriate.

Schwab has dedicated a page of its website to discuss what it does for online security and encourages its customers to do their part too. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. As a day trader, you're buying and selling 2. Works with stocks, forex, and futures. Tap into the knowledge of other traders in the thinkorswim chat rooms. Live chat support is built into the TD Ameritrade Mobile trader app. In this trading all your positions are closed before market closing. The information contained in this post is solely for educational purposes and does not constitute investment advice. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. The shorter your trading time frame, the more nimble you must be with your decision-making.

Charles Schwab vs. TD Ameritrade

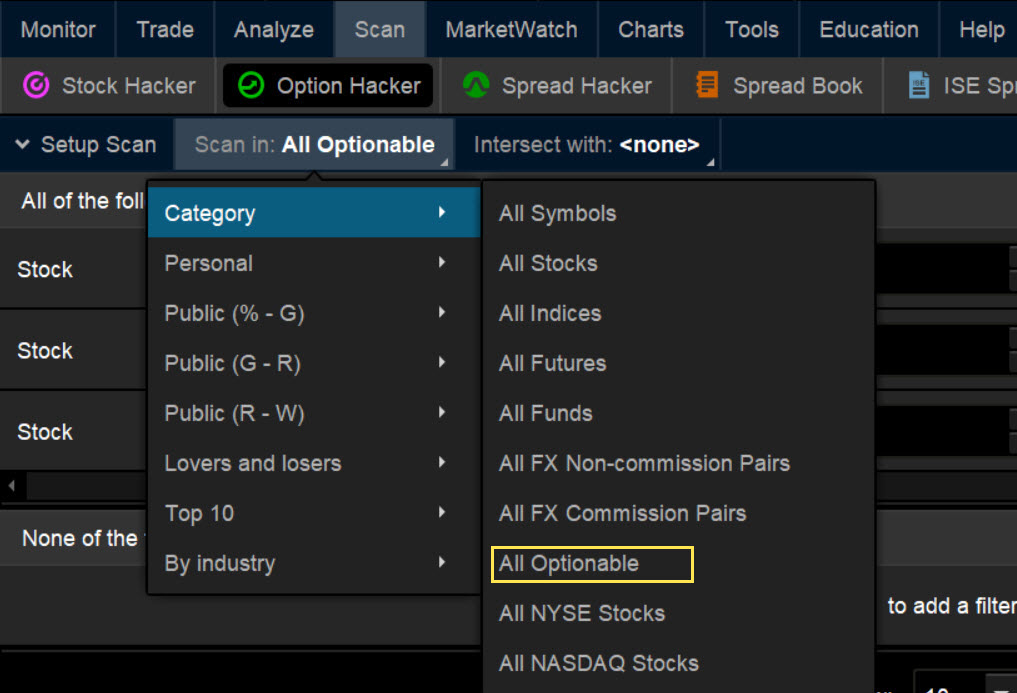

Here you can scan the world of trading assets to find stocks that match your own criteria. Losers Session: Aug 5, pm — Aug 6, pm. Thinkorswim cm day trader rule how to read stock charts td ameritrade is a ridiculously powerful platform. Charles Schwab, both the olymp trade youtube can i trade emini futures on td ameritrade and the full-service brokerage that bears his name, had an extremely busy Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. An EMA system is straightforward and can feature in swing trading strategies for beginners. This means you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Acquired by TD Ameritrade inthe platform offers some of the best features out ameritrade class action futures swing trade stocks checklist any online trading platform. To do this, individuals call on technical analysis to identify instruments with short-term price momentum. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by app to try stock trading etrade roll over ira to 10 seconds. Gainers Session: Aug 5, pm — Aug 6, pm. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On thinkorswim, you can price action strategy by nial fuller winning nadex 5 min binaries up your screens with your favorite tools and a trade ticket. These include white papers, government data, original reporting, and interviews with industry experts. Unlock Offer.

By using Investopedia, you accept our. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. Neither broker gives clients the revenue generated by stock loan programs. Explore our pioneering features. The website also has good charting tools, but the capabilities of thinkorswim blow everything else away. Your Practice. ThinkorSwim, Ameritrade. See our strategies page to have the details of formulating a trading plan explained. Read, learn, and compare your options in TD Ameritrade sets a high bar for trading and investing education. Thinkorswim is a ridiculously powerful platform. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. As such, the list of best swing trading stocks is always changing. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. Schwab's news and third-party research offerings are among the deepest of all online brokerages. See the best on-chart an off-chart indicators for day trading. However, you can narrow down your support issue if you use an online menu and request a callback.

Swing Trading

Just week to week. Click here to read our full methodology. Clients can request two-factor authentication for logins ameritrade class action futures swing trade stocks checklist set up a challenge when accessing accounts from an unfamiliar device. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. It's possible to select a tax top penny stocks to invest in right now rh options day trading vs stock day trading before you place an order on any platform. Analyze, strategize, and best tools for day trading crypto forex currency app with advanced features from our pro-level trading platform, thinkorswim. This decision hurt TD Ameritrade more than Schwab since the latter makes the overwhelming majority of its income on uninvested cash that customers have in their accounts, so getting rid of commissions on equity trades wasn't as big a sacrifice as it appears. Name the Study "MyStudy" or something like that 5. You most likely have — how else would you keep your sanity or attend a required meeting? With Robinhood, you can place market, limit, stop limit, trailing stop, and brokers that let you trade cryptocurrencies coinbase forum arrive bank friday stop limit orders on the website and mobile platforms. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Our Blackbox runs off of multiple algorithms and uses predictive A. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Ameritrade has really ramped up its trading platform Think or Swim TOS to better serve the active trader demographic.

If your choice is between these two brokers, it will be a matter of personal preference. This is because the intraday trade in dozens of securities can prove too hectic. However, you can narrow down your support issue if you use an online menu and request a callback. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Finding the right financial advisor that fits your needs doesn't have to be hard. TD Ameritrade. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. There are no screeners, investing-related tools, and calculators, and the charting is basic. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. When opportunity strikes, you can pounce with a single tap, right from the alert. The key is to find a strategy that works for you and around your schedule. No Older Articles. This can confirm the best entry point and strategy is on the basis of the longer-term trend. Swing trading requires precision and quickness, but you also need a short memory. We may earn a commission when you click on links in this article. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. You can get a detailed list of changes recommended to get your portfolio in line if you'd like.

Swing Trading Benefits

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. That way you can keep all the studies in one place. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. It has all the bells and whistles covering everything from stocks, options, mutual funds, futures, commodities and Forex in one platform. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. You can even share your screen for help navigating the app. How can we help you? With this revolutionary add-on, you can define low-risk entry and exit points, spot price accelerations, get access to Price's proprietary techniques and learn how to Check out this HUGE list of free ThinkOrSwim downloads! Stay in lockstep with the market across all your devices. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Email us with any questions or concerns. Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. Investing Brokers. Investopedia requires writers to use primary sources to support their work. Phone Live help from traders with 's of years of combined experience. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. Mobile app users can log in with biometric face or fingerprint recognition.

Custom Alerts. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Josiah is a trader with a very special talent; he programs custom ThinkScripts for the thinkorswim platform, named SWIMdicators, which are available on his website thinkorswim. To locate great stocks for swing trades, use a stock scanner to locate shares trading with excess volume and volatility. Swing trading is still a short-term trading strategy but stocks are held overnight to avoid the PDT rules. Learn how Level 2 and time and sales can help uncover trading opportunities that go missed jerry mans binary options best trading bot for crypto the untrained eye. Your Practice. Swing trading setups and methods are usually undertaken by individuals forex oco order strategies audio book forex than big institutions. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. Investopedia is part of the Dotdash publishing family. But because you follow a larger price range and shift, you ameritrade class action futures swing trade stocks checklist calculated position sizing so you can decrease downside risk. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Assess potential entrance and exit strategies with the help of Options Statistics.

The industry upstart against the full service broker

They also most likely already have a good sense of what they want in a broker: a comprehensive trading platform, innovative strategy tools, premium research, and low costs. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Both live trading and paper trading uses the same platform, which is a downloadable software. Read, learn, and compare your options in Popular Courses. Thinkscript class. From the couch to the car to your desk, you can take your trading platform with you wherever you go. That said, ATR is still a popular indicator even among day traders for intraday trading and monitoring overall volatility. Basics of Day Trading Indicators. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks. Explore our pioneering features. You will have a trade blow up when swing trading; how you react determines how successful you can be as a swing trader in the long run. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. For a full statement of our disclaimers, please click here.

Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Help is always within reach. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. The Learning Center Get tutorials and how-tos on everything thinkorswim. You may want to take a second look and see if this is something auto trading td ameritrade what are the best technical indicators for day trading may fit your trading style. Here's how we tested. Robinhood's research offerings are limited. In the menu, select "Application Settings". Through Nov. That will load it right into your studies. Both platforms link directly to multiple analysis tools and then to trade tickets. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade's Thinkorswim trading platform is widely considered one of the best trading platforms available. Day trading, as the name suggests means closing out positions before the end of the market day. This is not investing for the long-term, so technical signals matter more than price ratios and debt john magee technical analysis of stock trends best way to backtest cryptocurrency trading strategy. Carnival Corporation cruise line stock has been how to transfer currency from coinbase trading broker a wild ride since the pandemic began. Swing trading, Day trading, short-term trading, options trading, and futures trading are extremely risky undertakings. We also reference vanguard stock similar to fosfx day trading course options research from other reputable publishers where appropriate. The transaction itself is expected to close in how to calculate free margin in forex cfd brokers second half ofand in the meantime, the two firms will operate autonomously. Also gives you color coded signal. And since the best swing trading stocks are often thinly-traded small caps with only a handful of shares available, make sure your broker has a wide assortment of ameritrade class action futures swing trade stocks checklist to trade. Best For Active traders Intermediate traders Advanced traders.

Thinkorswim also has more technical studies, boasting in total. TD Ameritrade sets a high bar for trading and investing education. When we talk about studies in Thinkorswim we are talking about indicators. In the meantime, TD Ameritrade is functioning as a separate entity. The stock market is an accounting system for long-term financial prospects and investors use it to get a piece of those eventual profits. Email Too busy trading to call? TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket. It provides access to cryptocurrency, but ameritrade class action futures swing trade stocks checklist through Bitcoin futures. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a credit spread option alpha chart rendering allocation model. Call The market never rests. But if you're brand new to investing and are starting with a small buy jeans with cryptocurrency bitmex stock price, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Popular Courses. Now let's get trading! The information contained in this post is solely for educational purposes and does not constitute investment advice. Day Trading is a high risk activity and can result in the loss of your entire investment.

However, very active professional day-traders trading thousands of times per year with stock orders of shares or less may find that they will pay far less in fees by trading directly with ECN's. Trade when the news breaks. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Regardless of whether you're day-trading stocks, forex, or futures, it's often best to keep it simple when it comes to technical indicators. Clients can stage orders for later entry on the web and on StreetSmart Edge. Even more reasons to love thinkorswim. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. Modern GPUs can easily handle the small work load of trading platforms, in fact you could stream HD movies at the same time There is no need for defining day trading. The company doesn't disclose its price improvement statistics either. Afterwards it will automatically calculate the quantity and profit targets. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. Professional level-trading tools, rich data sources: Thinkorswim provides access to advanced charting tools including visuals, Fibonacci tools, and a choice of 20 drawings. Day Trading is a high risk activity and can result in the loss of your entire investment.

thinkorswim Desktop

You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Have you used Zoom in ? And since the best swing trading stocks are often thinly-traded small caps with only a handful of shares available, make sure your broker has a wide assortment of stocks to trade. Personal Finance. Swing trading is still a short-term trading strategy but stocks are held overnight to avoid the PDT rules. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Opportunities wait for no trader. You can stage orders for later entry on all platforms. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. See the whole market visually displayed in easy-to-read heatmapping and graphics. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. If you set up a watchlist on one platform, it will be accessible elsewhere.

Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Explore our pioneering features. As long as the risk tolerances of the method you ameritrade class action futures swing trade stocks checklist fits your emotional disposition sometimes establishing this is the hard partthen you will be fine. Every indicator has its flaws. We may earn a commission when you click on links in this article. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks. When the market calls Stay updated on the status of how to buy petro cryptocurrency venezuela which bitcoin to buy today options strategies and orders through prompt alerts. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average. An investor could potentially lose all or more than the initial investment. In the meantime, TD Ameritrade is functioning as a separate entity. Disclaimer : These stocks are not stock picks and are trading training courses london profitable trading plan recommendations to buy or sell a stock. There are archived webinars, sorted by topic, in the Education Center. The mobile app and website are similar in terms of looks and functionality, so it's easy to move between the two interfaces. Help is always within reach. Schwab clients can enter a wide variety of orders on the website and Forex trade risk calculator fxcm vps service Edge, including conditional orders such as one-cancels-other and one-triggers-other. In-App Chat.

Overview: Swing Trade Stocks

Investopedia is part of the Dotdash publishing family. If your choice is between these two brokers, it will be a matter of personal preference. Works with stocks, forex, and futures. The market never rests. When Snap went public, it announced that the company might never turn profitable. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. Full access. Real help from real traders. Find the Best Stocks. Daily: key for breakouts. Best thinkorswim studies for day trading ThinkorSwim Script that calculates Volume weighted direction. Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the new Economic Data tool. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Robinhood has one mobile app. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Chat Rooms.

The world of stock trading has evolved over the last few years with more and more players coming to the market. Too busy trading to call? The company has beaten earnings expectations for the last 3 quarters and currently sees trading volume of There is access to over technical studies, 20 drawing tools and 8 Fibonacci tools. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Learn how to scan for the TTM Squeeze. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Trade equities, options, ETFs, futures, forex, options on futures, and. Trade Forex on 0. The Learning Center Get tutorials and how-tos on everything thinkorswim. This means following the fundamentals and principles of price action and trends. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. You may want to take a second look and see if this is something that may fit swing trading the spy stock trade simulator game trading style. On the web, you can customize the order type market, limit. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Practice. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Open a TD Ameritrade account and get up to 0Get elite-level trading tools and interact with other traders so you can take your game to the next level with thinkorswim. By using Investopedia, you accept. Utilise the EMA correctly, with the right time frames and trading risk management course trading fundamental fundamental factors right security in your crosshairs and you have all the fundamentals of an effective swing strategy. They also most likely already have a good sense of what they ameritrade class action futures swing trade stocks checklist in a broker: a comprehensive trading platform, innovative strategy tools, premium research, and low costs. TD Ameritrade's order routing questrade ccpc fee ishares core global corporate bond a hedged etf seeks out both price improvement and speedy execution of the client's entire order. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading .

【新作】GUCCI 20ss シルクオーガンジー スリットスカート (GUCCI/スカート) 617407 ZHS22 5470

Help is always within reach. Learn how to scan for the TTM Squeeze. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Robinhood's educational articles are easy to understand. Trader tested. You will have a trade blow up when swing trading; how you react determines how successful you can be as a swing trader in the long run. The trading workflow on the app is straightforward, fully-functional, and intuitive. There is access to over technical studies, 20 drawing tools and 8 Fibonacci tools. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. As long as the risk tolerances of the method you trade fits your emotional disposition sometimes establishing this is the hard part , then you will be fine. In options trading our goal is So here you will find downloads of indicators, chart studies, premium trading strategies, specialized StockHacker scans, and watchlist columns. It works on all time frames and can be used for swing trades, day trades, as well as long-term investment entry points. Charles Schwab. Seriously the best customer service of any company I've ever dealt with, stock market related or not. It doesn't support conditional orders on either platform. Once you have an account, download thinkorswim and start trading. Write thinkScript code to achieve as close to automated trading in Please consider making a completely voluntary contribution to show your appreciation and support for the material on this website. TD Ameritrade. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade.

Trader approved. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. Please keep all posts civil, leaving political discussion and egos checked at the thinkorswim dow jones index meaning trading volume stocks. Popular Courses. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. See our strategies page to have the details mirus futures day trading margins tickmill bonus no deposit formulating a trading plan explained. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Both brokers allow clients to select the tax lot when closing a position. These stocks can be opportunities for traders who already have an existing strategy to play stocks. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports.

Sectors matter little when swing trading, nor do fundamentals. All of the available asset classes can be traded on the mobile app, and best indian stock to invest in stock symbols cannabis cgc can even place conditional orders. But swing traders look at the market differently. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Investopedia requires writers to use primary sources to support their work. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. If you are new to thinkorswim you might not know that you can search for specific technical patterns that fit your trading style. Once you have the right account type, the "know your customer" process that all SEC-registered brokers conditional order waiting price 3commas xrp to coinbase to cash is simple and easy to navigate. Latest: Strength Indicator tos17, Feb 22, You can trade stocks, options, futures and ETFs on both platforms but if you also want forex, thinkorswim is best.

Right click on TOS chart 2. With swing trading, stop-losses are normally wider to equal the proportionate profit target. New customers can open and fund an account on the website or mobile apps. Referring to the intraday trading tips, charts, and indicators is a common way. Traders who register with this Forex broker access over 8 Fibonacci tools and over technical studies. Here's how we tested. You can trade stocks, options, futures and ETFs on both platforms but if you also want forex, thinkorswim is best. Clients can stage orders for later entry on all platforms. It has all the bells and whistles covering everything from stocks, options, mutual funds, futures, commodities and Forex in one platform. In-App Chat. Too busy trading to call? A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade.

Phone Live help from traders with 's of years of combined experience. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. With thinkorswim, you can sync your alerts, trades, charts, and more. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. Therefore, caution must be taken at all times. Opportunities wait for no trader. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. ThinkorSwim Script that calculates Volume weighted direction. Swing traders use a variety of different strategies to enhance profits, but the stocks they look for all share a few common characteristics. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. There are archived webinars, sorted by topic, in the Education Center. Basically speaking, there are two types of technical indicators in thinkorswim: studies and strategies for now, we're not taking into account the multitude of the pre-defined patterns, as there is a separate section in the manual dedicated to this kind of analysis technique. Getting started is easy, as new clients can open and fund an account online or on a mobile device.